Cash is a terrible ‘investment’. As far as I’m concerned it isn’t one -though there appears to be one period over which it outperformed the FTSE100 TR. If you were dumb enough to sit on a shedload of cash and invest it all in one go in December 1999 then you’d have been better keeping it as cash for 15 years. Well, yeah, but who saves for a pension in cash over half their working lifetime, chucks it all on red and then goes home? If you are such a soul, you deserved all you get. Most of us save for a pension as we earn, albeit at varying rates through our working lives. In general, if you suddenly have a whacking great lump like that you haven’t earned it, so tough luck if you came into an inheritance in late 1999 and blew it all into the dotcom bust. Easy come, easy go…

In theory private investors can give up part of their lives to moving cash about between the latest best-buy accounts for years. You’ll be working hard for a lousy return, but at least no volatility.

Cash is not an investment. It is a mediocre store of value but a great medium of exchange

At the moment, interest rates are low. There is a lot of grousing about this, which I don’t have a huge amount of fellow-feeling for. I have never regarded cash as an investment. It’s a proxy for a claim on work in the future, and medium of exchange. It is crystallised power. It is symbolism, it is not procreative in itself. It still surprises me when people think they can get a real return on cash.

The stories your parents told you about saving cash and it growing were largely a lie. They were right that if you add £1 a week you end up with £52 after a year, it grows as you add to it, rather than in and of itself. You still have to work for that. If you want it to grow in value by itself, well, that, indeed, is why you invest. Indeed, the story of the talents I was taught at school is a much more accurate portrayal. If you want your wealth to grow you have to put it to work in doing something. Merely digging it into the ground, sticking it under the mattress or putting it into a bank account isn’t good enough. You can put it to work in the stock market, you can put it to work in a BTL house portfolio, you can put it to work in building a business or buying productive capacity, be that training of yourself or machinery and plant to make better widgets. All of these need skill and judgement calls, and involve some element of risk because what you think should happen doesn’t always happen. There be dragons.

If you want relative security of cash, it ain’t gonna grow – you will largely be running down your capital in retirement. There’s nothing wrong in that. It is what I am doing at the moment. It is what an annuity does. Everybody panics when they think of not getting an income. They want the security that the number at the bottom doesn’t change without their say-so. Clearly they’ve never read Lady Windermere’s Fan, in which Oscar Wilde summarises the problems of conflating price and value,

a man who knows the price of everything and the value of nothing

In doing that they miss that the value of that number slowly degrades with time, but that’s a different story.

So what’s all this cash doing in my portfolio then?

Cash is not an investment. It dies quietly in the night, slip-sliding away one tiny bit at a time. Unlike my fellow Britons of the grey hair I am happy with low interest rates as long as they go along with low inflation. When you see that the majority of my liquid assets are in cash you can see why.

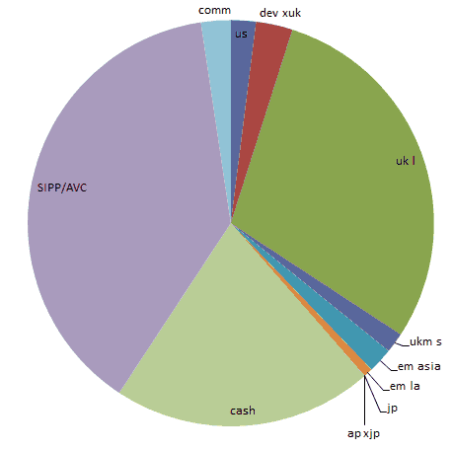

This doesn’t show my house, land holdings and main pension savings, but otherwise represent my financial status. For someone who spends so much time grousing about how crap cash is that a fellow PF blogger couldn’t resist the temptation to poke a sleeping Ermine with a stick about how well cash had performed over the last 15 years I sure hold a lot of it.

