Jezza’s at it again. Much is made of a 2pc drop in National Insurance, which is all very well but given the £12570 tax threshold was frozen since 2021 and would now be worth £14874 you’re paying £400 more in tax anyway. Sure, every little helps as they say. You have to be earning £21k1 before the 2% knocked off NI beats out the increased tax you pay due to fiscal drag.

A gotcha that FI aspirants may be in for is the final abolishment of Class II NI contributions. I had feared this since Nick Clegg’s crew had this in their gunsights pretty much as I retired. The devil is going to be in the detail I don’t have.

If you’re lucky, declaring as self-employed for a year would get you a paid-up year of NI subs for free rather than the £150 I paid, in which case I paid more than I needed to. I had seven years to make up. I can’t argue with that, I got 97% off what an annuity of equivalent value would have cost.

If you’re unlucky, there will be a minimum profit requirement to get those NI credits, in which case you will be SOL unless you meet that profit requirement. This was articulated in 2015.

Historically this was £6725 in which case freeloading mustelids would have been given the order of the boot. It’ll be Class III voluntary or nothing, and they come in at £17.45 pw. Since only full years of NI count, that’ll be 900 sods, which is a bit more than Class II was at about ~£150. I am glad I have done with this. Presumably all of a sudden people who were on a low income or even nil will start to make £6240, which at least is safely below the personal allowance 😉

The Great British ISA never turned up. Shame, as I would have used it to get more ISA capacity, I could have displaced some UK stuff out of my normal ISA, things like ITs, since index fund ETFs are usually domiciled in Ireland so they don’t count. Oh well.

I am glad sense prevailed and the tax giveaway for rich bastards otherwise known as reducing inheritance tax has been dropped for now. I guess it’s not a good look what with the cost of living crisis and increasing destitution, even if the torygraph will be disappointed.

Oi, furriners, keep your filthy paws off the Tory Party house newspaper

Taking of which, WTF is this with the gov toying with stopping furriners buying the Telegraph? I thought Brexit Britain was open for business? Seriously, that media ownership boat sailed many years ago, when Thatcher lifted the restrictions on foreign media ownership in the 1980s, giving the Digger the nod on the QT in 1981. Which is why we have such a rabid yellow press in thrall to money now.

Sure, people of a certain age will remember when it was in thrall to the unions, and indeed Murdoch published this love letter to Thatcher in appreciation for, ahem, services rendered back in the day. So I am genuinely surprised by all the pearl-clutching. The Torygraph is but a pale shadow of its former self, all it seems to do these days is bang on about inheritance tax. ChatGPT seems to be doing the work in the newsroom as it is, take a bow2 Harry Brennan on the tragedy of the impecunious Rich Kids of London.

Wot, no IHT abolition?

Disregarding the issues associated with favouring some rugrats over others, there’s a perfectly good way to favour the fruit of your loins without suffering the non-indiginities of being taxed six-foot under. If the HMRC come rapping on your coffin then crack the old lid a tad and tell them to eff off. Not in a position to do that due to being terminally indisposed? Well in that case not your problem, mate. The specific combination of death and taxes just doesn’t happen. It’s the lucky recipients that get to pay it, and if they are your spawn then typically only over £1mn. If they have that much then the kids are all right.

I reckon this one is gonna be served up as a a straight pre-election bribe, to keep all the old fossils in line and their undeserving rugrats too. You don’t want to shoot your load too soon, eh, Jezza?

Shame about that dispiriting growth forecast, eh? They may as well do the Dubya thang and say

this sucker could go down

Meanwhile, our friends across the Pond, who let’s face it have an orange ball of hatred spinning up for a second bite of the cherry, took time to tap their heads wistfully and wonder WTAF is going on with a small offshore island with no captain at the controls, in office but not in power. Rum old world, innit?

- Plus of course the extra NI you pay, but computing NI is the devil of a job so I didn’t bother qualifying that ↩

- I’m not charging Hezza with inaccuracy about his article on the dire straits that the rich spenders of London. It’s the epic due diligence fail in his citation of the book Uncomfortably Off, where a quick butcher’s hook at the publisher’s rubric on Amazon with the deathless social justice text “this book explains why, even if you are relatively near the top, it is in your interest that inequality is reduced and you can help make that happen” might have indicated to the old brain cell that the thesis of this book may not please his readers’ fur. Chat GPT is evil like that. I asked it to tell me something good about stoats, and it started referring to New Zealand websites. The highly invasive species known as New Zealanders have a really bad attitude to stoats on the grounds that stoats chomp their lazy good-for-nothing flightless birds, which is fair enough IMO, the whole point of being a bird is flight, and stoats have gotta eat, it’s not like they swam the Pacific ocean. ChatGPT has the same respect for truth and guidance as Boris Johnson, it’s always good to be aware of the character of your journalistic sources, and incorrigible liar/stochastic parrot isn’t a good look there. ↩

Below extract from HM Treasury – basically, the credit for those earning over £6724 will remain, as will the ability to pay Class 2 NICS to preserve entitlement if earning under £6725.

From 6 April 2024, self-employed people with profits above £12,570 will no

longer be required to pay Class 2 NICs, but will continue to receive access to

contributory benefits, including the State Pension.

2 Annual Survey of Hours and Earnings, Office for National Statistics, November 2023.

HM Revenue and Customs analysis of NICs liabilities.

3 HM Revenue and Customs analysis of NICs liabilities.

4 Tax Structure and Parameters statistics, HM Revenue and Customs, June 2022. 5 Annual Survey of Hours and Earnings, Office for National Statistics, November 2023. 6 School workforce in England survey, June 2023. 7 Annual Survey of Hours and Earnings, Office for National Statistics, November 2023. 8 NHS Staff Earnings Estimates, NHS, June 2023.

E02982473_Autumn Statement Nov 23_BOOK.indb 42 22/11/2023 02:06

Autumn Statement 2023 43

• Those with profits between £6,725 and £12,570 will continue to get access

to contributory benefits including the State Pension through a National

Insurance credit without paying NICs as they do currently.

• Those with profits under £6,725 and others who pay Class 2 NICs voluntarily to

get access to contributory benefits including the State Pension, will continue

to be able to do so.

