Strange and fractious times on the markets. Not enough of a hammering to be a crash, but perhaps some of the froth is coming off the top. As it happens I have a significant amount of capital I want to invest. Looking at the sturm und drang on UK share forums, looks like there were many folk balls-deep in Tech, but out in the real world it seems a bit of a meh so far. Of which more later.

What’s a fellow to do, eh? Time to take advantage of a bright winter day to look at some ancient stones near Avebury. As soon as we came past the main stone circle we saw that World + Dog was out. It probably wasn’t the wisest thing to go on a Sunday, after all part of the point of being a retiree is that you avoid the times when others are using the great outdoors. You need other people to make a music concert work, or presumably a football match, and arguably being in a restaurant on your own is a little bit lonesome, but the outdoors is generally best enjoyed with you and yours. The Ermine household switched to the wider landscape and visited Devil’s Den, a dolmen I haven’t seen up to now. We had it largely to ourselves, and very fine it was, too.

We parked at Gravel Hill car park and walked down to it. It was a bright day, and you could see the dolmen from above, there is a permissive footpath to the site. You are aware of old money and the Norman pattern of land ownership in the UK as you pass the horseyculture gallops, but looking at the map the National Trust is making inroads into the estate 😉 In theory National cycle path 403 and 45 would take me from Marlborough where there is a campsite to Avebury, but I only have a road bike, and it’s not clear to me whether the NCN cycle tracks need something more hardy.

The downs echoed with the mewing calls of the red kites, which seem to have broken out of their Welsh stronghold busy searching for carrion in the Wiltshire chalk downs

unlike most birds of prey that have been persecuted for centuries by English landowners and their gamekeepers, the red kites don’t seem to have come into much conflict with humans, being carrion eaters. They approached quite close, close enough to see their markings

and diagnostic fan-shaped tail.

Part of the reason we went on the weekend is because though Avebury is an easy day-trip from Somerset, being in the next county, Mrs Ermine wanted to sample the delights of the Gourmet Goat Farmer, which doesn’t do Mondays and Tuesdays. It’s quite a rinky-dink sort of operation. We had a goat burger, served on a piece of slate, and watched one young couple down from London at a guess.

As they left the lady bought about ten of the fancy hand-made soaps, clearing the stock out. Artisanal soap is all very well but people never seem to get towards the end of the bars, because they go manky after a while. And millennials don’t use bars of soap, anyway. The inquiring mustelid mind still wants to know how the hell you make soap out of goat’s milk, but goat’s milk soap really does seem to be a thing with an Amazon category of its own. Ain’t capitalism a wonderful thing it its multifarious diversity?

I guess manufacturers use the chemicals and sodium laureth sulfate in their soaps because it doesn’t go off by the time you get to the end. Sure, people used to make soap by boiling animal fat and lye but we don’t do that any more because it stinks after a while. But what the hell, they were buying a dream. So were we in a way, eating grass-fed goat served on a piece of slate rather than a corn-fed Smithfield CAFOD beef patty from Mickey D’s. It was pretty decent, though at more than twice the price of Ronald McDonald’s offering one would hope so 😉

You can wander round the back and see what you are eating. Goats have a rep for being escapologists, so I expected to see them up on the roof or halfway up a tree, but clearly the Gourmet Goat Farmer has discovered the secret of keeping their goats on the ground. Lots of hay, it seems

I always thought goats had sticky-uppy ears, more Alsatian than King Charles spaniel, but not these guys. The 45 degree slitty eyes are weird. They sound like sheep to me.

The sun was starting to go down in the short winter days as we approached West Kennett Long Barrow

The low sun and a mackerel sky showed Silbury Hill off to good effect – this is a 30m high manmade prehistoric mound of chalk

Doldrums

The financial system still looks like a hostile environment for returns, with valuations still too high. Flying pigs and incoming, 360. At least now the market seems antsy/becalmed, which beats lifting off into the stratosphere with afterburners. Tech has taken a bath, which is not before time IMO, but otherwise the signal’s not strong at this time. It could be a mini-crash-ette. Or it could be the Big One waiting in the wings. I have plotted out how much I want to buy over a period of about two years. I managed to make myself buy some VWRL in my Vanguard ISA, though the price was still well above my long-term average price. The good thing about Vanguard is you don’t pay dealing fees with batch ordering, so I can accumulate modest purchases over time. I need to move most of the holdings bought that way from Vanguard to somewhere else, because of percentage fees.

Trustnet tell us most funds lost money in January. I don’t see that as a bad thing. My main exposure to tech is VWRL, which is half US stocks. If you decompose VWRL into its components, it is 25% US tech, indeed skimming an Ermine Claw down the top 10 holdings shows 15%

full of the usual Big Tech suspects, including a hefty slug of the odious Elon Musk’s operation. I really would like VWRL to come below £70 which is my average purchase price. Over the next couple of years I would like to double my holding. Which means I need prices to go down. As perma-bear GMO says

let the Wild Rumpus begin

Barring the flash crash of 2020, we are in a long bull run pumped up by some seriously funny money, the whole basis of current valuations are the crystallised form of it’s all different now? Really? It’s never been all different the last however many times people have said that. Let’s look on the bright side, valuations haven’t actually reached dot com days which is the last time we drank the Tech is God Kool-Aid, so it’s all different this time.

Philosophers tell us virtual reality is the new real reality, so Meta can expand to the edges of consciousness. As if people don’t spend too much time in their damn phones as it is. Let’s hear it from Ruffer and Lux Capital

Masses have thrown caution to the wind and diligence to the dogs.

Woof. Lux are of course talking their book in the rest of that screed, but that doesn’t invalidate the comment. Ruffer and Lux are very different investing styles, so if they both feel the need for that quote perhaps there is something odd going on across the board. But seriously, I could use a decent crash, #FlyingPigs360 in the words of Michael Burry, he of the Big Short. Seriously. You gotta admire somebody who shorts Elon Musk.

In other news, inflation and power prices are increasing. Quite why this has come as a sudden surprise to people who should know better beats me. Interest rates have been on the floor for 10 years to try and dodge the consequences of the global financial crisis and pouring money into the system has to go somewhere. Cheap energy is dirty and running out. You always end up buying it from somewhere you’d rather not deal with – it was the Arabs in the 1970s and 1980s, it’s Putin now. These guys still have all the dirty stuff, as well as values that right-thinking people don’t always share, but when it comes to freezing or looking the other way, well when they have you by the balls then hearts and minds follow, eh?

The age-old problem of getting income from capital

An Ermine can see a time when I want to use the income from my ISA to top up my pension, which will track inflation up to a point, but probably not what we seem to have coming down the pike. I also tend towards fat-FIRE as I get older 😉 Let’s get this into perspective though – that means goat burgers in scenic settings rather than new cars every three years…

In the early days I thought I would have to draw my pension early, thereby reducing the annual income from it. So I saved in AVCs, planning to take the entire amount tax-free, adding to my ISA and make a top-up income.

As it happened George Osborne changed the rules and that didn’t need to happen. But the attempt is in the fossil record of my ISA shareholdings, in the high-yield portfolio (HYP). I never sold it, because one day I would want the income. It’s easier to reinvest income than to switch on income all of a sudden, particularly as you tend to want to start doing that as the economy is in a hole.

Favouring income gives up capital growth. It is a classic speed over comfort tradeoff. If you are ten years or more off getting to draw a SIPP, then do not favour income. People in that position are trying to win the war. indeedably deconstructed it well. When I read his article, I wondered if I have made a mistake selecting VWRL rather than VHYL. Why would I choose a tax of 5% p.a. in total return by excluding non-dividend payers? Like Apple, BRK, AMZN? For one simple reason

In the depths of a stock market winter, so that I don’t have to choose how much capital to sell down to live from day to day

I can give up some total return because I am not accumulating for 30 years. If I wanted to leave a big legacy, for example because I had middle class kids and I foresee the hollowing out of the workplace and opportunities for them because average is over, then I might feel differently about that. I have had two experiences which make me not want to burn capital in a stock market winter. The first was in the runout of the dotcom bust, which was a long, dreary, sideways slip-sliding away over several years after the initial crash. That’s the sort of thing that clobbers ‘I’ll just sell some accumulation units every year’ because everybody has a plan. Until they get punched in the face. The standard solution, carrying a couple of years of cash as a float, would have dried up, because that grind was more than a couple of years.

