Opening up Vanguard to add £10k of ISA contributions to buy VUSA, I come across this impressive chart of the amount of moolah a punter could accumulate, had they invested in the MCSI World Index since 1999. Nowadays you can do that easily, just go buy an ISA limit of VWRP on each April 6th, get on with the rest of your life. I don’t think VWRP existed 25 years ago, but this is what would have happened compared to saving it in cash.

Now I am old enough to know that tax privileged share saving didn’t start with a bang due to Gordon Brown in 1999, there was something called PEPs (Personal Equity Plans), I seem to recall I dumped some Sharesave shares in one of those back in the day. They were also tax-free, I was a tyro in those days, so I didn’t get the sort of wins I am getting now. Vanguard sell this as a good news story, look at that wicked win racing up at the end.

And it’s a good story, say Maya Millennial has just come of age in 1999, born with a silver spoon in her mouth. She loads up her ISA to the max and keeps on going, across 25 years, she’s 43 now and minted, nearly 900k sods. All jolly hockey-sticks, eh? Provided she has accumulated some of the other trappings of a successful middle class career, she’s in line for early retirement.

Wait but what? Valuation matters

Let’s call up VT in the basement and get them to roll the tape back to Maya Millennial’s 31st birthday. In a distant part of this septic isle an exhausted mustelid calls control for the final approach to retire, in 2012.

Maya Millennial pulls up her Vanguard account and takes a butcher’s hook at how’s it all going. Her BFF Candi Cash won’t have any truck with the stock market – “it’s a casino full of the wrong sorts”. She uses a Cash ISA. We compensate for that fact that the Cash ISA allowance started half that of a S&S ISA because Candi is on great terms with her mum who lets her use her cash allowance too. Apologies for the tasteless use of Photoshop, but this is what Maya looks at. I have estimated the £200k position, but to be honest it’s that shape that matters.

Years and Years

2003 – Maya is 22 and ~30% down

Four years into her journey, Maya’s about a third down compared to Candi. She tells herself fair enough, I am a long term investor, just a blip on the investing horizon. She’s doing a lot better than this mustelid did, I used to have a Virgin CAT FTSE all-share ISA, great values fees at 1% AUM, Monevator’s TA would rugby-tackle you to the ground for putting up with that sort of usury these days

Why should DIY investors flay costs as if they were the tattooed agents of darkness? Because the last thing you need is to leak 1% in management charges.

Gulp. Those were the days, my friend… We got older and wiser. Anyway, I switched to L&G at a slightly lower fees and a slightly more global outlook, but in the end I sold up. Go on, guess when I sold up, round about 2005 ISTR. Mind you I did put that into paying down some of the mortgage which was in the order of 6% I think, so it earned me a real return of 6% in the interest I didn’t have to pay, plus the tax on earning that.

2007 Maya is 26, and about 10% up

Maya’s feeling chipper about her stocks and shares ISA, got about 100k, she can buy a house for that. Not quite ready for that as she’s just split up with her boyf, the mating game is tough in those years. Candi’s starting to think there’s summat in this stock market casino thing and the market is all over the papers like a rash. Her Dad looks up from the paper on one of her rare visits home and says “Whom the gods would destroy, they first make mad”, and Candi sticks with cash, though she enjoys the free drinks at the party Maya throws in a basement bar in the City, full of raucous finance worker braggarts. Candi does worry about her bestie’s taste in men at times, but you can’t argue with the quality of the champagne.

2009 Maya is 28, and she’s abut 40% down

This is not a good birthday because Maya is nursing a 40% loss, and it takes the edge off being young, beautiful and in love, particularly when both of them are fearful for their jobs. Maya is feeling a chump for 10 years of loading her ISA giving her a 40% loss, and starting to wonder if she should have spent more on Louboutins and lived it up a little bit. YOLO and all that, you only live your twenties once. Candi buys her a few drinks and tries not to say I told you so.

2012 Maya is 31 and breaks even relative to Candi Cash

The good news is that Maya has reached parity with Candi, so they buy their own drinks. Everybody’s scared shitless of the markets, and Maya looks back at her twenties and wonders where it all went. In the toilets she looks at the crow’s feet starting around her eyes, and the stress of it all makes her break down. Candi comes in and puts her arm round her, but Maya looks at her friend and observes no crow’s feet yet, and great heaving sobs shake her. She collects her thoughts and the two leave the bar together.

