The Ermine is probably a decumulator now. I haven’t earned ‘owt for well over two years. Because I have a mix of DB pension and DC, and since the DB pension is adequate for my needs and wants, I am not decumulating investments, the trend in networth is still rising. Decumulators often dislike volatility in their financial capital, it’s bad for their old tickers. Even if they adopt floor and upside a volatile annual discretionary income is hard to live with.

There’s no really good answer to how to qualify the uncertainty of decumulation. You can spin endless spreadsheets based on past performance of asset classes, but in the end it’s all an act of faith. You know what the FCA has to say – past performance is not guarantee of future returns. It doesn’t matter how accurate you calculate it or how big a data set you crunch, it’s still an act of faith, and one discouraged by the FCA.

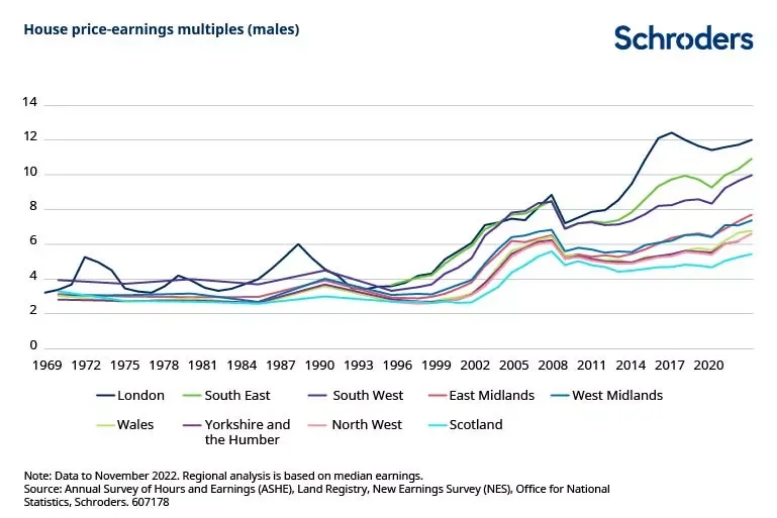

After all, the last 50 years have been years of relative peace in the west and up to the 1990s one where Western capitalism was more decoupled from the rest of the world. West was best in those years. If you are going to extrapolate from this past you are making a hidden assumption that the statistics of the economic situation are reasonably stationary across your future horizon. Do you feel good about that assumption, given many of the expected variations are to the downside, AI perhaps an exception to the upside?

Accumulators have a big relative advantage. If their assumptions fail on the downside, they get to work One More Year, or more as necessary. Decumulators who get it wrong are going back to work, usually at a much lower level, living on the street munching dog food out of tins or living off the kindness of strangers.

Decumulators’ other option is to reduce variability by spreading their financial capital across other asset classes. You wouldn’t do that early in life. There used to be a rule of thumb that said take your age from 100 and hold that percentage in equities, the rest in bonds. Then Liz Truss came along and taught us something about bonds that we didn’t really want to know.

for holding periods for 20 years or more the minimum real returns from equities have been better than from lower volatility cash or bonds. This is why shares are the best asset class for long-term savings.

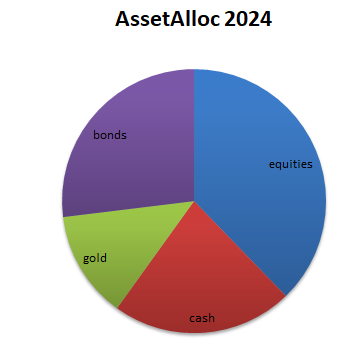

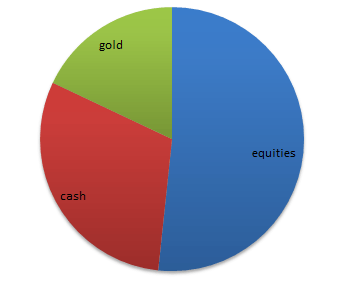

20 years is more than half my expected time horizon. And valuations are high. I have been adding gold and cash. I don’t hold bonds, I compute my notional bond holding as 20*the net income from my DB pension1. This implies a SWR of 5% on the bonds part, but since this is an annuity the SWR is a moot point. I can now compute the mix of this collection of financial asset classes.

I don’t tally housing in networth. My half of the house2 is not a big part of the pie lower down. I am not clever enough to evaluate a house as a financial investment. I regard it as a consumer purchase like a car, for the usufruct and the secondary benefit of getting BTL landlords out of my face. It is not a financial investment with a knowable value regardless of this sophistry. Sure, you can qualify the monetary value of a house by selling it to someone, but all of a sudden you are homeless or at the whim of amateur BTL landlords – you have lost an essential part of the means of living. And need to pay a load of that money to go fix that dire predicament. The usufruct is valuable and essential, so not an investible financial asset IMO.

I inquired of my asset allocation, with a view to comparing it to Harry Browne’s Permanent Portfolio3. Ten years ago I was surprised that his approach was the one that resonated with me most. A glance at the website will show you just quite what a wingnut Harry Browne was.

He’s somewhere to the right of Ayn Rand who looks like a pinko Communist in comparison so it’s kind of disturbing that his was the one that really resonated with my world-view. It matches my expectation that there are serious challenges ahead, his choice of four orthogonal asset classes is what I like. His domestic-only equity target is very much of his 197os world where the developed world ruled, so it needs adapting to the modern world. It’s more an asset class allocation strategy.

A less grizzled decade-younger mustelid

Wingnuts show excess and bias, but I’d say Browne’s taxonomy of economic cycles has stood the test of time, albeit in peacetime.

There’s very little you can do to hedge wartime, perhaps be young, live in the country not the city, and have some understanding of the basic needs of life. Flabby middle-aged preppers in camo posing with weaponry and a stash of MREs on Facebook need not apply. They will last longer than me, but not that much longer.

I listened to some of Harry Browne’s radio shows from way back when, he was an avuncular old-skool wingnut rather than the raving and drooling loons that talk radio and the internet foster now.

Goldbugs should listen to his The Money Show 09 from the 19th Sept 2004 Gold and Other Precious Metals. Equity nuts telling us that AI will change everything and usher in a new Age of Plenty may want to listen to show 19 from 21 Dec 2004 Bull Markets End, because they do, and this one will.

The Permanent Portfolio is kryptonite to accumulators, do not even think of using the PP while you are still working, it has far too much deadweight 😉 You will always pay a high price in future returns to reduce volatility. Monevator shows you why

Volatility is the price you pay for potentially superior annual returns.

If you are under fifty and thinking of switching to the PP, well, don’t. It’s an old man’s game, think capital preservation, not accumulation. Half the assets are unproductive, and one is subject to inflation tax. And before the rationalists pile on me saying VWRL is the One True God, I don’t disagree about the superiority of your end capital in all likelihood, your kids will be pleased with their inheritance on the way back from the crematorium.

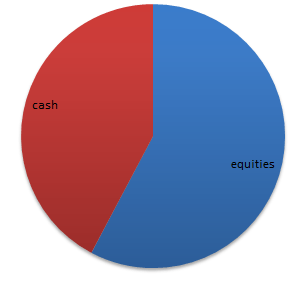

It’s the rough ride that’s the problem, old bones feel the volatility harder because: no future income stream to ‘enjoy’ the low prices, they mean you draw down more of your finite pot of money than when the good times roll in the markets like now. This is what my asset allocation looks like.

Some of the high level of cash is still left over from shorting Covid. The problem with shorting is that it changes you, you are running against the grain of the markets, which in my case made me slower to return than was ideal. I shorted a lot of what I had in the ISA and left most of original holdings in the ISA, which recovered in the resurgence. The short built up cash outside the ISA.

The asset spread looks different now from last time I did this. Back then I had managed to roughly match the notional capital behind my DB pension with the equity holdings.

Cash levels are also increased now because I inherited some money. I did the work of filling the IHT tax forms – you have to do this even if there isn’t any to pay, as was the case. Most people seem to pay a solicitor, from the MSE forums. While it was tiresome, I was earning money at solicitor’s billable hours + VAT rates + 20% tax for the work – the money I didn’t have to earn to pay a solicitor.

I gave about half away, because King Tut is still there, and as you get older it is more about who you are and what you stand for than what you have. Actuarially, I am likely to survive seven years, so HMRC is still out of luck probably. I get to see the gift in action, improving lives. There is joy in this.