• The main rate of Class 2 NICs is usually uprated by Consumer Price Index (CPI)

and therefore had been due to rise to £3.70 per week in April 2024. For those

paying voluntarily, the government has decided to maintain the current rate of

£3.45 per week for 2024-25.

3.11 The government will set out next steps on Class 2 reform next year. As part of

this reform the government will protect the interests of lower paid self-employed

people who currently pay Class 2 NICs voluntarily to build entitlement to certain

contributory benefits including the State Pension. This is a progressive reform,

giving lower-paid self-employed individuals a significant tax cut. It simplifies

the system for self-employed taxpayers, reducing needless complexity, freeing

up valuable time for them to grow their businesses rather than interacting with

the tax system. This builds on the Spring Statement 2022 decision to ensure that

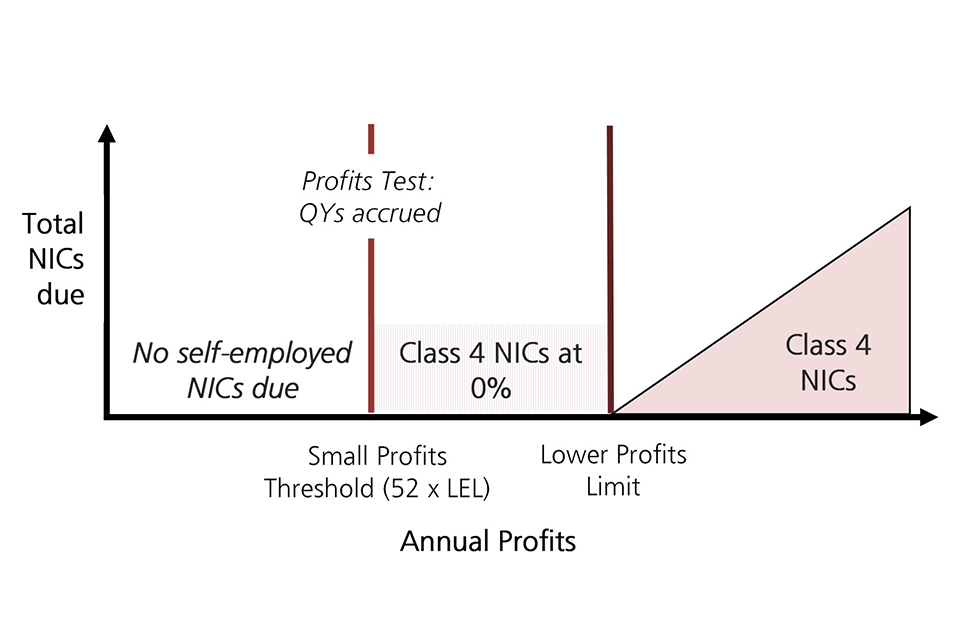

self-employed individuals with profits between the Small Profits Threshold and

Lower Profits Threshold could continue to build up National Insurance credits

without paying Class 2 NICs.

LikeLiked by 1 person

That’s excellent news, emergency averted 😉

LikeLike

Full(er) details available at: https://www.gov.uk/government/publications/autumn-statement-2023

LikeLiked by 1 person

And more specific NI stuff is teased out in

https://www.gov.uk/government/publications/autumn-statement-2023-national-insurance-factsheet/autumn-statement-2023-national-insurance-factsheet

long story short, you can still voluntarily pay class II, though I’d say the wind is blowing in a direction where I wouldn’t assume that in future is this crew get back in…

LikeLike

Yup.

The key phrase looking forwards is:

“3.11 The government will set out next steps on Class 2 reform next year. As part of this reform the government will protect the interests of lower paid self-employed people who currently pay Class 2 NICs voluntarily to build entitlement to certain contributory benefits including the State Pension.”

and exactly what the clause “protect the interests …” actually means?

One other thing worth noting in the budget (re ISA’s) is:

“ISA: Allowing certain fractional shares contracts as a permitted investment” again, however, the devil may be in the details of what this actually means.

BTW, did you get a chance to do the calculation I suggested (re redundancy, etc) in your last post?

LikeLike

Fractional shares will be good for this sort of problem

> did you get a chance to do the calculation I suggested (re redundancy, etc) in your last post?

Yes. I’ve been trying to tone down the post. I extracted the year-end figures from Quicken and summarised them year end.

I’m still not sure I have the balls. Passivistas may get on my case six ways to Sunday because there’s thoughtcrime in it.

LikeLike

If I understand you correctly, it is just a question of having possibly used the wrong boundary conditions. So perhaps human error but certainly not “thoughtcrime” I had a maths teacher years ago who we nicknamed “boundary conditions”. Really odd how these things stick.

LikeLike

> having possibly used the wrong boundary conditions

No. I did the comparison with ‘what would the capital be if a desperate mustelid had taken everything and put it in VWRL in 2012. And then grown longer canines, and become a vampire, and hibernated until 2023. The end result is about the same. I adjusted for inflation (rescaling earlier amounts to 2023 using the results of the BoE inflation calc).

Advantage passive. All that effort gone to naught. Buy VWRL and hold. But: I extracted the part windfall given away. IRL I lived off the amount for 7 years. I bought more house, which I write off as consumer purchase. I also made some serious errors – a little muppetry in the early days and I underweighted the US in the first years, which hindsight shows to have been a opportunity cost.

It is not possible to determine analytically that this was not good fortune, as the elective turning points where I did something are only one and a half data points out of the two and a half decision points in total. The first was in powering out of the GFC, which was situational, not elective.

But for all that, bollocks to it. I was active, I didn’t get killed. Je ne regrette rien.

LikeLike

OK, I see.

And I now get what you meant by “thoughtcrime”. Interesting result though.

The calculation I had in mind was much simpler, explicitly:

net redundancy package (inc share saves, etc) / average annual spend during the gap

In my case this came out under four years, but if you refine the calculation a bit (and look at the year by year spends) it lasted longer. These durations surprised me.

Had you taken the pure passive route (with a prolonged period of hibernating vampire thrown in for good measure) you would not have so much to write about and would have missed all the fun and games of the last few years too. No contest, really!

LikeLike

Just to be clear, where I say spend I really meant drawdown ie annual spend is covered by any income/ earnings and drawdown.

