Annuities are dear, so if someone offers you 97% off, you run, not walk to take them up on it. If you are an early retiree, don’t leave State Pension on the table. You need to get enough NI to get a full SP before you reach SP age, though don’t be in too much of a hurry to pay extra years until you are in the endgame of working.

The Ermine declared himself done with work in 2012, and little has occurred in the intervening seven years to make me enamoured with the idea of working again. I’d reconsider if I were going to live forever, or perhaps even to 150+. Despite Monevator’s exhortations to the educated erstwhile specialists among us to get their asses back into the workforce – on a post ironically titled Choose Time, I can’t be arsed, I’ll choose time, thanks.

There’s enough of interest in the world to keep an Ermine mind occupied in all those long hours I used to spend working, provided one has enough income. The definition of enough varies from person to person. I am not of the view that one needs enough to keep one’s yacht afloat and staffed, although I do wonder at some of the assumptions some FI/RE aficionados bake into their lives with extreme frugality in retirement. I get more in favour of creature comforts as I get older – I have managed to get to fifty-something never having spent a night in a tent and there needs to be an exceptional reason to break the habit which should be more than ‘it’s cheaper’ 😉

However, although I never wanted to darken the Man’s threshold again after I retired, I haven’t totally avoided making money in the intervening years, and that tended to go with the tedium of filling in a self-assessment tax return. I have just completed one for the last year. It isn’t onerous in my case, I have absolutely no investment holdings outside an ISA or SIPP, I made a modest amount of money last year though above the £1000 no need to declare level. I took the opportunity to pay voluntary Class II National Insurance payments, to get an additional year of State Pension entitlement.

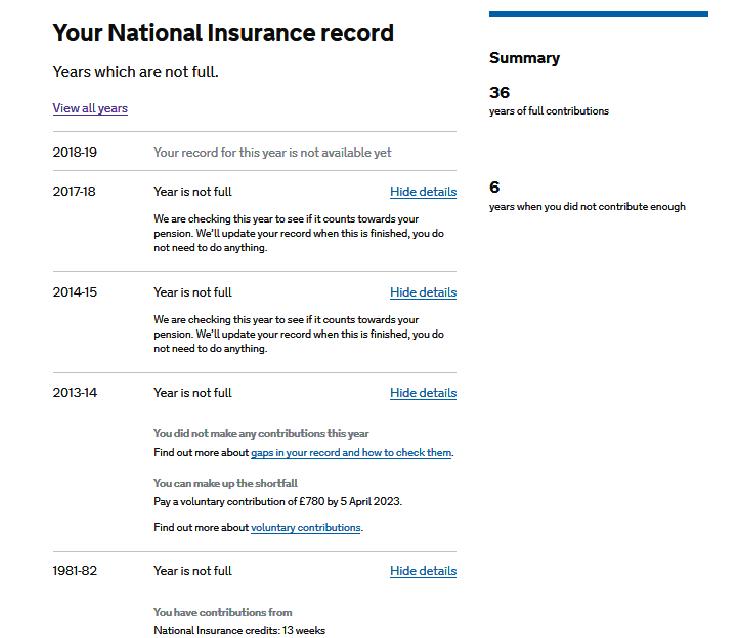

Early retirees are likely to be short of NI contributions, you need 35 years of contributions to get a full State pension. I am OK on this

It’s not too bad in my case – Thatcher’s shock doctrine to the economy in the early 1980s meant it took me to the February after graduating to get my first job, hence only 13 weeks of lost contributions. That would have been 26 weeks lost if I had got a job on graduating. But money is short when you are starting out, and making this up is pointless if you don’t aim to retire early. I can’t really give my younger self a hard time for not making it up. Taking time out of the workplace for children doesn’t count because you get NI credits for all the child-related benefits handed out, so it doesn’t count as time out for NI.

Self-employment is the greatest NI scam there is

Those poor grunts on PAYE don’t have any choice on how much NI they pay, with one exception – if their employer offers salary sacrifice pension contributions, then instead of a basic rate taxpayer getting a 20% boost on what goes into their pension it goes up to 32%, because the NI is saved as well.