Maya had a tough ride and it’s a cautionary tale

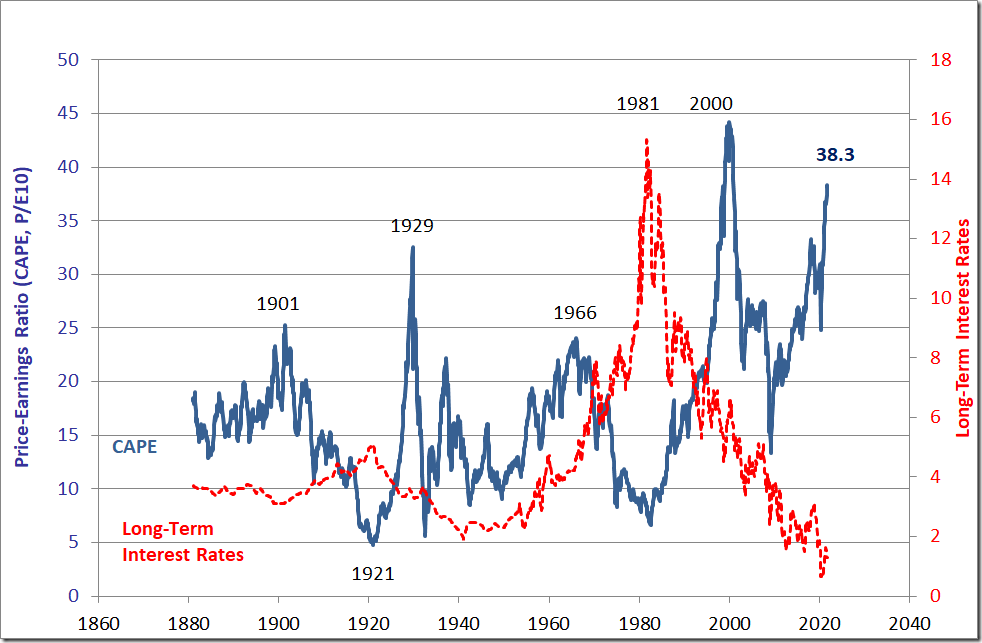

Why did Maya have such a rotten ride? She started in 1999, it was the dot-com boom that was about to turn to bust. Go look at UK Dividend Stocks’ CAPE valuation chart. Maya started investing when the SPX CAPE was literally off his chart. The SPX is the largest proportion of world assets, particularly back then, so it did a lot of damage.

You’re a good little passivista and you say Meh, it’s not like Maya inherited a shitload from her grandfather and invested the lot at an all-time high CAPE. And you’d be right. Assuming Vanguard did the analysis competently, Maya dollar cost averaged into the market, and she still needed Candi to put an arm round her on her 31st birthday because of all the stress. DCA is not a panacea for a shitty sequence of returns. What gives you a shitty sequence of returns? Bad luck and high valuations.

At the time of writing, the Shiller CAPE ratio is on the high side, about 34, that’s less than the 44 when Maya started. Seeking Alpha has a chart showing if you buy the US at CAPE >34 you can expect a return of ~4%, over the next 15 years!

Vanguard’s good news story only came good after the halfway mark

and then it hit it out of the park. But Maya Millennial needed a lot of TLC through her twenties before the rocket boosters fired. There’s a cautionary tale, too, for people starting now. Inspect the Shiller CAPE ratio for the SPX over the last 50 years

You can take a little bit of solace from the fact Maya Millennial took a couple of years of the CAPE being much higher than now. Perhaps humanity is getting a little bit more efficient in the art of capitalism that might justify the gradual lift in the CAPE over the years, extrapolate that and it is high, but not Maya Startup high.

Is there fire underground, perhaps?

Now ask yourself if you observe anything rotten in the United States, and arguably in the West in general? Do you think that AI will mean that we can happily live inside our smartphones while the shit piles up in our rivers and the doors fall off our aircraft every so often? What say you about president-elect Donald Trump? We should note he wasn’t as terrible for the stock market as you might think, though other shit was going down in the latter part of his reign to muddy the waters. The CAPE on VUSA isn’t astronomically high like it was at the end of 2021, but it’s still running a bit rich.

The trouble with the CAPE expectations is take a look back over 15 years. The Apple Iphone had only just been released two years ago. We were not to know that a rapacious ecosystem was going to grow that meant we could all be rude as hell to the people in front of us in order to live in a simulacrum of the real world in servers owned by the Magnificent Seven, who would track the bejesus out of their punters and lock the suckers in. It’s a step-change as the world of atoms gave way to the world of bits, and in the world of bits scale is everything and marginal costs are low. CAPE is a measure of what people will pay for future earnings flows. Low marginal costs can justify higher valuations.

I detest this ecosystem with a vengeance and don’t carry a mobile phone tracking cattle tag with me in general, but it sure as hell makes money, at scale. I can afford to take the punt on VUSA.

It’s a new ISA year, and I had to make myself lob £10k into my Vanguard ISA to buy VUSA. That’s only half of the ISA and it’s a small part of the whole. I still hate myself a little bit.

I am going to counterbalance that VUSA outside the ISA with non-USA deadbeats, where valuations will be better. I am therefore making a mild bet that the rush of blood to the head that has made us all dive into cyberspace because it’s better than our normal lives justifies the higher valuations, but that is a riff on the deadliest words in stock market investing

it’s all different now

History shows that it never stays all different now 😉 I am doing this because I am starting to struggle with the capital gains allowance on unsheltered VWRL (or currently HMWO.L, which is the same thing).

I’ve split off the US stuff, if it isn’t all different now and VUSA is at 50% then I may get to pay more tax on the non-VUSA part in the GIA. But I’ll take that risk, because when America catches a cold the rest of the world usually does too, which probably gives me time to think. I will lob the other 10k into the iWeb ISA to rebalance some of that.

Framing matters, Vanguard 😉 You wouldn’t have run that story when I retired in 2012, though you chart shows that wouldn’t have been a bad time for Maya to start and Candi to switch. Ain’t hindsight a tremendous thing…