Maybe the dotcom bust was a particularly egregious piece of irrational exuberance, but finance is fat-tailed, lows (and highs) happens more often that people think. And if ERN says that runout would have killed a steady 4% withdrawer, then I don’t fancy that.

The second experience was trying to retire early out from the GFC. The answer to the question “how much can I spend” was always “as little as possible” so that I would be able to maximise my AVC contributions through salary sacrifice while working, and always fill my ISA from what was left, which drifted down towards minimum wage through salary sacrifice. This was easier because I had a paid off house. ISA limits were lower back in the day, ~12k in 2012. My current self is better off because of that, but I don’t want to live like that again. I appreciate still having most of the original HYP, which means I don’t have to make that VHYL/VWRL call now.

the wider setting

The West is clearly in decline. Declinism is of course the general lament of people getting older since humanity began, as they project the micro onto the macro 😉 That doesn’t mean it isn’t happening. I can see costs rising, which is not to repudiate the fact that an awful lot of Britons are probably in a more precarious position. The obvious hazards are:

healthcare

Universal healthcare is likely to become less universal in the UK, and it is already a lot less universal than it’s made out to be, although it probably is still true that if you are in a RTA they don’t check your ability to pay before trying to fix you up. At the moment I have managed to avoid bothering the health system that much, but as you get older the likelihood of that increases. There are some things you can do to improve the odds – while I have never darkened the doors of a gym since leaving school I walk to places a lot of younger folk seem to drive to. There are also things you can not do to improve the odds – avoiding all fast food, gratuitous sugar and drinking less than my younger self are also ways to shift the balance of probabilities. But I have seen people much more clean-living succumb to ill-health. And it is pretty obvious to me that the direction of travel in healthcare is more like the US rather than away from that. There’s profit to be made, and since we don’t stand for principles when faced with that, we know where it will go.

energy

Hard to say about the rise in cost of living etc in terms of energy. An awful lot of claptrap is talked about energy in the home – the fuss about insulation for instance. The materials are cheap and easy to DIY for loft insulation, I seem to recall I paid less than £2 a roll when I did that, and a little bit of that goes a long way, and if you had uninsulated cavity walls then you have probably had them filled because it’s not that dear. These are the easy wins, and after that it gets stupendously hard and expensive very fast, though double glazing is a sort of intermediate if you haven’t got it yet.

Heat pumps seems to be a bonkers technology. They are expensive to retrofit because of the civil works, and ever since Margaret Thatcher did for council housing and the Parker-Morris standards, Britain’s housebuilders have been building rabbit-hutches. Thus inviting the obvious question ‘so where exactly would Sir like to put this humongous monstrosity of an air handler for your heat pump?’.

Heat pumps are more complex, and wherever I see complexity in a system I see future maintenance hazard. Plus all those great big fans, I foresee a godawful din rising above our towns as no doubt people will fit the cheapest Chinese bearings that will wear out quickly. Still, I suppose it will be good for employment. These rabbit hutches would have been better served by a communal or district heating system installed at the time of building, which would address the space and noise problem too. Let’s hear it from the Guardian, who are normally highly into all things green

Those taking out a gas boiler are highly unlikely to see any savings and could well end up paying more each year. Octopus Energy says in a poorly insulated home it will cost as much as 40% more to run a heat pump rather than a traditional boiler. This is because the cost of electricity includes carbon taxes and subsidies to support low-carbon energy projects.

Hmm, well, that’s a no, then. I am considering switching to gas for cooking for precisely that reason – I don’t see why I should subsidise other people’s energy projects when I roast a chicken, and the slow startup of the hob is tedious. I am going to keep a gas boiler running for as long as I can. Even at current prices, I can buy an lot of years of gas heating for the £15,000 capital cost of installing a heat pump, and the extra cost of making good after having to massively increase the size of the radiators for the fact that is is a gutless low-temperature power source that isn’t really up to the job.

I am also tempted again in the direction of a wood burner, despite the hate campaign on the technology in the Guardian. This is from a resilience point of view rather than lifestyle. I am cheered that finally building regs now mandate feeding the intake to a wood burner from the outside, rather than a massive ventilation brick that you have to cover to stop it getting freezing in winter, and getting a CO monitor to make sure the wood burner isn’t fighting you for oxygen. An outside direct intake was always the obvious right way to do this job.

As for battery walls inside the home, wonder how you put the fire out? Whatever you do, don’t try and hose the bugger down. That’s the trouble with high density energy storage, it’s highly dangerous store of energy 😉 You wouldn’t be allowed to keep that much kWh petrol or propane in a domestic setting, you need to keep that outside.

and more diffuse issues

The coarsening of debate, the brazen corruption, the casual impoverishment and nastiness of the ‘welfare’ system, general loss of contact ‘twixt falcon and falconer. Maybe that is just what decline looks like, but it’s not good.

Digging up the blotters

In the quiet period between Christmas and New Year it’s good to turn over the old grey matter, in amongst the usual excesses. I have a large amount of data I would like some answers from, which are the tapes of all my share transactions from the beginnings in 2009. The very first forays in 2009 are only summarised by year, in an Excel spreadsheet, but I only used £3600 of my £7200 ISA allowance then, putting the rest into a cash ISA. D’oh. Ermine standing next to big open goal of a crashed stock market. And buys a cash ISA with half. OTOH I didn’t know if my job was going to go titsup like, tomorrow. So it was the best I could do given the knowledge I had to hand.

Platforms make it hard to catch that sort of raw data, and since I have been kicked out of three platforms (Interactive Investor no less than twice due to their rapacious greed) I observe they all present it differently. No doubt the modern way is to diddle on your smartphone with all your data aggregated and sold to the highest bidder, but I still use a real computer and my own data. The first law of signal processing is what has once been lost can never be regained, so each time I downloaded the digital equivalent of the blotters before I cleared the account by transferring the assets out to a lower cost ISA platform.

I did try and get a feeling of P/L using Excel. The downside of Excel was that it started to get slow after about eight years, which probably indicates rotten programming on my part. Excel is nasty, as the computing logic is distributed over many cells depending on each other, it is hard to trace. With the last move to iWeb I integrated a summary of the position into Quicken, but hung on to the raw data. I hoped one day to be able to use that – a record of every transaction and countless dividend payments.

I tackled R again. This is a program to munge large amounts of data, under the general heading of data science. It’s the sort of thing that makes Dominic Cummings feel all warm and fuzzy inside when he’s not sticking the boot into his old boss. It is not enough to succeed, others must fail, eh, Dom? In finance Real Men use something a lot better, but Rstudio is free and well documented.

I was intrigued to learn over that dividends have bought two years worth of contributions at current rates, I would say the high-yield portfolio (HYP) that was so difficult to believe in in the early days came good and stayed good. My excel spreadsheet lumped all dividends together, making it hard to split off the difference between that and the passive part. But the transaction tapes still carry the information and R could break it out. I could start to look at the in-ISA total return (TR) because there is enough information in the downloaded dividend payments to ascribe a dividend to its parent stock. And then to make R do a cumulative sum along the timeline. Some things are surprisingly easy to do in R, cumulative sum being one of them, some things that look easy like looping iteratively seemed harder to me than they should have been. But I have not been coding for a living for over 10 years, perhaps there are stylistic changes in modern programming that are drifting away from how I learned to approach things.

I am happy enough with the results, though this was easy enough to see in Excel by comparing the totals across all my ISA platforms with the contributions. This gets harder as you start drawing out, the R library I use has the functions to unitise, which fixes that. The story is not complete, because it started in the crawl from the 2008 crash and as of writing ends on a bull market that has not yet surrendered to old age. #FlyingPigs360 and all that. The HYP shows dividends are less volatile than the market value in a crash. I am grateful to my younger self for testing that. Dividends aren’t immune to market sentiment, particularly on the individual company basis, which is why greybeards buy investment trusts where the dividend is smoothed over years. They swap that for amplified capital value gyrations because of the closed-end nature and discounts and premiums.