The self-employed, however, have all the tricks in the book, and at the higher end, they control the tax they pay as well. However, at the bottom end where I am, it only costs me £160 to voluntarily pay Class2 NI contributions for a year. If I look at my State Pension forecast

I am still short, because I was contracted out of the State Pension for a significant amount of time. Those NI payments went into my company pension instead. I happen to know that I paid my 2017/18 Class 2, as well as the 2018/19 I have just paid. They are not swift on updating this, I guess because most people leave their tax returns until January in the following year. So if I need another three years contributions, I already have two in the bag.

I am still short, because I was contracted out of the State Pension for a significant amount of time. Those NI payments went into my company pension instead. I happen to know that I paid my 2017/18 Class 2, as well as the 2018/19 I have just paid. They are not swift on updating this, I guess because most people leave their tax returns until January in the following year. So if I need another three years contributions, I already have two in the bag.

I am tempted to stay self-employed this year. I will probably earn £100 running a PA for some guys to justify it. I have to stay self-employed for a whole year, though it will take about a day to earn that £100, but what the hell. There’s been a fair amount of scuttlebutt about them wanting to kill off Class 2 NI contributions, presumably because of their terrific value. But it appears that there has been a stay of execution until the end of this parliament, probably on the grounds that they can’t think about such trivia at the moment.

In theory that is to April 2022 but it is unlikely that the immovable object of Teflon Theresa is going to hold out against the irresistible force of Brexit Gotterdammerung until then. I can probably count on Class 2 NI being available for this tax year since it has already started. After that I don’t give a toss, because I will have as much SP as it’s possible to get, even with my wastrel 30 years of real employment. The current position on NI seems to be that the abolition of Class 2 contributions has been abolished.

So what do I get for my £450 over three years? An inflation-linked annuity backed by the government of about £10 a week, or about £567 a year. In reality I will only get to see £450 a year, because I will pay tax on all of it.

If I look at a quote to buy an inflation-linked single life annuity now to happen at 67 with £100,000 I get £3287 p.a. which is about five times the (pre-tax) increase in SP. So buying £567 p.a. at this rate would cost me £21500, which is 47 times dearer than the actual cost. It’s tough to argue with that sort of odds, although I have to try and live to 70 to break even. I will lose out if I suddenly see the wisdom of Monevator’s words and re-enter the workforce in the next few years, though if I leave it till after 67 to discover my undying love for spending more time in the office then I will be OK – I won’t pay NI under current rules.

The sharp-eyed will observe there’s another way to buy an extra year’s NI – I could pay £780 for the year after I retired. Now that’s still pretty good value in many ways. After all, at annuity rates it would cost me £7200 to buy that year’s income, which is still getting on for 90% off. You’d break into a sweat to run after that sort of offer. But call me a greedy bastard, but filling in another tax return isn’t such a tough job to get the 97% off offer. The government gets to ignore the economically inactive Ermine for another year which is all good for the unemployment figures, and I get a great annuity deal. Sounds good to me.

Yes, there are things that can go wrong with the State Pension. One of the obvious ones is a future government deciding to means test it. I can’t predict what the future holds, but I will take the chance of it all going to naught for 97% off. I’d mull it over for £780, but for £150 it’s pretty much JFDI – now.

Dear Ermine

I think you (like me) need 35 years for full “NEW” state pension under the new rules as we were born after 6th April 1951.

I have just retired age 57 living on my DC pension pot until my frozen DB comes available at NRA (62) without actuarial reduction.

I will be 1 year short of a full state pension as I was contracted out but will not bother making it up as it equates to a bottle of wine a week & my DB is worth 3X the state pension when I get it.

Love your blog by the way – it was part of the reason I jumped ship at age 57 rather than hang out the last 5 years.

Ian Baldwin

LikeLiked by 2 people

> 35 years

You are absolutely right and I have corrected the erroneous value I had of 30. For some short period it was 30 years I think, down from 40 beforehand but those days have gone!

> it equates to a bottle of wine a week

Maybe I’m just a greedy SOB but I’m not leaving the price of a bottle of wine a week on the table. Not when I can buy it at Class 2 prices 😉

LikeLike

“For some short period it was 30 years I think, down from 40 beforehand but those days have gone!” I think it was 44 for me but only 39 for my beloved.