I earn some interest on the cash, but I can safely say less than 10% inflation. Still, they tell me inflation is <3% so that’s all right now? I have lodged a decent amount with Mrs Ermine, who can take all the interest without paying tax. I would rather forgo the interest and keep it in the family rather than give 20% to HMRC, because I am irrational like that. This increases the depreciation of that part of the pie for me in real terms. I use cash to fill the ISA, of course, and I stoke the GIA with it.

I haven’t got much experience of using a GIA, I opened it in 2020 to handle cash from the short, up till then the 20k ISA allowance was enough for my needs. It’s a real pain to operate a GIA, the tax computations are very limiting in what you can do and still stay sane. You have to minimise transactions, in particular slowly building up a holding monthly will make you hate yourself when computing CGT, which is a bastard as it’s tended to be my modus operandi with things like VWRL in the ISA. You have to churn to use CGT. The only time I’ve ever sold VWRL was in the GIA, to go buy some HMWO which is the same sort of index, and i could take my cap gains. The complexity is less bad than getting reamed by inflation, but only just. All this pain has made me slow to deploy the cash, so I ended up paying about 30% inflation tax on what I haven’t got into the market from the Covid short. Less Mrs Ermine’s collection of the ‘interest’ which improves her quality of life. Easy come, easy go…

goldbuggery

The gold allocation has increased, some of it by its own appreciation. I started building this allocation before the infernal 2016 vote. Gold is always vexed, a difficult asset class to wrangle. Warren Buffett is not a fan because it isn’t productive. I view it more as insurance against serious bad stuff happening than an asset. In a war of all against all then gold is not useful. True goldbugs hold it in physical form which I don’t. You need to be careful with gold, it has a magical power that transforms the holder, if you start holding more than a third in gold, particularly in physical form then like the Ring it corrupts Sméagol into Gollum. I suspect that the collective unconscious of mankind rises within and makes you spit bricks about fiat currencies and the depravity of politicians, while all around slowly take a step back and look for flat rocks. Beware this event horizon – hold more than a third you are drawn to it, hold more than half networth in gold and you have passed the point of no return.

Monevator’s TA manfully tries to compute an analytical case for gold (paywall), and I’d say his conclusion is there’s no signal in this noise. As a rough guide – it’s an old man’s game, if you hold a lot of gold below 50 it’s probably too much. It’s there to stiffen the spine and hold your head when all around you are losing theirs. If you’re holding it as a hedge against inflation, don’t. Indeed if you’re holding it for one specific reason, you are probably wrong. Covid showed us that in a crisis what the world needs in the short term is US dollars, not gold. Hat-tip to Harry Browne, he said as much in the Money Show 07 Gold and other Precious Metals (19th April 2004).

decumulation is a slow surrender

If I must fall from on high

may my fall be slow

Mylene Farmer, Désenchantée

I was aware of the PP’s limitations at the time. Then it was likely that I’d have had to draw my DB pension early and invest for the income I’d lose by the massive actuarial reduction, and I was looking for ways to reduce the volatility to make that more annuity-like. This was before Osborne’s changes that meant I could front-run the DB pension with the DC SIPP. On retiring in 2012 I was not to know that. I have seen much change in only 15 years of retirement planning.

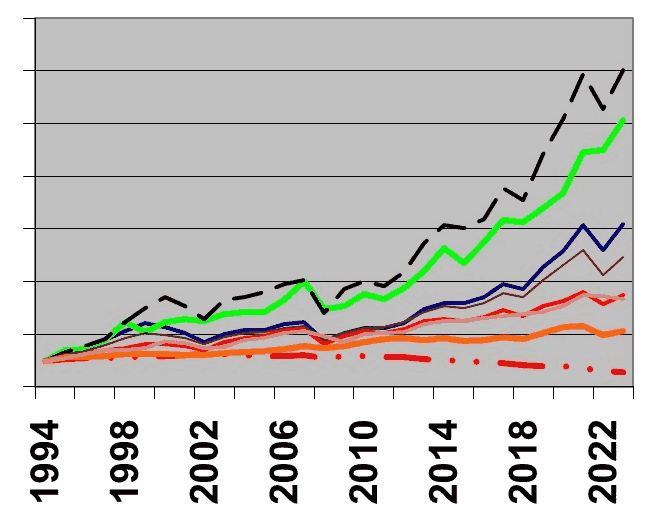

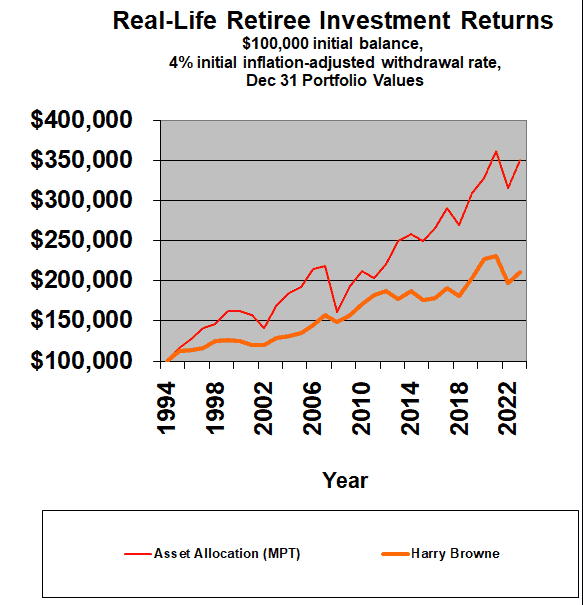

Look at the real dollar result for the PP after thirty years of steady 4% inflation-adjusted withdrawals. Retire Early was kind enough to provide the source Excel sheet so I offed some of the more successful investors, realistically you aren’t going to do a Warren Buffett, so the PP can be seen easier

The PP is an easier ride. It’s not free of retrenchments, but they’re gentler than MPT. As the man said

Volatility is the price you pay for potentially superior annual returns.

Bear in mind this starts just after the early 1990s recession, JPG chose his retirement date well and this flatters equities. Starting from low valuations does that. Warren Buffett did much better, as did the classic 60/40 stocks/bonds for Americans. But it’s not a shabby result, IMO.

the Harry Browne portfolio barely beat inflation. The other four equity-based portfolios showed gains in the 100% to 200% range.

Yeah, Epic fail, Hezza. You survived a massive stock market boom or two and just about washed your face, paying out 4% every year. Wait but what? Another thirty years is an outside possibility for me, and I do not expect to be enjoying not one but two stock market booms across those thirty years, given that we are perched at high valuations, though it’s possible. What I fear is a general sideways slip-sliding away, like the early 2000s.

If you want to leave a legacy to your children, then you must stay equity-heavy. I do not have that requirement, so the greater resilience/lower volatility of the PP has something to offer me. Harry Browne took pains to say that the PP should be for the money that is precious to you, he described the ‘permanent’ part as that securing the floor. It doesn’t have to be everything, you can have a separate speculative portfolio.

In practice my floor is secured from the DB pension, and later the added State pension. The other three components of the PP are unloaded, though the depreciation of the cash to inflation will consume resources in real terms. It implies I am underspending relative to the 4% SWR norm. If I spend 5% SWR of the bond pie which is ~ 27% of the total then I am spending about 40% of the 4% SWR, or conversely running at an SWR of a bit under 2%. The years of frugality changed me 😉

I am not frugal in the earlier sense of the term which was to maximise saving, but it showed me the emptiness of some of my wage-slave spending. I don’t pinch the pounds as I had to do earlier, but I don’t spend for the sake of it. Like Bill I bought a camera, a Canon RF series. I don’t shoot stock any more, I will embrace my amateur status, it is pure frippery. If the damn things didn’t become obsolete so fast I’d buy a 3D printer, but at the moment I sent jobs like that out, particularly as some of what I do is better suited to laser cutting, as I learned form the last piece of work I did. This is for building interesting gizmos to satisfy my curiosity. There is a relief in giving up the vague idea of trying to make money out of anything I do, I can indulge the pursuit of knowledge for the passion uncoloured by filthy lucre. Yes, I become an amateur, it wasn’t always a perjorative term, perhaps I should call myself a gentleman scholar. If I am running at a relatively low SWR I don’t need to chase earnings.

It is not just the psychological that turns inward at the Second Turning at midlife, as Carl Jung said

But when this purpose has been attained —and more than attained—shall the earning of money, the extension of conquests, and the expansion of life go steadily on beyond the bounds of all reason and sense? Whoever carries over into the afternoon the law of the morning, or the natural aim, must pay for it with damage to his soul, just as surely as a growing youth who tries to carry over his childish egoism into adult life must pay for this mistake with social failure. ~Carl Jung, CW 8, Para 787

There is no need to spend to get to a particular number. Life has ebb and flow in itself, it is better that I determine that ebb and flow than the markets. They are sky-high at the moment, in the GFC the low-water mark was 40% of the high-water mark. A higher SWR could come to me from that reason alone!