Never be a forced seller of an investment trust. It’s worse than being a forced seller of an index fund 😉 If you are the sort that coolly and logically sells down units of capital for your income, even through a crash, ITs are very definitely not for you, because the discount will tax you more into the low-water mark, discounts widen in times of market stress. Buy ITs in the low water mark, don’t sell ‘em. If you have to sell them into a suckout, short them, and benefit from the discount opening up. This is a specific case of the general principle of investing in volatile assets all round. Never be a forced seller. In my book if you have to sell index units to realise annual income, you are a forced seller. But hey, the theory is great. You can make all this sound grand with the Guyton-Klinger rules etc. But you’re still a forced seller, and ERN shows what that can do to your lifestyle. Forced sellers don’t get to choose, fire sales aren’t pretty in tough times.

It seems FI/RE forerunners in the UK on the fool.co.uk messageboards spawned some of the HYP ideas. There was much more talk in the early days of using yield for income. Back in the day you could do that, roughly equivalent to 5% SWR. Tech ate much of the investable universe since then. And just like in the dotcom bust, tech doesn’t pay dividends if it can avoid it. Tech is always about the sizzle, not the steak.

It’s good to see old theories vindicated. Monevator gave up on the demonstration HYP because it started to lose popularity as Bogleheads took over the investing scene. One of his posts early in my journey was shortly before I bought MRCH (should you swap your HYP for an investment trust at a discount)

I started with an investment trust, which happened to be MRCH, and skipped selling the HYP I didn’t have. Monevator probably sold his ITs when the discount cleared (2010 to 2013-ish in this case by inspection) and bought his HYP back for all I know. Perhaps the TR rip out of 2010 was an example of the discount narrowing. I do know MRCH was one of my early purchases, precisely as a result of the discount logic.

In other words, for every 90p you spent, you effectively bought £1 of the trust’s underlying investments. Such a discount is great if you’re buying income, since a trust’s income is generated by its underlying investments. All things being equal, a 10% discount means roughly a 10% higher income for you.

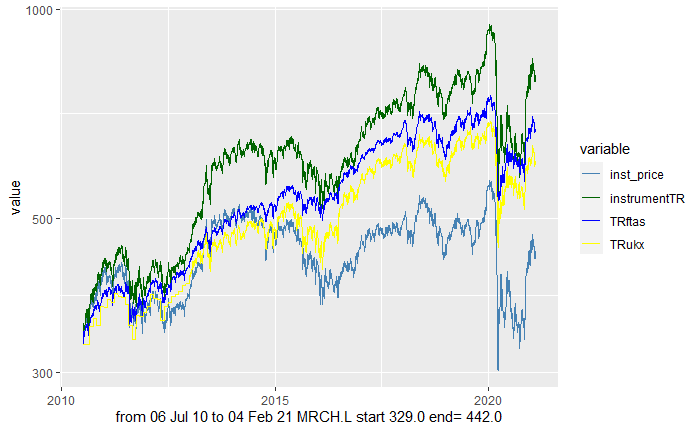

In my own version of this in R, I run my holding of MRCH, and match the SP plus dividends received with what I would have seen along time for the FT all-share total return or the FTSE100 total return. However, if I have bought any more, as is the case here, that really screws up the visuals by putting a step in the chart when I buy more stock. The discount opens this up when things go bad. This happened in 2016 (wonder what happened then, eh?) as well as 2020. I will confess to shorting some of this outside the ISA in early 2020 as well as boosting my ISA holding later in the year. That adds jagged noise to the chart.

So for this chart I use the Yahoo adjusted prices for the chart as of my first purchase. I tested against the real evidence from the trade and divi data for a period from one purchase to just before the next, and concluded Yahoo either do an okay job of the adjusted prices. Or they balls it up dramatically with some instruments, usually by changing the scale factor from GBp to GBP (yeah, it’s subtle, see what they did there?). If you want to see this look at the HSBC fund CUKX.L which at the time of writing goes crazy on the 4th of July 2021.

Anyway, looking at the cyan instrument price (R calls it steel blue) plot of share price, terrible investment, trailed yellow and blue traces of the FTSE100 and all-share TR. But the green TR line shows dividends made up for that, forcing open a gap between SP and TR. TR didn’t fall behind those indices in the period I owned it in terms of the money returned. Because I started my investing career in the sunset of my human-capital career, exchanging share price appreciation for more income along the way made sense to me.

I started to find looking for individual stocks more tiresome and plain harder to do from 2015 on as valuations drifted up.

I read this article on using a single world tracker. I didn’t sell the HYP I had. VWRL seemed a good bet to go forward, and my AVC/SIPP had been a 50:50 Global:FTSE100 fund. I moved that into the ISA, keeping the draw from the SIPP under the personal allowance for a few years to get it out mostly tax-free. My largest holding is VWRL. I have never sold VWRL, but I have bought it many times to add to that holding. R tells me that if I divide what I paid for it by the shares held I paid an average price of £69 a share.

VWRL has given me a reasonable 34% total return on the investment, but the yield blows. R tells me members of the HYP occupy the first 19 slots of the securities ordered by total return(TR)%. Because I started with the HYP in a market suckout these were bought at lower valuations, and have been held longest, so it isn’t surprising that their TR% is higher. This is NOT the same as saying these are inherently better than say VWRL. I got a poor relative TR from VWRL because I started later. Valuation, timing and time in the market matters.

I got what I wanted, a serviceable income from equities. Lars’s article came out in 2015, a year after Osborne changed the ground rules on pensions. Back then VGLS100 was the default go-to index without thinking choice, but the UK version is different from the US flavour.

the HYP and income

Buying income takes ages in an ISA. If you go all-in at say 4% then each year you can add about £800 dividend income each year. It would take five years investing into an ISA flat out to match an annual payout of Jobseeker’s Allowance. On the plus side, you don’t get spotty tossers ’employed’ by the DWP to give you shit about taking any job in any field after a month. Sometimes I wonder if the DWP is a job creation scheme for administrators to be horrible to the unemployed.

I built the HYP over about five years. That cost me TR, because I ignored the world market in the ISA, that was what my AVCs were for. However, I did buy the income at better rates. I will sell gold in the ISA and rebuy it outside to give me extra ISA capacity.

The cost of living and tax rises will probably cost me about £2000 extra a year, and at the moment I don’t need to dip into the ISA yet, because I have simplified calls on my income. But these rises are coming my way, and I don’t see the increase in energy costs stopping this time next year. So I need to start lifting the income from the ISA, because I get the feeling that tax-free income is going to be a valuable thing to have in years to come.

the Art of Execution

I bought this book, H/T Monevator. The main takeaway is track dogs better and shoot them earlier. In particular, if something falls 20%, then do something. Either it is a conviction stock, in which case buy more since it is now a fifth on sale, or it isn’t a conviction stock, in which case GTFO. Coming back from a 20% loss is a lot easier than coming back from a 50% loss. I have been fortunate in recent years that most purchases haven’t done that, bar some of the Covid hit, which was an exogenous non-stock-specific hit more suited to shorting collective indices and ITs.

But it would have saved me money way back when handling AGK and TSCO. Using R would let me automate this early warning process. There is some caution in TAoE that an early warning is not as useful as an honest stop-loss because people prevaricate, ending up frozen like rabbits.

R also makes it easier to ask “given what I paid for this share, and the dividends I have collected, how is that doing versus the index TR”. There should be a way of making the index inform the tolerance of the share. The Art of Execution showed me I lack a process to get out, particularly for stock-specific risk, and this probably lowers my return. The effect is less because I have been investing across a bull market, and many of the HYP stocks are investment trusts so diversified.

When I list my purchases across all time in R , marked to market in the case of stuff I still hold, I have to get to the very last page, 61-65 out of 65 instruments I have owned to find four dogs that delivered a return of lower than -20%. They are from early days, I don’t hold any of these now.