If you get the old style pension there’s a fine reward for deferring it, where “fine” implies ruddy expensive for the taxpayers who fund it. It’s hard to see much point in deferring the new style pension unless there’s a chance for a bit of tax avoidance.

P.S. Never slept in a tent – is there no end to your decadence?

LikeLike

> it was part of the reason I jumped ship at age 57 rather than hang out the last 5 years.

Glad to be of service – life’s too short to spend more than necessary of it working!

LikeLike

Chapeau for spotting such a bargain! Money well spent I would say?

I find the whole NIC arena quite tricky to comprehend. You have to really pay attention to know what the hell is going on..

LikeLike

> Money well spent I would say?

Having filled in the tax return, when I got to the ‘would you like to buy voluntary Class 2?’ I thought about it for, ooh, 10 seconds and then hell yeah!

It’s one of those curious things where you have to be income-poor to really make it work, though I would say FI/RE folk should fill their boots if they are in the post FI phase. When they wanted to can Class 2 they were going to replace it with a minimum requirement for profits of > 6k p.a. which would have stuffed me. As things stand is if I were to do nothing gainful in this tax year I’d be tempted to pay myself £50 to mow the lawn and declare that as my annual income and pay voluntary Class 2 😉 But as it is the PA job and royalties on some photos and sound recordings will get me something, though nowhere near £1k p.a. so in the next tax year after this I will sign off self-employment, use the £1k disregard and hopefully not have to do a tax return after the next one, it will be back to PAYE on the pensions.

LikeLike

Thought-provoking post.

I recently retired early and this year will be my first without earned income. I’m 5 years short of my NI contributions for State Pension but am 15 years away from being able to claim it so no great hurry.

It was planning to pay the £780 as until recently I’d assumed that Class 2 NI would go.

Question…can you simply pay Class 2 NI, or do you have to go through the full effort of registering as self employed with the Govt? My understanding is you do, even if your income is under £1k and you want to pay voluntary NI contributions, but I’ve no idea how onerous this is.

I could easily do a few odd jobs for neighbours, essentially taking a nominal payment for things I would have done for free previously.

Seems a bit dodgy though…and if I’m honest the £780 isn’t a problem (although I’d rather have that weekly bottle of wine on my table than the Govt’s).

LikeLike

I think you need to be registered (and do) a self-assessment tax return that includes the section for self-employment income. When you register as self-employed do so starting with the beginning of the tax year (6 April) as NI is charged on a weekly basis at £3 a week. When you sign off as self-employed do that at the very end of the tax year. I personally would give it a week either side, because you need 52 weeks to count for NI, 51 won’t do.

You only have to be self-employed for the year, you don’t actually have to make money every week. I guess you don’t have to make any money at all – after all it isn’t atypical to lose money at the beginning of starting a business.

> Seems a bit dodgy though…and if I’m honest the £780 isn’t a problem

If you want to make yourself feel better about it take a look at your NI history and see the many thousands of pounds you paid into NI annually under PAYE earlier in your working life. I’m of the view I’ve done my bit for the country and £150 beats £780, but each to their own. It is damn good value, and to me it appears to be entirely within the rules. If HMRC is going to invite me to pay £150 to get a year’s NI after I have filled in my tax return then I am going to take them up on their kind offer

LikeLike

How difficult is the tax return. I was always PAYE.

Have I missed the opportunity for this year?

Is there any danger of falling foul with HMRC?

I could mow the lawn and my wife would pay me £50, she would do the weeding and I could pay her £50.

Thanks for this, I have loved your blog and learned much, especially front running a SIPP in front of a DB scheme. We are doing that at the moment. I am in drawdown and wife will be when she hits 55. Thanks

LikeLike

> how difficult

It’s not faff-free, though the 97% off makes up for it IMO.

> any danger of falling foul

Well, there always is if you screw up, though this is within the rules. Hell, they invite you to do it after your tax return, they pretty much point at this as one of the reasons you might want to become a sole trader

> Have I missed the opportunity

No – provided you manage to do it by the 5th Oct this year.