By the way, the mad asset allocation needs breaking out into 2/3 HYP and 1/3 something that will eventually look like the VGLS100 mix, but I want to buy the components when they’re cheap. I believe valuation matters. There is a big slug of The Firm’s shares gumming up the works I bought as Employee Share Incentive Plan (easy way to avoid paying 40% tax and get at it in 5 years not retirement age) and sharesave humping up that UK large cap pie. I am limited by CGT to running that out into something more diversified and in my ISA. So it’s ugly compared to the delightful balance of RIT’s portfolio. A HYP where you don’t sell grows in a gnarly and lumpy fashion. If you want neat and tidy, buy a total world equity index tracker and spend the rest of your time on the golf course. They look after pruning the lumpy bits for you.

I hold a lot of cash because I am an anomaly. I am poor and wealthy at the same time

Let’s just nail high-level definitions here. I am not a Russian oligarch and I’m not worth a million pounds, okay. I am nowhere near the 1%. As Philip Greenspun said, people vastly overestimate the networth of early retirees because they are anomalous. One of those anomalies may be they spend less than most! The ONS, bless them, summarises the difference between income and wealth well.

The difference between wealth and income

Total household income is a flow concept, and refers to the incoming flow of resources over time. […]

Total household wealth is a stock concept, and refers to a balance at a point in time.

That said, I am not in the left-hand side of their Fig 2. I have no income – the ONS counts investment income but I reinvest mine. The Joseph Rowntree Foundation tells me I am poor despite living like a king. Everything in a modern industrial economy qualifies people by their income, and so a financial institution would pull up my credit files and flag up in red “this mustelid is a destitute deadbeat. He must be sleeping under the railway arches. Don’t even think of advancing him credit”. I haven’t had to punch The Man’s clock for two and a half years now, there’s not too much hazard of that in future, I got to wonder what the hell is this bad boy looking at me in the Suffolk sunshine yesterday while most folk were doing an honest day’s work, but I am apparently boracic lint.

I have the existing credit cards I had from when I was working. I wanted to raise some cash recently, to help someone over a short-term shortfall. I struggled to borrow money even though the amount doesn’t really show on this chart. It’s the stock and flow difference, I didn’t want to pull this out of my Cash ISA or NS&I and I had ISA allowance to make up, so I had stock in the wrong place and frozen, and needed flow. It wasn’t emergency enough to break into NS&I if it could be borrowed. I’ve got all this wedge back, it did its job, it now lies uselessly in some bank accounts (I’ve knocked the value of the loan off the cash balance, natch). To a large extent, other than about £10k, I am locked out of credit. Nobody will give me a mortgage, the bank wouldn’t consider me for a loan, I am an unperson. They probably wouldn’t give me a mobile phone contract if I wanted one. I did wonder if I would struggle to change electricity providers. People who have no income but are not destitute are rare in 21st century Britain. There aren’t that many pre-55 FI retirees in Britain, leastways not enough for the financial system to find it worth qualifying for advancing flow against their stock.

And that is why I hold so much cash. Credit is the engine of a consumer economy, and it is a reasonable thing for somebody younger than me still working to take the Jacob ERE line and say “emergency fund? I don’t need no stinkin’ emergency fund, I have a credit card for that”. He has human potential. I don’t have human potential I can count on – I am over 45 😉 So I have to be able to pay cash in an emergency.

When I left work I designed my emergency fund to address emergency across five years or so. So far it hasn’t happened. But I have no ability to raise funds and I can’t pay down any emergency from earnings. Above all else what I want from cash is liquidity. That means no term accounts, it excludes Zopa because you can’t get money back from them very fast, it excludes all sorts of wheezes that people who believe cash is an investment use to slow its dissipation into thin air.

So what’s all that cash in my SIPP/AVC then, surely that’s nuts?

I saved up almost exactly 25% of the nominal value of my DB pension is AVCs. This was targeted at the 25% tax-free PCLS. I did that before Osborne’s pension changes, and I couldn’t use any increase because there is an asymmetry if I take stock-market risk – I would lose 20% of any upside to the taxman and have to annuitise it anyway. Any downside I’d eat 100% of. For a period of five years, I figured I’m not having that. I will eat the roughly 10% loss of value as cash. I saved 42% going in and made about 20% while it was in the stock market. Sometimes you gotta lose some battles in the interest of winning the war.

