Mrs Ermine and I recently celebrated a year of lockdown with a bottle of wine. A strange year, but there’s something to celebrate, which is that we are still here. I will drink to that.

This is one that a lot of the the rich world got wrong, ballsed up in spades, with the UK in the top ten with a death rate of 1 in 530. There aren’t any really big-picture commonalities that can be drawn, though the intelligencer’s high-level takeaway isn’t bad. We have become soft in the West from having it easy for a long time, so we didn’t really believe shit was happening to us. That’s bad when you are up against an exponential.

We have continued to just think that something bad isn’t happening to us, and that there’s an out somewhere — that, of course we’re going to solve this next month. It’s always been one month away. And as long as the solution is always one month away, the urgency isn’t there. And I do believe that this is a symptom of a bunch of nations and societies that really haven’t had to deal with adversity on our shores in a really long time. We are uncomfortable with making the hard decisions that have to be made.

Europe including the UK, the US, and for some reason South America made a pig’s ear of responding to Covid. You have to scroll down a long way down to South Africa to get out of Europe and America on the JHU table ranked in deaths/100k.

Yes, we have a route out in the vaccination programme, a win for science. It’s also a win for the one thing that Boris’s crew did get right – dropping a lot of money, and in not trusting Trump/Merck in the Oxford vaccine production.

Anyway, we are still here, and we cleaned most of the green slime off the camper van in the hope of being able to use it sometime next month. Even if only to go and eat lobster – except that it seems to be closed season so we will have to make do with fish and chips by the beach.

The NT opened only a third of the car park, so while we got there early the car park was already rammed. I asked them if they were going to open the other two, but apparently not. Helpfully they said it would be open for Easter, it was to do with the grass being ready. I had assumed they were doing it to limit numbers on the beach. Anyway, this is the south coast. There are beaches enough, indeed the next one westwards had a council car park where you could park all day for £2 as opposed to £6 for a day. The view was still superb, the fish and chips tasted better after so long and people were spread out.

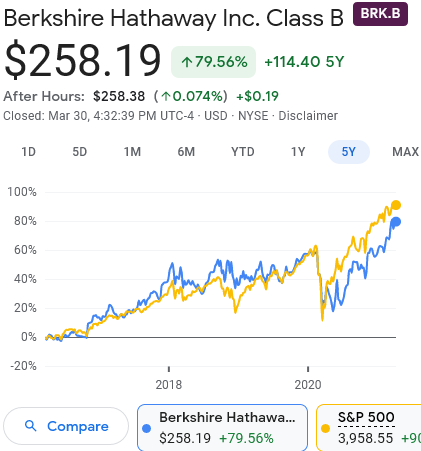

Stock market gives Covid the middle finger

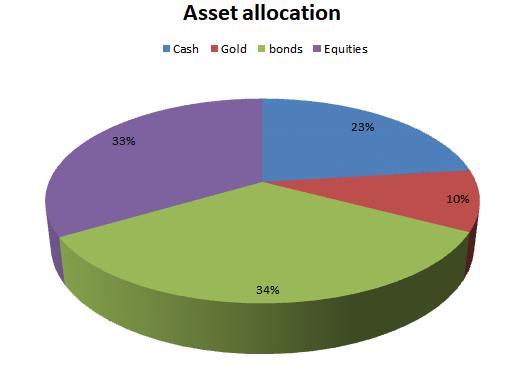

The Ermine sticks a snout at my ISAs, and it appeared they have still been creeping up. Didn’t really look like what I expected this time last year. It is now much more defensively biased and there is a fair amount of gold, on which I have taken a soaking in £ values. But the other stuff seems to have outstripped the loss of lustre. The change in the gold price leans away from the obvious possibility that our great British Pounds have become rather less Great, they are relatively spiffing of late. Maybe World + Dog thinks Brexit is the greatest thing to happen since sliced bread? Or they think Covid is on the run? Goldwyn had it to a T Nobody knows anything. I don’t think it’ll be over by Christmas, but I’m a nobody…

I can’t say that’s what I expected, but given I have a rammed Premium Bonds allocation and NS&I ILSCs and next year’s ISA contribution in cash I have far too much GBP exposure, so being wrong in that way is not a hardship. I’d rather be wrong than poor. I still worry what is coming our way though, and with the markets up in the sky what the hell do you buy to diversify that? Gold is one place. There have been other oddities. What’s up with BlackRock world mining? Have we all decided to start digging shit up from the ground then?

Years ago, there was a quote from a City wallah to the effect of I’ve no ‘king idea what we’re doing up here mate. No, me neither, bud. In fact, generally the only rational response is to stand there with your gob open and go WTAF?

I am getting older, and perhaps not allowing for that.

I recently had to do one of those finametrica attitude to risk things, as a CYA exercise I guess. Less extreme results this time than last time. Perhaps that is as things should be, after all, a tenth of my three-score years and ten has rolled by since the original result. The ISA is now much higher than it was, buoyed by a rising stock market and swelled by the transfer of my old AVC/SIPP during my lean years of earning very little. To a first approximation I have achieved my financial goals, and I am reminded of Warren Buffett’s observation of the likely lads of Long Term Capital Management. “Too much cock, boys”

to make money they didn’t have and didn’t need, they risked what they did have and did need. That is foolish. That is just plain foolish. It doesn’t make any difference what your IQ is. If you risk something that is important to you for something that is unimportant to you it just does not make any sense.

The Belle Curve has it put in a different way

My job as a wealth manager is to help clients hold on to their wealth and to preserve and grow it to keep pace with inflation. My number one priority is to ensure that money is there to meet their goals, when they are ready to spend it.

I don’t need to hit it out of the park. Just as well at current valuations, eh? Perhaps I have more in common with Warren’s last outing. He sounded pretty much out of ideas. I am not the desperate Ermine of 2009, needing to chart a route out of work as soon as possible. I need to look closer at preservation, and that is a different mindset.

Preservation is about asset class diversification. You give up return for security

The trouble with FI/RE is your younger self sets a course at the start of the journey. You have time on your side to ride the markets, and you need win, because over a working life you’d rather the mythical magic of compound interest double your savings in real terms over 40 years, and it builds a certain mindset. If you happened to be a feckless Ermine who started all this stuff far too late in life then you need a lot more punch, and the win that feckless blighter had was starting in the hole of the GFC, which coincidentally was also what made my job a bit shit hence the breakout requirement.

Trouble is, your younger self sets the direction, and what was right in the morning in the afternoon becomes a lie, not just in the psychological sense. I was playing that hungry younger self, this time last year, looking for opportunities in the noise and hum. I took them, more actively than most, and shorting the market in March/April to boot, and I have been fortunate, the numbers are decently bigger now than the end of December 2019. Obviously I am chuffed that it worked, but there’s a bigger Warren Buffett-style question I should be asking myself

“Self, what are you doing on the bleeding edge of the coalface shorting, when you are grizzled of fur? OK, so you have win, but you have to ask yourself whether you should have been on the playing field at all?”

Let’s hear it again from The Belle Curve. Now obviously I don’t employ a wealth management firm, so I am not sure I classify as being able to stay rich, I have never worked in finance or the upper echelons of IT, but I am reasonably well off, and I am with Joseph Heller. But Blair has some words of wisdom. She doesn’t help people climb the mountain. What she does is help them stay near the peak, and that appears to be a very different ballgame.

Few things compare to the high of making millions off a concentrated bet; whether that bet is on a single stock, building a business, or working for a successful start-up. I imagine the brain responds to this high in the same way it does to addiction. The temptation to chase the next high is all-encompassing. I talk to investors all the time who can’t stop chasing that high.

Hmm. Am I that guy? I recall reading TA’s Do Not Sell post into the teeth of the March selloff last year and thinking to myself “F*ck that for a game of tin soldiers, there’s win to be had”. Not only did I sell a load of crap, I shorted some of it, along with some of what I retained which was taking on water. Sure, I made errors along the way, like selling BRWM, only to rebuy it, fortunately still bent somewhat out of shape. But in the round it paid off handsomely, as I cleared a couple of numerical thresholds which are more a product of having ten fingers than actual significance, but nevertheless good for the fur.