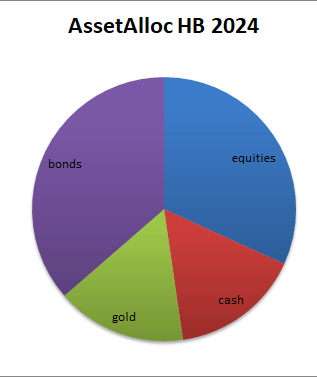

Pure Permanent Portfolio is too extreme for me, I am not that pessimistic, so I will accept the risk of a higher equity allocation. Should an grey haired mustelid still be writing this in 2054, perhaps I will kick myself for chasing the upside with a higher equity allocation exposing myself to the Great AI Bust. History doesn’t repeat itself, but it rhymes, how did it go with that DotCom boom, younger mustelid self? At the moment I haven’t split off a speculative ISA to hold the equity excess over 1/4 networth. Since I can’t control the notional bond component I’ve compromised on a HB split

which then leaves me a speculative split of the rest

At least the equity allocation is larger than the cash. If we look back at the high-water mark of the GFC the SPX (VWRL didn’t exist then. And anyway, tech ate the world so VWRL is largely a SPX proxy) was 1564 on the 10 Oct 2007 reaching a low of 666 in March 2009 the equities would fall by 60%, reversing the pie. The main HB portfolio would be eaten by bonds, since I can’t change that element maybe I should regard the HB portfolio as just what I can control, equities, cash and gold, and target 50% equities, 25% cash and 25% gold in it.

There aren’t many likely scenarios where I would buy extra bonds to make up to 25% of the whole, particularly given the SP will inflate the bond allocation in a few years’ time.

all asset classes carry a worm within

All asset classes carry their own dark side. Outrageous volatility and five year suckouts4 in the case of equities, decades long suckouts in the case of gold, slip sliding away in the case of cash and getting shot in the back from left field with bonds when you need them most. Monevator’s TA put it well

There’s not a single asset class that can’t break your heart for multiple decades at a stretch

I have already loaded this year’s ISA, allocating 10k to VUSA and about 10k to various UK investment trusts and increasing some of my worst performing holdings mainly renewables ITs that got hit by the increasing cost of capital. That’s Taleb’s barbell approach – invest in gangbusters and garbage, leave the middle be. As time goes by each ISA contribution moves the needle less on the dial.

It’s an interesting reflection of different times to contrast this indirect stamp of approval to a fellow exiting the game

Congrats on getting to a point where you feel set. My hunch is this is not a bad time to pull the plug generally

with the fellow that dropped the chequered flag 15 years ago in 2009 – if you are going to go with the markets, then go now. He didn’t actually say ‘or forever hold your peace’ but got close

Ultimately, if you’re not trickling money into the markets at these levels then I think you might as well forget stock market investing altogether.

I never dreamed that 15 years of the wild ride following powered by about three years’ gross earnings at my peak would beat out the capitalisation of my DB pension accumulated over 23 years at The Firm, just managed in 2021. Not all of this was my own work, a fair amount of it was the lucky environment. But before cynics say I had it easy starting into the low-water mark of the GFC, nobody knew it at the time, and it was extremely hard to actually commit resources to the markets against that backdrop. It was made a little bit easier by doing some of it in an AVC (like a SIPP) with the benefit of saving 42% tax, it’s easier to take chances with money you’ll never see 😉 But it was against a backdrop of tremendous fear and loathing, a lonely, bitter place surrounded by the wreckage and failure of many people’s dreams – including mine of finishing my career on the expected terms I had started it.

The choice of a stock market path is never an easy one, particularly if you start from a point where valuations are favourable5. The way is rough and narrow, with many switchbacks. It is not just the volatility of the markets that you must fight, you also have to fight yourself.

w(h)ither frugal FIRE

Once you have quit a well-paying specialised job the value of your human capital drops precipitously, particularly if it is in the form of employment. True, I earned a higher hourly rate after leaving than at The Firm, but that wasn’t a rate sustainable full-time 220 days a year. I really, really, hate hustling for jobs, most of those I did came to me through connections, I did not hustle. This is why I was an employee for my working life 😉

I am part of the post GFC cohort that believed frugality was a route out of the workplace. ERE posited the theory first, though it is reflected in MMMs the shockingly simple math behind early retirement. It was perhaps true then, but it’s not as true now. Obviously the maths is still true, but the world has changed, Dido was right, life is much more for rent now. Fifteen years ago I could believe, having paid off the mortgage, that if I failed to bridge the three years saving while working target, I could hunker down and minimise outgoings, and play for time, falling back and falling back until either strength returned enough to stack shelves in Tesco or I was stuck until my pension became payable. Mary Oliver would not have approved if I had told her that’s what I planned to do with with my “one wild and precious life” but I needed to know the lowest point of the river before trying to wade it.

Rent is a bigger feature of modern life now, for accommodation but for other products and services too. I know people who pay more for their mobile phone monthly than I do for power. The people who use to bitch endlessly about the BBC licence fee pay far more in aggregate for Netflix and Sky and sports TV. Since 2012, students pay over £30k at the start of their working life to join the guild of knowledge workers, often renting the money from the government.

I kicked myself for paying down the mortgage rather than doing a Monevator “can you afford not to have a big cheap mortgage” but truth be told I didn’t need it, and Warren would like a word in my shell-like.

But to make money they didn’t have and didn’t need, they risked what they did have and did need. That is foolish. That is just plain foolish. It doesn’t make any difference what your IQ is. If you risk something that is important to you for something that is unimportant to you it just does not make any sense.

The difference was Monevator was speaking from a position of strength he was/is earning, and I was in a position of weakness, because I wanted out of the earning rat-race. I should not have risked something important to me for something less important, and I went with my gut, though my head always told me I was leaving money on the table, and hindsight confirmed that. Past the point of no return, I didn’t have options to recover from the downside. Slow surrender, not moonshot.

Rent, and debt, which is rent on money, degrades the shockingly simple math behind early retirement, which is why you must get out and stay out of debt. That includes your mortgage, as people stiffed by mad cow Liz Truss discovered, though she sez ‘twasn’t my fault bozos, you had it coming to you anyway, suckas. Government debt levels have increased since the GFC, there be unknowable tail risks in that.

Frugality has limited upside, you can’t save more than your entire earnings. If you have the skills, in a high-debt situation earn more punches higher.

spending in retirement

A period of frugality changes you. You see the pointlessness and lack of value in a lot of consumerism, though I will say that’s easier if you are over 40 and have established yourself. Your first kettle, chair and washing machine improve your life no end 😉

My spending is down on that of my working self, and I live within my DB pension, I have never drawn any income from the ISA, and used a lot of my erstwhile SIPP to fuel the ISA across the years.

Many things are cheaper if you have control of your time. We go for midweek short breaks, avoid school holidays and bank holidays like the plague. If you can be opportunistic then a lot of costs are lower than for one’s working self.

Spend big on the things that really matter to you, and let the rest go hang.

I wanted to live in a detached house because I experienced living next door to a baby in my first house, which required playing The Wall at full pelt on my hifi downstairs to drown out the racket, not so much of the baby which was dreadful enough but the screeching battleaxe of a mother hollering shutup Sinead, at the top of her voice at all hours of the night. I had to move my bedroom from the back of the house to the front because of Sinead, traffic noise is preferable to baby noise, traffic usually drops at night.

In the next house I heard enough of the grandchildren and the hound and the rising level of the TV as my last neighbour became increasingly deaf. It didn’t trouble me exceptionally, it is night-time noise that is the pits. This was at least in the day/evening so it didn’t require excessive prog rock in the early hours. Mrs Ermine wanted more garden.

The UK doesn’t really do sound insulation 6, particularly in old houses split up into HMO. I presume Bose and Sennheiser are a flat-dweller’s friends. While it is only old fogeys that listen to music on speakers nowadays they haven’t made children and dogs any quieter over the decades, and the TV is usually on a soundbar.

So I wrangled the heart of darkness that is British residential property, but I paid cash. No mortgage broker wants to hear from someone without a job even with share capital to cover the purchase, they may as well have a sign on their desk saying

in Wage Slaves and God we Trust, all others cash.

If you’re not earning and you carry debt then your margin of error is very low – you are one Liz Truss brain fart away from fiscal hell, perhaps these brokers knew a thing or two, though I had enough capital to buy both houses outright, I just didn’t want to give up a house worth of ISA. I had to arrange the float privately.