Osborne’s kind of shaken this all up, and it may make sense to shift some of that AVC into my SIPP and run the sucker flat over a few years before taking my main pension. Dunno. Will see what happens this April and May. The stock market is high at the moment anyway, if we had a worthwhile correction I might be tempted to nut 20-40% of that cash into the market.

The Ermine is my banker of last resort, and liquidity is king

Liquidity above all else is what is prized in the banker of last resort. He doesn’t have to shoot the lights out in terms of paying a return. His value is in being last man standing when the emergency comes, and he needs to be able to pay.

As soon as I get a pension income I am going to treat cash with the contempt it rightly deserves as an investment and shift a load of this into equities. I hold so much cash now because I need instant liquidity – the Ermine is my banker of last resort at the moment, and in a credit crunch liquidity trumps ROI. I won’t be a forced seller of equities under most likely conditions because of this cash; later on when I have an income I won’t be a forced seller because I will use the income from equities, and in a push could probably do without that and use other income. if there is one thing I have learned about the stock market (it applies to the leveraged housing market too) it is Be No Forced Seller.

The money you could earn on cash in a productive asset class is the insurance premium you pay to avoid being a forced seller. Like all insurance it’s a deadweight cost. Until you need it…

The reason I snarl about cash is I know how bad an investment it is from the worry this has given me 😉

Inflation worried me no end a couple of years ago, I was wrong, as it happens. Now people are stressing about deflation, unlike nearly everyone else I could probably use any deflation offered. I was preparing to eat the loss of a lot of money. As it was I was lucky and dodged that bullet, and soon I will have choices about reallocating it. That’s the trouble with cash – you take on a shitload of worry in return for serious amounts of liquidity. In the end the way the government pays for all those promises we vote for but don’t want to pay tax for by salami slicing the value of the pound in your pocket, they slice a teeny little bit out of it every single day.

In the end it’s our own fault, because we refuse to have a grown-up conversation about how to pay for all the goodies we want though don’t need, so inflation is the only way the poor devils can square the circle. And that, dear readers, is why cash is not an investment. If you’re going to dedicate so much of your life to wheezes attempting to keeping the value of your cash, then why not try and get your head around the reason why investment is better in the long run and get a better return for your time and trouble? I’ve gained more in dividend return (ignoring capital gain) by paying attention to investment than I’ve lost due to the cash rotting despite cash being the larger part of my total portfolio. You have to continuously shift your cash from pillar to post to get decent rates, you’re still almost bound to lose the fight over a period of 30-40 years.

The other reason cash-boosters are wrong is scale. It is relatively easy though tedious to get a decent return on a modest amount of cash – you can get good inflation-beating rates on £5000 or less rate-tarting it about. Try doing that on an order of magnitude more and up and all of a sudden you have a lot fewer options open to you. NS&I were an easy win here – you leave a hoard with them on index-linked savings certificates and you get to come back a few years later and you have a hoard that is roughly the same value without all the rate-tarting, worrying about whether you are investing the the new Icesave or whether you will feel like the Three Bears when you come back for your porridge and find somebody’s eaten it all.

People tell me this was different in the past and maybe it was, but it hasn’t been for any part of my experience of having a notable amount of cash. The past is a foreign country: they do things differently there, among them paying you real interest on cash. I used to be able to turn a return on other people’s cash by stoozing – credit cards would lend me up to £15k without interest or fees and Nationwide used to look after this paying me interest. Been a long time since that was possible, too.

Cash is okay over five years usually. Not so much over 50 years

Let’s hear it from Warren Buffett

During the 1964-2014 period, the S&P 500 rose from 84 to 2,059, which, with reinvested dividends, generated the overall return of 11,196 per cent.

‘Concurrently, the purchasing power of the dollar declined a staggering 87 per cent. That decrease means that it now takes $1 to buy what could be bought for 13¢ in 1965 (as measured by the Consumer Price Index).

‘There is an important message for investors in that disparate performance between stocks and dollars…The unconventional, but inescapable, conclusion to be drawn from the past fifty years is that it has been far safer to invest in a diversified collection of American businesses than to invest in securities – Treasuries, for example – whose values have been tied to American currency.