They support TAoE, there’s no excuse for tolerating hits of more than 20%. My losses to all dogs was ~£5800. 20% seems to be battle tested in real markets over time. You need a 25% gain from a 20% loss to break even. Let things slide to 33% and you need a 50% gain, and you need a 100% gain to compensate for a 50% loss. Any more than that, just don’t go there. OTOH if you are trigger happy then you get pitched out by noise. A 10% loss is in itself not a reason to get out. I tolerated a 30%+ loss three times. That cost me £5600 of the losses. The rest was made in one 21% loss. So I find the 20-30% loss danger zone compelling.

You can’t make this mechanical, because it should be informed by the market as a whole. If the market falls by 20% that should point towards topping up. Or selling your HYP and buying investment trusts at a discount. R scores here by being able to track the market indices, giving valuable context.

On a positive note, I have run my winners. There are eight double-baggers or more on a TR basis, and three triple-baggers. TAoE doesn’t have any examples of people adding to their winners over time, which I have done with several. His Connoisseurs do the exact opposite, selling a little bit out every so often. But then these are not people investing dribs and drabs of money as they earn it into a capped contribution account like an ISA.

What did I learn from the exercise?

- I am less convinced by the passive mantra seeing some of these actual trajectories graphically, particularly against the index, although I have great respect for Lars, VWRL ain’t a bad way to go I will continue to build that stake, outside the ISA if necessary. I will build up the HYP to target about twice the anticipated top-up I want. There’s nothing wrong in pursuing more than one approach to getting a result, where both show a positive result but in different ways. Inflation may make income more valuable to me sooner than expected.

- I gained a greater respect for the HYP as a result of R’s summarisation of P/L. Enough to test against the provided example data to make sure I wasn’t using the code wrong, because it’s always a hazard with data science – you are at risk not just from garbage in but of making garbage out of perfectly good stuff in.

- No plan survives contact with the enemy. When either the world changes or my situation changes the plan may need to change. Ten years is enough to see quite a few serious needs for change. Ten years is enough to see quite a few serious needs for change. Sometimes they are opportunities, like Osborne’s changes to DC pension rules which meant I didn’t need to draw my main pension early because I could front-run it. Early on, I thought I needed the HYP, so I focused on that. I needed it less after a few years and Osborne’s changes, so I shifted to building up VWRL. The art of successful investing is probably in smoothing enough of the noise, while remaining responsive enough to change.

- The Art of Execution is right in that I need to post sentries in the R code to KO stuff that falls anywhere near 30% and to act if something falls 20%. That action may be buy more, or to let it go. This has happened rarely to me, but when it has, doing nothing has never been good.

- I may get useful signals for individual shares from comparing holdings against the FTSE100 index. This is UK specific because I only hold non-UK stocks in index ETFs.

- There is no useful difference for me between a FT All-share index compared with a FTSE100 index. The small and midcap tail isn’t strong enough to wag the FTSE100 dog. Historical TR data for the FTSE100 is easier to get and easier to keep updated using a FTSE100 Acc index fund.

Those stones look lovely. You got the best weather for a visit that’s for sure. Another set on my list for the next time I get back West.

It’s been a long time since I got to West Kennet too now – I walked the whole Ridgeway Trail ending there as a younger self.

The cafe looks like a contender for this campaign – https://twitter.com/wewantplates

I also closed my eyes & bought a bit more VWRL this week as it goes. Time in the market, not timing the market, as they say. I’d say I’m still 8 years from any drawdown.

The chatter in some of the FI groups I am in this week is showing some nervousness on the interest rate rises & what this might mean for peoples mortgages & remortgages. Still so low historically really the trajectory can only be in one direction for many years there I feel.

LikeLiked by 1 person

That Twitter campaign is funny, the micro shopping trolley has to be the best! The Devil’s Den was excellent. Mind you, I may need to get the bus to penetrate to the Great Wen for this British Museum Stonehenge exhibition sometime – I haven’t been inside the M25 for a couple of years now but I could make the exception for that!

Interest rates could mean a lot of hurt. The next generation of putative buyers would be grateful, those currently in the sausage machine not so much. I still recall the early 1990s where there were three million in negative equity. All too clearly because I was one of ’em 😦

LikeLike

A few themes here that caught my attention!

First, I’m glad it’s not just me who’s FIRE is getting fatter over the years, lol. I can see it continuing, too, at least to a certain degree. It’s not that I’m suddenly buying Hermes handbags or anything, but there have been lots of little upgrades that add real value to my life. All those uber-frugal years, that enabled me to sock away a staggering proportion of my income, have finally paid off 😉

The NHS thing is truly a wicked problem. Friends and relatives who live abroad in countries widely considered to provide ‘better’ health care than we have here, report gradual erosion and seam-splitting in their countries’ systems, too.

And they generally pay much more for health care out of their incomes: a concept that we will certainly need to get to grips with here in the UK …

Your discussion of energy issues was interesting for me, since I am the owner of a pretty standard issue Victorian terraced house built on three storeys and with a miniscule garden. As luck would have it, we got a nice new gas boiler a couple of years ago which should see us right for a while. The thought of finding an efficient eco alternative that heats right the way up to the top of the house makes me come over all faint 🙂

Jane in London

LikeLiked by 1 person

Probably the same trajetory as your experience – squeezing things harder earlier makes me appreciate finer things now. Slightly uncomfortably, showing up in one of Early Retirement Extreme’s trifecta

but I am easy on the tickets. And while buying better wine falls into the class of shopping I guess, I am a long way from needing BNPL and a Klarna card.

LikeLike

This Guardian article that seems to bear out my cynical observation. Loft insulation, yes, cavity wall insulation, yes. The rest, fuhgeddaboutit. I watched one terraced house in Suffolk being externally insulated, I walked past it for a few weeks with my gob open at the amount of scaffolding, amount of time and amount of craft skills that seemed to be necessary and wondered to myself how the hell they were ever going to get a return on investment. It looked OK when they had finished, yes if you looked you could see it was a shade bigger than the one next door, and it was an end-terrace which broke up the visual oddity left.

The only thing that surprises me in the Guardian article is that so many have not had the easy wins done

£1000 is probably the loft insulation and cavity wall stuff, and if they say savings are £500 p.a. then a payback time of two years is a no brainer. The devil is in the “much more” part of the detail… Britons seem to move every 20 years but I’d say cash for expensive capital projects is short at the start of one’s house-owning career, so payback periods of 10 years plus are likely to get nixed in practice

LikeLike

Totally with you on:

The worth of going beyond insulation. My house and everyone else’s in the top of the Pennines are three hundred years old. I’m fed up with suggestions of air pumps and other fancy things that need electricity to work in an area with frequent outages in winter. Lucky we have coal and log burners and bottled gas heaters.

You were also right about waiting on the electric hob being annoying. Great oven but we’re thinking of swapping out for a bottled gas hob.

Pity wind turbines (worthwhile ones that is) are so dear. I’d ditch wired electricity entirely then. But it’s the extra cost of deep discharge batteries.

The price of coal is probably the cheapest of all fuels. There’s a local working coal mine in Cumbria. Maybe need to look at particulate meter

LikeLiked by 1 person

Yep, I think island sites (or those that easily become them 😉 will keep on fossil fuels or wood for a long time yet. Battery storage will sort people’s lights, perhaps enough to make tea every so often and run the TV, computers and microwave but for space heating it’s not gonna cut it. And running a heat pump off batteries may save you a third, perhaps two thirds of the electrical power but running even 1kW for eight hours is a very serious amount of battery storage, compared to fossil fuels, even this diesel heater

On the hob I know a fellow who has a bottled gas hob and electric oven – apparently they do make dual fuel cookers. Although the speed of start of an induction hob would solve that gripe 100% for me, but I wouldn’t do that somewhere subject to frequent lengthy power outages.

> Maybe need to look at particulate meter

I grew up with a single coal fire heated living room. Which for some bizarre reason made the ocndensation come down the back wall giving rise to mould. I had bronchitis often enough as a child but not so much since the advent of central heating. OTOH I had a wood burner in the last house and didn’t notice any respiratory aggravation, or to me honest any shocking smell of wood smoke. So I figure I am probably old enough that it won’t catch up with me, and beats getting cold in the brave new world.