I have now well over twice as much in my ISA as the capital assets I left work with1. Inflation makes that less riveting than it sounds, but it’s still worth having. I saved a capital amount starting three years before I stopped working that is over half the capital amount backing 23 years of DB pension savings. You aren’t meant so save for retirement that way, but all’s well that ends well etc. However, it’s got to stay well, and here perhaps I have something to learn.

I have to look in the mirror and wonder if this grizzled mustelid is doing the walk of shame as far as Warren’s LTCM comment. I didn’t need that boost last year. Maybe I should have listened to TA, much as it went against the grain. Self, be like Joe Heller, not the hedge fund manager in Kurt Vonnegut’s poem. I’d imagine by now it’s worked well enough for TA, if you did nothing than you are probably better off than before Covid in a balanced equity portfolio. Update: TA is 20% up on the deal. Chapeau that man. I am up a fair bit more, but I sweated buckets for it and in retrospect took a shitload of risk for it. Shorting anything always comes with a ‘here be dragons’ warning. TA just wiped his brow, went away with all this noise and hum and sat on his backside watching Netflix.

Sadly I know some ex colleagues who are well pissed off with the markets, I put my foot in it with one of them because I figured pretty much everyone with market exposure has come out well of the last year. Not necessarily. If you did something in the crossfire, it depends what, and how long you took to get back on the horse after you fell off if that happened.

I was balls-deep in equities before March last year. Some of that is because I have a DB pension, which is a very bond-like asset, and it is enough that if I scale the annual income by 16 to roughly get the capital value behind it, I will never tip the balance to the classic 60/40% equity:bond ratio because I didn’t save up enough in my working life.

However, if it leads to intemperate behaviour, then maybe I need less of that. I now have a large slug of gold, and because the shorting happened outside the ISA I have a fair amount of cash. I have as much premium bonds as I can have, still the old NS&I ILSCs and some random savings accounts earning sod all.

Much of that is because I took some money off the table selling rubbish and moved it into gold, and my cash was lifted by short-selling some of the ISA which indirectly moves money out of the ISA. Since then the markets have lifted the ISA in the same way as for TA , turning it into a sort of double win. TA will probably leave me in the dust over the Roaring Twenties with buy and hold. The Big One is gonna come, and TA is a young fellow, he can probably ride the suckout and hold on for the uplift. Me, not so much. Roaring Twenties be damned, as the Germans say

Gott läßt sich keinen Baum in den Himmel wachsen

the Lord sees to it that the trees do not grow into the sky.

I am closer to the Permanent Portfolio than I was before last year. All in all it was interesting reading the purity of purpose in my seven-year younger self – investing is all about return, about getting ahead. It was then, for me.

I could be more aggressive with the security of the DB pension floor to my income, but I am still a relatively young retiree and the value in my ISA holdings is in defending me against longer term hazards like inflation, so I should perhaps be more respectful of its value to me, and take less risk. It’s instructive to look back nearly 10 years at my younger self when I wrote about the PP last

Back then, I was in the final straight to retire. Fixed interest is the rescaled annual amount of my DB pension at 60 after tax (because I don’t giveashit about what I don’t see, it isn’t useful value to me). It was over half my networth. It has more or less stayed the same in real terms, but I have forced that beggar back to 30% of my asset allocation. Which is OK for a deadbeat who is considered ‘economically inactive’ by Her Majesty’s government. Yes I have earned lousy amounts here and there, but never amounting to more than 10% of my erstwhile salary, and most years less. The magenta part of the Pac-Man swelled, not only to match the cyan pie, but also to fund my life over nine years, spaff more on a house and fund the other 33% in gold and cash. At current valuations, it’s not inconceivable that it falls to half, but the problem is in calling when 😉

It is easier to derisk after having taken a win from one last Covid crash hurrah than if it had all gone titsup. While I am less exposed to the markets now, all that cash exposes me to inflation and currency risk. An obvious move would be to take half of it and buy gold over a period. I would still have less than Harry in cash and gold, but the balance would be better. Harry Browne was a 1970s USA guy. I am also not in the USA, and 50 years have rolled by. The West is not cock of the rock and insulated from China and Russia, it was still in the ascendant in his time (the UK was further along the Imperial downslide than the US is now).

There’s some hazard in having gold as the only non-fiat currency store of value – surely there are others, but I can’t think of any that I trust. I did give a short consideration to Monevator’s ‘should you own bitcoin in your portfolio‘ and thought – intellectually the answer is probably yes, but bollocks to all that. I should probably own a BTL or two but, well, bollocks to all that as well. I’d rather do bitcoin than go there.

the Vanguard Borg

I should take a leaf from AlCam’s book and switch out of Charles Stanley to Vanguard’s ISA for my standby ISA account. I shouldn’t increase iWeb any more – they are attractive because there are zero fees if you don’t hold OEICs and you don’t trade, which suits my general activity pattern well. CS charges 0.35% as a platform fee, which begins to irk me as the account increases in size. Vanguard charges 0.15%. There’s nothing racy in there. I hold a L&G world exUK fund in there and a L&G FTSE250 ex ITs fund. I favoured L&G over Vanguard to diversify away from Vanguard – I have a lot of VWRL and had way too much VUKE. I can accept the risk of Vanguard going titsup now because the great lump of VUKE is gone. Vanguard offer a serviceable replacement for the L&G Dev World exUK fund and a FTSE250 fund albeit without the ex-investment trusts tilt.

Main and standby is good enough ISA protection for me. Finimus has the go-to post on why you can’t rely on platforms client-money segregation rules. In engineering having 1+1 redundancy is usually the main win. You can do more to spread the risk, but complexity gets out of hand and you end up with a maintenance liability.

Your broker going down is a tail risk, very unlikely but the results could be devastating. From a gut feel Vanguard going down is less likely to me than CS going down. I will make sure in future that I don’t buy more Vanguard ETFs in iWeb, though I won’t liquidate VWRL. I am sure somebody else does an ETF like VWRL, though the substitute is not obvious on Monevator’s list. I don’t want a fund because iWeb charge platform fees on funds. Scratch that – having just checked to see if I can substantiate this, which was true when I opened my account, I can’t back it up from iWeb’s charges list. In which case the obvious course of action in iWeb is to go buy Ishares HSBC FTSE All-World Index C GB00BMJJJF91 and be done with it. Vanguard slightly frightens me – so many people believe in it and it is huge. The win for a bad actor taking it down is enormous.

Vanguard are a better and cheaper bet that Charles Stanley, with similar advantages of the flexible ISA offering and regular investing. So rather than putting cash into CS next month, I will open with Vanguard. I can defray part of the market risk by selling the L&G funds in CS and buying the equivalent ETFs in Vanguard on the same day. There’s a lot more than one year’s ISA contribution in CS but at least that takes out some of the risk. I can then do an ISA cash transfer at my leisure.

Covid makes spending and working very different

It’s reduced my spending overall. There was a flurry of spending at the beginning, to hedge some of the worst eventualities which didn’t come to pass. They also hedge Brexit to some extent, which is very clearly making the price of some things rise – oddly electronic gizmos from Amazon seem to have risen, and food is rising. We bought a lot of wine, but still have most of it in stock 😉 But overall outgoings are very clearly down.

Monevator has occasionally given me stick about a rabidly anti-work stance, basically the whole point of getting to FI was to get the monkey of The Man off my goddamned back. Work is overvalued in our society. It’s way overrated as a source of meaning in life, to be honest if you’re going to look for meaning from a belief in God or a meaning in work, I’d take the former any day. At least it gives you hope in adversity2. Whereas a belief in the meaning of the grind of the 9 to 5 is empty IMO – a form of terror management theory writ large. Even a Grand Fromage is typically forgotten about two weeks after they take the nameplate off the door.

The Protestant Work Ethic is a mashup of meaning and money. Niall Ferguson made a cogent case that it was what until recently made the West cock of the rock economically3. Not absolutely sure how you make sense of the more recent decline and the rise of the East, I am a little bit more with Oswald Spengler there, that there is a cyclical nature to empires. Let’s hope it’s not Jared Diamond and catabolic collapse eh? The problems Obama called out eight years ago don’t seem to have got any better. MAGA doesn’t seem to have improved the State of the Union that much.