The American market is probably better than ours, but in the end it’s a variant of the tale of the talents. If you want to hoard a store of value then maybe gold is a better bet, though our Warren doesn’t rate that much better – to wit

“neither of much use nor procreative”

Cash is useful, but unproductive, unless you’re prepared to open shedloads of current accounts. Take this Telegraph reader who put the legwork in to stow £70,000 in 11 accounts to win £1800 a year. Unless she has specific reasons to need massive amounts of liquidity that seems to be a tough way to stay just ahead of inflation. Yes, she’s realising 2% more than me – about £1400 p.a. I’ve given that up on the equivalent part of my cash, but my ISA cost me a lot less than her £70k and is worth more (at the moment) and in dividend income alone beats it into a cocked hat – and being an ISA no further tax to pay. Not only that, but if I leave it damn well alone it’ll very likely do similar next year, whereas the Telegraph reader is going to have to close a load of accounts and open a load more, just to stay in the same place. The reason she has to work harder than I do is because cash, while of much use is not procreative. It is a so-so store of value and an excellent medium of exchange. Getting more valuable just by sitting there is not part of its job description.

84 to 2,059 over a 50 years period, works out at roughly 11.6% interest per year. It would be interesting to know what a current/savings account in the US was earning through the same period to see if it was that far behind?

LikeLike

@David – the Barclays Equity Gilt Study is a good long-term source of research and you can get past PDFs by googling the title. In the case of the UK the table here indicates a 50-year real annual return of 5.5% for UK FT allshare relative to 2.5% on gilts and 1.5% on cash, I would expect the differential to be a bit greater for the US. You can’t just take the 85 to 2059 because it excludes dividend income which is how WB pumped the return on the S&P to more than 11.6% p.a.

LikeLike

Yes sorry I missed the overall return, I think that works out at something like 84 to 9,400 including dividends, or around 15% annual growth. I think reading WB letters he regularly beat that with average circa 20-25% compounded annually.

I’m mostly in cash too, with a view to one day buying a house, although becoming more skeptical. It’s difficult because I don’t want to miss the growth, but also want to have access to it. I have been trying to protect the money in a similar vein to the Telegraph reader you mentioned.

LikeLike

In that case you have a specific case for holding cash. Like mine, though with a more open-ended time horizon.

There are indexes and indeed some investments you can buy to track housing. Heck, I purchased a small amount of Castle Trust that tracks the Halifax HPI because I wanted some of the free money from Help to Buy. However, there are liquidity issues with these, which mitigate against the house buyer.

LikeLike

I’m also a cashaholic, as our dream is to buy a plot of land build a home.

There are a few reasonable options for a couple such as Santander 123 accounts and maxing out Premium bonds has worked out okay for me as a higher rate tax payer.

LikeLike

I continue to admire the way in which you’ve craftily managed to retire ahead of your time! I had to dance with The Man for 6 years longer but when I got away from him at least I could collect my discounted DB pension. A couple of years later my Canada Pension was available. My wife had her DB pension as well.

So far I’ve kept our tax deferred and tax exempt plans invested. Our cash allocation is around 8% and I suppose I could get that lower – but it wouldn’t tick any of Maslow’s boxes for us if I did.

LikeLike

I’ve got a nasty little habit of holding cash, I’m probably at about 40%, should be 25% and could reasonably be 15%.

It is the “security and happiness blanket” asset, I’m hoping I’ll wean myself off it eventually. However with the subtle whiff of potential deflation in the air maybe this is not the week to quit stuffing the mattress.

LikeLike

“It is crystallised power” – this is very true.

A lot of people just hold cash because they are afraid of the stock market. It does annoy me when people claim it to be a safe asset, and put money into a cash ISA earning less than inflation. How is an asset that is guaranteed to devalue ever considered safe…?

I used to hold nearly zero cash, precisely because it was liquid. And this liquidity meant I could get my grubby paws on it, in moments of weakness.

I have a bit more cash now that I am older and wiser (ha!), but that’s to manage cashflow and a bit of stock pile for a house move in the next year or so.

As ever, a great read.