In the interests of fairness I should link to this anecdotal report of a happy heat pump customer in Bath, although to be honest if I were goign to buy something complicated and new tech like that I’d also buy it from somewhere like Bath & West community energy on the grounds that they will have put in the effort to understand it and also will be around if it goes wrong 😉

LikeLike

If I understand you correctly, your primary [non stones] concerns are contained in the paragraph that starts “An Ermine can see a time when …” May I ask why you did not include your impending state pension into the discussion?

LikeLiked by 1 person

I’m not old enough that it’s that impending as to help me 😉 Though I am at least now fully paid-up, well, as long as they don’t change the rules again in the next few years…

Plus there’s the somewhat increasing hedonism along similar lines to Jane 😉

LikeLike

Unfortunately, none of us are getting any younger!

Surely, your “flight” from work to starting your DB pension has taught you an awful lot about how to negotiate such a gap? And this time, all you may be looking at is the possibility of a shortfall, or have I missed something?

LikeLike

> all you may be looking at is the possibility of a shortfall, or have I missed something?

Only the teeniest violins needed 😉 I hope I did tip my hat in the post at the start of ‘the wider setting’ to the fact that many of our fellow countrymen are likely to be in more need, sadly.

Broadly, I regard VWRL etc as defending the long term, and to date I have used the income in the ISA to buy more shares, rather than take it out. But a few years of 7% inflation would probably mean I need to draw on the some of the income. I want the HYP to deliver about twice the desired income boost; it’s easier to reinvest income than to shift in that direction quickly.

the 10 years timescale, yes, that’s for VWRL to defendm, perhaps against those health costs. My SP should easily be in payment by then for boosting normal spending capacity, for future decent wine and lobster 😉

LikeLike

FWIW, I’d have thought cash might just have a part to play too.

One thing that did occur to me was that it is not entirely unknown for folks who can afford to spend more to begin to spend more once they realise: a) their good fortune; and b) that in all likelihood they will run out of time first!

BTW, I take your point re the ‘wider setting’

Are you familiar with https://en.wikipedia.org/wiki/Cullen_skink ?

LikeLiked by 1 person

> I’d have thought cash might just have a part to play too.

I’m uncomfortable with holding lots of cash – to the extent that I favour PMs, and am buying, in the GIA now. Three years running costs is about the max I want to hold, and arguably that’s too much now I have income…

> One thing that did occur to me was that it is not entirely unknown for folks who can afford to spend more to begin to spend more once they realise: a) their good fortune; and b) that in all likelihood they will run out of time first!

I can relate to that. The last couple of years have focused the mind on b) and perhaps I should appreciate my younger self and fortune for a) But my younger self got to here by being paranoid…

Cullen skink, eh, now that makes me hanker after visiting some of the stones in Aberdeenshire, while I don’t yet need a passport and an IDP to cross the border…

LikeLiked by 1 person

Freshly made is usually best, but IMO this is pretty good, see:

https://www.tesco.com/groceries/en-GB/products/268548876?sc_cmp=ppc*GHS+-+Grocery+-+New*PX_Shopping+GCS_New_Generic_All+Products*New:+F%26D:+Food+Cupboard:+Food+Cupboard*PRODUCT_GROUP268548876*&ds_rl=1116322&ds_rl=1116019&gclid=EAIaIQobChMIyZ7FqbL29QIV2u3tCh09KwcWEAQYASABEgI-v_D_BwE&gclsrc=aw.ds

LikeLike

With an average annual shortfall of up to 30%, three years running costs would last around 10 years, and, as you say: “My SP should easily be in payment by then [10 years timescale] for …. “

LikeLike

> With an average annual shortfall of up to 30%, three years running costs would last around 10 years,

Not so fast. You can’t hold cash anyplace it holds its value, and ten years running @ 5% will thin out a significant part of it. But yes, technicalities apart, I acknowledge I am being a paranoid android. Which doesn’t mean they’re not out to get me 😉

OTOH giving up some growth for income will save me burning capital – well, purists would say I am burning capital slower, but it probably won’t catch up with me. I have a high-level target of 10k tax-free income, the HYP segment is well over half way to this. I should be able to get there in a couple of years.

LikeLike

You are, of course, correct – even ILSC from NS&I are now linked to CPI. RPI vs CPI is a debate for another day.

Pragmatically, however this might be a good use of your cash if you are loath to invest it for fear (or should I say hope) of a market correction – that might never really come.

The thing I would be wary of is unintentionally ‘sacrificing’ safe (or floor if you prefer) assets in an attempt to protect an (ultimately unprotectable) upside which as things stand today is nice to have. Now, who is paranoid?

Perhaps a blend of both approaches would hedge some of the risks.

LikeLiked by 1 person

> ILSC from NS&I are now linked to CPI. RPI vs CPI is a debate for another day.

Pragmatically, however this might be a good use of your cash if you are loath to invest it for fear (or should I say hope) of a market correction – that might never really come.

Absolutely, and they will prize my ILSCs that my former self bought from my cold, dead, hands, unless that sort of emergency happens first… I bought those as a hedge against being offed from my job sooner rather than later.

I have a spreadsheet of the overall plan to move a fair amount of money into the markets over about two years, so spacing it out. So far I have managed to follow it, attempting to aim at lower-valuation assets first (so far that’s been some HYP stuff, some EM index funds, some VMID and a rump of VWRL). Yes, theory says go all in on Day 1, time in the market and all that, but I can afford to spread myself out. That should give me a tax-free income of more than the SP available after the two years should inflation and other rises mean I need it, which should insulate me somewhat from the correction. If I don’t need it, well, I will carry on reinvesting it. I am not going to flatten my cash reserves. I just don’t want to hold more than three years

LikeLike

Shitty prospect of future long- to medium-term returns aside – I don’t think there will be another QE anytime soon – here are a few thoughts:

1) The funny money is not going to be unwound by central banks but rather inflated away. Because: Reasons.

2) The subscription model to life, which I hate and think resembles the central premise of a sci-fi B movie about a dystopian society where folks have to work increasingly hard to keep up with the price of oxygen, that model supports tech and energy industry valuations by being correlated with [global population] ^ [consumption]. We might have reached peak stuff in the west (your goat soap is a symptom), but not everywhere else. We won’t reach peak tech and data services in my lifetime.

3) Climate change will require a lot of investment in infrastructure, partly public, partly private, but in the end it will all end up as some company’s revenue, and, as counter intuitive as it sounds, this will support market valuations.

Personally I need one more market crash (a proper one, preferably in China) before I retire. I hoped 2020 was going to be it, but the blip barely registered on the charts, and I am getting increasingly antsy as my target date is getting nearer.

LikeLiked by 1 person

Not a fan of Ida Auken of the WEF I take it 😉

I had a post a while back ‘a pox on subscriptions’ but it looked a bit too Victor Meldrew so it never sw the light of day. The reaction to that WEF article, I see it is now removed, clearly jarred off a lot of people.

The inflation makes it hard to qualify a lot of things – I got used to (successful) investing in a relatively low-inflation environment. Even say my historical purchase price for VWRL at £70 probably needs the individual buy transactions inflating to current values along the timeline so I don’t end up anchoring on an artificially low historical purchase price. Still, if

> We won’t reach peak tech and data services in my lifetime

then it won’t be in mine!

LikeLike

Great blog as always, I thoroughly recommend a visit to East Kennet Barrow.

LikeLiked by 1 person

“grass-fed goat”: the traditional way to feed a goat is to let it into your garden. It will hoover up your kitchen garden including any fruit bushes. It will move onto your flower garden and scoff the lot. The one thing it won’t do is mow the lawn for you.

A bit like politicians, really.

LikeLiked by 1 person

“I can give up some total return because I am not accumulating for 30 years. If I wanted to leave a big legacy, for example because I had middle class kids and I foresee the hollowing out of the workplace and opportunities for them because average is over, then I might feel differently about that.” – Haha, this one really rings true for me. We have four year old twins and it’s really a concern for their future financial security, not my own, that keeps me working into my forties. So new money goes into the market each month. Here’s to the coming crash?

“And it is pretty obvious to me that the direction of travel in healthcare is more like the US rather than away from that” – This is a shame, because it’s very dangerous here to go without employer provided insurance or an ACA plan – appendicitis last year cost me 3k and my ACA insurer 138k (thanks Obama) – if you can’t cover the monthly payments, there can be big problems….