My small camper van is an excessive spend, we tend to favour AirBnB nowadays, but for solo trips to out of the way places it scores for me. PLSA have one car for all couples, but they churn them frequently. We have a different form of waste in this area, each to their own.

We eat well, London weekenders come down and bring down their fancy to the eateries with all sorts of frippery. Take Hauser and Wirth Bruton.

It’s a hell of a poncey way to do a restaurant, build an art gallery first 😉 Their grub was all right, and we went midweek, all the London customers who uphold the bottom line at H&W were in the Square Mile doing God’s Work I presume. It’s a tough life in the Smoke, they need some R&R. The Londoners mainly do this in the eastern part of the county, further afield there is the Dorset south coast and Devon.

Doom Spending

Other things that can make you a lower spender in retirement that your working self is that you probably have most of the Stuff you need, you are more in replacement of things that wear out mode rather than acquiring new Stuff. I could afford an Apple Iphone and I would pay the £1200 cash rather than credit 7. But I don’t want one, so that’s £1200 saved by not wanting it. I view all subscriptions with suspicion, which is a very oddball approach. I was tickled by the concept of Doom Spending.

‘doom spending’ category” — those who consider their savings so far from being able to fund something meaningful that they simply don’t bother putting money aside at all. Instead, they just buy more stuff.

Signs of doom spending can be seen across social media, in posts celebrating vintage Chanel handbags, for instance, or exotic holidays — things regarded as “little luxuries” procured in spite of, or perhaps to distract themselves from, the state of their finances.

I do have some sympathy for millennial Jenny. I confess to indulging when I was hammered by negative equity in the early 1990s.

I was regularly pouring money down the toilet of negative equity and could see no way out, so I took a break and bought some Naim SBL loudspeakers to replace my student Spendor speakers. Graham’s hi-fi came up all the way from London to install them – the quirky design needs the seal to be set in situ. They are still in service 32 years later. I really ought to pay someone to refresh them, or ask myself whether 30 years of engineering means I could improve on this. But yes, it was Doom Spending- it appeared impossible to dig my way out of what still ranks as the worst financial mistake I ever made. I will say for my former self that I saved up first rather than putting it on credit. Frugalistas will rightly observe that this effectively put the purchase on the mortgage that I wasn’t paying off with the money I paid for the speakers.

I hadn’t heard of Doom Spending before, but I Googled it and it appears to be a massive thing. See also the shopsies on the distaff side, that article features a US TikToker offering the antidote

“It’s not, ‘I don’t have enough,’ it’s ‘I don’t want to spend,’” Battle said in a TikTok, adding: “If you know any rich people, you know they hate spending money. So it’s almost more chic, more stylish, more of a flex.”

Apparently called Loud Budgeting these days, which can probably be applied to the entire FIRE space.

I am not sure frugality is the solution to retiring early now. From experience I’d say beware of assuming thin-FI/RE, because if you lock your future self into a life of frugality, then you need to stay young enough to do all the frugal things that assumption is built on. In Monevator’s snowball post there’s a litany of things I used to do to save that I don’t do anymore, I have one of those too, and it’s always expanding 😉

- There’s a case to be made that the notional capital depreciates as I get older. I don’t necessarily disagree, but I don’t see how adding this complication is useful for me. When I am one day from death and the notional value has dropped to almost zero, I don’t need to buy a load of bonds for that last day ;) ↩

- as per valued at purchase. Houses are cheaper in the sticks ↩

- Beware that the Permanent Portfolio always gets a lift when gold is high. There’s an argument gold is overvalued H/T Monevator. Though I wish that these analysts didn’t start from the premise that gold is a hedge against inflation. It’s a hedge against unknown disaster and debasement. There are easier ways, particularly for Americans, to hedge against measured inflation, the clue is sort of in the name with TIPS. ↩

- Pedants will point out suckouts can be longer, eg the Great Depression and the 1970s oil shock. These are relative to a lump sum investment. I accumulated from 2009 onwards, so if you are going to mark down the suckout you do have to somehow account for the appreciation, so it is shorter than the 20 year price suckout for the DJIA after the 1927 crash, particularly if you have the intestinal fortitude to continue to buy the index. OTOH if you experience WW3 then you are hosed. ↩

- Naseem Taleb lists this as hindsight bias. I am still standing, so I say I must have done something right. As opposed being lucky – just about old enough at the threshold of my fifties that I had enough resources that combined with the low valuations of the stock market made it likely enough that a hospital pass with three years’ earnings could succeed in bridging a ten year gap, where it wouldn’t have done three years before where I would have eaten the GFC suckout in a big way, or three years later, when the erosion of returns through higher valuations would have reduced the margin of error. ↩

- The 1980s seem to have been a particularly dire time. I knew someone who had bought a semi in Felixstowe, and Barratt homes, the scumbags, fitted a spiral staircase, which was somehow tied mechanically to the corresponding spiral staircase next door. The coupled resonators transmitted the noise of the neighbours going up the stairs directly to his house, you could see the staircase vibrating and it sounded like elephants were charging up the stairs. The only consolation was he was presumably doing the same to them. ↩

- Obviously I’d buy it with a credit card to get my Section 75 protection, then pay the card off in full, not using it for rolling credit ↩

Since there isn’t a rational way to calculate a sensible withdrawal rate from a lump of assets it would be logical for many retirees to spend part of their capital on index-linked annuities.

But there’s an amazing mountain of – how to put it? – stupid and resentful disparaging of annuities on the web.

LikeLiked by 1 person

I didn’t take the full PCLS on commencing my DB pension because I figured I had enough investment side assets. It was possibly a tactical error as @AlCam has pointed out the hazard of my future self ending up paying HRT again with SP + dividend income. But there is peace of mind in it just turning up, which has value. But I can see that people wanting to leave money to their kids will dislike annuities

LikeLike

Nice round up of the greatest hits. As I’d recently read on your flattening you SIPP in early years is your DC essentially what you’d saved in AVCs while building DB pension (plus maybe some churning around the MPAA) or is it something else?

As I contemplate my NMY plan I can see I’d be delighted to be in your position that long after pulling the trigger (though, of course things could happen like inheritance) given I only have a small DB pension awaiting. I do struggle a bit with whether monitoring net worth is going to be very healthy for me given I could probably live quite happily by setting a prudent SWR and following it. I have a feeling based on natural pessimism that downward volatility will push me into greater frugality without a opposite effect when the portfolio blooms.

Maybe that’s all moot as there no real way of escaping the numbers if a decumulator isn’t to wake up one day and find someone has hacked and absconded with the pot. I think I just need to be a big boy about it.

LikeLiked by 1 person

That was it. I targeted an AVC fund of a third of the nominal capital of the DB pension, I was saving it into a FTSE100:Global index 50:50 which was the most diversified fund. I did this via salary sacrifice, pushing my salary almost down to NMW at one point, doing sal sac meant that I got the win of the 40% tax rate but about 32% on BRT so it was still very worth doing. I then added the excess of redundancy over 30k.

The Osborne let me front-run the DB pension with it, so I actually let go of some of the 25% PCLS to get more DB pension. Since running it down I did top it back up again, but flattened it more recently fearing a NI on pensions, saving 20% tax to pay 21? % tax+NI wouldn’t be a good move.

I recognise the hazard 😉 it is a little bit why I have shifted more defensively, I don’t fancy the rough ride anymore

LikeLike

IMO, this is a really nice post.

I think the post sets out to primarily answer the exam question: how does @ermine want to shape his de-accumulation portfolio and why? As I mentioned in a comment to an earlier post [of yours] I think that the question is often key!

Currently you are clearly in a nice position where seemingly around a quarter of your assets (exc. property) support you & yours lifestyle. This situation may improve further as your SP comes on stream too. Having said that, your cautionary note at the end re “thin-FIRE” is almost prescient – did you see @TA’s latest post!

There is a lot of food for thought herein – which no doubt I may come back to later. Trust this is OK?

Just a few points about the JPG spreadsheet:

a) if you want, it is easy to remove the effect of the annual w/d’s; just set the initial w/d (of $4k- around cell F17*) to zero;

b) for the PP, JPG always re-balances each year to 25%/25%/25%/25% at no apparent cost – you could easily change the allocations if you so desired, but the spreadsheet – as constructed – will always re-balance back to the initial allocations you select;

c) he uses real funds – so a lot of fund costs are built in (albeit it is all in $’s); and AFAICT there are no platform costs (other than some “front-end load” whatever that may be);

d) he uses real [US] CPI inflation.