LikeLike

> In my case this came out under four years

Probably five years. The SS and ESIP were a decent lump. they were still on my books into the gap

I couldn’t really sustain NMW frugality for the duration of the Gap, there’s an argument I would have been living quite a pinched life, and let’s face it, I have lived 10% of my life as a retiree. Frugality was easier while working because the reason for it was right in my face. Although the simplistic calculation comes out at five years it would have been harsh. I didn’t spend much in the first couple of years because that was recovery/decompression.

Monevator gave early retirees gentle ribbing about not working, I think he’s still of the Calvinist work is good for you school of thought, but more specifically he hasn’t had the experience of running out of road in that aspect of life. A fellow recently contacted me on LinkedIn about some instrumentation on a subject I seem to be a Google main result on. I admit to a faint temptation – I still have a fondness for the dying art of analogue electronics which tends to be still a thing in sensor design. It was interesting, after all I pursued that article as a hobbyist so for it to be a key post about this aspect of instrumentation shows there are problems to be solved.

But I CBA, and I don’t need the money. I pointed him at some physics papers and some COTS suppliers and did my best to get rid of the job. I don’t need the pressure, it’s fine to follow as an intellectual pursuit but not with a CEO breathing down my neck. There are easier ways to make money, and this is one of the problems Jezza is up against. Neoliberalism has made work shit in the interests of efficiency. If you want to repair the shot research base that is future growth than make it fun again, across the board from universities to industry.

So was it five years Gap or was if three or four? Depends on the benchmark. I wanted to do more than survive.

LikeLike

> If you want to repair the shot research base that ….

Indeed, I clearly remember my early years at work being great fun!

But, there may be an element of “rose tinted” in this too.

>So was it five years Gap or was if three or four?

My main point is that redundo, etc can act to cushion some of the costs of the Gap, and, when this is the case, any other assets you have are able to grow in that period too.

LikeLike

The Telegraph isn’t just IHT whinges. I subscribed today for an annual £25 – good to read what the right wing is talking about – and essentially a guide on how the middle class shoplift. Maybe they weren’t condoning it, they certainly weren’t strident in denouncing it.

LikeLiked by 1 person

> The Telegraph isn’t just IHT whinges.

Well, they talk about other stuff 10% of the time 😉 My local library has pressreader as part of their online services, which gives you a sort of facsimile of the print edition, including the Telegraph. Sadly no longer the Economist, which they used to do until last year.

I read that shoplifiting article too, I suppose the cost of checkout ops saved is more than the stuff that walks off.

LikeLike

Did you keep your Suffolk/ipswich library account? I still have The Economist on my press reader. If only the comments were as good as the real thing

LikeLiked by 1 person

OK, I have to ‘fess up to a lack of imagination fail. The Economist was on the Libby app and it got the bum’s rush on the New Year. It never occurred to me to look for it on pressreader 😉 Thanks!

LikeLike

Something I missed in the first scan about ISAs but will be a very welcome move is what HL highlighted

In my case I’ve used Vanguard for the last three years as it’s a cheap way to slowly build up VWRL and VMID, which means I haven’t been able to do anything with my iWeb ISA, other than use the proceeds of dividends to buy. I’d quite like to add the odd 5k into that, giving me about 10-15k pa flexibility in that with dividends, retaining 15k in Vanguard, and it seems from next year I can do that. Vanguard ETFs I usually move end of year into HL, which is fixed-fee for shares/ETFs as opposed to percentage fees with Vanguard, so this could be the best of both worlds. So I did gain something from this after all.

LikeLiked by 1 person

Thanks I missed that somehow. Not sure if I’ll use it, will probably Bed&ISA the Vanguard GIA VLS funds into into a new ISA with them. Cheaper to park them there than on HL and I have quite a lot on the HL platform. I wish Vanguard actually did an automated Bed&ISA though. I probably should have had those funds in VWRL in hindsight…

LikeLiked by 1 person

> Cheaper to park them there than on HL

I am puzzled by this, though I suspect the devil is in the detail of your holdings. I only have a small SIPP and a reasonable sized ISA with HL, but they say

https://www.hl.co.uk/investment-services/isa/savings-interest-rates-and-charges

annual account charges (shares)

> capped at £45 per year

and ETFs like VWRL seem to count as shares

> Including UK and overseas shares, investment trusts, exchange-traded funds, VCTs, gilts and bonds.

LikeLike

It’s Lifestrategy funds so they would attract the 0.45% above the HL cap even in the HL GIA account. I tend to look at the charges as % of pot including fund charges but actually the VL platform fees are exceeding the HL ISA. A shame VG haven’t reduced their cap as they attracted more accounts. The problem of putting too much with one broker though. I could cash some if it and put it in HL as ETFs. HL, too big to fail but you never know…

LikeLiked by 1 person

> It’s Lifestrategy funds so they would attract the 0.45% above the HL cap even in the HL GIA account.

IWeb could be your friend in that case. No fees to hold shares or funds (but you do pay £5 per transaction to buy/sell funds or shares). Plus you save the £100 a/c opening fee if you get in this year

LikeLiked by 1 person

I normally loom forward to the budget/Autumn Statement and try not to partake in the speculation beforehand and instead indulge in a deep read of the actual statement to understand what is being said (check the detail) and make changes to my personal finances accordingly.

Unfortunately, this was a largely boring and uninteresting statement. It doesn’t really make any changes to me, and even the impact of 2% off NI doesn’t make much of a difference to your average earner (especially when fiscal drag is considered).

LikeLiked by 2 people

I thought the move to lower Ni rather than lower income tax was clever – no more gifts to the retired and non- workers. It’s also perhaps the start of a master plan to merge the 2 – next year 8% Ni 22% tax, the 6% /24%…. Intergenerational fairness and all that.

It was also neat how the employed v self employed NI difference was effectively removed.

In terms of tax free allowances I’d rather they were reduced than increased – most adults should have skin in the game and contribute to tax revenues

LikeLiked by 2 people

I’d thought that maybe, just maybe they’d scrap the personal allowance and just pay everyone* 20% of £12,570 or £2514 (maybe £200 every 4 weeks?)

A sort of UBI to save on admin and to help those who aren’t earning – like carers – who lose out at present.

The chances of having inter-generational fairness? Not under any government.