LikeLiked by 1 person

I’d kind of hoping it won’t go all the way in my lifetime. But I do expect to pay for quality of life interventions. It goes against the grain of the free at the point of use historical ethos, but OTOH much more can be done nowadays than back in 1945. The NHS still works well for things like appendicitis and strokes/heart attacks etc, it’s things like joint replacements that it seems to do poorly with. touch wood I can avoid that sort of thing…

I guess if your twins are four years old the integration of time in the market is on your side 😉

LikeLike

“…the red kites, which seem to have broken out of their Welsh stronghold…”

My guess is those kites have spread along the Ridgeway from the Chilterns rather than Wales.

Thanks again for an interesting read.

LikeLiked by 1 person

> it’s not clear to me whether the NCN cycle tracks need something more hardy.

Yes, they do – very familiar with the 403 and 45, and the intersection thereof near Avebury. I have a hybrid with front shocks and it copes well, but with the downside of more weight. This is where I think the gravel bike comes into its own – light, fast, and can cope with whatever our NCN throws at it – wish I had one! 😉

LikeLiked by 1 person

Damn. I guess I need to walk this first. The win with a pushbike on campsite is you are not limited to the gate opening times. I could stage at Gravel Hill car park I suppose. I rather fancy seeing Long Tom despite the challenged antiquity and the polissoir up that aways.

NCN45 eh – looks like that’s the Ridgeway, and I recall that was bastard enough to walk along in the night up from the A4 car park, thankfully with a full moon. Sure, you could get a 4×4 along there and it looked like people had, but I totally lack the cojones and all-round hardness to think about that on any sort of bike!

LikeLike

Hi Ermine,

I totally agree with you about heat pumps and also also feel they will use the cheapest parts and bearings available. What shocked me though was last autumn I went to look at some brand new houses, still being built. They weren’t even putting heat pumps in them, so even they will still face costs in retrofitting them.

I feel it is technology that could work, if there was a solar voltaic panels on the roof to generate the electricity to run the heat pumps, but they weren’t there on the new houses either.

My personal peeve is hybrid electric cars. Normal combustion engine have relatively a lot of parts, but no batteries that will degrade. Electric cars do have the problems with batteries eventually, but are simpler mechanically. Despite the sales hype saying they are the best of both worlds , hybrid electric seems the worst of both worlds, making the cars heavier too. I am keeping my old car going for as long as I can.

Speaking of batteries, as a long time reader thanks for the old tip about this battery charger:

https://www.batterylogic.co.uk/technoline-bl700n-battery-charger.asp

It is very good and I am replacing traditional alkaline batteries with Eneloops. Do you recommend Eneloop Lite batteries or just regular Eneloops in remote controls? (Can’t see for my use case I would ever need Eneloop Pros). Thanks.

LikeLike

The lite ones should be fine for your remotes and clocks etc – I seem to recall reading that their self-discharge is slightly slower than pro which are for max capacity, which I think means the separator was thinner to get more active capacity. If it’s something with a motor in it you probably want to go to the regular 1900mAh. But the lites are slated to hold 70% capacity after 5 years, which is great for clocks and remotes.

My version of that charger had the soft-feel surface that goes sticky and gunky after a few years. Goo-gone and elbow-grease fixes that. It doesn’t affect the functionality. Nice to see the BL700 now takes a 12V in. I smoked the first one I had by not realising it was 3V, d’oh. I labelled the replacement and the adapter with a skull and crossbones to warn of that!

LikeLike

I had read that the separator was thinnest on the Pro’s too, a bit thicker on the Regular and thickest on the Lites, which accounts for the lower discharge for the smaller capacities.

Anyway, I wasn’t sure if I could get away with the Regulars. I hadn’t thought of using them in clocks, only remotes, but will give them a try there too when the time comes.

I hadn’t heard of goo-gone either, but will save the reference if the charger goes icky, thanks.

From my reading around it seems that Ikea batteries are made in the same factory as Eneloops and just the branding is different apparently. If so, then Ikea do Pro and Regular AA and just Regular AAA’s, if that helps. Just no equivalent AA or AAA Lite versions sadly 😦

LikeLiked by 1 person

I use regular eneloops in remotes. It’s hardly a tough load. But that’s because I bought a couple of bags of 10 of the regular ones. They go quickly when they do run out, but they last long enough, a couple of years ish. And don’t leak, which is the major win! Those lite ones will give you longer runtime, because I’d guess self-discharge is the limiting factor rather than capacity.

If it’s a clock where you’ll notice that it’s stopped, alkalines are OK and give you a great runtime. But in remotes you end up not using for a while so you don’t notice alkalines have run down, then the batteries leak. While the fibreglass pencil (or Dremel and brass brush if it’s really bad) works OK leakage is a problem I just don’t have having moved to Eneloops

Life’s too short to worry about batteries, and after some maplin NiMH ones faded/died off prematurely – well after five years 😉 I cleared them all out for eneloops. I haven’t worried about batteries since. Not ultra-fast charging them, and intelligently charging then as individual cells rather than those horrible 2×2 chargers that used to be all the rage seems to be a win. I stopped having aggravation with rechargeable batteries after switching to single cell charging which was around the same time as I got the eneloops

LikeLike

It was getting caught out with a leaky alkaline battery in a torch I hadn’t used for ages that started this. I cleaned it and replaced the batteries, but then decided to check everything else I have that uses batteries and replace them too. It gave me a huge pile of disposable batteries and seemed a real waste and thought there must be a better way.

Strangely I found I had saved a link to that battery charger from ages ago, on the basis it might come in useful sometime, which it has.

“Life’s too short to worry about batteries”

It certainly is, so I am going to use the Eneloop Lites in my remotes and the Ikea equivalent regulars in everything else, doing this on auto-pilot from now on. It is good to get a good decision in place.

Thanks for your help and advice.

LikeLike

Now for torches have you considered going 18650 lithium (for which you do need a suitable charger). I find single-mode WF501B with LED (not the xenon cheaper version) to be the dog’s bollocks, and Li batteries have a very slow discharge, so they are great for that specific use case. Just make sure you get the protected LiIon red ultrafire batteries, not the cheapo copies that look like they are printed up in a Chinese garage with a rubber stencil 😉

I also have one of these 8-way chargers which does NiMh and LiIon because it’s good to be able to use 12V for charging if on the road, which is one possible alternative. It plays fine with eneloops and 18650 ultrafires. 18650 batteries are also scavengeable from older laptop batteries and some power tools – charging them cell by sell lets you spot and take out duds

LikeLike

Those Lion batteries and replacement torches look like a whole other rabbit hole of investigation to go down. I did replace my torches with the old filament bulbs with LED ones a few years ago now, so couldn’t really justify another change any time soon, but thanks for the idea.

Interesting about the 18650 batteries is that they look like the would be used in battery packs of cordless drills, lawnmowers, etc. Having looked though, none of them look like you could swap out individual cells from their battery packs. I may have a proper ‘hands-on’ look next time I go to B&Q.

LikeLiked by 1 person

> torches look like a whole other rabbit hole of investigation to go down.

https://www.candlepowerforums.com/

just sayin’ 😉

> none of them look like you could swap out individual cells from their battery packs.

Those are usually tagged 18650s. I will confess to having soldered NiCD and NiMH batteries, but I don’t have the cojones to solder LiIon, though it seems it can be done. Do you feel lucky 😉

Going the other way, the cells you scavenge from tools, laptop batteries and defunct USB powerpack gizmos tend to be tagged, but a little attention with wirecutters and a dremel makes then into untagged cells OK.

A Chinese WF-501B shouldn’t upset the bank manager if you already have scavenged cells and you’re prepared to wait for the slow boat from China</a.

LikeLike

I don’t think anyone would term R modern programming 😉 With what I know of your background, did you consider doing it in Python? The data science libraries are good (though I don’t like the API of Pandas dataframe compared with R’s dplyr and have to Google it every time) and it works more like a normal programming language.

Nearly a decade ago I wrote a system to scrape my HL account and record the prices each day. Their UI showing total gains or daily gains is useless for making decisions as it doesn’t take into account the time in the market. I never finished it as the legalities of how I got the data were clear, so I could never open it up to father, others etc.