Mr Z

LikeLike

Good stuff ermine, even though we disagree I admire the re-examination. 🙂

I’ll just make a few quick points:

1) Scale — Nobody (well, at least not me) is saying hold all your money in cash. Six figures is tartable — I know someone who does it (albeit with a spouse to help out). Even on a huge 25% permanent portfolio type allocation that’ll get you towards £500k.

2) Liquidity etc — Yes, agree with all your points here. That is one of the attractions of cash as an asset class (/investment! 🙂 ) As you know, investments are not all about return. They have other characteristics too, that make them attractive/unattractive.

3) Somebody made the ‘yeah but who swapped all their cash for shares in 1999’ argument on my site too. I don’t buy it — again, it’s a straw man. Fine, that was a dumb trade but the reality is you could get 5-6% or more for many years on cash after 1999, and avoid 2 bear markets on the trot. And that, incidentally, is when cash really showed its stripes — nobody felt dumb with a big chunk of cash in 2003 or 2009, provided they went into those markets in cash!

4) Agree it takes work. Sitting in 0.25% cash is much less attractive, though still good for liquidity.

5) Re: the Barclays study, as I’ve mentioned before, that’s institutional cash returns. They can’t get the advantages we private investors can accrue up to a reasonable level, so it’s less attractive for them.

If I might be permitted a link on top of the ones you kindly included in your post:

http://monevator.com/maximise-savings-rates/

Cheers for the follow-up, and hope my email didn’t really wake you! 🙂

LikeLike

@all – writing this, and the comments, clarified this a lot for me – almost to the point of considering a cash conundrum:redux post.

The liquidity that comes with cash in its purest form is key. I saved a lot of cash ahead of leaving. Some of it was for several years of (~11k at the time) ISA allowances as yet unborn, but most was to hedge the unknown. You need liquidity for that – Marco’s house plot and Mr Z’s house move are cases like that too. You need liquid cash to seize opportunities or deal with challenges – so many of the ways of ‘investing’ cash don’t work. There’s no point in getting 2% on your cash if you lose the house of your dreams or can’t fix the roof… Immediate access cash (for people like me who can’t borrow) is the only game in town.

There’s a bit of Nathan’s and Mr Z’s critiqued security blanket in there for me. The total amount is too high – the pie chart shows the imbalance.

I think Ray’s balance is about right – in the end I want a swinging amount of cash in my portfolio roughly informed by CAPE as RIT does to be able to take opportunities, but it should only swing up to 25% IMO. And that’s market timing which we all know is hard to do 🙂

@Monevator – I think your maximise savings rates post sums up the problem. I’ll happily give you that in theory, and provided you don’t require liquidity, you can ‘invest’ cash. But look at the ridiculous amount of work – 26 flippin’ accounts, probably half of which have to be churned every year! The opportunity cost is spending the same amount of time in researching equities which may be more lucrative, or simply looking at hawks which is at least more restful.

The thought of looking back on 15 years spent doing tarting cash post 1999 doing would make me feel like the protagonist in the book Light Years you recommended a while back (great read, BTW) – it’d feel like a ghastly empty waste of life energy -all in return for roughly 10k at a guess in real terms. I gave up a lot more than that in retiring early and I don’t want to sell my time gotten back from The Man to The Beast instead. 26 accounts comes along with a lot of email advertising, junk mail and special offers even if you tick all the boxes ‘don’t contact me’. But each to their own – there are countless stories in the papers and on MSE of people who take this on as an enjoyable challenge to stick it to The Man , and why not?

Compared with that, sitting on a HYP and holding one’s hand out for the dividend cash is a walk in the park, and indeed benefits from slothful inaction, at least in my case.

I do think that the liquidity requirement is often at odds with treating cash as an investment. For a lot of the time, you can have liquidity or you can have return, but not both. It’s important to know the difference, and qualify what you want of your cash.

I need liquidity, because I am in a weak position compared to the working population (and the honestly retired with pension income!) without an income or access to short-term borrowing. In future, when I can borrow and cash is part of an investment portfolio, I will probably use something like Zopa, hopefully within an ISA, together with NS&I.

Nathan invoking the spirit of Mark Carney has helped me be more relaxed about this. Hopefully the power of other people’s instant gratification will hold the line

It appears I am part of the sleeping danger he is discounting!