*not everyone obviously – you need some hate groups to discriminate against.

LikeLiked by 1 person

How dare the Tories. Cutting taxes for actual working scum, when the beautiful retired Tory gets nothing! These Tories are basically Marxists …

Seriously though, with the UK govt spending £14k+/person, the whole idea of taking people out of tax has gone rather wrong. I did support that idea 15 years ago but, as you said, then people have no skin in the game. I’d prefer cutting allowances and bringing back 10% income tax rate for those on low wages. Or do the right thing and merge NI and income tax with a new lower rate combined rate of 20%. I can hear the Tory pensioners wailing right now. What a lovely sound that would be …Shame it will never happen.

LikeLiked by 1 person

I like it – how about 3 years NI earned stamp, or £10k paid income tax to be eligible? Clearly we don’t want 18 year olds to miss out on the benefits of part time work

LikeLike

Came across this earlier today:

https://ca.finance.yahoo.com/news/why-contracting-means-might-miss-050000296.html

As It came from the horses mouth – so to speak – it is worth a look.

It seems to agree with what: DavidV; yourself; and I flushed out a few months back. Which is good to know.

My take away was Steve Webb was/is obsessed with contribution rates (ie %ages) and not the absolute contributions made – which IMO is a very odd way to quantify “fairness”

LikeLiked by 1 person

That does seem a quite clear explanation from Steve Webb of how the New State Pension was designed as it is. Of course, as I and my colleagues were always members of contracted-in pension schemes, whether DB or DC, we were relieved that our SERPS/S2P accruals resulting from paying full-rate NI for all those years were not to be taken away from us.

LikeLiked by 1 person

I recall being pleasantly surprised that the years dropped from 40 to 30 in the origianl 2006 pensions A day as I could never have made 40 years even if I retired at The Firm’s NRA. I thought it was too good to be true at the time, and so it transpired. I had to pay up 39 years in all. I can’t say there’s steam coming out my ears about the 4 extra years, since they were at Class II rates which is a steal. But it confirmed the TGTBT assumption. I am minorly needled about a decade of SERPS that seems to have disappeared into a black hole, but sometimes you gotta listen to the ping of the bullet and just be glad you didn’t stop that sucker, so I can let that go.

> not the absolute contributions made – which IMO is a very odd way to quantify “fairness”

I’m not sure there’s a philosophical way of defining that universally. There is an inherent and irreducible battle between the “get proportional to what you pay in” and “from each according to his means, to each according to their needs”. This is a dialectic, nor a single-valued formula 😉

FWIW I feel Steve Webb did okay. I managed to persuade an ex-colleague who retired at the same time as me but who was three years older to pay for a few years at Class 3 rates. I did tell him he could do Class II for the sake of doing a SA100, but he CBA. I used the agency of the power of beer plus pointing him to an annuity quote site of how much that would be on the open market, not index-linked, along with the suggestion he run, not walk to take the opportunity 😉 He only has to make it to three-score-years and ten to be in the money, and this is an investment you can’t screw up or be conned out of. Class II rates are a giveaway. No wonder Jezza wants to bust its ass, I’d say the days of that are numbered… OTOH I thought that in 2012 and I always think housepricecrash is imminent, so what the hell do I know

LikeLike

@David V: IMO it is awful that it has taken some seven years since it [the new state pension] was introduced for a clear explanation to emerge. The fact that said explanation is written by an ex minister and not HMG is very odd too; especially seeing as one of the major justifications for the new state pension was that the old scheme was just too complicated!

@Ermine: agree with both: class II and that “fairness” is much easier said than quantified.

LikeLike

> I am minorly needled about a decade of SERPS that seems to have disappeared into a black hole, but …

I am nearly 100% sure that your “foundation amount” (to use the Steve Webb terminology) would have been calculated using the “the old scheme calculation”. Hence the only NI contributions you paid that did not buy you any state pension were those you made in years 31 to 35 inclusive. Whether or not these included any SERPS/S2P I cannot say.

AFAICT this would also have happened under the pre 2016 state pension system, although I am a bit hazy about what would have happened to any SERPS/S2P payments you made for qualifying years 31 to 35 inclusive.

BTW, an explanation of qualifying years (as opposed to years) is missing from Steve Webbs post. In essence, you had to make at least the equivalent of 52 weeks of the minimum weekly NI contribution in a tax year for it to be qualifying. Note, this means you did not have to pay in for each and every week in the tax year if your weekly NI contributions were greater than the minimum required.

LikeLike

P.S. my above comment tacitly assumes that your contributions in years 31 to 35 inclusive were made whilst you were still working and were taken by your employer from your salary. If this is not the case, then less years of your NI contributions did not by you any state pension. Hope this clarification is sufficiently clear?

LikeLiked by 1 person

> that your contributions in years 31 to 35 inclusive were made whilst you were still working

hehe, layabout that I am, I only worked 30 years,That is, after all, the whole point of this FI/RE game 😉 I have some spurious 3 years while still at school though not UG university, but I have 1 year for the MSc I did after working a few years.

There was a load of noise and hum at the time around 2016 as to which years were worth buying. I had earned enough by June 2012 to easily clear the NI bar for TYE 2013. Looks like I skipped TYE 2014 and 2015, informed by that chatter at the time. The record shows I bought five years Class II and that I have a total of 39 years. I was wondering how the maths add up to 34 given 3 came while I was a nipper and I only worked 30 years in total, but the MSc explains the extra year.

I didn’t get a grant from the SERC but from the Manpower Services Commission. I got NI credits of 28 weeks, then 25 weeks the next year over that period. I came straight from work into the MSc and from the MSc immediately into work. I don’t know if everyone gets NI credits for postgrad study or if this was a Manpower Services Commission thing, their remit was probably to reduce the unemployment headcount.

Can’t really bitch about five years Class II, that’s 897 Great British Sods to buy an annuity of £1215 p.a. post tax. A single life RPI annuity from 65 which is the closest match to the SP HL cite would cost me £34,500 at current rates, so I got to pay 3% of the going rate. I only need to make it to 68 to be in the money on that bet. I’ll let the SERPS entitlement go for saving £33k.