Have you thought of sticking your scripts on GitHub and open sourcing them? I don’t know of an open source investors dashboard which kinda sucks, you’d expect a bunch to be there.

Turning to energy, raising the price cap is going to be brutal for us. The dear previous owner of this house rewired by dropping cables down the cavities, including a 100A cable to the extension. Down on the south coast with some driving rain the cavity wall fill we need to use is expanded polystyrene beads. PVC plus EPS is apparently a no-no, so we still have draughty cavities. Unless we rewire. I’ve glued an unwanted UPVC door shut this winter to stop draughts and filled the gaps round a cowboy-installed double glazed window with expanding foam, which has noticeably warmed my office this winter. Just need to get them replaced along with a few more…

This winter I’ve been looking at whole home temperate and humidity monitoring. I’d like data to know which rooms hold their heat better and to keep an eye on the loft – and underfloor spaces as I start insulating them. I started looking at ESP32 or ESP8266 with a BME280 attached, but it sounds like the battery will last a few months at most with the wifi waking up every 10-15 minutes to transmit a reading (not that I need realtime atm, but I didn’t see a build that will log locally and transmit later in bulk). This led me to 433MHz where reputedly the batteries could last a couple of years (great for inaccessible ones, and fit & forget). But… the cost of Zigbee, https://openenergymonitor.org/ or https://lowpowerlab.com/ boards is at least £30-£40 per device, plus base station. I’d want 10+ to do some proper modelling and to put a couple in places where once the battery dies you can’t retrieve them. Progress stopped there as the costs moved from inconsequential to the wife needs to know. Have you worked with 433MHz systems or done this on your house? How would you approach it?

LikeLike

How about HopeRF ISM solutions (868MHz in the UK, although you can use 433, but ISTR it’s being deprecated) and pretty much whatever microcontroller of your choice? Way back when I did this for the farm I used the ciseco/Wireless Things version of 868MHz SRD which had an on-board Arduino, and they got the standby down using the TI RF chip to manage standby. But that was a few years ago, I’d imagine someone does an ESP32 with suchlike.

You don’t need to go LoRA (and note that LoRA != LoRAWAN unless you really want to go down the IoT path and carry the overhead of the protocol) but the basic modules seem cheap enough. I have a gizmo with one of these Heltek wotsits in it c/w OLED display. Word has it you MUST terminate or fit the LoRA antenna if you Tx else you trash the PA.

With temperature and humidity just fire out a packet every 15m with a CRC, and have your concentrator to listen. I used LLAP which is sort of like serial UDP but low-tech. Sure every so often you’ll lose data in collisions but it’s no big deal for that sort of thing. I’m not familiar enough with LORA to know if it does collision detection to eliminate corrupt data, had a couple of modules on the bench for a while but no obvious application, because I bought enough Ciseco modules in their closing down sale to probably see me out. I guess you’ll be using the old DHT22/ AM2032 workhorse for the sensor?

My system still works link

comes off a Raspberry Pi that listens on the RF network, uses Python to munge it and updates RRDTOOL. Red trace is the loft, OU is a shed in the garden AR 1 and AR2 don’t exist (they are two probes tracking compost when they are there) Most of these sensors run from a 2032 coin cell and run serial LLAP wake up fire out and then sleep. The Raspberry Pi is powered all the time. I get to change the coin cell every couple of years.

LikeLike

Thanks a lot ermine, that’s really helpful. My knowledge of electronics is sketchy (I can solder fine but as an undergrad I had a reputation for making anything malfunction in labs so went to software) and I didn’t know of HopeRF; that looks exactly what I need. As does your system, which is recording what I want. I’ve found the CC1101 tranceiver – are that and the SX1278 module you linked to equivalent?

Assuming this site is legit (the site changed hands in mid-2021 and is broken in multiple places) it ought to be possible to make each temperature/pressure sensor for under £15 which is far more doable. And if this board is compatible, even cheaper. DH22 is what I’m thinking of for the sensor.

I’ve read much love and lament for Ciseco while researching. It’s a shame no one stepped in and reproduced their range…

LikeLiked by 1 person

JemRF have pretty much replicated the ciseco/Wireless things devices and use the same TI SoC. If you can live with buying from Kentucky which may be OK for the quantity you want, run with it. I would have thought

this device would meet your requirements. Any reason you are looking at humidity everywhere? It’s usually a very slowly changing variable indoors, and the DHT22 isn’t that reliable long-term. Whereas thermistors are bulletproof. Having said that JemRF use some sort of Honeywell SHT analogue sensor, these are fine, I used a SHT11 ISTR in with some chickens in an incubator and that’s a pretty horrible environment for electronics, the sensor was fine.

You don’t need the Pi specific Rx, you can use a sensor board as a receiver, with the serial pass-through code flashed

Jeelabs is another source of ideas, on how to use hopeRF serial modules, but pretty much any serial module would work.

I’d avoid anything WiFi if low power consumption is your aim. Wifi is both power hungry in and of itself, because it is designed for a fast data rate, and the TCP/IP protocol overhead means you need more computing power than you would otherwise need, which also slugs your power drain. Bluetooth can be low power but pairing all the devices will drive you bonkers, I don’t think there is a broadcast mode on BT other than when pairing.

The low-tech SRD serial is perfect for this sort of temperature monitoring – I used these on the farm covering distances of 250m in the open, and the OU station in the shed on my current system is about 15m away and passes through an outside cavity wall and two inside stud walls OK at 868MHz. There’s a tendency to put everything on the damn internet these days if you need networking, but IMO iOT is a red herring. A simpler RF network (what they call a personal area networkw though I am sure Bluethooth got there first( with a concentrator allows you to usually mains-power the concentrator which means you can make it more secure if you must have it on the net, you can munge the data (my pi presents it as a web page, in the jem example I think they use PrivateEyePi which will interface with a smartphone if that’s your thing

LikeLike

Interest really, I thought It’d be fun to see the effect of cooking, drying laundry and get a feel for areas of the house that are damp (early warnings?). There’s also the idea of investigating voids – the research at http://www.sofiepelsmakers.com/suspended-timber-ground-floors.html is good to poke into but doesn’t seem to have progressed (discussions: http://www.greenbuildingforum.co.uk/newforum/comments.php?DiscussionID=16395 and http://www.greenbuildingforum.co.uk/newforum/comments.php?DiscussionID=16574&page=1). What sensors would be suitable for measuring RH over time?

Given the VAT and import duty I’ll have to pay when buying from JemRF, I’ll have a go at making one myself. Then when I see how much money I’ve wasted in my failed attempts I’ll give in and buy them 🙂 Jeelabs looks interesting.

LikeLiked by 1 person

Checking my notebook I used a Honeywell HIH5030. Gives a ratiometric output which is nice as yer microcontroller (eg PIC16F88 or arduino if that’s your thing) A/D is similarly ratiometric, so run them from the same power supply and they will drift together cancelling out.

Given your power and access issues you could go wired for your house system, and you could use a three-wire system (GND, signal and +12V locally regulated down) . Pull signal up at one end with a resistor and listen with a Pi, put your sensors via a PIC with the TTL RS232 through a diode. If you only send data every 10mins a burst at 9600k will very rarely collide and no harm done. Listen at the far end with a Raspberry Pi. If your house has telephone extension wiring then you could repurpose that since it won’t be any use in a couple of years, alternatively 4-core alarm cable is cheap, thin and widely available. It would save you a packet on mucking around with RF modules and solve your power and access problems. RF modules made sense on our farm where a station could be 250m from the concentrator but inside in a house where you look to be doing a lot of civil works it’s a lot of cost you don’t need.