Presumably if this applied to you, you started your business on the 6th April 2018. You will, of course have produced outgoing invoices for any work you did in that tax year, dated in that tax year. Your copy of those is one of the business records you need to keep for six years. Invoices from a sole trader need to be numbered consecutively, ISTR, though most people start at 100 not to look like utter noobs to their customers. HMRC seem to say the number only has to be unique, which gainsays that, it appears you could use random prime numbers in any sequence should you so desire. There are some other requirements of an invoice, but it’s not too hard. And I’ve seen enough invoices from other people to observe they don’t all meet these requirements 😉

If your wife is still working it would not seem to be rational for you to pay her to do the weeding, though I guess she can use the trading allowance if she is working under PAYE. She will pay her NI in her own right. I am absolutely not clever enough to be able to say if people can use the trading allowance at the same time as working PAYE if they earn over the personal allowance. I recall this being trailed as such on the radio when it was first launched, the canonical example being someone with a side hustle selling stuff on ebay. But it sounds too good to be true.

You should first investigate if you are short of NI years and if so, by how much. You do that at Check Your State Pension

LikeLike

On checking my pension I find that I’ve made 42 years full contributions, up to 2015 when I retired.

Predicted SP is £129/wk due to being contracted out for many years.

In order to get to £148/wk, I am required to shell out £1900.

Arithmetic suggests this is around a 2 year payback, so assuming I don’t pop my clogs before I’m 68, it makes sense arithmetically.

But the thought of shelling out almost £2K at this point just doesn’t appeal. Especially as now you get full SP after 35 years contributions. mmm…

Nor does the hassle of setting myself up so I can get the Class 2 contributions – I’m done with work and have become quite used to the easy life!

LikeLike

> due to being contracted out for many years.

The hit from contracting out seems to vary. I was contracted out for 20 years I think, but the variation in years to make it up seems wide.

You have pretty up to the year before you reach SP age to decide, Class 3 might be the way to go, if at all.

> I’m done with work and have become quite used to the easy life!

Now I can relate to that!

LikeLiked by 1 person

I do this too. I registered as self-employed, do a small amount of work each year, and opt to pay the Class 2s. Like Ermine says, it’s an absolute steal. In total I’ve got many more years of Class 3 contributions than is supposedly needed, but because of swingeing reductions due to having been contracted out for just over a third of those years, I wouldn’t get the full ‘new’ state pension on the basis of those years of paying because they don’t offset the fact you’ve paid for an extra five years or so against the reductions due to the contracting out, annoyingly. I could just stick with my entitlement under the ‘old’ state pension as with the SERPS added that amount would be only a bit less than the amount due under the ‘new’ state pension. So why bother paying for Class 2s to get the new state pension, you may wonder. Well, although the ‘basic’ part of the old state pension gets uprated in the same way as the new state pension does (i.e. triple lock), the extras – in my case SERPS – don’t. There is more discretion about how to uprate these and they are treated less generously so I can see that in time the value of the SERPS bit is very likely to decline relative to both the ‘basic’ bit of the old pension and to the new state pension. Hence my wanting to pay a small bit extra now to ensure I’m on the new state pension and not the old.

LikeLike

> Hence my wanting to pay a small bit extra now to ensure I’m on the new state pension and not the old.

That is an interesting wrinkle in the change between old and new I hadn’t realised – thanks for highlighting that!

LikeLike

I am not sure about this. I thought the new and the old system were compared as at April 2016 and you got the higher of the both as your “starting amount” in the new system. If the starting amount is less than the full new state pension, then I thought it all gets the new state pension increases, regardless of whether the starting amount was based on the old system or the new system being higher? Having said that, I am with Ermine in why not have the extra if it is cheap, even if it is small.

LikeLiked by 1 person

I am under the same impression, that your starting amount is set and then increases are at the rate set in the new system. I have seen my amount creep up on the pension estimator by one of the years purchased with class 2, for a tax year three tax years ago

LikeLike

PS: it’s also worth mentioning that if you look after grandchildren for more than 10 hours a week, you qualify for free NI credits – check out the NI website. The paperwork for claiming childcare credits is very light touch (or was when I looked into it a year or two ago). There are similar credits for carers of disabled or elderly relatives, I believe.