LikeLike

In which case you have a maximum of four years of NI contributions (that may have included SERPS/S2P) that did not buy you any state pension. That is 34 qualifying years on leaving work minus the 30 qualifying years required for full state pension under the pre-2016 system. Admittedly I am a bit unsure about what actually happened to any SERPS/S2P payments for qualifying years 31, 32, 33 and 34 – hence why I say “maximum”.

LikeLike

> I am a bit unsure about what actually happened to any SERPS/S2P payments for qualifying years 31, 32, 33 and 34

Although ISTR The Firm un-contracted out towards the end when they were trying to can the DB pension, all my SERPS contributions will have been for about 8 years at the start of my working life.

LikeLike

Maybe DavidV will add his thoughts?

LikeLike

“Maybe DavidV will add his thoughts?”

I just got home and turned on my computer to see the latest additions to this thread. I’m fairly certain that voluntary NI contributions would not buy any SERPS/S2P entitlements – only credits towards a full basic or new state pension, i.e. under the old or new system of calculation (the clue is in the name if you spell out SERPS). Of course, as you explain yourself, the years in which these are paid are significant in terms of when you reach SPA and whether your pension is optimised under the old or new system of calculation.

IMHO the information published by the government in the run up to the introduction of the new state pension in 2016 was fairly clear. The problems of unfulfilled expectations arose, I think, because the press picked up on it and described it as being a flat-rate scheme. In fact it is less flat than the old system. Under the old system most people with a reasonably full working life received at least the full basic pension. They may have received some SERPS/S2P on top, but as this was little understood it was probably regarded as an unexpected bonus. In contrast the ‘flat-rate’ new state pension is very likely to be reduced by years in contracted-out pension schemes. The press failed properly to prepare people for this or explain that they were paying reduced NI contributions for these years and that their pension schemes had GMPs that were supposed to make up the difference.

LikeLike

> In contrast the ‘flat-rate’ new state pension is very likely to be reduced by years in contracted-out pension schemes.

I guess this will apply to people who were on the cusp of retiring in 2016, but otherwise it’s reasonably actionable. Were I still working I would be paid up by now, indeed had I stayed at The Firm I’d only have one year to make up post NRA. If I worked until SPA I’d easily catch up.

In fairness to HMG, at no stage did I think I was buying SERPS or S2P with voluntary Class II and at no stage did anyone imply that. The minor whinge about SERPS was from the beginning of my working life, not only did I pay a higher rate of tax back then but it was on a much larger part of a more meagre salary so it was more of a hit, all to naught. However, the saving at the end compensates handsomely. For all I know the four year malus would have been even worse without the residual SERPS.

LikeLike

@David V:

Thanks.

@Ermine:

Assuming I have understood things correctly* and all your SERPS/S2P contributions were paid towards the start of your working life then the additional state pension they bought you is included in your “foundation amount”. That is, you got all you were entitled to from all the SERPSs/S2P you paid.

But, you got nothing for the final four years of NI contributions (which I assume were contracted out) whilst you were still working. This is because you were already maxed out on the basic state pension which tops out with 30 qualifying years.

* I am not sure what precisely is meant by “un-contracted out towards the end” e.g. do you mean the end of your working years, the end of the DB scheme, or something else?

LikeLike

> do you mean the end of your working years, the end of the DB scheme, or something else?

The DB scheme contracted back in. I can’t remember exactly the reason why, I vaguely think this is because it was cheaper for them to sponsor the contract in and get the effective annuity from the gov. So my last three years ISTR were in the DB scheme, but it was contracted in. They say in the scheme booklet

> With effect from 6 April 2009, members (of the DB scheme) were contracted into the State Second Pension.

LikeLike

If you left work in 2012, that probably* mean that:

a) you got nothing for the final four years of NI contributions whilst working ; and

b) you may have got nothing for three years of SERPS/S2P contributions that you paid prior to leaving work after your DB scheme contracted back in

So probably not as “minorly needled” as you feared re SERPS/S2P!

* depends on your leaving date (and how it relates to April 2009) and your actual NI contributions (in £ notes) in your four final years of working

LikeLike

@Ermine I agree with Al Cam that your eight years of SERPS would have brought your foundation amount nearer to the level of a full New State Pension than if you had not had them.

Regarding it being actionable to make up to the full NSP, I suppose I am relating to my own age group. I reached SPA in late 2018. Had I been in a contracted-out scheme (or voluntarily contracted out to a private pension for more years than I did) then I could have had a shortfall which would have been very difficult to make up either by working longer or paying voluntary NI contributions.

My employer’s DB scheme (which closed to new contributions from me in 2003 when my part of the company was sold) was always contracted-in. This was, I believe, an astute judgement by the management that SERPS offered better value than being contracted-out. The benefits did, however, involve a complicated formula that included a reduction for the amount deemed payable by SERPS. The astuteness of the management was not matched by many of us when we followed the herd and voluntarily contracted out to private pensions (in my case initially with Equitable Life!) when this became possible in 1989 (effective from 1987). I jumped back into SERPS/S2P in around 2005. As SERPS began in 1978, I think, I had around nine years SERPS before contracting out and another 10 or so after. This was enough to bring my foundation amount above the NSP and so gives me a Protected Payment in addition to full NSP.

LikeLike

@Ermine A further point that I failed to address earlier. After The Firm’s DB scheme contracted-in in 2009 your NI contribution rate would have increased. They would in principle have bought you further S2P accrual from 2009 until you left in 2012. However, I recall you saying that in these final years you salary sacrificed to close to minimum wage. The S2P accrued would possibly be minimal. In any case NI contributions in the later years of the SERPS/S2P regime were generally regarded as less valuable than those in the early years. The scheme was made more beneficial to low earners, though, so there is the possibility that your extreme salary sacrificing would have had less effect on S2P than I first thought. In any case, any S2P accrual, however, small should have increased your foundation amount. I’m sure you are correct in saying that the major contribution would come from those eight years at the beginning of your career.

LikeLike

DavidV,

Was it the case [in the pre 2016 state pension system] that for a contracted in person SERPS/S2P continues to accrue even when the max baseline state pension was reached [after 30 qualifying years]?

I ask as I have never been sure if this was (or indeed was not) the case.

I do recall there being an upper limit to additional pension but whether this was related to qualifying years or perhaps just pure £’s has never been clear to me.