We once had a positive view of a world with less work

In the twisted wreckage after the Great Depression, Keynes dreamed of a better way – Economic Possibilities for our Grandchildren

I feel sure that with a little more experience we shall use the new-found bounty of nature quite differently from the way in which the rich use it today, and will map out for ourselves a plan of life quite otherwise than theirs. For many ages to come the old Adam will be so strong in us that everybody will need to do some work if he is to be contented. We shall do more things for ourselves than is usual with the rich today, only too glad to have small duties and tasks and routines. But beyond this, we shall endeavour to spread the bread thin on the butter-to make what work there is still to be done to be as widely shared as possible. Three-hour shifts or a fifteen-hour week may put off the problem for a great while. For three hours a day is quite enough to satisfy the old Adam in most of us!

The old boy did well in the what will happen. Compared to the 1930s his narrative of economic and material plenty has largely come true. But he achieved an epic fail in the why of work. It’s hard to know where we lost the plot, but if the peak human breeding age is about 30-35, then there’s no escaping that fact that those grandchildren have definitely come of age and entered the workforce, and they stick their head up above the parapet and go WTF? Where are my fifteen hour weeks, then?

One can argue that for a narrow section of the workforce, that has arrived, paradoxically amplified by the coronavirus pandemic. There be many workers who change the state of information. They don’t turn metal on a lathe or unload ships or build stuff. If what you do falls into that category, then working from home wins. I would say that if you’re doing that for an employer and you find it successful, then watch your back. If you can do it at home, then it’s susceptible to geographic arbitrage, and it can probably be done in a country with a much cheaper cost of living, to your detriment. Be careful what you wish for, and all that. I expect to see a big hollowing out of lower-end white collar jobs in the years to come. Pandemics accelerate change, because they squeeze the focus onto the essential to the detriment of the cosmetic. We didn’t hear so much about the Kardashians last year 😉 McKinsey say this is also acting on businesses, again amplifying the difference between the best and the rest.

Keynes was right about work in one way IMO

I gave thirty years and arguably the best years of my life to the god of Work. Unlike many others, I didn’t have a great attachment to it.

I never had a problem with keeping myself occupied since giving it up, but one thing I have missed in the pandemic is creative activity with others. I would do this in the area associated with recreation before, but in one of the clubs we decided to cease operations until a secure way of meeting is possible and it’s not, at the moment.

I am an introvert, I see in others quite serious distress at relative isolation, because the community of people I know are generally fortunate enough to be able to work remotely. Which may have its ups, but it seems to also have its downs. True home/remote workers probably compensated for the remoteness in the leisure or other non-work areas of life, like I did, though as a retiree you have more time to do that.

I recently physically built an instance of the design I made to qualify it worked, with somebody else. Physically assembling it was basically technician work for both of us, but there was an element of the case for working with your hands in it. We didn’t even really have the right tools4, so needed to improvise with a bench vice and a bunch of cardboard boxes, but there was something satisfying in assembling this component, making the connectors, and sparking it up and having all components report back as present and correct. I had been spending too much time in the virtual world spinning the parts on a screen to make them fit and optimise things at home, and it was good to do something real with real stuff and real people for a change. It was a good win for half a day.

There’s probably more of this work than I want to spend time on it, so I needed to think and prioritise, chase the higher value-add. Keynes was right. One day a week to one and a half is about right – although the pattern is different. Some of this work is CAD, and I am on the maker side of the maker/manager divide.5 It doesn’t fall neatly into days, or even half days, Sometimes I have to have at it, then take a walk. Strange things happen in the downtime, and things which were intractable before become obvious after.

You’d get sacked in a heartbeat doing that in a company. Where the hell is that Ermine? What do we pay him for if he’s not there? However, as a maker, the productivity of the time in such an unscheduled way goes way up.

On the other hand, working one day a week doesn’t earn enough to build a life – I’d be in the precariat renting a single room if I had 30 years of that behind me. I can do that now because I don’t need the money, other than to feel valued and to buy commitment 6. I can work Keynes’ pattern, but in an economy designed for a 24/7 requirement. Because: FI. There’s no other way for most people.

I am also doing a recreational creative project with somebody else. This is an entirely virtual operation. It was a chance to get my head round how to use Git, bitbucket and Cloudcannon to redevelop a website while making the technology usable to somebody who has had no background in software engineering. There will never be a revenue stream from this, but it is developing something bouncing ideas off other people, and that is something valuable, even to somebody identified as a lone wolf on leaving primary school. I am introvert, but not an island.

I am also privileged I can avail myself of these incidental upsides precisely because I don’t need to make them pay my costs of living. In What’s Wrong with the Way we Work. the New Yorker indicates that the cult of finding meaning at work started in the 1970s

“management must develop a better understanding of the more elusive, less tangible factors that add up to ‘job satisfaction.’ ”

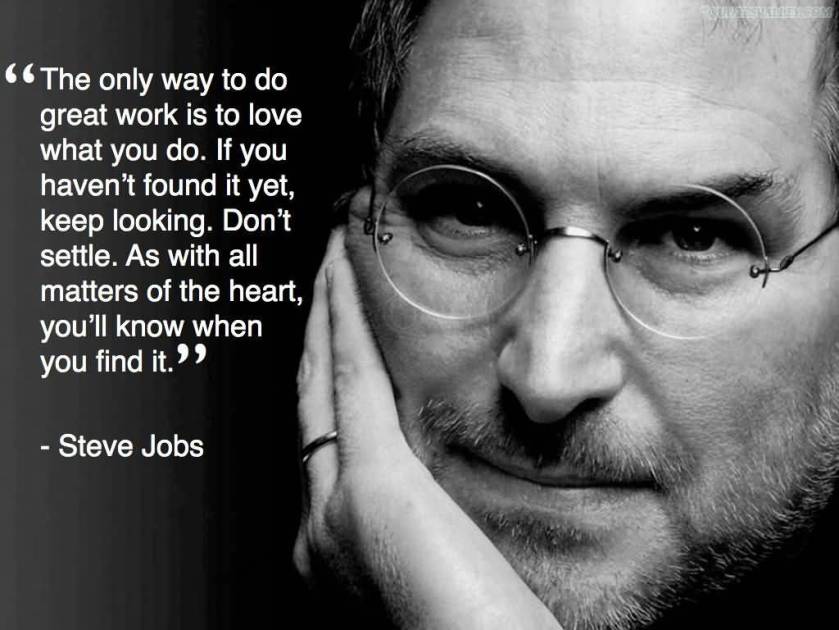

Hmm, respect, enough pay to live well on, and not too much time lost to it seems a good place to start, eh? How did we let twats like Steve Jobs tell us rubbish like this

You’re not going to believe Usain Bolt telling you it’s easy to win the 100m Olympics, so why believe the DWYL-LWYD lie from Steve Jobs? No doubt it worked for him, but you shouldn’t infer the general from the particular. Not without at least some statistical analysis.

Work can offer you some of that peripheral claptrap, but only after it gets to pay your rent and put food on your and your family’s plate. The trends weren’t heading in the right direction before the pandemic, never mind after it.

Keynes was cheerful sort. Current visionaries, not so much.

Work is the fundamental problem. We have designed systems where you need to work to satisfy Maslow’s hierarchy of needs

In theory we have a welfare state that addresses the bottom of the pyramid, but you have to ask yourself why if you go around the streets of London or Oxford or many other towns and cites you see people who have clearly fallen between the cracks. There’s no law saying this has to be so – Asimov’s Solarians and Keynes’s grandchildren were imagined in worlds where you didn’t have to work to meet these bottom needs. But it was why the twenty-something Ermine signed up for working five days a week – to be able to get out from under my parents’ roof and get food on my plate. I could have occupied myself better elsewhere, there’s plenty enough to interest a curious mustelid. However, not being able to make the rent concentrates the mind.

Steve Jobs was telling us all to get into the green and blue bits up top, all the other stuff will take care of itself.But he had the self-same blind spot that many people who don’t have to fuss with the lower parts of the pyramid have. He spent his time up in the world of ideas, and that’s where a lot of the successful folk in our economy end up. The people who have the money are focused on the top end, and just like Al Capone, if you want some, then go where the money is. Hence all the poncey services to help the ultra-rich feel great about themselves, with their yachts and stuff. But that goes a long way down the line. Why is Facebook minting it? Ask yourself – does any human being really need Facebook’s services, in the way you need water, or shelter? I don’t use Facebook in any big way, indeed I don’t use social media in a big way – it was fun to learn about but after a while I came to the conclusion life was better without that stuff 😉

I’ve survived so far, in a way that I wouldn’t without water, or trying to use a cardboard box as shelter rather than a house. Facebook addresses the upper two tiers of the pyramid. Go where the money is. If you want to make money, compete at the top, and if your business has the capacity and smarts, then you see this as being all there is. That fellow made a cogent case for it, though he lost the plot at the end

Consumers in the Purpose Economy have too many options in every marketplace and want you to give them a reason to buy your product. Simply, they want you to help them find meaning in their lives. We are entering a world where meaning is the most valuable currency. What a time to be alive.

