In a recent post Monevator started off decrying the slow fade-to-black of the UK finance blogs, did nobody tell him that

This is the way the world ends

Not with a bang but a whimper.

but more seriously, I wonder if it isn’t in the nature of the beast. The blaze of frenzied writing is to be had in the initial stages as you are working out what is what, and if this FIRE malarkey is possible at all, and what stage of the process you are at. Then come years of grind, when not much interesting happens at all, particularly is your investment strategy is basically buy a tracker every month for 20 years, then quit on the proceeds.

Before I join in bemoaning the passing of the old guard we really ought to have a rundown of some great new UK FI blogs I have come across:

- Ms Zhi You: FI blogging from a feminist viewpoint

- indeedably: intelligent philosophy and an interesting alternative view of malaise in the FIRE community

- YoungFiGuy: some great insights on FI esoterica from an accountancy background

- The Fireshrink: finance and philosophy

There are also some interesting EU FI blogs, achieving FI is different in most of Europe because tax-sheltered accounts seem to be less generous and tax thresholds lower. It reminds me of the situation in the UK when I started work, when although we were all poorer the social safety net seemed to have a bit more humanity1. The Anglosphere has gone more towards a winner-takes-all model, diverging both from mainland Europe and from its former self when jobs were more stable, addressed a wider range of the intellectual ability range and particularly in the UK, housing was less vile. Firehub.eu is a good place to start. I wonder if the Brits will be kicked out in April for their renegade ways 😉

Steady investing and a lack of market drama isn’t good for narrative

I would say that RIT has done well with the steady investing narrative, turning it into a book. But there are only so many ways you can slice the lemon. Maynard Paton has an interesting FIRE journey – note that it also features some fantastic luck. In his case, calling the housing market well, but selling out of stocks before the GFC to realise liquidity to buy the house. Luck on its own is not enough, you must also carpe diem. MP gets to stop work nine years earlier in life than me.

It was much easier to write about investing ten years ago. We had just gone through a humdinger of a crash. Not only did you stick out in a big way saying the stock market was something to run towards, rather than away from as fast as you could, but starting from such a low base meant the market was tolerant of mistakes other than churning. The expected return is inversely proportional to valuation, you could buy pretty much anything left standing in early 2009 and do reasonably OK. Building a high-yield portfolio (HYP) with a useful yield looked like a reasonable possibility then. Nowadays you’d have to indulge in risky behaviour to get a high yield because valuations are higher. Sure, there’s Sturm und Drang in the papers about recent retrenchments, but the FTSE100 is back to two years ago, not 10!

Other things have changed since the financial crash to reduce attention spans and the capacity for reflection2.

(Anti?) Social Media – Too many twits might make a twat

as the twat David Cameron, a.k.a. The Grand Architect of Brexit said. Takes one to know one, guv, though we take your general point on social media malapropisms.

I don’t know enough about social media to say just how much this citation from Monevator commenter Norfolk on that thread is true

It rings true for me, but then I am a serious introvert, and I am old enough to remember the beginnings of the WWW3 which was very intellectual and had a strongly anti-commercial bias. The Web works far better and faster now, but the quality of the writing and discourse is a pale reflection of its former self. A colleague observed that as Internet bandwidth went up, the signal to noise ratio went down. From an engineering point of view Shannon’s Law would say this is inherent in the nature of the beast. 4 but perhaps it lies in the original sin of the WWW, the notion from those early days that information wants to be free.

Although I sporadically use social media professionally on a couple of jobs it never sang to me as being a rewarding way to use my own time.

I do see social media sucking the oxygen from a lot of Internet discourse elsewhere. Vaknin makes the point well that negative statements are much more concise than positive ones, so perhaps social media does tend to waken the nascent sociopath in us. It’s certainly not a place for long-form writing.

That’s enough of the grumpy old man bit about fings ain’t wot they used to be. I’m sure the kids will be all right, though if we could find a way to push back against the extremes that make it harder for those who aren’t all right and find themselves in a tough place that would be nice, Mr Zuck, pretty please?