LikeLike

DavidV,

One further note/clarification re your comment that begins “A further point that I failed to address …”

The term “salary sacrificed” is key!

Were the additional pension contributions (aka AVC’s) not salary sacrificed (and therefore only eligible for relief of income tax) then you would still pay the full contracted-in NI rate on your whole salary. I know this as this was my situation in the final years of my working life.

LikeLike

@Al Cam SERPS/S2P did indeed continue to accrue even after the 30 years minimum contribution years to achieve full basic pension had been achieved. Before changes in either 1997 or 2006 (A Day), I forget which, the number of years required was much higher – 40 or 42. There was an Upper Accrual Point (UAP) that limited the amount of SERPS/S2P that could be accrued in any year but, I believe, no limit to the total that could be accrued. Of course the combination of the lifetime of the scheme 1978(?) to 2016 and the UAP set a cap on how much could be earned in total. I believe that when the NSP was introduced in 2016 the maximum theoretical pension achievable calculated under the old system (basic pension plus additional pension) was around £15k p.a.. This would have been for a very high earner who was contracted in to SERPS/S2P and managed to hit the UAP every year of his/her career from 1978 to 2016!

Of course I’m not sure what Ermine’s situation in The Firm was, but from what he has previously written I believe his AVCs could be salary sacrificed. In my own case the whole pension contribution, including AVC could certainly be salary sacrificed, thus saving NI as well as income tax. Salary sacrifice was only available to me from 2013, by which time I was in a DC scheme. The whole pension contribution was treated the same and AVC only had the meaning of that portion of the contribution above the maximum employer match. For those three years from 2013 to 2016 I was conscious that choosing to salary sacrifice would lose me a small amount of S2P accrual. The analysis I did at the time showed that it was nevertheless well worthwhile.

LikeLiked by 1 person

Those AVCs were most definitely salary sacrificed, and this is visible in a reduced rate of NI yearly payments. I also used ESIP which I think was also salary sacrificed, though the limitation was low, £125 p.c.m. I recall, so the AVCs were the big hitters here

LikeLike

DavidV,

Thanks very much for that comprehensive reply.

I think I can piece it all together (hopefully fairly definitively) now.

It goes as follows.

AFAICT, what this means is that all Ermines SERPS/S2P contributions bought him some additional pension that has been included in his “foundation amount”. That is he forfeited no SERPS/S2P payments.

So seemingly no need for Ermine to be “minorly needled about a decade of SERPS that seems to have disappeared into a black hole”

This situation is what I have long suspected, but was not totally sure about.

As it happens this SERPS/S2P scenario also applies to myself.

On leaving work in 2012 (and on conversion to the new SP in 2016) Ermine would have got nothing for his final four years of basic (non SERPS/S2P) NI contributions whilst working. This is because he already had 30 qualifying years.

On conversion to the new SP Ermines SERPS/S2P must have purchased additional pension worth at least one but less than two equivalent qualifying years; as he only needed to make four years further contributions (under the new SP) to get to the magical 35.

Again, my situation was remarkably similar, albeit my SERPS/S2P contributions were all at the end of my career (noting that whilst my baseline DC pension contributions were salary sacrificed my AVC’s were not salary sacrificed). I also worked most of the 2016/17 tax year too, so actually only needed to make three years further contributions (under the new SP) to get to the magical 35 on leaving work.

For info, my SERPS/S2P bought me 1.44 equivalent qualifying years of additional state pension at conversion to the new SP. IIRC, I did once calculate this figure for Ermine somewhere on this blog but just cannot put my fingers on it right now.

LikeLike

@Al Cam @Ermine

Oh dear! My brain is beginning to catch up and I think we are now in a situation where we can’t be completely sure whether it was Ermine’s early career SERPS or post-retirement voluntary Class II contributions that had any beneficial effect. As I think we all know and agree, a notional calculation is performed as of April 2016 under both the old and new systems to determine which is higher and establish the foundation amount. I’m slightly unclear when Ermine made his voluntary contributions and to which years those were allocated

Old System: In 2012 Ermine has over 30 qualifying NI contribution years, so qualifies for at least the basic state pension. In addition he has eight years of early career SERPS plus three years of less quantifiable and possibly negligible S2P between 2009 and 2012. This is added to the basic state pension. If the old system calculation is the higher of the two it sets the foundation amount and any voluntary contributions allocated to years before 2016 would have been wasted. Post-2016 voluntary contributions can be used to increase the foundation amount to the full NSP but not higher (unless the foundation amount was already higher than the NSP, as in my case).

New System: In 2012 he has insufficient NI contribution years to satisfy a future requirement to be introduced in 2016 to have 35 qualifying years. As 2016 approaches he makes five-years-worth of voluntary Class II contributions (if I understood correctly). Any of these allocated to years up to 2016 will bring the first part of the calculation either up to or at least nearer the full NSP (depending on whether there is still a shortfall from 35 years). Unfortunately the next part of the calculation is to reduce the amount for the number of years he was contracted out via The Firm’s pension scheme. If this still turns out to be the higher amount (I think unlikely) then the pre-2016 voluntary contributions will have been useful, although any that took the total of years beyond 35 would have been wasted. Again post-2016 voluntary contributions can bring the foundation amount up to the full NSP.

LikeLiked by 1 person

@DavidV:

>and I think we are now in a situation where we can’t be completely sure whether it was Ermine’s early career SERPS or post-retirement voluntary Class II contributions that had any beneficial effect.

I may be misremembering some things, but I believe the answer to this is that both these sets of his contributions had beneficial effects. Theoretically his late career SERPS were also beneficial, albeit these probably had a miniscule impact that might well disappear in rounding.

Having said that, IMO it is very easy to make a mistake and pay pointless voluntary contributions*. I did! But I did finally get them back earlier this year – without any interest of inflation uplift. And what is even more interesting is that the year in question (which is of absolutely no use nor ornament) is available again for me to purchase (at a somewhat increased price) AND it is by far the cheapest (using voluntary Class III) available year too!! What could possibly go wrong with such an [IT] system??

* Short of quitting work, beyond a certain level one cannot escape paying pointless basic NI employee contributions.