Same category error as Steve Jobs, mate. Meaning isn’t the most valuable currency for everyone. If you see people sleeping in boxes and cars, they couldn’t giveashit about meaning, because they’re down at the red end of Maslow’s pyramid.

In this article by Bloomberg about trends, two out of the three trends are putting more people down at the red end. Talented folk ask why does Joe Public love sweatshops?

I used to fulminate at the radio in the 1970s that that sonoabitch Arthur Scargill was governing the country, with his damn flying pickets stopping other people working and turning my lights off. Which he did, and I am still of the opinion that that sort of thing needed to be crushed. I have absolutely no problem with people withdrawing their labour, but getting in the face of other people working in industries that used the product (power generation) and threatening them with GBH to stop working isn’t good. Nor is dropping concrete blocks on taxi drivers when you’re trying to reduce strikebreaking. And yes, for the record, the violence wasn’t only on the miners’ side, though it did seem like they had the lion’s share.

It always puzzled the young Ermine why there was such resistance to closing pits when the selfsame Scargill went on the radio to talk about how bloody dangerous the job was. He was right. Britain industrialised earliest and this was powered by coal, but it’s hard to disagree that the history of mining disasters in the UK is horrific. Wikipedia has 60 UK coal mining disasters listed. Coal mining fits the sweatshop moniker to a T.

All these white collar folks go tsk tsk, work is the route out of poverty, education, training, yada, yada. Really? You and I with our soft uncallused hand can say it’s easy, but it isn’t, and the rising water’s coming for us now anyway. There’s an argument my job went bad because of globalisation, though a humdinger of a financial crash didn’t help any. What do the good folk at Bloomberg have to say?

The unskilled worker is the next pandemic.

Let me just step back. First of all, I think that it’s pretty clear if you have high degrees of unemployment, there are basic economic impacts that are not good for the nation. It puts an incredible strain on the economy. It usually only gets addressed through higher taxes on a smaller and smaller tax base. It increases the gaps between the haves and have-nots, which historically has caused more social unrest if it goes on for a period of time. We saw high levels of unemployment like in the Depression create hopelessness and despair in individuals, in families, and their communities.

I think [unemployment] happens as quickly as automation displaces people from work without concurrently retraining them and retooling them for other types of work.

Ah, that old error again. concurrently retraining them and retooling them for other types of work. That’s OK if the other work is at a similar level and hopefully needs at least some of the same skills. I’m sure there are some ex-miners that went into high finance, but if you drive through the Welsh valleys 35 years after Thatcher won that fight and Scargill lost, there are still pockets where regeneration didn’t happen. Hope went to die and got buried.

When I was a child playing on the bombsites and slum clearances where they eventually built Goldsmith’s College halls of residence I had to watch out, there were builders all over the place who would give kids hell. 40 years on and at the end of my working life and the canteen at the Athlete’s village of 3000 flats of the London Olympics only needed a maximum capacity of 200 for a much larger build. The market for unskilled7 work has been falling for decades.

Less risk. More spending

is what I want to do with my post-covid world, if and when I get there. I can’t really do much about the more spending at the moment, but I can change the risk. Changing a mindset isn’t easy, however, but if and when the next crash comes along, I need to think to self

What would Warren do?

and this last time, to be honest, Warren sat in an empty exhibition hall looking scared, telling us all that in the long run it’ll come good, while thinking to himself ‘but I don’t have a long run!’

I’m not writing the old boy off yet. WB is better at this game than I. But I don’t want to try play the next curveball.

I’ve had a lot of luck in the stock market. Singlehandedly it stamped on the absolutely dreadful luck I had in the housing market, and then some. Whenever I listen to people talk about property is my pension or even smart folks over the Pond talking thusly

Real estate is actually my favorite asset class to build wealth because it is easy to understand, is tangible, provides utility, and has a solid income stream.

and an Ermine thinks to himself WTAF? Property was the greatest source of hurt in my entire personal finance life, and it grabbed me by the nuts at an early age and wouldn’t bloody well let go until 20 years later. I’d rather gnaw a leg off than rely on that. I don’t consider property as an asset at all. When we moved down here we went for a detached house, because I don’t want to hear the neighbours’ grandchildren squealing or Coronation Street on t’telly as they get mutton jeff. Mrs Ermine wanted more garden. I want to hear my own stuff, and if Mrs Ermine is away, then I want to play music at 1am without feeling bad about its impact on other people’s beauty sleep. So I spent more, but I considered the extra as frivolous lifestyle inflation, not an investment in property.

Whereas everybody else leans in, rubs their hands together and thinks ‘money tree’ when they spend money on bricks and mortar.

But I should also listen to the whispers in the wind. I have heard a few times now from people of a certain age that they got slaughtered in the stock market last year and are very pissed off. The advantage the younger Ermine had against being hammered by property was youth, in particular the ability to keep working. These greybeards don’t have that advantage.

There’s a lesson in here. Safety first for a grizzled pelage, though where you get safety in the current financial arena frothed up by money created out of nothing is a difficult question. It is why I have shifted it in the direction of gold, and RICA, RCP and VWRL, and I may sell out of some of the individual shares from the old HYP. It looks more like a greybeard’s asset allocation – and indeed the eponymous writer on Monevator took a lot of shit from young pups who said “investment trusts – pah – just buy a single world tracker and be done with it”.

They don’t know his hopes and fears, which is right, you shouldn’t put an old head on young shoulders. Conversely, you should take the young head off the old shoulders when you are grizzled of fur the return of capital matters more than the return on capital. Most people end up dialling down risk when the markets are in a hole and they have just lost their shirts. Spinning the dial towards risk-off when the markets are up in the sky is not a terrible time to do it…unless you need the return, of course.

TA will probably lean back in his chair bingewatching Netflix and double his money in the next year as the coiled spring doctrine of the UK economy does its stuff. I probably won’t be swinging for that ball, other than what’s already in equities. That’s OK. I don’t need it.

Now if Monevator posts another dark transmission like this one, from deep in the trenches of The Big One, then I don’t know. An old sailor still hears the call of the sea. Perhaps I should dabble in my residual SIPP with a few grand, after all, there are big wins to be had in the teeth of a storm, and it’s ringfenced from my main investments.

- financial assets ignoring property, though that has been inflated a bit too. I don’t care what Monevator says, property is not an financial asset in my world, though I can see the argument for an income stream as it stops you paying rent. Do I contradict myself? Very well, then I contradict myself, (I am large, I contain multitudes) ↩

- I’m not taking a position here ;) ↩

- there’s a school of thought that accumulated assets from Imperial plundering may also have had something to do with being king of the castle, though our Niall would probably say the the PWE made all this imperialism a lot more effective and directed. ↩

- fitting 250 screws by hand without a power screwdriver or even a Yankee screwdriver, or even damn it – a ratchet one gets old very quickly… ↩

- Farnam Street has a more accessible translation of that article for people who aren’t makers, particularly those who are managers and unaware of the divide. ↩

- Succinctly summarised by Monevator as “including, I say again, the feeling that getting some cash for doing something generates in a capitalist society, like it or not.” I may have outrun the getting meaning from work in a spiritual sense side of things, but the fellow has some point. I am just not going to work minimum wage, because I am a peacock like that. I pitched for a pay rise, not because I need the money or can spend it, but to feel valued enough to put in the time. How absolutely barking mad is that? Walt Whitman again. ↩

- By no means all building work is unskilled, but particularly historically, a lot of it was more brawn than brains. I didn’t see any hod carriers on the Olympics site, but it seems the job still exists. They were the guys my primary school self had to watch for, because they were often up on the scaffolding with the time to look for miscreants on the way back. ↩

A great read, worth the wait. Thanks! Plenty of food for thought as always.