LikeLike

Cash producing an awful return is a QE era phenomenon

Back before QE there were numerous bank and building society accounts and bonds that paid inflation plus 2-3%

LikeLike

@Ermine — I take a riskier attitude to ‘cash like’ investments, so while I do some tarting I do also use NS&I, Zopa, Ratesetter, Mini-Bonds, and other kinds of stuff which I would fully agree are not really cash. For me with my nefafarious active activities these aren’t actually so risky by comparison! But I do hold cash and soon hope to hold more of it.

You write:

“It’d feel like a ghastly empty waste of life energy -all in return for roughly 10k at a guess in real terms.”

The Accumulator has told me before it takes about a solid day a year to keep on top of his accounts, adding up all the movements and so forth (many of these higher rates run for 2-3 years etc, or just run automatically when programmed with cash inputs and outputs).

The key he says is to have it all on a dedicated Calendar with opening/tarting deadlines and so forth.

Also, it’s about a holistic approach. So some is in longer term 3% money, but there’s regular saving stuff running at 6% etc. So the overall return is say 4.5%.

Your point about researching equities is a bit wide of the mark, in my view. It’s true there’s a time cost, but it’s not comparable with time put into researching shares because that is an unknown outcome.

Whereas the return on say a £100k cash portfolio for the 1-2 days (I couldn’t do it in a day personally!) is guaranteed.

The liquidity point is fair, though I think that’s solved for most by having say £20k in say a Santander 1-2-3. With a Mrs Ermine you’d get to £40k liquidity. And then you can put your other cash accounts into run-off as needed.

I think 1-2 days for say £4-5k a year (pre-tax) on a £100k cash slug isn’t bad. Especially if a bear market strikes in the meantime. 🙂

Anyway, happy of course to agree to disagree.

Glad you liked the book! 🙂

LikeLike

@Monevator The book was excellent – thanks for the heads-up. I didn’t realise it was literature until I read the preface after reading the book, which is just as well given I failed Eng Lit. I get on a lot better with American classics than with British ones, looks like the mark of school incomprehension cast a long shadow across three decades!

Maybe I’m just too lazy, and clearly have an attitudinal problem with not regarding cash as an investment. While I was working I’d never carry much more than 5-6k as cash unless I was saving for something – and things like cars is what fixed term cash account were for in the past. And these were the halcyon days Neverland and you talk about. I’ve never experienced them as a saver – I far preferred making money on cash borrowed at 0% from other people – MBNA, Barclaycard and Tesco served me well in those days when 0% meant 0%!

I don’t like carrying several times my erstwhile salary as cash. Half of it is in my AVCs where I have limited choice anyway, but I need to understand Osborne’s changes and the attitude of the new Government before doing anything with that. And I’ve had decent tax and stock-market returns on it from ’09!

In the longer run with an income and borrowing capacity again I can ride shortfalls, and can leave my £15k with NS&I because that doesn’t die. I have temporarily unusually high liquidity requirements for a few years because I am that incomeless anomaly that the financial system assumes is destitute.

It isn’t brought out that much in the PF community but a non-working early retiree’s risk profile varies much more across the early retirement to post 55 period than most people, who are earning up to the time they can get hold of their own money in pensions. Any period where you have zero income blocks a surprising number of options that increase liquidity requirements hugely.

I only had a few years of this, but needing high levels of liquidity from, say, 45 to 57 could very seriously dent someone’s wealth in a time of QE if that is what is depressing returns.

I could get more interested in cash once I have digested the compounding interests post you referred to. It would truly become part of my investment portfolio rather than the security blanket, and then it needs to work. Long-term cash holdings do need to pay a return, but a five-year high-liquidity cover doesn’t – particularly in a time of deflation. That’s a pure stroke of luck, I expected QE to raise inflation.

Carney seems to think deflation will last for roughly as long as I need the extra liquidity. If he could kindly engineer a stock market crash towards the end that might be nice too so I can deploy it to good effect. But we should always be careful what we wish for…

LikeLike

“It is symbolism, it is not procreative in itself. It still surprises me when people think they can get a real return on cash.”