Other people have used onewire sensors which is specified to run over house sort of distances, don’t be tempted to use I2C with is board level 😉 Onewire is a little bit old-skool nowadays but the popularity of the Dallas 18B20 temp sensor means it’s widely supported – Raspberry Pi and Arduino support it out of the box. The 18B20 sensor is cheap, you get chinese clones for very little, I used the stainless steel encapsulated ones for sensing compost heaps as they are waterproof, and a onewire network would sort you right. I personally favoured running one wire to one sensor with two sensors in a compost heap but you can parallel these up if you determine the addresses before you stick them in some inaccessible place, which might be easier in a whole house scenario. Though if you can use a three-wires, running power separately, you will save my debugging. There’s a lot of hurt in the passive two wire config, and alarm cable comes with four wires anyway. Don’t do parasitic onewire power operating to yourself unless you have a very specific reason to go that way. BTDT 😉

> the effect of cooking, drying laundry and get a feel for areas of the house that are damp (early warnings?)

Drying laundry inside the house eh, I look down my mustelid snout at that sort of student behaviour, well unless using a tumble dryer 😉 If your sensor is easily accessible then the DHT22 is fine, just change them out every couple of years if they fail. Structural moisture in wood people seem to sense using the resistance method used by the sort of thing you stick a couple of pins in by hand – just fixed like this. Resistance between a couple of screws would be easy enough to measure/digitise with a microcontroller.

LikeLike

> PVC plus EPS is apparently a no-no

Can you use conduit for that? I don’t think plastic conduit has the plasticisers that react to EPF in it. I use electrical conduit for making some antenna bits and can confirm it tends to break. Didn’t realise it is ABS, which means I can try ABS cement to waterproof it. But you’re still stuck with a rewiring job for those runs and what with Part P you aren’t meant to do that yourself 😦

> to put a couple in places where once the battery dies you can’t retrieve them.

I’d be tempted to run fine wire to a battery holder elsewhere. It’s only 3 to 5V and probably of a current you can have a 100mA fuse at the battery holder to eliminate fire hazard due to shorts

LikeLike

Conduit is a good way to do it and keep the cables in the wall, or replacement LSZH cable (derated in both cases). Getting to them is the next problem. To complicate matters further said previous owner fitted engineered wood floors throughout and the cables drop down the cavity and go somewhere under the floors. So to get cavity walls filled we need to rewire, which means lifting (and replacing) the engineered floors, which means taking off the skirting boards, which means I’ll keep paying higher energy bills to save all that unnecessary work.

When I was a homebuyer I was annoyed when homeowners didn’t have the certificates for work done; now I’m a homeowner Part P is less important 🙂 I’ve had registered electricians round to quote who didn’t know the regs. Finding good – and knowledgeable – tradespeople is a nightmare.

LikeLike

> Have you thought of sticking your scripts on GitHub and open sourcing them? I don’t know of an open source investors dashboard which kinda sucks, you’d expect a bunch to be there.

My code is disgusting spaghetti code, because I was learning R at the same time as trying to get useful information. However, you’d be much better off with the foundations I built it from

Portfolio Management with R library which does p/l from journals. I believe it would also allow you to inject dividend income into the series, though I do that in a separate process. It also allows you to unitise, which I need to learn by the time i do get to draw out of the ISA. I got a couple of years to get my head round that.

The database of instruments relevant to me is maintained using code shamelessly swiped from The R trader

I then create a vector of the latest instrument prices as marked to market from those files and inject that into the vprice variable of PMwR’s PL function.

The spaghetti code to slam all this together is entirely my fault and I’d hate anybody to try and use it, but most fo the heavy lifting is done in PmWR and tidyquant libraries 😉

LikeLike

Awesome set of libraries you found there! That’s my next side project set up. Once I’ve finished the current one, and the 5 half-finished ones, and binned the 25 slightly-started ones 😀

I should prioritise moving from HL above all else, but picking a new SIPP/S&S ISA provider is so much less fun than – well anything really.

LikeLike

> Once I’ve finished the current one, and the 5 half-finished ones, and binned the 25 slightly-started ones

Haha, know the problem only too well 🙂

Unitizing your portfoliois always a headache. I spent far too much time overthinking this in the early days when my amount was paltry. But every time I try and think about it it does my nut in, I can hold the concept long enough to do it in code but if PmWR does it for me then so much the better. I took a simpler approach – never draw out from the ISA, in which case the computation is as simple as add up money in and look down the bottom of the marked to market value. Though you have to run a series computation of the amounts contributed along the years to derive the effective annual rate of return. PmWR have thought about this – looking at Enrico Schumann on SSRN I got the feeling he’s cracked this so I don’t have to 😉 The backtesting paper was an intriguing rathole.

One thing I did learn from mucking around with this is that financial outcomes are very fiercely dependent on the initial conditions. That is otherwise known as market timing. In the early days I focused on valuations, trying to favour beaten down segments. There is always the hazard of value traps with that, but I haven’t seen any evidence to change the viewpoint, my largest successes were bought at advantageous valuations…

LikeLike

What a lovely rambling read. Felt a bit like leaving the cafe with you after stuffing ourselves with goat’s cheese and listening to you hold forth while watching the view, and reminiscing about when I was half of the young couple down from London.

Just on the demo HYP front, it’s true I did discontinue it. I actually downloaded all the data but never wrote the post.

Partly it was indeed because of the increasing passive focus of our site; it just sat a bit oddly with the other messages.

Partly it was because, related, I was increasingly thinking 99% of investors would be better off getting a batch of UK equity income trusts to do the deed, for lower risk at perhaps a bit higher cost. This led to the heyday of our contributor Greybeard’s articles; sadly impossible to pin him down nowadays, he seems to have slipped into the balmy slow waters of FIRE, too… 😉

But finally, the reason I discontinued it was because it was tracking real-money portfolios (because truly tracking a basket of individual dividend-paying shares is more hassle than one would imagine) and I decided to sell almost everything I had outside of shelters (and one humungous holding pregnant with capital gains) to put into my flat deposit when I bought.

Must admit I DO NOT miss filing gazillions of individual dividends for HMRC each year. Yay ISAs! But I do sometimes wish I could have pushed on with the demo HYP. There’s some good discussion on the LemonFool forum from some old hands of the ancient demos from The Motley Fool (20 years old I think) if you want more. 🙂

Thanks for the links and hat-tips.

LikeLiked by 1 person

Glad you liked the story,thanks for the link! It seemed a time to tip the hat as most of the strategy was informed from Monevator twelve years back. Fortune smiled on me in offering a long bull run, of course, and the HYP worked dandy. Greybeard took some incoming for the a non-boglehead approach, but I wouldn’t have liked to be someone having sell VWRL for income regularly in mid 2020. I thought that time of drawdown would come for me much earlier than it will. Greybeards 2019 table helped me widen my base a bit in 2020, too.

LikeLike

I too owe a debt of gratitude to the Greybeard for his articles on pensions and ITs in particular. Before reading these I’d only ever bought one IT (3i) but now I have a great collection covering all bases from SMT to Ruffer. It’s a pity Greybeard can’t be enticed out of retirement for an update on the plan for us old guys still following his lead. I read John Barons book on ITs and also Jonathan Davies IT Handbook (which I downloaded for free from the publisher) to keep me informed of developments.

On a separate point, have you considered an induction hob instead of upgrading to gas? I’d say it is quicker to heat up than gas, but you might have to upgrade your pans as induction only works on those you can stick a magnet on the base.

LikeLiked by 1 person

> induction hob instead of upgrading to gas?

Certainly if we were redoing the kitchen I would favour going induction. A friend of ours installed one in his kithcen rebuild and we were instantly envious. The kitchen here is currently as inherited from the previous owners, and the electric cooker is old, though the fan oven is perfectly serviceable. However, the cooker has needed patching of the supports for the grill element and suchlike because it is old. If it is the first thing to fail then if it is replaced on its own I would favour a freestanding gas cooker. If it’s time to replace the whole kitchen then induction would win out. We don’t need to change pans because Mrs Ermine had a purge on aluminium a while back.

I quite fancy a standalone little induction plate for the camper van – I usually take electric hookup for heating if it’s that part of the year and using EHU for cooking would save the cost of gas, and those plates are both cheap and compact.

I totally agree, induction hobs are what electric cooking is meant to be 😉 I am sort of assuming that they would be more efficient because they deliver the power much closer to where it’s wanted.

LikeLike

You can get freestanding induction cookers too (Zanussi ZCI69060XE – Which? Best Buy, for example).

A good idea to have a portable induction hob for the van as it avoids the risk of CO in confined spaces.