LikeLike

Woh – there is an awful lot to digest in this post! Welcome back!

Just to be clear – I have never actually used the Vanguard ISA flexibly.

A couple of quick Q’s:

a) what about HSBC FTSE All World Class C

b) what did you mean by PWE in footnote #3, I ask as I can think of a couple of rather different decodes

LikeLike

> what did you mean by PWE in footnote #3,

Sorry, Protestant Work Ethic. I write the footnote at the same time as the calling para, so I didn’t take into account the large physical distance as read.

> what about HSBC FTSE All World Class C

my bad. the HSBC fund is what I linked to and TA had identified in his list, but in a random brain fart I ascribed it to iShares. Will go back and correct!

LikeLike

No worries – I think there may be a typo re BRWM too.

Re PWE thanks for clarification – I thought you may have meant Post War Economics or even less likely, but probably more interesting, Political Warfare Executive, see e.g. https://en.wikipedia.org/wiki/Political_Warfare_Executive

BTW – as I am sure will be no surprise to you – I applaud your move towards “preservation”.

FYI, Harry Browne was no great shakes (in the US) over the last 25 plus years though – see e.g. https://retireearlyhomepage.com/reallife21.html.

But, having said that, it did achieve [US inflated] preservation with inflation adjusted 4% annual W/D’s.

P.S. glad you enjoyed your Fish & Chips!

LikeLiked by 1 person

> But, having said that, it did achieve [US inflated] preservation with inflation adjusted 4% annual W/D’s

Hard to argue with, bearing in mind it was deployed into a very different world from the high-inflation 1970s Browne was from.

Nobody should expect to shoot the lights out with that strategy. With gold and cash making up half (in the original design) of the entire portfolio that’s going to be a serious drag on returns, and with bonds being another 1/4 then 3/4 of the portfolio is a deadbeat. This is definitely one for those trying to hang on to the mountain-top, not those trying to climb it. OTOH I see no remarkable drawdowns.

The cautionary tale of Joe Dominguez retiring in 1969 in US Treasury securities till his death in 1997 was remarkable. That is lean FIRE, and it was only 30 years. Although a tough 30 years in terms of inflation…

LikeLike

IIRC if you look at the series with 2000 as the start date, the HB Portfolio fell behind for a few years near the start – but otherwise does pretty much as I summarised. IMO the JD tale highlights the need for at least some equities!

LikeLike

And, not to forget, your living costs are all but covered by your DB pension and, in due course, you will draw a state pension too. So your investment/savings Pot could probably be described as “the amount of dry powder that you have for creating upside, funding impulse purchases, or absorbing negative uninsured shocks”.

LikeLiked by 1 person

Enjoyed your post. We have had a long year too, and have not been vaccinated yet. It should happen later this month. As far as finances go I do have an advisor so I stood pat. We ended up all right and the DB pension funds continue to flow. I agree that there’s no point risking your capital if you don’t need to, and with COVID your outflow is lower.

In retirement, our net worth has grown so we should be OK. What’s more important is to keep your mind in gear and I have done that by learning about Linux and refurbishing old computers. No need for making money at it, but I helped the grandkids get PCs for distance learning.

In the real estate universe, my own home has been pushed to unsustainable sales prices by pillocks in Canada who want to put everything into one asset and screw up their finances for decades. But I won’t sell as I have to live somewhere. Who wants a germy condo building right now?

LikeLiked by 1 person

“I agree that there’s no point risking your capital if you don’t need to” that makes me feel better about not buying any Bitcoin.

LikeLiked by 2 people

TIL that there is a close season for lobster. And some financial stuff too obvs but mainly the lobster thing 🙂

LikeLike

Not in season January to March apparently. That’s if you are after native lobster, which is the point of going to the south coast for it. City mice rather than country mice seem to import them from North America as well. That’s part of the decadence of the Great Wen, really , you get to eat lobster all year round if you are prepared to, er, shell out for it.

LikeLiked by 1 person

Great to see a new post. My wife and I are firmly in the Vanguard buy-and-hold camp.. here in the States we have a very favorable demographic set up for the next 10 years or more. America recently started the process of replacing ~60 million GenXers in their prime spending years (35-55) with ~80 million millennials. In an economy driven by consumer spending that is no small thing… lots of focus on the recovery in the next year or so but I think the 10 year window looks even better. The last time we had an analogous situation here with demographics was in the mid-eighties

I’m with you on Bitcoin. It will probably end up multiples of its current “value” but I don’t want the sleepless nights that would go along with buying it.

LikeLiked by 1 person

Interesting take on the demographics! On Bitcoin I think it was that Buffett fellow who said

There’s not a terrific intellectual difference between gold and bitcoin, and I don’t want to sound too much of a ZeroHedge wingnut on the fiat currency thing. But there’s rather more history for gold as a store of value. Although I do wish I could find something to diversify from that and Bitcoin matches the requirements, but I’ll pass on the swinging for that pitch nevertheless!

LikeLike

I wish to pick a nit. “a DB pension, which is a very bond-like asset, and it is enough that if I scale the annual income by 16 to roughly get the capital value behind it …”

16? For an index-linked annuity with a widow’s annuity too, I assume, at age about sixty? The sages speak:

https://www.hl.co.uk/retirement/annuities/best-buy-rates

LikeLiked by 1 person

I got 16 from HMRC, though they’ve changed the RVF to 20 while I wasn’t looking. But I do take the point, which perhaps points that the balance is more conservative than my rough estimate

LikeLiked by 1 person

Judging from my latest CETV, I suspect even using a multiplier of twenty you are somewhat under-estimating the current value of your DB pension!

LikeLike

Good to see you and Mrs Ermine are still around, hope the wine was good. I enjoyed reading you post, which I will probably have to read again to take it all in. Hadn’t seen that Belle Curve blog, thanks for the link.

“ If you can do it at home, then it’s susceptible to geographic arbitrage, and it can probably be done in a country with a much cheaper cost of living, to your detriment”

This is so true. I got laid off from my job of over 20 years in February as part of a big sweep of redundancies. In my final days there I got to see the hiring posts for many software engineering positions in India. From what I saw most low-level tech engineering jobs were being advertised in India and the management and senior stuff in UK and US. That seems to be the way it is going. I’d been working part time for a few years and was going to retire from it last year but during the pandemic I thought what the heck, I can sit at a computer in my own house 2 days a week and get paid for writing software code. It seemed a no-brainier to stay on. So being made redundant I got to walk away with some severance pay and I don’t resent it, I got some additional cash in my pocket instead of just retiring out of there with my planned stash. I don’t have to feel guilty about retiring and leaving colleagues in the lurch. I get to miss all the corporate BS you get these days, the annual performance review ‘blow your own trumpet’ stuff and the business being carved up and bits of it sold off – good luck to those folks in India!

Now I get to work on my decumulation strategy (maybe spend some of it on fish and chips at the coast in a month or so!) and I can do some ad-hoc coding work on a project for a friend – which like you say I can do on my own schedule and the thing about going for a walk when a gnarly problem hits works for me too.

LikeLiked by 2 people

Chapeau, sir, and congratulations on getting a send-off!

Darwin was apparently a fan of the walking thing helping you think. I have no idea if that article has any substance, but if it works for you, me and Chaz then it’s not all bad!

LikeLiked by 1 person

Bill,

Glad it has all worked out for you.

However, I find it rather sad that we seemingly have not really learned any lessons from the pandemic – ‘low cost offshoring’ has been around for years and IMO has more in common with Unicorns (and possibly short-term financial gains) than real sense!

BTW, I am beginning to think that the readers of this blog have a thing for deep-fried seafood!

Yuuummmm

LikeLiked by 1 person

Warren Buffet has 2 Ts in his name.

Did BWRM mean BRWM?

LikeLike

Corrected, ta!

LikeLike

A great read as ever. So looking forward to all these restrictions being over and listening to lots of travel podcasts at the moment which is giving me some inspiration on some new places to go. Though looks like abroad will be 2022 at earliest, despite being vaccinated.

I am probably being too financially cautious but have now got 5 years of cash in my DC pot. My husband has his DB pension and mine will start in just over 5 years at 60, so although inflation will impact for 5 years I have built it into my plans. Plus thought I would be retired by now and starting to live off my savings so each month while working the coffers continue to grow.