When you deposit cash at a bank or building society it isn’t then put to work?

I’m earning 4% on an instant access, fixed rate cash Isa at the moment: it’s not on a lot of money not but this isn’t a real return at the moment? Remember when RPI in England turned negative in c.2008 and it was easy to find 6.5%+ from even the Nationwide: not a real return? And these weren’t £2.5k limit accounts, they were the real deal. Cash certainly has its moments, and especially when markets are tanking. It offers optionality and is non-correlated to equities and other assets so can be a useful hedge. “Cash is rubbish, equities are the only way” articles and comments are quite common towards the end of bull markets.

(Btw, HSBC has a “save together” offer at the moment where if you deposit £300 in its “loyalty” Isa it’ll give you £120 interest over the next 12 months (+ interest if you leave it deposited) That’s 40%. I know, it’s peanuts and an outlier but hey, it’s from cash, and cash is the worst.)

Cash is a part of every portfolio. I’m affected by the culture I was raised in (‘pile up enough nickels and you can build a house’) so I cannot let anything go, and I’m also in the accumulation phase, but why not make what you can on it? Giving up 200bp in a Zirp world is massive (really, think about it) and don’t just think about what you’ve forgone in one year, think about it compounding over many years. Plus it’s some of the easiest money you’ll ever make (but of course be wary about insured limits, the credibility of insurance schemes and the viability of the institutions)

If you want try at least one or two of these current accounts and regular savers I’d rec. Club Lloyds and it’s instant access reg saver and Santander 123. In my experience they don’t take a lot of time even when you have a lot of accounts. Everyone normal needs a current account anyway and apart from a rare letter I haven’t had a problem with marketing and I’ve used these things for years now. You wouldn’t think twice about owning multiple stocks so what’s the difference between this and holding multiple accounts? But hey, it’s just another asset to take or leave.

LikeLike

Don’t know WTF you’re on about most of the time Ermine, but that bad boy looks like a sparrow hawk to me.

Regards

Chris H

LikeLike

@Willem de Leeuw – thanks for the pointers. I’ll look at those two, and at least qualify what I’m giving up (both seemed to need shifting DDs as well). It’s a shame the Chancellor didn’t add P2P in with ISAs in the budget. Cash ISAs aren’t worth the candle at the moment 😦

@Chris Howson Thanks! Explains why it didn’t hover then. Didn’t really expect to see a sprawk so high in the sky, only really seen them in ambush mode.

LikeLike

No worries Ermine. Sparrow Hawks are part of the buzzard family and like to catch thermals and soar. This is when they are taking a break from hunting in woodlands.

LikeLike

PS On another thread. I havn’t followed your blog for long, but have you any thoughts on using an Offset Mortgage as part of a tool for acheiving early retirement? I took one out with YBS around 10 years ago on a small mortgage and saved a considerable ammount in interest.

Just an idea for a new thread.Your thoughts would be appreciated.

LikeLike

@Chris Interesting – the hawk was over a ridge-line, well, what counts as a ridge in East Anglia, and there’s a spinney near there. We seem to be getting more birds of prey on the farm – we have a colony of little owls and had a barn owl a couple of years ago. It’s good to see them!

You are right, anybody retiring before the time they can access pension savings should give serious consideration to keeping the mortgage at least till 55/57. Discharging the capital is arguably what the tax-free pension commencement lump sum is for!

I screwed this up and discharged my mortgage before then because I didn’t zoom out to look at the big picture across my finacial status. As a result I have an income suckout now, and planned to invest the PCLS which gives me more income later. George Osborne’s changes last budget will help me a bit to smooth the income. So yes – you have got this exactly right!

LikeLike

Thanks for your reply. Good to hear you have a variety of birds of prey on the farm. Keep your eye on the little owls as I gather sparrow hawks enjoy them for a light snack!!! I was surprised to read this as the little owl is a fierce predator in its own right.

Glad you agree on the Offset Mortgage. It may not suit everyone, but I found it to be a useful tool in my strategy to achieve financial freedom, as I approach retirement.

Interesting that you advocate paying down mortgage debt with PCLS, I had not considered this and it would certainly be useful for people in the right circumstances.