LikeLike

@Al Cam

“but I believe the answer to this is that both these sets of his contributions had beneficial effects”

I don’t think this is possible when it comes to establishing the foundation amount, but of course it is in achieving full NSP at SPA. Until Ermine came back with more detail I thought some or all of his voluntary contributions were pre-2016. SERPS accrual can only affect the old system calculation and Ermine already had the full 30 years for the basic state pension so pre-2016 contributions would have had no effect. Pre-2016 contributions could only have benefitted the new system calculation by getting closer to 35 years, and SERPS would not feature in a new system calculation. As it turns out, Ermines voluntary contributions were post-2016. Of course, once the foundation method is established by the most advantageous calculation, these post-2016 contributions, can get you up to the full NSP as achieved by Ermine.

I don’t think it’s fair to regard compulsory employee NI contributions as ‘wasted’. It’s just another tax and those of us no longer working are privileged (for the time being) to be exempt from it. Making unnecessary voluntary contributions is another matter!

LikeLike

DavidV,

> I don’t think it’s fair to regard compulsory employee NI contributions as ‘wasted’. It’s just another tax and those of us no longer working are privileged (for the time being) to be exempt from it.

That is very magnanimous of you. However, HMG describes the purpose of paying NI as:

“You pay National Insurance contributions to qualify for certain benefits and the State Pension”, see https://www.gov.uk/national-insurance

Until that definition [of NI] changes and any such change is generally agreed and understood, I stand by my statement that being forced to pay more [NI] than is strictly necessary is a ‘waste’ of my money. But arguably this is a minor issue compared to the glaring difference between class 2 and class 3 rates.

Furthermore, IMO the state pension is already heavily means tested, ie those who contribute the most (by virtue of being the best paid) get the lowest percentage return.

Lastly, asking pensioners to help pay for their own state pension (via retiree NI contributions) would surely be the ultimate xxxx take? Although forcing the BBC to act as an unpaid tax collector is pretty devious too!

LikeLike

> If the old system calculation is the higher of the two it sets the foundation amount and any voluntary contributions allocated to years before 2016 would have been wasted. Post-2016 voluntary contributions can be used to increase the foundation amount to the full NSP but not higher

Should be said in their favour that they did flag up that if you have a way to SPA then don’t pay voluntary NI till 2016, I have a gap TYE 2013 through to 2016-ish for that reason.

> post-retirement voluntary Class II contributions that had any beneficial effect.

I took the mustelid of very little brain approach. After the 2016 cutoff I added years class II until the SP number said you can’t increase it any more, and then stopped. I spread them out a bit, so yes to 2016 to see if it shifted the needle on the dial, took a break 2017 as I considered moving, missed TYE 2018 as I had moved, did 2020 and 2021 and then it says your work is done here so I stopped.

You can never be proud of numerical methods and empiricism, but they worked for me when faced with this black box 😉

LikeLike

> You can never be proud of numerical methods and empiricism, but they worked for me when faced with this black box 😉

Now please do remember that this is the: new, much simpler, easier to understand, [sort of] flat rate UK state pension system!! Ahem, ahem ….

Furthermore, I am totally in awe of your trust in a government IT system!

LikeLiked by 1 person

> Furthermore, I am totally in awe of your trust in a government IT system!

Yeah, but if you’re sporting what, £180 a year, heck life is too short. There seems no analytical solution to this, certainly back in the day

LikeLike

> There seems no analytical solution to this, certainly back in the day

Indeed!

LikeLike

@Ermine

Then it looks as if none of your voluntary NI contributions was wasted as they were post-2016 and you stopped when you reached full NSP. It remains of theoretical interest to the likes of me and Al Cam whether your SERPS accrual had any effect on your foundation amount. I suspect it did as your years contracted out most likely made the old system calculation more beneficial to you.

LikeLike

By my calcs (assuming old system used to calculate foundation amount) Ermines SERPS/S2P must have purchased additional pension (AP) worth at least one but less than two equivalent qualifying years; as he only needed to make four years further contributions (under the new SP) to get to the magical 35.

FWIW, using this approach my AP on conversion was 1.44 years.

LikeLike

And this is the subtle point where you can lose up to the equivalent of one qualifying years worth of AP.

Or, in my case, nearly a third of my accrued AP has been forfeited due to only being able to purchase whole years of voluntarily NI contributions.

I think £’s is the currency used for any excess?

LikeLike

@Al Cam Yes, the whole NI system is very confusing. You pay it on a weekly basis and yet achieve qualifying years. As you say, voluntary contributions are for whole years. Like Ermine I ended up with more years than I expected (although I was already comfortably above 35) from a combination of partial years from pre-university training, summer vacation work, and a partial year after graduating. I’ve a feeling that you got NI credits back then for education between 16 and 18. When I was still at school/university I remember going to the local social security office at home each December to renew my NI card. Each time there was a little stick-on label where you made a declaration of being in full-time education. Once you were above 18 though, you didn’t get any NI credits for education. The student literature at the time had discussions whether it was worth paying voluntary NI contributions and the almost universal consensus was that it was not.

I’ve seen your calculations of equating AP to qualifying years before. I’ve never really used this approach as I comfortably met the qualifying years and was more interested in the AP in cash terms! I do sympathise with you though that if the old system calculation leaves you below the NSP you can effectively forfeit up nearly a whole qualifying year’s worth of AP when you make it up with voluntary contributions.

LikeLike

David,

It is a bit of a …..

What also intrigues me is that I am 100% sure that there will be many people of my age group who paid similar amounts (or even considerably less) than I did in NI but they get a bigger state pension on conversion to the new state pension just because their employer did not contract out. Think, for example, about teachers, civil servants, self-employed, etc, etc ….

The famous squeezed middle I guess – and I would wager that the vast majority of them are entirely unaware that this has occurred – and that extends to both those who have gained and those who have lost out!

Is the currency for your excess £’s, ie not rounded or tweaked down in any other subtle manner?

P.S. in the interests of transparency, I did get the age 16 to 18 (education fillip) and also have NI contributions dating all the way back to when I was 16 too

LikeLike

@Al Cam

“Is the currency for your excess £’s, ie not rounded or tweaked down in any other subtle manner?”