Living on the coast we have a lovely supply of fresh fish and chips, as well as lovely woodland walks to the beach. Still feel like I am on my holidays. The icing on the cake is a nice detached house because as my husband has got older he is definitely less tolerant with other peoples noise, even though when our kids were young sure they were worse.

Still have you, Dearieme and Al Cam to thank for making me understand the importance of using my DC pot before my DB pension, moving house and getting a mortgage sorted etc before I retire. In fact my major life changes have been because of your advice, and I am forever thankful.

I was reviewing my many spreadsheets today to try and decide if my strategy should be to pay my mortgage off a bit quicker as not sure how easy we will find it to remortgage when we are approaching our 60s. I am hoping my husband’s DB pension alone will mean we have sufficient income to get the remortgage we require. May have to use some savings to reduce the amount we require if not the case. When I am 6o and my DB pensions start we will have more than enough provable income. Shame it takes until 67 to achieve an income that will mean we are better off than I could have ever dreamt of.

LikeLiked by 2 people

> The icing on the cake is a nice detached house because as my husband has got older he is definitely less tolerant with other peoples noise

Comes to us all, eh? Part of the reason is as you get older you can’t pull the eardrum tight enough to reduce the signal path through the ossicles. But part of it is you get less tolerant IMO. That’s probably my main reason for wanting more space….

> Living on the coast we have a lovely supply of fresh fish and chips, as well as lovely woodland walks to the beach. Still feel like I am on my holidays.

Well done on getting moved before the pandemic happened!

LikeLiked by 1 person

> I am probably being too financially cautious but have now got 5 years of cash

I have some many years of cash too, it helps me sleep at night. I have plenty enough in the markets to worry about with ISAs and DC pension pots. You are lucky to have DB pensions – I keep on good terms with my partner as she has one she can take soon!

LikeLiked by 1 person

How delightful that it’s worked out well for you.

I have evidently lived life backwards. The coast was mine in my childhood and intermittently later on. But we’ve been marooned inland for decades now. The Boss hath spoke and since I rate her more precious than rubies, inland we stay. At least a tsunami won’t get us.

LikeLiked by 2 people

I enjoyed reading your post. I’m glad you are doing well and that the fish and chips were good.

I think I first posted on your blog back in 2019 when I started at the beginning and worked my way through all of your posts. I’m just re-reading some of your older ones for the third time.

I’m into my fourth year now of an 80%+ savings rate since finding the concept of FIRE. I find I need your posts once in a while, on the deteriorating work environment, the myth of continual growth, ageism for 50+ people looking for work and the importance of frugal living. They help remind me why I am doing this and are keeping me on the path.

I need to make hay while the sun is shining because at 43 my workplace environment is deteriorating rapidly with copious amounts of corporate nonsense, and my skills are gradually being automated.

Knowing how to invest post-tax money is difficult. Premium Bonds and VG’s LifeStrategy finds have called to me. I’m about as unsophisticated an investor as anyone could be.

I’m glad you’re doing well. Take care.

LikeLiked by 1 person

> fourth year now of an 80%+ savings rate

That’s a tough gig! I guess it implies you have bought yourself 16 years of those running costs taking you almost to 60. Living that differently from a peer group can start to get lonely at times.

Over that sort of period, once you have left and consolidated where you are and have decompressed you may find things open up a bit after a few years, because you aren’t locked in to a particular place and spend rate. Even I softened a very black and white approach to earning after nearly 10 years 😉

Good luck in your project, you’ve already got an impressive achievement under your belt!

LikeLike

Thanks. Surprisingly I haven’t found the spending tough at all. The work environment on the other hand…

My expenses have averaged about £9k a year since I found the concept of FIRE in Q3 2017. I’m basing my FI number on expenses of £16k though, so the savings rate maths isn’t quite as clean. It is absolutely covering my core running costs as you rightly say. I do increasingly feel different to my peers.

I’m playing catch up after being a mortgage over-payer during the post 2008 era. I was too scared to invest and wish I could have found your blog and Monevator at that point.

I’ve thrown myself into all my free or virtually free hobbies during these last three and a bit years. e.g. walking, cycling, gardening, personal finance, reading. So I haven’t felt deprived at all. My desire to be independent of needing a job appears to greatly exceed my desire to own stuff or have expensive experiences.

There is a limit to how long it is worth pushing this though. I aim to go part time after another year or so, or find a more fun career (if such a thing exists) to see me through to early to mid 50’s. I don’t think I’ll mind working at something if (1) it’s part time, and (2) I can leave at any point.

Markets and the economy still all terrify me! But at least I’m taking control of the parts I have control over. Thanks again for some of your posts here. Many of them really resonate with me and have helped me during this intense four years.

LikeLiked by 2 people

> I’m playing catch up after being a mortgage over-payer during the post 2008 era. I was too scared to invest and wish I could have found your blog and Monevator at that point.

I wouldn’t beat yourself up over this decision – the best approach (invest vs pay down mortgage) is IMO far from clear cut and given your comment that “Markets and the economy still all terrify me!” I strongly suspect you took the right path for you.

BTW, do you think that redundancy may be a possibility for you in due course?

LikeLiked by 1 person

> The work environment on the other hand…

Commiserations! That really sucks. I can’t say I ever missed having to justify my existence. Every flipping quarter, with SMART objectives. Grrrrr…. Your running costs aren’t hugely different from what mine were back in the day, allowing for 10 years of inflation and natural variations in circumstances. I did find the disconnect with the peer group tough.

The mortgage thing is a funny old one. I bang the drum often enough here that one shouldn’t overpay, but in the end I paid mine off before I started investing in earnest. I didn’t appreciate the opportunity cost, particularly when I wanted to move, and also the flexibility it gives you to limbo round the tax year quantisation if/when you have a variable income. It didn’t do me any harm in the long run. I was able to be more aggressive this time last year with investing than if I’d had a mortgage, while there is fair question as to whether that was wise, it worked out. I would have quailed with a big mortgage…

What is important, however, is not to invest over your risk tolerance, and it seems you have this right. You will see another two market cycles by the time you reach 60 at a rough guess, so a mix of VGLS and premium bonds isn’t a bad place to be – presumably the PBZ underwrite the short term and the VGLS defends the medium term. Once you have cash savings, it is strange how the rainy days tend to hold off. My NS&I ILSCs were there to be an emergency fund against me being iced from work early. That fund is still with them, rolled over countless times. You have time enough to feel your way into investing, and if you haven’t made some part-time work a no-no than you have a route away from the investing path anyway. Monevator was right in that you need an absolute shitload of investing capital to make up for your salary, turn that on its head an a little bit of earned income means a lot of investing exposure that you can leave alone. I don’t earn as much as the dividend income on my ISA, but I am exceptionally idle.

And good for you on the “walking, cycling, gardening”. I didn’t do near enough of that, and where you are in an adverse work environment that sort of thing is valuable for your mental as well as physical health. Keep up the good work!

LikeLike

Apologies I didn’t have a reply option to your last two posts, so I think this may mess up the sequencing, not sure what I’m doing wrong.

Al Cam – yes you are most likely correct. Even with more investing experience now, if a 2008 scenario occurred again I’ve no doubt I’d be scared off a bit. Not having a mortgage would help, but in that 2008 scenario it felt like the entire financial system was collapsing. I wanted that mortgage gone, but so much so, I didn’t even contemplate there may be a better way. I wish I had at least researched into other options, rather than being driven by pure fear!

Redundancy could definitely occur in the future, my role does seem to be increasingly under threat of automation and I’m less enthusiastic now about re-training or keeping relevant. I think a role somewhere less large and corporate appeals. A chance to do something completely different. This four to five year 80% SR blast is really about giving me options and taking the vast majority of financial pressure away.

Ermine – groan! Yes even just hearing the term SMART objectives makes me want to curl up and hide away from the world!

I beat myself up continually about the mortgage but I shouldn’t really. It was a good thing to have achieved, and a vital milestone on the way to full FIRE for me.

My DC pension is a bit more aggressively invested, but my ISA and accessible cash is only about 40% stocks and this is falling. Bonds terrify me too so it’s all fun! What to invest in is a tricky question right now.

Thanks for the well wishes. I’m making sure my health is right up there on the priority list.