FWIW, I am really glad that somebody else has realised just how useful this JPG spreadsheet is.

*I am looking at an earlier version than the latest

LikeLiked by 1 person

By all means it is part of how I and hopefully we learn 😉 I really must do something about that cash proportion which I hadn’t realised was that high because it’s in too many places but what to buy with it: stocks and gold valuations are high, and they claim they have licked inflation 😉

Yep, only after I had finished this as it happened. Whisper it but I did wonder if he might run into a speedbump, you could sort of ballpark the amount by the SWR and the WR. FWIW I didn’t have anywhere near that amount when I left work but I had much much lower valuations on my side, and the DB pension defending the longer run. I did come to the conclusion that I pulled the trigger without really having enough, and I was a lot more skint in the early years. I wouldn’t have taken on remodelling before SIPP age. However, he has dealt with the issue with vim and enterprise and I am sure he’ll get it straight, sounds like a speedbump not a faceplant.

Another thing TA did get right was bailing from work before he was incapacitated from working, something I ballsed up, which is why he has this solution available to him. I think it would still do my nut in to kowtow to The Man.

LikeLike

Yes indeed. I have already learnt loads and hope to continue to learn more through our chatter.

Yes, I know that feeling well. Currently, our cash allocation is probably higher than yours. And at least one injection of further cash is likely too. For the time being, we will live with this as we can get decent interest rates on some of the cash and everything else is IMO just too expensive. This could, of course, turn out to be a mistake – but so be it.

I am currently thinking about how best to structure things going forwards. I have recently dusted down some work I did a good few years back (started prior to pulling the plug) on risks and opportunities. I am not yet sure where this will take me but hopefully it might prove to be useful.

With regards to the JPG spreadsheet, I downloaded the latest version and noted the following:

i) all of his asset types (inc all his cash proxies) show a positive return versus inflation (albeit very small in some cases) over the 29 year period of interest – I do not think this seems a particularly likely outcome for UK-based cash over a similar duration

ii) if you remove the 4% w/d’s all his Pots have a positive return over the 29 years; the smallest increase (in real terms) was c. 50% and the PP more or less trebled (ie up 200%) in real terms

Have you given any thought to re-balancing? I ask as your DB component will just move with inflation* (to the indexation cap) and I cannot see how you could re-balance either away from or towards it? Perhaps, the way to handle this is to take the DB (bonds proxy) out of the equation and focus on the remaining assets only! Simplicity is worth a lot.

Re @TA: I remember your post from last November well. Whilst you perhaps did not have as much as he might have had at the outset, you would of course have needed far less as you had your DB to fall back on. In some ways, @TA’s SIPP not yet being accessible is possibly good news as it has brought the [overspending to budget] matter to a head early enough for it to be addressed; rather than later when returning to gainful might be somewhat less viable. IMO, there is far too much concentration on sequence of returns as the most likely failure mechanism for the early years – there are lots of roads to hell, including: rampant inflation, over spend to budget, financial shocks, etc. Or, more succinctly, shxt happens!

*noting that in due course the SP will introduce a step increase, which will also revalue broadly in line with inflation but subject to a different set of indexation rules

LikeLiked by 1 person

I take some solace in that 😉 I have at least managed to make myself load up the full monty in my ISA despite despising valuations, and I didn’t buy any gold, despite ZXSpectrum48k’s astute observation

With respect to JPG’s spreadsheet

True, but observe his starting point, the late 1990s recession that almost ruined my younger self re housing. With hindsight, it wasn’t the end of history but it was a benign environment for financial assets, not so much for the working middle class but by definition he’s outta that enshittification.

I don’t think a repeat perfomance is a likely scenario for any of the assets. Globalisation and a massive increase in the available pool of labour was a one off free gift to companies, bought at the expense of that western middle class worker bees. The potential loss of the US dollar as a global reserve currency after what happened to Russia as a cautionary tale for China may lead to interesting times for American capitalism. OTOH Warren Buffet has been right so far in ‘never bet against America’, through the Vietnam war and so on. Perhaps there really is something special about America.

The temptation is to roughly qualify this by ignoring the DB=bonds part totally, and shoot (for the HB part) for a 50% equities, 25% gold 25% cash split. The advantage there is it is easily quantifiable and is something I can change. I’d first hive off the excess as the speculative split pie and use that to fiddle more actively, to scratch that itch. This is currently a work in progress. It will distort the design philosophy of HB’s PP, I am not sure I am clever enough to qualify how much extra risk it adds. In theory I could simulate using JPG’s spreadsheet, but there are more congenial things I could do with the time 😉

I’d agree that at time passes sequence of returns isn’t the main hazard. I’m always uncomfortable when I hear the term forever house. Nobody knows what the future holds. Health can turn a forever house into a trap. Sure, you can do some things to improve that/make disability less likely, but you should have started in your 20s 😉 I have been fortunate in this respect so far, but I have seen it hit peers hard. One of the greatest advantages of early retirement is that it can reduce stress in your fifties and on, and I have seen that express itself in health issues. It started with X in this post, but I’ve seen it become lights out in a few other ex-colleagues in that age group.

LikeLike

Yup, we discussed this before and IIRC you said you had to “hold your nose” or “close your eyes” or similar. Since pulling the plug, every year I have bought to the ISA limits (and for reasons previously explained, a bit more into a GIA too) but only effectively what I had sold in the SIPP/erstwhile DC. So I have bought nothing “new” or “additional” for some years now and the cash pile has declined far less than I had forecast it would over that period. Far from the worst problem to have; and I agree valuations look bang out of order!

I calculated the CAGR’s for all the JPG assets (rows 21 to 43 inc) across 29 years and they range from 2.4% to 13.8%; US CPI inflation over the same period was 2.5% PA. So a couple of cash proxies did actually fall a tad short of inflation when calculated correctly!

How much worse [or better?] do you reckon the next 30 years might be?

The “forever house” is an interesting one. My in-laws had a split-level house which became an absolute bind in later life as there was no ability to extend/modify and nowhere in the property that one could: cook/eat, sleep, and use a shower/bath/toilet on the same level. This was never a concern/consideration until it was far too late – when traversing just a few steps became a major issue!

Makes sense to me – as I said simplicity has real worth.

Hiving off the excess is an interesting idea – albeit that it may incur additional costs/complexity. Having said that, if it allows you to “scratch that itch*” then why not? Personally, I have always tried to use platforms/accounts to help me segregate things and, at least in principle, provide a level of traceability back to the origins of that particular Pot too. FWIW, I find traceability a useful feature** – but others are quite happy to mix and match and see no value in this particular trait!

*and lets face it you do seem to like to try [active] things out and have to date, I reckon, an above average hit rate too!

**some folks might view this as particularly “sad”, but so be it – [some of the] disciplines and practices I learned working just seem to live on!!

LikeLiked by 1 person

You’ll be able to say to folk who bought in the “irrational exuberance” ‘told you so’. But holding off changes a fellow and the mindset hardens, so when it comes to throw it into reverse that gets harder, I suspect therein lies the rub. But hey, look at me, a third (and indeed a half of controllable) assets in the deadweight assets of cash and gold FFS. Nobody’s going to hit it out of the park carrying that sort of baggage. But it’s the nature of the speed|comfort tradeoff.

I never really believed in the passivista mantra. It probably works fine if you do it over 30 years due to the integration of increasingly long market cycles, but it wasn’t going to save my tail so late in the day.

I did prove to my reasonable satisfaction that I had no sector edge (stockpicking in common parlance). I also proved to reasonable satisfaction that there may be people who can do macro calls, but I am not one of them.

Valuation, on the other hand, I have used to profit. First with my start, which was not my choice, but the covid short and sometimes buying beaten up garbage has worked well for me. Bollocks to the efficient market. Sometimes everybody runs for the exit or rushes to fill their boots, and there be lags in the market until it works out which way is up. The trouble is you can’t cause these events, you just have to be opportunistic, and if you sit out the slow updraft of the market too long that eats your lunch in a different manner. A bit of passive isn’t a terrible match.

Way back in the day, the Ernst and Young alumnus Rob Bennett that JPG takes the piss out of here I found convincing in that he was hollering valuation matters. I don’t know how long he had been doing it, he even got banned from Monevator comments back then for opposing the passive buy in regularly and hold with ‘valuation matters’.