LikeLike

@tyro

Thanks very useful, thanks.

That should close my wife’s 2 year gap in a very cost effective manner.

Boltt

LikeLike

hmm…must check this out to see if walking the ‘grand dog’ counts. That would work for me 😉

LikeLike

Just to add one thing to all this (apols if someone has already mentioned this), even if you are missing more years than you can buy or make up, if you have significant S2P contributions, ie you didn’t contract out, these also count towards the total projected amount. One of the usual sneaky sleights of hand by the govt to grab a bit more unearned money while thinking we’re too thick to notice.

I missed about 15 years of contributions (youthful fecklessness, plus later living & working overseas), a few years ago started looking at my state pension, paid as many of the missing years as I was allowed to but was still short by a number of years, which is when I discovered that the S2P would make it up.

To make it absolutely clear, if you have the 35 years of contributions, your S2P is simply swallowed up, and you see no benefit from it, but if you fall short, you will get some benefit.

PS “Working” to qualify for the Class 2s, yes, but working past the point you have to, no way. The clock is ticking – even in their early 60s several friends and acquaintances have been hit by terminal or serious versions of the prostate, hip, cancer, heart variety, it does raise the obvious question in one’s own mind. There is no way that any of the limited amount of time remaining to me is going down the drain of work…

LikeLike

> which is when I discovered that the S2P would make it up

does the pension reckoner show this properly? This fellow seems either to have been wool-gathering when he bought more years or was misled by the indication he was short of years. I don’t have that much S2P (and I was short of years, because: FI/RE) so the indication is very much that I will get a little bit more for added years, though this current tax year is the last one where it would make any difference.

> There is no way that any of the limited amount of time remaining to me is going down the drain of work…

Amen to that, in no way was I going to suggest that people return to the 9 to 5 for it 😉

LikeLike

Hi Ermine, I enjoyed the post thanks for sharing!

Some thoughts:

r.e. Class 2 – Well worth paying if you can. It’s £3 a week, so small change. And if it helps get you a bigger state pension it’s almost always worth it. From speaking to those more in the know, the Class 2 scrapping is off the table for now. Brexit has gummed up everything. The Treasury also doesn’t want the bum-fight with the self-employed lobby which almost toppled the finance bill last time they tried to get it through. In the long-run, it’s likely to go just because so much fiddling with income tax and NI has made class 2 an anachronism.

@Tyro r.e. SERPS and S2P increases. These *are* increased by CPI each year. However, the Basic and New State Pension are increased by the triple lock. So the later have tended to increase a little bit faster, but not dramatically so. The key with buying additional years is down to your “Starting Amount” as Jedi points out. This is whichever is higher: entitlement under the old system or the New State Pension.

@Roderick – S2P and contracting out are different things. If you contracted out then you obviously didn’t build an S2P. But you also didn’t build a State Pension – which is instead your COPE (contracted-out pension equivalent) in your private pension. It’s also not necessarily the case that with 35 years your S2P is “swallowed up”. In fact, many will find their entitlement under the old State Pension is higher – thus their Starting Amount stays under the old system. This is what confuses a lot of people…

@ermine … the fellow in your link was one of those. His Starting Amount must have been on the old system and maxed out. So more contributions made no difference. Of course, he filled in his ‘shortfall’ of years (terrible language by HMRC). But he should have spoken to DWP. Don’t presume that HMRC and DWP talk to each other (they don’t). The HMRC text is ‘technically’ right. But in practice, people won’t read it as intended. There is a link in the piece to Steve Webb’s excellent guide on this.

Anyway, this whole thing is incredibly complicated. If you’d indulge me, here’s a link to my blog about it: https://youngfiguy.com/the-state-pension-ni-fiasco/

The post is a year old but still applies. It also contains a link to Sir Steve’s guidance. DYOR.

LikeLiked by 1 person

Blimey, seems like the Ermine career is a particularly simple case. Though it still puzzles me that I was contracted out for 20 out of 30 real PAYE working years, I’d have expected to take mroe of a hit from that, but I’m not complaining. Your article shows me there’s no useful chance of trying to validate the NSP starting value calculation myself.