LikeLiked by 1 person

My point about redundancy is that this might just give you the extra fillip.

And some (although I suspect I should say very few) company pensions schemes also offer special terms in such circumstances.

However, going part time would/could adversely impact any redundancy payment and/or pension boost.

So, probably worth checking out those details.

IMO, the consequential positive behavioural effect of clearing a mortgage is almost always overlooked in discussions about the relative merits of such an approach.

LikeLiked by 1 person

Yes I see your point. I think that it is possible to have redundancy paid into my company pension, but would need to look into it in more detail. Going part time would reduce any redundancy but would still be a lot more than leaving of my own accord. I’ve worked at the same company since leaving Uni.

I agree with your mortgage assessment. It’s a huge relief and I pinch myself sometimes to still believe I achieved it.

LikeLike

> I’ve worked at the same company since leaving Uni.

Does this mean you have some form of DB pension or is it all DC?

LikeLike

Al Cam – My pension is all DC. I’d like an element of DB to provide a base and take away some of the market nerves but I won’t be in that position.

LikeLike

In due course, your state pension (assuming it is full by the time you become eligible) should give you that base.

LikeLike

Yes that’s very true although the State Pension feels like a long way off and much can change. If it keeps up with inflation of my core running costs then it will be a great help.

LikeLike

> I think a role somewhere less large and corporate appeals. A chance to do something completely different.

This 😉 Small companies don’t have time for all that bollocks. They are maddening in their own ways, of course, but you get out from that sort of garbage. If there is a trend towards automation, some of the corporate claptrap can sometimes be a disguised attempt to get people out on the QT without paying redundancy, simply grind people down.

Far be it for me to advocate working, but anyone who has the application to make FI work has probably got enough general adaptability to do something else. I’ve never been trained in what I am currently doing very part-time, but with a generally inquiring mind, Google at my side and decent experience of engineering and how things are made I can add enough value to make it worth their and my while.

Something I hadn’t realised properly until I moved westwards as that there are clusters of industries. Talking to someone I went ot university with, they moved and stayed around the Birmingham/Warwickshire area because there was a cluster of light engineering there – lose one job and you don’t have to move to find another. I was out on a limb in Suffolk working for The Firm, to do that sort of thing I’d have needed to move. There seems to be a cluster of small electronics/automation companies around the Bristol area, when I moved my location on linkedin I start getting swamped by recruiters. I would have though my age would be apparent from my university degree so either there’s a dearth of applicants if they are chasing me or there’s a surfeit of jobs. Whether I’d get any of them is of course untested, but the difference is notable.

On a wider aspect, while you are still in the corporate environment is the time to build out things like your linkedin profile and for me I got Chartered Engineer a fair while ago while at The Firm. That sort of thing is easier in a larger organisation where you can drum up proposers/seconders/references etc.

> I beat myself up continually about the mortgage but I shouldn’t really.

haha – me too. 😉 It’s not what you actually do, it’s mainly that you’re aware of the tradeoffs. The financial system views the FI/RE person as a pariah and a bum, because it only recognises income, not capital. So get enough credit cards and bank accounts while you are still employed. You need enough bank accounts to have resilience in case any get frozen, and arguably enough cards to spread around you if going abroad for instance to not everything gets half-inched if you’re pickpocketed leaving you stranded.

LikeLike

That’s an interesting point on companies wanting to grind us down. Having been there over 20 years I’m sure they would be delighted if I left one day of my own choice! I still enjoy the work itself, it’s just I seem to be doing it for a smaller and smaller proportion of the time. I’m sure corporate nonsense, pointless meetings and meaningless fluff must now account for about 60% of my week. What a depressing statistic.

I would also have to move to do what I do elsewhere. I’m not interested in moving so that’s another reason for me to be flexible and take on something different.

That’s a very good point about bank accounts and credit cards. I am in a good position there but not because I was consciously thinking of the examples you highlight.

LikeLike

I too paid off my mortgage early, but it gave me more confidence to make other decisions, including as regards investing.

Yes, the dreaded SMART objectives – my theory is in 20 years time people will look back with horror on this time-wasting approach to managing employees.

LikeLiked by 1 person

Very interesting and comprehensive update. On markets, like everyone I haven’t a clue on the direction but I do know that at the back end of 1999, 10 year treasury yields were 6% and as of yesterday they were 1.72% and that when one considers whether assets are cheap or expensive it really should be factoring in the price of money. I also have no insight on the outlook for interest rates beyond thinking those who can influence them will do their best to keep them lower for longer for a variety of reasons (inflation / financial repression). I also think it likely that the rubicon of printing money has now been irreversibly crossed and the next time a financial crisis occurs govts will simply turn back to electronic printing press. Plus rising rates would likely cause a recession. So I am implicitly betting rates stay very low for a very long time and accordingly I’ve been loading up on equities for the last year as relative to 10 year bonds I don’t think they are particularly expensive. I also have $TIPS and Gold as my balance sheet fortress. Of course, I’m in a different position to you – still earning. If you are living off your capital it’s a very tricky place to be I agree – I think I’d be a little higher than you in equities but not sure to what extent. Unfortunately, I am reminded of a recent WB quote “People say, ’Well, I saved all my life and I can only get 1%, what to do I do? You learn to live on 1%, unfortunately,” he said.

I’m glad you called out the Steve Jobs quote. IMHO (worth little) that and other FTSE CEO’s who I have regularly heard spout to my face (do what you love) talk utter drivel. How many senior tax partners grew up and thought you know what, I want to be a tax partner. I would change that harmful moniker to do what you excel at and do it to the best of your ability.

The pandemic has for me shown an ever present conundrum – on the one hand it has increasingly exposed a somewhat innate desire in people for the devil take the hindmost (I admit to increasingly thinking a bit more like this) on the other hand the solution is clearly for people to work together.

There’s a few people around me who seem to be mentally of the view that they’ll be able to work for home more than working from the office, which reminds me of the saying that if you can work anywhere and do your job then someone anywhere can do your job! I can already see companies seeing this as the next leg down to cutting costs.

LikeLiked by 2 people

Good point re the difference between treasury yields twenty-odd years ago and now. The cost of money is a major determinant of prices. I was thinking yesterday about how many people still hold on to the idea that an important driver of house prices is the loan:income ratio, historically somewhere around 3.5 (?), and therefore get worried when it gets to 6 or so as now. But when the “norm” was established, the bank rate had been steady at around 5% for two or three decades, there was quite strict credit control in place – does anyone remember that you had to save with the building society / bank for a couple of years and the amount they would lend was restricted to 2.5x the main earner’s salary?

All gone now. If IRs stay low for a decade, implied by the 10 year treasury yields, then the historic loan/income ratio is simply replaced by a can-you-afford-the-repayments metric.

Like most of us, I’ve also been wondering about where the markets are heading over the next year or two. Even from a distance of a year, the correction last March was only a brief interruption in the steady rise in equity prices. Even back then markets were quite fully priced – I moved into cash in February in response to the oncoming virus and had no qualms in doing so because it seemed after a 10 year bull run that there was a lot more downside potential than upside. Yet prices are now higher… Cheaper and more abundant money. And with the US predicted to grow at 5 or 6% pa over the next two years, and its clear intent to keep IRs down, it’s hard not to think that there’s further upside. But I am still nervous…

LikeLiked by 2 people

> and therefore get worried when it gets to 6 or so as now

It’s probably OK from a strict month on month affordability POV. But think about what that’s saying when you zoom out for the 30,000 foot picture. Basically that punter is putting six years of their gross working life salary into paying down that loan. A basic rate taxpayer paying about 30% tax and NI is going to be putting in about 10 years of net pay into that house. Maybe less, in that inflation typically erodes the nominal value of money by half over a typical mortgage term. But in a low interest rate environment does that hold? Plus your earnings have to keep up with inflation to get that win.

I had a 30 year working life, and saw a 3:1 real-terms increase in net earning power. I bought a house roughly a third of the way in, and discharged the mortgage, perhaps unwisely, after 20 years. I was stupid enough to buy at a 4.5 times ratio, but because I had a deposit the mortgage was on about 3.5 times ratio.

I just don’t think clearing it in 20 years would be possible at a 6:1 ratio. I was never unemployed or made redundant in those 30 years. There’s far more Sturm und Drang in typical careers now. Perhaps they get ahead a little bit quicker, but modern careers are more susceptible to switchbacks and interruptions.