He’s an interesting interesting cautionary tale. I suspect that finance has strange attractors in it, a little bit like when you hold more than half in gold you have passed the point of no return. Too much apparent success with any one finance wheeze in the early part of one’s investing career make you believe that you have hot hands. Taleb in Fooled by Randomness has several reports from finance houses of Icaruses that flew too close to the sun then blew up their accounts. Bennett was perhaps one of those guys, being a hedgehog rather than a fox in investment is a dangerous game.

In the early days with a little bit of intelligence it was easier to read between the lines of Monevator’s output, and I used those err, tips, I still have some of these holdings. It guided me a little away from my excesses and thinned some passions, as well as teaching me a different way to play the game. But I can’t describe how, it’s not an analytical thing. And I’ve made enough bad calls myself, but so far the very lumpy wins have beaten them out. But I want to quarantine that sort of thing now. Taleb showed me that over a short timescale you can’t really tell luck from judgement. As the song says you gotta know when to hold ’em and know when to fold ’em, and I don’t need to take so much risk now

LikeLike

Apologies – but I have no idea why my last comment appeared twice?

LikeLike

Me neither, but I deleted one to simplify the flow. WP having a senior moment I guess 😉

LikeLike

Agree and the real crunch might only come in another couple of years – by when I should have finished flattening my erstwhile DC and nearly a full years ISA allowance comes available. However, a lot could (and probably will) happen between now and then!

If I re-cast my plans to require a floor income equivalent to my DB plus SP* then I currently would have a similar allocation to Reserves and Upside. Furthermore, that level of reserves equates to a tad over an 80% confidence plan** and the combined reserves and upside equates to over a 90% confidence plan. So, no need to hit it out of the park!

IIRC, the last time we had a chat along those lines, just a few weeks/months later you were deeply into your shorting adventure! I am not sure an ermine really can change its fur – which is why I liked your idea to “hive off the excess as the speculative split pie and use that to fiddle more actively, to scratch that itch”! Just an observation and what do I know.

*which would be an increase on recent spending history

**versus the risks and opportunities as I currently understand and have enumerated them

LikeLike

For context, when I pulled the plug the combined reserves and upside equated to about a 70% confidence plan.

LikeLike

When you say confidence do you mean that on a many run simulation you’d run out of cash in 30% of scenarios before your modelled death date? Or are you talking about a different kind of confidence that 70% of your anticipated spend was covered in a “guaranteed” way?

Not benefiting from a significant DB and wanting to be able to withstand a future where SP might become means tested (I know political napalm) I think my main levers (bar annuitising which is not for now – too long a possible horizon) are really in a prudent WR.

LikeLiked by 1 person

Below is an answer largely culled from something I prepared years ago to answer a not dis-similar question:

Some years ago (prior to pulling the plug IIRC) I set out to stress test my retirement plan.

What I wanted to explore were the possible impacts of risks (and opportunities) on my retirement plan.

I wanted to do this for the following reasons:

– to quantify (or at least get a good feel for) the overall risk that the plan faced; and

– to identify the biggest vulnerabilities/threats to the plan so that I could focus my attention on exploring options to mitigate these (best bang for my bucks if you like)

The way I did this was to establish a baseline case and try to identify the risks and opportunities to that baseline case.

Risk is mentioned a lot in the FI blogs but I do not recall seeing much about Opportunities, but, as far as I am concerned, opportunities (or if you like upside risk) definitely do exist.

Simple example opportunities that came to mind are: underspending vs baseline plan, inflation less than baseline plan, windfall, such as an inheritance, etc.

So what did I do:

First, I compiled a Risk/Opps Register.

Then I quantified all of the entries.

I was quite happy that I could explore individual risks by hand, but what I was really after was the overall combined risk (& opps) picture.

For example, just how likely is a scenario where all the individual worst case risk outcomes occur together.

Sure it can happen, but just how often does that happen?

I then spent quite a while looking for some ideas for framing/expressing the problem [mathematically] and ideally a tool to allow me to do this too.

I had a stochastic tool in mind, something similar to @Risk or Predict – both of which I had used previously professionally.

I drew a blank on the tool side but did find some good stuff for framing the problem. FWIW, the ideas do not originate from the FI world.

I concluded, possibly completely wrongly, that [holistic] risk management seems to be a bit of a fuzzy/woolly area in retirement planning.

This may be because the timescales etc of a retirement can be rather long and there will be zero probability of a method (or tool) providing an answer that is valid for anything other than the time that the underlying assumptions are valid. My observation is that the assumptions change frequently – but so what, you can just periodically revisit and update as necessary. No fire and forget / auto-pilot here!

Anyway, undeterred I set about building my tool.

Stated simply I really just wanted to get a feel for:

if I have a baseline plan (with cost £X) that is subject to the R’s & O’s captured in the Risk Register, how much extra/less money should I have to be Y% confident that the plan is achievable.

It took me a little while to come up with something and what I did come up with is, not unnaturally, riddled with assumptions and simplifications.

But it seems plausible and I found the exercise very helpful. Looking at the work/tool again some seven years down the line I have not changed my mind.

One thing definitely worth adding is that the tool gives a snapshot in time view – that is, it does not attempt to forecast how risks/opps might develop temporally.

I trust this was of some use?

LikeLiked by 1 person

P.S. the tool is effectively a stochastic (monte carlo) simulator with 1000 iterations. I had to restrict the tool to 1000 iterations as my PC ran out of puff with more iterations! Whether or not this is enough iterations for the answer to converge is a good Q. However, using repeated runs of the tool each with a 1000 iterations is how I addressed that concern.

LikeLike

Thanks. I think I understand. I’m not sure I’m disciplined enough to forecast lots of risks individually because I’d be making a whole ton of assumptions or listening to too many voices from the internet. I’ve shortcut in my thinking by running a lot of the publicly available simulators plus leaving out a slug of buffer (parked at the moment in bricks & mortar) which would do the heavy lifting in extremis when all other assets crash at once and stay crashed. Not immediately liquid of course.

Of course there are all sorts of doomsday risks that I could imagine – that the UK becomes uninhabitable in a nuclear disaster/war scenario for instance but it would seem absurd to be a prepper for everything so maybe those sort of risks I just have to accept.

LikeLike

It is probably a lot more straightforward than you think.

In my model each risk can have one of three possible outcomes bad, neutral, or good. For neutral outcomes it has no impact on the baseline assumptions. Bad & good outcomes are, I trust, fairly self explanatory*. The probability of each possible outcome [for each risk] is set individually and all three must sum to 1 per risk. This is what is sometimes called “complete risks” in the literature.

For example, in my baseline model I had assumed inflation would be 3.5%PA. A bad outcome is inflation is somewhere between 5%PA and 7%PA. A good outcome was ml 3%, with 2% set as the lower bound. So quite a range and possibly overall somewhat pessimistic too – but so be it! For completeness, I set p(bad) as 0.3, p(good) as 0.3, so p (neutral) was 0.4 for inflation. I also used ranges with defined distributions for the good & bad outcomes, but single point outcomes could have been used to further simplify things.

OOI, since I pulled the plug CPIH has been 3.6%PA!

The full set of risks I parameterised are given below:

DB pay out model is wrong

SP pay out model is wrong

Pot battered “early doors”

First death

Spend estimate wrong

Inflation estimate wrong

Assumed Pot performance wrong

Legislation etc changes

Tax assumptions wrong

Longevity

Paid employment post retirement

Inheritance(s) boosts funds

Not Used/ Spare

Other Income estimate is wrong

There are some example risk registers kicking about on the web – but the above list IMO covers all the important bases.

FWIW, IMO, the key learning does not come from the outputs of the model but rather selecting and parameterising the risks. From memory, this did take me rather a long time, and several iterations too. However, I learnt a huge amount of things along the way, e.g. from 1915 to 2017 the modal 45 year average RPI rate of inflation was between 6.0 & 6.5%, the average was around 5%, the min was about 1% and the max was 6.7%. Hence you can probably see my rational for how I parameterised the inflation risk.

Until very recently I had never seen anyone else attempt this type of analysis. However, the last paragraph in this recent comment at Monevator reminded me about my analysis, see: Weekend reading: The risk of ruin – Monevator

Re doomsday scenarios, have a look at Bernsteins ideas on shallow and deep risk at e.g. Inflation, Deflation, Confiscation & Devastation- The Four Horsemen Of Risk (forbes.com)

Lastly “buffer” is good and is sometimes over-looked too!

*although it might be worth explicitly stating that good outcomes generate -ve values; ie they reduce the baseline plan costs

LikeLiked by 1 person

Not to forget: The Retirement Calculator from Hell, Part III (efficientfrontier.com)

LikeLike

I am wondering if there is material for a guest post in a different take on risk profiling, if that’s of interest. There is an argument that describing something helps you shake it down and kick the tyres. Though it sounds like you’ve given it a lot of thought already!

