Midnight CET today is meant to have been the culmination of Theresa May’s premature invoking of Article 50 to leave the EU. She did that, without really having much idea what success looks like with Brexit, in an unforced error which seems to have played into the hands of the other side, who naturally looked after themselves and their own interests. Not sure we are any closer to knowing what a successful Brexit does look like. I am of the opinion that there’s no such thing, which explains why the search party keeps returning empty-handed.

The Brexit crew seem to be channelling Thomas Edison, but they seem to lack his talent

I have not failed. I’ve just found 10,000 ways that won’t work

Thomas Edison, on the electric light bulb

Why you need Financial Independence – The Sovereign Individual

Let’s take a deeper look a Jacob Rees-Mogg, headbanger at the end on the left. Hopefully his crew are unwittingly acting more as useful idiots in weakening the No Deal ultra-case, but it ain’t done yet.

The Latin in the title is a hat tip to JRM’s tendency to break out into Latin, to confuse the bejesus of of those not drug up right in some elite British public school. Fortunately the proles have Google on their side

Where did he get his twisted ideas from? Maybe his Dad, who wrote The Sovereign Individual, basically Thomas Hobbes updated for the 21st century. Let’s hear it from JRM’s Dad

Nation-states will experience a sharp drop in revenue…but retain the unfunded liabilities and inflated expectations and social spending inherited from the industrial era…tax consumers will be the losers.”

The Sovereign Individual

To summarise, it’s a libertarian manifesto, Ayn Rand updated. Look after yourself and your own, and may the devil take the hindmost.

The Sovereign Individual was written in the last years of the last century, but its predictions do track some of what has come to pass in the ensuing twenty years

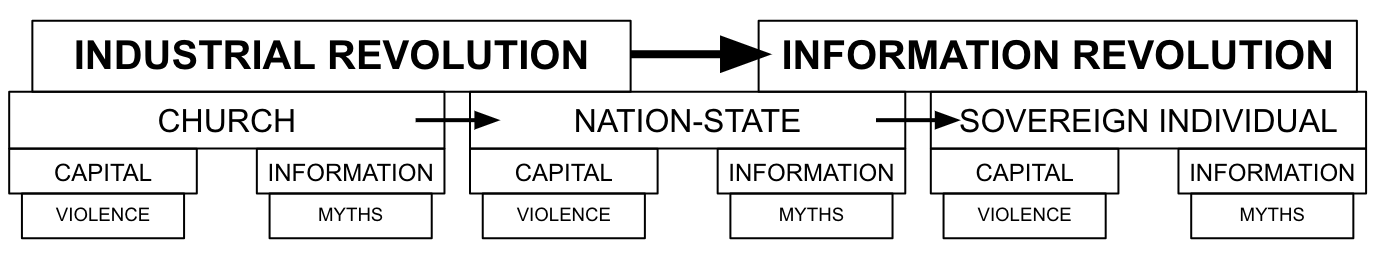

Rhys on Medium has a good summary. The SI looks at the metamorphoses of society through the intustrial revolution to now through the lens of capital, the capacity to impose your will on others through capital and violence on the one hand, and information and myth on the other. Daddy Rees-Mogg’s analysis bears witness on today’s world.

You need financial independence to be less enslaved to those with more. Violence isn’t a fist-fight in the street, it is the ability of the church, nation-state, or sovereign individuals like Jacob Rees-Mogg to make you do their bidding. The Church used the Inquisition, the Nation-State police forces and armed forces (in connection with other nations states) and Jacob Rees-Mogg and his libertarian ilk will use their superior capital assets.