So paradoxically I think that higher interest rates and lower prices would be a better match for modern career patterns, even though people would scream blue murder about affordability being terrible. That’s what people always forget about house prices. It’s people thinking that’s unaffordable and dropping out of the market lowering demand that limits house prices. Grubbing about to improve affordability in and of itself raises prices, as well as making people’s lives more fragile, because it increases the amount of lifetime earnings that go into buying shelter. High house prices also impair renters’ lives, by raising the capital cost of the underlying asset.

There’s also a ratchet effect, because all this government jiggery pokery to improve affordability in lower interest rates and help to buy and whatnot means there’s hell to pay at the ballot box if they let prices fall or interest rates rise, because there are so many losers. High inflation is pretty much their only way to let go of the tiger’s tail.

LikeLike

And right on cue…

https://www.theguardian.com/business/grogonomics/2021/apr/15/yes-interest-rates-are-low-but-that-doesnt-mean-australian-housing-is-getting-more-affordable

LikeLiked by 1 person

Interesting ideas in that

Eh? What do the Aussies measure then – the cost of conveyancing? Removal people? Be that as it may, the more interesting bit is

I haven’t yet worked out if this is something I have missed all along, or if it’s way off beam. I bought a house because I was sick of shitty landlords and the dreadful insecurity of tenure in the UK, which may or may not be better in Oz, I hope they don’t tolerate a nasty little brigade of BTL amateur landlords Down Under. I didn’t buy a house as a capital asset, I bought it to get power over a bad situation. As an investment my first house ranks as the poorest financial investment I have ever made in my life. I don’t consider housing part of my networth, the capital in it is still about power, and stopping landlords getting in my face. There was a similar mentality to paying off the mortgage, while banks are less objectionably in your face than landlords it’s still about power IMO.

Everyone else thinks property = money tree. Which leads to the second extract

Huh? It took me 20 years to pay down and out that mortgage, although I did buy more house in the meantime. It has taken me half that time to get my ISA well over my part of the purchase price of my house a couple of years ago. I don’t live in London but it’s not exactly in a trailer park. Although buying a house still makes sense from the power angle, as a way of building capital I don’t get the religion at all. Shares, yes. Building a business, yes, though it’s not my bag. Housing not so much because you depend on the usufruct of your so-called wealth which places a big dead hand on what you can do with it. Sell your house to fund a round the world trip and you come back to some great memories and a really bad housing situation. That wealth has some value as an income – it saves you paying rent. Maybe I will never get this because my experience of the asset class was so rotten.

This looks like a nasty sting in the tail

There be trouble coming down the pike in the next 10-20 years then 😦

LikeLiked by 1 person

Out of lockdown boredom I notice more mundane things now, so a house a couple of streets away has taken 2 years to be built, between staffing shortages and material delays. This means the wood for the roof has endured at least a year of rain and when I had a closer look, noticed it looked thin and cheap. Once completed, the weakness of this roof will be hidden and the buyers will be shocked to find out in a couple of decades or so that they need a new roof. Curious, I looked at the beams in my own attic and they seem twice as thick and definitely solid after ~60 years, so today’s new-build homes could be half the quality for twice the price, 4 times less value on this back-of-fag-packet guess. It’s going to be a nasty shock to the next generation that their home falls apart around them in their own lifetime when they’re frail and most unable to do something about it. Rip-off Britain now in full bloom.

LikeLiked by 2 people

> Curious, I looked at the beams in my own attic and they seem twice as thick and definitely solid after ~60 years, so today’s new-build homes could be half the quality for twice the price, 4 times less value on this back-of-fag-packet guess.

Isn’t this because the elements that go across the short section of a roof and nowadays built at the timberyard and craned into position on site? In the houses I’ve owned, and presumably yours, at a guess they built the brick walls, put the joists down and then a chippy assembled the roof out of straight timbers, cutting on site. I’ve never really thought about it, but this indicates (US) it’s a pretty skilled job.

The timbers in a modern roof are much thinner, but there are a lot more of these timbers in a modern loft, to the extent that a new-build loft space isn’t that useful for storage, and you have to limbo round all the forest of small timbers. Just as well modern practice is moving away from water tanks in the loft, because you’d never get to change one! Whereas the loft space is largely open in my house, other than a couple of cross-ties.

Prefabricating building components apparently massively reduces construction costs, which isn’t a bad thing in and of itself, though it doesn’t seem to lead to cheaper houses oddly enough 😉

LikeLike

“it saves you paying rent”: imputed rent was subject to Schedule A income tax until the Budget of ’63.

That’s 1963.

LikeLiked by 2 people

@Ermine, I have no expertise in this area, I blurted out the observation before quizing my brother-in-law who constructs various types of buildings and has a lot of experience, so I hope you’re right, because to a layperson it looks bad. Maybe another commenter here can enlighten us.

LikeLike

Hey, I’m a rank amateur in these things myself 😉 It’s mainly from observation – how much of a right PITA it is to wrangle stuff in a post 1980s house loft than in an old one.

Plus one of my favourite restaurants is near a large timber company. I see these roof elements stored in the yard outside, and occasionally have seen a low-loader truck with a massive pile of these things going down the M5, presumably to deliver to some new-build.

Beats me how they get away storing these in the outside yard, though I think their turnover was pretty quick – the stuff didn’t stay there anywhere near like a year. I quite liked smelling the pine on the way past.

LikeLike

Jung & synchronicity…

The cliff in your main pic (I think it’s the one heading east out of Seatown?) collapsed into the sea a few days ago.

Just sayin…

LikeLike

@Magnus Muir

I think that cliff at the top of the post is at Burton Freshwater – I recall from walking the South West Coast Path a few years back – and is not the one at Thorncombe Beacon which collapsed into the sea, as you say.

LikeLike

It’s East Cliff at West Bay although that’s next to Burton Freshwater. That took a hit last year, which is a shame, as that’s the dog-free side of the next beach down. Or rather it was the dog-free side 😦

LikeLiked by 1 person

Wont let me reply to Ermine’s comment re dog free side of beach. Just wanted to say that it is one of the few things I dislike about living near the coast / woods. Bloody dogs, well some dogs!!! Fine if they are on a lead or their owner can call them back. But so many big dogs just run around uncontrolled and the owners assume we all love their dogs jumping up etc. Done worry they are friendly etc etc…

I suppose my views are not helped by a Great Dane running at me full speed last year when we were walking, jumping onto my shoulders and knocking me over. I was like a skittle, my oh said one second I was there and the next gone. Banged my head on the ground and ended up with mild concussion and whiplash. Then as we eventually walked away after my oh had an argument / altercation with the owner realised my glasses had fallen off and we had to go back searching for them. The owner was foreign so don’t think he quite got my oh’s scouse expletives.

The other week another dog jumped up and bruised my leg.

If I ruled the world dogs would be on leads except for certain locations …. Right off for a walk.

LikeLiked by 1 person

I took out an extended bloody foul hounds rant from this post 😉 My observation that there seemed a dreadful increase in dogs was indeed grounded in fact. Britain’s army of mutts has been increased by a sixth over the pandemic.

Why exactly is it so hard for dog owners to understand that by no means everybody likes dogs, some of us dislike them because of bad experiences of being bitten and treading in their shit, some of us just don’t like dogs, and the ‘oh he’s just being friendly, he won’t bite’ bleat as some uncontrolled foul brute charges up at you walking on the public highway counts for nothing. I don’t know that, and past experience doesn’t support it. If I were king you wouldn’t be permitted to have dogs within the town limits.

Now working dogs, they are a totally different matter. Perhaps we should restore the a dog licence and ownership test. Either keep your brute on a lead in areas open to the general public or get fined, or if you think that’s a terrible infringement of a mutt’s right to self-expression, take the dog obedience test and demonstrate that you can recall it 90% of the time.

LikeLiked by 1 person

A few years ago I was parking my bike at the Co-op when a bloke with an aggressive-aggressive dog walked close by. The ruddy thing growled at me. I gave it a filthy look and the chump whop owned it sid “don’t worry, it won’t bite”.Just as well I replied, because if it carries on like this I will feel obliged to kill it

He took fright and scurried away dragging the beast with him.

LikeLike