LikeLike

@ermine,

If you contact me by email (I assume you have my email address from my WordPress comments) we could discuss further – rather than blocking up this post.

LikeLike

Always good to read your posts … I think it’s partially my innate American interest in all things British… but another part is I like getting perspective on how I might need to approach finances 10-15 years down the road when I’m around your age (I think). Sure, your DB and SIPP are a little different from Social Security, and no pension for me, but a lot of it translates over.

Reading through the other comments I do hope the observations about valuations are wrong. Right now I’m only just FI according to the 4% rule, and since US equities spent the past ten years doing what they did in the 1980s, I sure would like them to follow up over the next ten years by doing what they did in the 1990s, i.e. triple again. After that they can crash, it will be fine! I’m trying to pad it all for a safety net for my kids.

My other big comfort is in 11 years those kids are done with school and I’ll be done with Seattle. I’m picking out all of my favorite places where the rent is like half of what it is here. New Mexico looks good in this regard. Or maybe somewhere around the North Sea? 🙂

LikeLiked by 1 person

Are you really FI if you’ve got that long until the kids fledge? In the sense that you can quit working tomorrow, fulfill your commitments and still live out the rest of your life. If so hats off.

I assume being done with Seattle means not a huge fan of the PNW climate. I’m not sure Scotland, Newcastle, Denmark , Southern Sweden and Norway wouldn’t give it a run for its money in terms of moisture. It’s one of the areas (if we set aside Microsoft and Amazon fueled cost of living factors) that I would consider in the US but then my biggest aversion is to hot.

LikeLike

Good question! The 4% does include kid costs – for now. It’s a bit too close for comfort, one of the reasons why I am not planning to quit. They are 6 years old so one of the challenges in the years ahead will be saying “no” a lot

As far as climate goes, I still have a fair amount of wanderlust so I envision myself potentially living in more than one place. The places that you mention, such as Newcastle, might be good summer candidates 🙂 It’s really not that bad here though, the principal issue with the PNW is the cost.

If you are interested in living in the US, by the sea, and you hate the heat, you might consider the far north part of California or Oregon. I think the all time high in Eureka CA is 87 F.

LikeLike

Now where’s your Paul Volcker when you need him 😉 Not all that gain was real ISTR. Mind you, I am with you and probably hope the same, I have a lot of VWRL/HMWO!

LikeLike

” New Mexico looks good in this regard. Or maybe somewhere around the North Sea? “

Bruges is rather lovely. And don’t overlook the coast of the South of England: there’s some lovely territory there. We have particularly enjoyed time living near the New Forest and the Solent.

LikeLike

Post GFC while doing a ski bum sabbatical I did look at houses around Tahoe CA/NV. Definitely would have made out on capital appreciation given the hand the keys back second homes at the time but cost of living post Covid plus medical would kill any retirement plans for me as a Brit.

LikeLiked by 1 person

Property in the US is weird – towards the end of my career I did some work in Boston and then took some leave and went for a road trip in the Adirondacks with a colleague – work didn’t mind as long as it didn’t increase the cost of the flight, obviously we paid for the car and accommodation. I remember looking at a realtors in Lake Placid and being gobsmacked that I could more or less afford a house there, it was about £50k. I know the US has more land and a more benign weather they can construct their houses out of wood, and this was pre-GFC so make that 82k nowadays.

Medical insurance, and also some State taxes can be high and of course residency are all a thing but it certainly cause a ruffle in the Ermine fur to imagine a different timeline

LikeLike

You could always check out the Big Bear City / Sugarloaf area of Southern California. Kind of a poor man’s version (or “Mustachian” version) of Tahoe at less than half the cost. You’d need a summer getaway from the heat though.

LikeLiked by 1 person

This post resonates with me very much, although i’m about a decade behind you having only pulled the plug on employment a year or so ago. The fiendish art of Decumulation is turning into a full time (voluntary!) pretty enjoyable job for me these days, although so far it’s consisted more of a case of monitoring situations as opposed to actually actioning too many things. No need for hasty decisions as i see it. I have initiated taking the TFLS from the DC pension (commenced this well before Rishi’s election announcement) and those funds are being deployed into a gilt ladder until they can be drip fed into the ISA each year. Apologies if i overlooked any reference to gilts in your post, but I was curious as to why you seemingly hadn’t allocated any of your cash holding to this asset class? To me, it’s a good way of diversifying and being a bit more tax efficient at the same time, although of course we’re all travelling down slightly different paths and we all have our chosen meat and poison.

LikeLiked by 2 people

Thorough bone-idleness/incompetence, Jam wrote a great intro as to how to do it. I haven’t done last year’s tax return but when I do I will look for where this goes to see if I can get my head round it. Mrs Ermine can use savings interest tax-free so I have lodged a fair amount with her, she is welcome to the ‘interest’ while I reflect and/or wait for the opportunity to show itself. This is definitely my bad, though Mrs Ermine gains utility from the inflation burn rather than HMRC which can’t be too bad!

LikeLike

@ermine

You may recall that I dipped my toe into low-coupon individual gilts last tax year to mitigate against reaching the HRT threshold. My purchase was late enough in the year that I haven’t yet received any income that I have to report . I also at last managed to qualify for self-assessment through having some CGT to pay. While completing my online tax return recently I did keep an eye open for which supplementary section will be needed next year to report my gilt income and it wasn’t immediately obvious.

However, looking at the paper forms it’s clear that the appropriate form is Additional Information (SA101) and gilt income is the very first section. The notes don’t make this clear, but when you buy a gilt you are also paying for the interest that has already accrued (I think this is called the dirty price). This doesn’t count as income as you have already paid for it, so you can deduct it from the interest payment when you report it on your tax return. The contract note when you buy the gilt details the amount of accrued interest. One thing to watch with IWeb is that if you capture the contract note as soon as you buy the gilt it is not fully formatted and does not explicitly show the accrued interest. If you wait until the following day the contract note is formatted and does clearly show the accrued interest.

I must also say what a joy it is now to have a tax code that is not messed up by HMRC’s wildly inaccurate guesses of my 2024-25 interest and dividend income, having ticked the box to report it in next year’s return.

LikeLiked by 1 person

@DavidV,

Nice one re the tax code.

Sometimes plans do work out – even if they involve HMRC. Bravo!

Seems there is still some stuff to learn re gilts, etc. Thanks for sharing. Did you ever come across this book:

The Sterling Bonds and Fixed Income Handbook: A practical guide for investors and advisers (Harriman Finance Essentials) eBook : Mark Glowrey: Amazon.co.uk: Books

I bought it years ago, but decided against that approach then and have not dipped into it (either the approach or the book) since. From memory, it was quite a detailed read – but a bit slow and ploddy!

LikeLike

@Al Cam

I certainly haven’t read the book you reference, but it’s possible I’ve browsed it in the finance section of one of the large London bookshops (Foyles or Waterstones Piccadilly). Some of the bond textbooks there can be fiendishly mathematical. I don’t pretend to understand the advanced aspects of bond mathematics, nor do I aspire to, but I think I understand enough to use low-coupon gilts as a substitute for fixed-term savings accounts and doubtless will learn more now I have a dog in the fight.

One slight disappointment with my self-assessment tax return was that, although I also ticked the box to pay any tax owed for 2023-24 directly rather than through my 2025-26 tax code, I have not completely cleared last year. One of the questions on the tax return was if my final tax code for 2023-24 included an estimate for underpaid tax to be paid through my tax code in 2024-25. Of course, because of the problems I had last year with HMRC, the answer was yes. The amount of this, although only an estimate, gets baked into the calculation and the difference (~£30) from the actual amount owed set against the CGT I owed. So I am still paying the nearly £1k underpaid tax from last year through this year’s tax code. But at least it has all been properly calculated now and, as I said, my newly-received tax code no longer includes an estimate for this year’s interest and dividends as I will report that in next year’s return.

LikeLike

Thanks for the post Ermine, I managed to get through it all :D. It is really interesting hearing your thoughts on the whole decumulation phase and also your views on the changing landscape of how difficult it can be and in fact is for many new FI pursuing folks.

I was fortunate to start my FI pursuit only a few years into this long bull market. I also find myself lucky to work in the public sector where I have my DB pension along with state pension providing an epic safety net kicking in at 68+. If it weren’t for this, I think I would find myself having to deep dive SWR research and plans, I would be far more worried about spending money even though I have built in the ability to spend far less, there is a lot of buffer and I could forgo holidays abroad and big purchases if needed but even with this, I think I would be deeply concerned about my money running out in old age were it not for the safety net. I would likely look for something similar to the allocations you mention. The design, planning and execution of this might consume me!