I was attracted to the Offset for several reasons, one of the main ones being flexibility as it is a sum of working capital which can easily be accessed if the needs arise.

LikeLike

> Interesting that you advocate paying down mortgage debt with PCLS

It’s one of the things people used to use this for years ago, when people actually did repay their mortgages, rather than view them as a new form of the never-never. Tax-free saving to repay your mortgage, at the peak of your earning power when you are paying most tax and often had the kids off your hands, what’s not to like?

An offset mortgage is a good way of minimizing interest paid, but beware the Ts and Cs of the contract that usually permit setting-off. There’s an ex-colleague working in The Firm who had a business offset mortgage that was all of a sudden repoed against the offset in 2009, starving the company of working capital so all of a sudden he had to raise the working capital as an IO mortgage on his house. He is now working at The Firm past 60 and drawing his pension, so paying shedloads in 40% tax to be able to muster the wedge because he can’t get the res mortgage extended because he is too old.

The takeaway seems to be avoid any contact with the offset mortgage provider other than the offset mortgage and corresponding savings account 😉

I guess something needs to thin out the little owls! The sprawks must have remarkable vision – I’ve never seen our little owls, only heard them.

LikeLike

Glad we are in agreement re Offsetting Ermine. Mortgage rate 4.5% Cash ISA paying 1.5% seems a no brainer to me, but WTF do I know.

How are you on National Insurance? I have been self employed (now semi retired)for ever and paid 37 years contributions at the last count, so I should qualify for the flat rate pension when I take it in 7 years time.

I contacted HMRC to see if I could stop paying class 2 as I had paid enough contributions to get my pension. I was told NO as continuing contributions entitled me to other benefits, which to be honest amount to SFA. Not too concerned as Class 2 works out around £12 per month, although I would prefer not to pay it of course.

After last weeks budget, I was interested to hear Class 2 NI is being abolished. Now call me a cynical old ba….d but I can’t believe the revenue will forgo the dosh and give the self employed free flat rate pension estimated at around £150 per week.

Have you any idea what class 2 NI will be replaced by? I have scoured the various tax advice sites without success.

LikeLike

Yes, Self-employed class 2 were god value. I had 33 years up to April 2012 and worked till June that year, so I probably have 34 years. I was thinking of expressly becoming self-employed for a little while to make class 2 contributions for a year to get up to the 35 but that’s unclear new – I have no idea what will happen.

I’ve been contracted out a long time though, so that will be less. And I still have the suspicion the SP will be means tested/taxed out of sight. I regard it as a nice windfall rather than a fundamental part of my plans, I will have been retired 15 years before getting it!

LikeLike

The SP is an integral part of my retirement strategy as I never had the disposable income nor inclination to invest in my future financial health until I turned 50.

I don’t work as much these days, but still enjoy working a few months a year to use my personal allowance. I try and invest 50% of my income by drip feeding the minimum into a Tracker ISA and saving the rest in a Cash ISA. Not very exiting or profitable. However, I may alter my investment strategy as I become more knowledgable.

I will most likely have to have a rethink about paid employment when I take my SP due to income tax considerations.

LikeLike

I dunno. I pulled the trigger and saw blanks as of 52. You still have human capital. You probably have to ask yourself what the Cash ISA is bringing to the party. And I certainly wouldn’t like to pay tax on employment were I a) to indulge and b) have anything to offer the world and c) be so inclined. One of the things I regret was putting £8k into a cash ISA in ’09 – it stayed £8 and a bit k. As opposed to the FTSE 50:50 global/index fund that I put shitload in, which, er, did better…

I like it. And keep on doing it – I’ve turned down a few jobs because I got hung up on the concept that work was shit. It’s only shit if you have no options. A tip of the Ermine hat to those talented enough to have options!

LikeLike

Thanks Ermine. I am into a FTSE All Share Tracker, which is doing ok, but not as good as the Japan Index. Am taking a leaf out of your friend on Monevator and building up a spread of funds, passively invested.

I am hoping that over 7 years or so, investing in global index trackers may allow me a decent return. Don’t have the bottle to reduce my cash just yet!

LikeLike