LikeLike

You can also pay Class 2 or Class 3 contributions if you live abroad. Fantastic value, but actually getting HMRC to take your money can be somewhat… challenging.

https://www.retirejapan.com/blog/uk-state-pensions-5/

LikeLike

That looks like an amazing world of hurt and a true case of the left hand not knowing what the right hand is doing at all. At least you had a UK bank account to pay them from!

Here’s hoping that your eventual UK State Pension will be worth something when it comes to payment rather than being hammered by changes in the currency exchange rate.

LikeLike

Thanks! I mainly see it as a low-risk/low-reward form of diversification, but I guess there is a small chance it will be pretty worthless 😉

The incredible mess at HMRC brought home just how bad Brexit could be…

LikeLike

@ermine – could you clarify your response to an earlier poster, to register as self-employed at “the beginning of the tax year (6 April) as NI is charged on a weekly basis at £3 a week. When you sign off as self-employed do that at the very end of the tax year.”

Do you mean to say that if I register now, i.e. after the first week of the tax year, I won’t be able to make voluntary class 2 NICs to get a year’s credit for State Pension? If so, do you know why this is the case?

I’ve just been offered a small amount of freelance work, and intended registering as self-employed, both to make it straightforward to submit an invoice, as well as to avail myself of the Class 2 opportunity.

Thanks.

LikeLike

If you’re gonna go Class 2 (which implies your SE profit for the year is under £6,365) then you need to pay for all 52 weeks of the year. Part years don’t count*. You have no worries about not having done it yet. You have until October in your business’s second year to register.

A moment’s reflection will show that you need to register as SE from (and including) 6th April this year running through to and including 5th April 2020, and no less.

It doesn’t matter if you made all your money in some fast and furious one day hit. That’s the joy of being self-employed, and since you aren’t claiming benefits you don’t have to show some minimum profit. You can make a loss.

Note that I have been unable to find a definite statement that only full years count with Class 2 NI. I make that claim only because at the beginning of my working life I had a year that is not full, it does not count as a year for NI or my SP. It is true that I stopped working at the end of June 2012 but my NI for 2012/13 is good. This is because I paid a shocking amount of NI through PAYE. It appears that

and I easily earned that much between April and the end of June in 2012.

* Back to Class 2 NI – make ’em full years or do the research to find out if you can butt together half of one tax year and half another, or even itty bitty weeks across several years. And please let me know, I believe that is not the case. So take appropriate action in determining your specific period of self-employment 😉 All it has to do is cover the period when you issue the invoices and buy services or supplies should you be claiming these as allowable expenses. It can cover a longer period should you so wish, you aren’t doing anything wrong…

LikeLike

Thanks for the reply. I’m still trying to get my head around it all (reading the HMRC guidance) but I think I may have misinterpreted – I originally thought you were stating that in order to pay the £150 for a year’s credit, your self-employment had to already be registered as of the point in time that tax-week1 commenced, but I think now you may have meant that when you do register as self-employed, you must ensure that you enter the self-employment start date as tax-week 1 (but this can be done retrospectively, e.g. registering today, stating that my self-employment commenced 6th Apr 2019) ?

LikeLike

> you must ensure that you enter the self-employment start date as tax-week 1 (but this can be done retrospectively, e.g. registering today, stating that my self-employment commenced 6th Apr 2019) ?

Yep, that is my understanding of the situation. When I did I was a wuss and took the last week of the old TY too 😉

LikeLike

I cannot remember if I was contracted out at any point or not. I just assumed it was all based on how many years contributions you had made. Where can you see if you were contracted out or not and the resultant impact on the pension you will get?

LikeLike

> Where can you see if you were contracted out or not and the resultant impact on the pension you will get?

These are two separate questions. For info on your SP I cannot recommend Check your SP highly enough. You will have been contracted out very likely if you had a defined benefit (final salary) pension pretty much any time since the early 1980s through to about 2008/9 ish, but only your pension statement from that DB scheme can tell you AFAICS.

> and the resultant impact on the pension you will get?