I have however turned my FI Fund into essentially a bridging fund that will need to last me around 18 years. This will be completely held in an ISA and I still have not decided what the asset allocation will be when I drawdown from it. I only know the accumulation part which I likely will not change. Even though I have 10-13 years to go and there could be a major bear market, I don’t worry about it too much. Like you say, I will just have to work a few more years if so and still retire early compared to most – I can hardly grumble. Any scenario where it’s wiped out entirely for me is a situation where there will be bigger things to worry about.

Thanks again

TFJ

LikeLiked by 1 person

A DB pension does help simplify the problem no end. I share some of dearieme’s thoughts re annuities, which is one way of getting a DB element for those that don’t have one.

I have to admit that I’d struggle to qualify the SWR. After the GFC we’d talk about SWRs of 5%, then it drifted down to 4%, there’s a lot of ask in that small difference – save 20 times your annual spend compared to 25 times now. I’d always be wondering if the next step is 3%!

The accumulator advantage of OMY is a big one, particularly at the higher end of one’s career progression!

LikeLike

Enough? This is the eternal question I keep on running into. What is enough and where to stop. Add to the “Die with Zero” mentality age based spending plans. It seems really important to have some sort of financial age based spending plan.What if you save too much so cannot spend it all when you are too old to appreciate it? Does that mean you wasted x years making and saving it for no benefit? De-accumulation sounds like a luxury when you consider you have enough for the future and can de-accumulate.I have been looking at financial planning just from theoretical numbers perspective and they do provide some guidance – over caution can lead to the FOMO problem yet the FIRE problem of building a frugal habit is another rich world problem. Luckily the older you get the more you understand stuff is not happiness, the “You can’t take it with you mindset”…..If you understand the game of inflation targets, what is money actually is and how is it used to benefit the few then you get a chance to understand the permanent portfolio and a clue why empires rise and fall. The thinking of global trackers as a great choice IMHO is based on a very short historical horizon.Great post to highlight blind spots and normalcy bias in an environment that is compounding negatively in an exponential manner.

LikeLiked by 1 person

Where to retire to: every now and then I comment on a blog that I know a lovely spot in NZ where I would happily spend a retirement, but I’m going to keep it secret so it’s not spoiled.

And almost every time a reader shoots back saying he agrees, and naming the spot. Some secret.

LikeLike

I’ve been in decumulation for just over ten years. I’m invested in investment trusts that pay dividend income from their holdings in equities, bonds and property. These currently pay out a natural yield of 5.5% of the portfolio value. Fortunately, we only need to spend about 4% of the portfolio value at present. This bias to income paying equity holdings has, however, meant that my portfolio capital has grown by less than the UK inflation indices. In time I could shift to more of a total return strategy with greater emphasis on capital growth, but I would look to keep about 80% in equities. I don’t favour the permanent portfolio because I think it would involve lower income and lower growth, although it should have less risk.

LikeLiked by 1 person

I started out with a HYP philosophy, indeed I still have that, but it’s been massively overbuilt. There is something good about running of the yield, although Covid showed us that company dividends can be fragile, just a lot less fragile than the SP 😉

I’d agree with your summary of the PP! Total return is probably the right way to go if you can stay the course, but as Tyson said, everybody has a plan until they get punched in the face

LikeLike

Ermine, I have run a HYP portfolio since ERE 10 years ago with the added complexity of moving country to FR and loosing the ISA protection on the income. Social charges 17.7% are required on the income in France. We have continued to add to the HYP portfolio but in a new French account. We did see slashed dividends during the last downturn. They have bounced back and the premise of dividend growth investing has been working fine, our yield on purchase cost is 6.7% where as the yield on current value is 4.7%. With the way the monetary system is setup to always have inflation or it dies, income growth is obviously a must.As we downshifted very early in our late 30’s the idea of living off yield seemed appropriate at the time – yet the income has not kept pace fully with the recent burst of inflation and we have two growing children with increasing costs. We have had to offset the inflation with a small side business of 1-2 days work a week taxed at 25% until private pension access in 2 years. I do like the PP considering its diversification, the rich prices of the stock market and bonds, current inflation waves and any future depression. We have tried to align to the PP with our pensions – options are very limited in out pension plans to do this.

There are clearly cycles to investment classes as proved by the likes of Martin Armstrong, Charles Neuner, historical climate cycles impacts on the economy and food production and the PP research. 100 years of returns as a basis for a 4% rule on concentrated portfolios of Bonds and Shares could be too short a time-frame to be able to encompass longer cycles. Reserve currencies come and go and the cycle of empires seems cyclical as well. Economies mature and then the debt gets out of control, more spending, entertainment etc….. rinse and repeat.

On lifestyle cost – we believe is cheaper here in the South of France especially comparing to London where we used to live. Housing is so much cheaper. Good weather and local holidays by car to the slopes, med, atlantic and many tourist locations and attractions in the south have avoided expensive holidays (flights, hire car etc.) for the 4 of us. As mentioned previously we have offset other costs by investing in energy efficient solutions for the house and transport. We have free fruit and veg from our garden – everything grows so easily due to the hot weather. This has helped to keep basic costs low.

Keeping basic costs down I feel is an important consideration as you can’t easily avoid basic costs without lowering your standard of living. We aren’t eating dandelion leaves yet! More income is required hence more tax to pay to service these basic needs. More time spent earning a living. % increases will force de-accumulation to occur for us if not managed effectively.As we have children we would like to make sure we have a good plan that allows us to give them their inheritance early when they need it (Die with Zero approach). Considering longevity risk; geopolitical events, extreme indebtedness of the west, over consumption / resource constraints, curve balls such as a mini ice age all highlight the need to preserve capital through downturns the PP is one perhaps safer option to avoid de-accumulation of cheap assets in a difficult situation…

LikeLiked by 1 person

> I have run a HYP portfolio since ERE 10 years ago with the added complexity of moving country to FR and loosing the ISA protection on the income.

Interesting that it sustained over that period, albeit with income growth falling back in the recent inflation hit. I started with a HYP because it gave me hope that I could win enough to sort of survive over the initial period. I did add to some of these ITs in the Covid period, because the premium/discount mechanism gave the capital value a disproportional kicking ref NAV, so it’s a slightly higher proportion than it was. Although I did note some divis (particularly individual company shares, I still have some from that period) were paused in Covid times, the original policy of carrying three years essential spend in cash would have bridged that quite easily in practice. Inflation does seem to be the bugbear that won’t really die, I felt that when I booted the gold out of the ISA into the GIA due to the capital gains from the inverse, GBP cash has lost nearly a third of its value in the last three years. I think you’ve probably had a softer ride with the euro,

South of France sounds a great move. We were tempted to do some snowbirding to that part of the world, the sort of Jan/Feb part of the year. Though Peter Mayle did warm us up to the mistral as a possible spoiler.

> everything grows so easily due to the hot weather.

And the extra light! Nice one with the garden – it’s also better for you in the greater freshness. Mrs Ermine harvests dandelion leaves indeed, as an addition to salads, and other things I’d have called ‘weeds’. Some of the idea is to increase the variety of plants, though I’d say they should be honoured as a flavour in themselves!

LikeLike

For the HYP we diversified across UK, US and EU shares to mitigate some currency risk. During the market downturn several companies halved dividends, some did pay specials to catch up after the event. The cash buffer you mention is a must have I believe.

Currency is all being debased globally – every 100 Days 1T added total US debt – complete madness. Who is buying their debt / how much is being printed / how long can it continue – it has been a long time already.This hidden inflation is hard for income to keep up. Companies have the problem to measure real inflation for their products properly and price accordingly.

Our pensions are in global funds but geared towards a PP slant noted above. I moved a good chunk from a global share tracker into a commodities fund (high fee….) over a year ago now as the commodity cycle is due…but who really can know? Commodities are historically poorly weighted against the general market so we will have to see how that pans out. There are some peculiarities when pension funds are between countries which may be of interest to some people. Currently a UK private pension can be taken in full, moved to France (reclaiming all UK tax) and just pay a 7% tax on the money in France. I am toying with the numbers, if this is worth it (primarily due to fees (investment fees are higher in France from my research). The move will avoid income tax (if the pension were paid from the UK a tax of at least 17% would be applied) and has inheritance tax benefits. Secondly UK property income is taxed in the UK and you can keep the 0% band being British.