I don’t quite understand your question. Do you mean my Protected Payment? As I think I reported in previous discussions my eventual Protected Payment was in line with the steadily increasing Additional Pension forecasts on successive SP forecasts. All SP forecasts were in pounds in today’s values, i.e. no projection of future cost-of-living increases. It was very slightly less than I had calculated myself (in contrast to Ermine’s assertion, there is an analytic solution if you dig hard enough for the information). I put this down to having worked on annual totals for simplicity whereas, as we know, NI employee contributions work on weeks. There were many occasions when pay rises were delayed and then came as a large lump of back pay. This would have put me above the UAP for those weeks and not accrued quite so much AP in the year as the annual totals would suggest.

Of course, I can’t be certain there weren’t any policies or errors working to my disadvantage, but monitoring over the years and the final award didn’t give me any grounds to doubt the accuracy of my eventual SP amount.

LikeLike

@DavidV

Yes, I did mean your Protected Payment.

And thanks for the additional info.

P.S. I totally agree there is (and indeed must be) an analytical solution. However, it seems to me that the solution is so full of conditionality that it is hard to understand/check – which IMO is just not a good place to be. And the ‘coup de grace’ comes in the obtuse form of the conversion(s) to the new SP for folks with accruals (of basic old SP plus additional pension) that sum to less than the maximum NSP!

LikeLike

I’m a little late to the NI party. My understanding and experience has been:

1- we used to get 3 free NI year credit in the tax years of your 16/17/18th birthday – I don’t believe this is still the case

2- you don’t need to pay weekly NI, once you’ve hit the annual lower earnings limit (used to be around 6k) that’s enough for the full years even is it’s from a single months wages. This may explain why a a gap year MSC doesnt lead to a lost NI year, if topped and tailed with enough wages.

I left work in a November and got a full years credit

3-I registered as self employed mid way through a tax year (which was silly) but I was able to buy back the missing weeks at a cost of around £15 per missed week.

4

I worked for 24 years plus 3 freebies – had a COPE adjustment of around £34 but was only 4.25 years short of the full new pension. I can only infer that I gained some benefit from an earnings related element at some point. So I’m fully loaded now, class 2 is brill! But grandparent credits for child minding are even better – my wife filled her missing 3 years this way.

LikeLike

Boltt,

This has been a long running discussion, which of course, is spread over several of @Ermines posts. He has been very gracious in allowing us to work this all through on his blog, and I hope we have all learned something from the chatter?

Re your point 4 above, I would direct you to the Steve Webb post linked to above as there are two distinct ways to calculate the new state pension starting value (aka foundation amount in the Steve Webbs post). I suspect you may find your answer therein.

Re your other points: they all look good to me, but please note being 4.25 years short is rounded up to 5!

Lastly, I suspect you may have had additional pension (SERPS/S2P) worth the equivalent of 3.75 qualifying years on transfer in 2016 to the new state pension scheme.

OOI: were you ever in a DB scheme?

If so, was it ever contracted out?

LikeLike

@Ermine, would Sir like to take a timely punt on predicting possible highlights of the new year looming into view, given your past ruminations have been quite accurate, according to the recent poll linked below?

https://www.theguardian.com/politics/2023/dec/30/britons-brexit-bad-uk-poll-eu-finances-nhs

C’mon, such an article would be a harmless bit of fun, not so?

LikeLiked by 1 person

Did you see this?

https://www.bbc.co.uk/news/av/uk-england-shropshire-67833287

LikeLiked by 1 person

Now that is cool, and the best news I’ve seen this year – Happy New Year BTW. I donated a few times (with the wonder of CAF https://www.cafonline.org/ to do it anon but getting giftaid) to the Vincent Wildlife Trust. Who are all round good eggs and no anon required, I signed up as a non-donating civilian to their pine marten news and they don’t spam you shitless. Looks like the martens are working their way out from Scotland to oop North, from the VWT resettlement in Wales outwards and from the New Forest. Hopefully they will chomp their way through some grey skwerlz and not through too many landowners’ chickens and gamebirds 😉

Nice to think that in my dotage I may not have to hightail it all the way up to Scotland to get a look at the Weasel of the Trees, Wales or even the New Forest might do. Another remarkable thing looking at that post is how shit decent digital cameras were only 10 years ago – my s/h Canon eos RP mirrorless which is on the rubbish end of the range has so much better performance than its decade earlier 450D – when I unsuccessfully looked for the Northern Lights on the Somerset Levels the RP showed me things I couldn’t see with the naked eye, whereas the pine marten looked a damn sight sharper IRL than my 2015 pic. I still have decent night vision, and can sometimes see the Milky Way unaided from my back garden. But the EOS RP showed me the unholy flare from the Hinkley Point construction site which I was unaware of until it pointed it out, and stars I’d need bins for.

Mebbe I should take another run up to Inverness, since presumably those martens are building their ranks. Abernethy Forest has red skwerlz. And there be recumbent stone circles in Aberdeenshire.

LikeLike

HNY to you too.

There absolutely has to be some light in all the darkness.

I did not know that PM’s munch grey squirrels but rarely the red ones.

Re photography: seems that over time processing improvements also apply to somewhat bigger/more expensive cameras too, see: https://www.bbc.co.uk/news/science-environment-67892275

LikeLiked by 1 person

Pine Martens seem to predate grey squirrels preferentially because the greys are heavier than reds, so the greys can’t go far enough away from the pine martens on the ends of branches. It’s not that they wouldn’t chomp the reds, but both being historically native it seems they evolved as coexisting.

https://www.britishredsquirrel.org/grey-squirrels/pine-martin/

LikeLike

There is an anomaly in Class 2 for UK people overseas. If you have paid in for 5 years (I think) then move abroad you can still continue paying Class 2s if you are in overseas employment rather than Class 4s.!!!!! SO you can register as self employed for a few hours a week and hey presto!

LikeLiked by 1 person

Now that is dead cool. Thank you! I will pass that piece of info on to a fellow who moved to France a few years ago (all pre-Brexit) but has well over 10 years bog standard Class I and was looking at this a while back, it could be a decent win for him!

LikeLike

Government page for working

https://www.gov.uk/national-insurance-if-you-go-abroad

And Class 3s for not working is also available.

LikeLiked by 1 person

Wow –

Even at Class III rate, for that sort of annuity you run, don’t walk, to the opportunity

LikeLike