Now that is a very tough calculation to make. Most people in a DB pension seem to have eaten a greater hit that I did, I believe that is because early in my working life I had some years of some sort of additional state pension (SERPS I believe) which lifted my starting amount. But as to how that impacts your starting amount on new state pension I have no idea how to validate that. Young FI guy gives you more technical detail.

On the check your SP site you can see whether you get the full amount, as you can see for mine. Some people who have a lot of SERPS and S2P will be able to reach a higher level than the 168 p.w mine is maxed out at, but that si the top level for most people, and the nominal amount for someone starting out anew on the new system, which has no additional earnings-related amounts.

There is a delay of two years to credit NI years, you have to read the three more years in my case with the NI record and know if you have paid up the last two years (by working or paying Class 2 or 3, or indeed caring duties) . In my case I know I only need this current TY Class 2 to reach the max. because I know I have paid up the last two years even though the records shows these as not full.

LikeLike

Thanks Ermine. I have a vague memory of being offered a choice to contract out but maybe I am mistaken as I have never had access to a DB scheme. Possibly it was something to do with SERPS – I know I have a small SERPS component but not sure how this will be affected by the new system they have brought in. As for contributions I thought I had made up all the NI I could a few years ago but when I look at my statement it shows I still have three years I could make up. That doesn’t make sense. I hope they haven’t screwed up my contributions. Anyway I’ll investigate and have a look at the SP website.

LikeLike

> offered a choice to contract out but maybe I am mistaken

This sounds unlikely if you did not have access to a DB pension. You can infer whether or not you have been contracted out from your State Pension Statement, because it will contain a COPE amount.

If yours does contain a COPE amount, and you are unaware of the pension then the pension tracing service can help you trace pensions for companies you may have worked for early in your working life that are now long gone.

> As for contributions I thought I had made up all the NI I could a few years ago but when I look at my statement it shows I still have three years I could make up. That doesn’t make sense.

You may have been correct but the goalposts changed 😉 Way back in the day ISTR you needed 45 years NI for a full SP, I wouldn’t have made that even if I had worked to 65. So I was chuffed when they dropped this to 30 in 2006 ISTR – win. Then they raised it again to 35 in 2016. So if you formed your opinion you had enough before 2016 you were right then, but are no longer right now.

> I have a small SERPS component but not sure how this will be affected by the new system they have brought in.

That means you must first look at the new SP amount you get on the system. It is possible that with SERPS you don’t need the full number of years to get the full SP, because your starting amount was lifted in 2016 to reflect the additional earnings-related SP you had bought. The number of years I am short seems to be reduced due ot that effect compared to other people who were contracted out for long periods, because I have about five years of SERPS from the beginning of my working life.

So if you look at your NI records and see that you are short of years (and remember there is a two to three year lag in actually getting credited your NI years) then before you think about making these up check your SP forecast. If yours shows £168.60 based on your current record up to April 2018 then you need do nothing more.

Mine says £157.16 (see screengrab above) based on my record up to April 2018, which means there are three years up for grabs. Two of those years are in the bag already, just not shown on my record, and the last one will be this TY, after which I will sign off self-employment, hopefully for good 😉

LikeLike

Assuming I understand things correctly, class 2 NI contributions are not always the most cost-effective way of acquiring qualifying years for the self employed. If you earn a few £k more than the £1k minimum you mention above and operate as a limited company (rather than as a sole trader) you can actually structure things such that you can obtain qualifying years foc. I understand that Option 2 at the following link explains this particular strategy

https://jf-financial.co.uk/2019/01/11/optimum-salary-and-dividends-2019-20-limited-company-directors/

LikeLike

Looks good, though as a Ltd company you will a) have an accountant because of your Companies House filing requirements so you are likely to have costs of more than Class II. Which is a moot point because the decision to go Ltd co or not is usually about other things that trying to save the last £200. Plus there’s the danger of IR35, it appears sole traders are not individually at risk of IR35.

It’s all good stuff and part of the mix, and thank you for highlighting this specific case in the case of Ltd companies. Hopefully one’s accountant would point out there are tax benefits of the structure, Mine did when I had a Ltd co on the side back in the day.

LikeLike