So what did I learn in 10 years? You have a lot less control than you think you have, and luck matters – if you have the cojones to use it. Let’s have a run-through:

You can invest passively active or actively passive

Nowadays the classic way of investing passively is to buy a representative sample of all the shares in the world, and then hold. Way before Jack Bogle, there was another form of passive investing, which seems to play to a weirdness that seems inherent in the combination of investing and the human animal. Perhaps it is inherent in making choice as a human:

if at all possible, couch a decision making query in positive terms

What shall I sell is inherently a negative question. There are two problems with couching something in negative terms. One seems to be that we have fast-moving and perhaps more primitive mechanisms to keep us safe in the face of threats. These seem to have a louder voice in our heads than reflective cogitation about how to improve our lives. Loss aversion is a thing – the siren song of something might go wrong, get me out of here is never far away. The bear story is more compelling. I spend much more time on here bitching about how my younger self was slaughtered by the housing market in the UK, with nary a hat-tip till now to the fact that Lady Luck smiled on my older self through the stock market to a greater extent, even after the tuition fee the dotcom debacle charged me under the line ‘miscellaneous muppetry’. The housing loss sticks in the mind more5 than the greater win.

The second, as currently demonstrated in the Brexit process, is an answer of not this can have multiple mutually exclusive solutions, turning what looks like a simple choice into a tough multiple choice later on. Somebody will be able to tell us one day what Brexit looks like, but half the people who voted for it will be pissed off with it because it’s not the not the EU they thought they were voting for. Tough luck, suckers. Be careful what you wish for, you may just get it.

In investing, Sell Shell carries a second implicit question And Buy What? Whereas Buy Shell is a pretty easy instruction to carry out.

Selling shares is inherently harder than buying

Intuitively, running a share portfolio usually means you buy and sell, just like trading anything else. The aim is to buy low and sell high – works with beans, Ebay dodads or pretty much anything else in a market economy.

Well, no. Selling shares isn’t like anything else in a market economy. Say you are a company making bricks. Your plan is to make bricks, and to make a profit. You can look at what the demand for bricks are in your area, what others sell them for. You can rough out your input costs and the cost of running the company, and if it all works out you know ahead of time that your expected cost of making a brick is less than the cost you expect to sell the brick for.

You can’t really do that with shares, when you buy them. Sure, you can have a rule – I will sell if the share price does this. Pessimists sell if there is more than x of a loss -a stop-loss. Optimists sell if the share has gone up and retrenches, a trailing stop-loss. Many of the rest of us sell in a panic in a market swoon as the monkey-brain screams the world is ending, sell now.

I don’t know of any method of knowingly buying a share beforehand with the same planned strategy of making a known anticipated profit in a known time-frame, like our brick-maker, a company making M4 nuts, or farmer Joe growing spuds, or Starbucks selling coffee experiences on the Old Kent Road. The closest you can come is to buy a good share and bank the dividends for years. The problem is that typical yields are low, 5% is good in a high yield portfolio. Chase too much yield and you get stuck in value traps – companies who have fallen on hard times and are about to go bust.

At 5% yield you’ll take 20 years to break even on that principle. I have companies like that in my HYP, because I was fortunate enough to buy them in 2009 when they were seriously undervalued6, and the total sum of the dividend stream is greater than what I paid for these shares. These companies can go titsup tomorrow and I will still be better off having owned them than not. Rationalists will yell that I shouldn’t anchor on the historical costs, only on what I could do with the money realised now. But you don’t stay alive in a HYP taking that line. Because: selling is hard. Do Not sell in a HYP.

Nearly everybody buys shares in the hope that the share price goes up, in which case you have another source of profit, the one the brick-maker and spud-sellers have – you buy the product for less than you can sell it for. You need stockpicking talent to make that work for you. I don’t have enough of that for normal markets, and definitely not for markets at high valuations. It is easier to be a stockpicker in a market crash 😉

The greatest profits in a business accrue to the founders, either if the business is private, or before it floated on IPO. The takings for stock market investors are thin gruel in comparison. OTOH many early businesses founder before getting to IPO stage, so you have less risk, the failures also accrue to market founders and their sponsors.

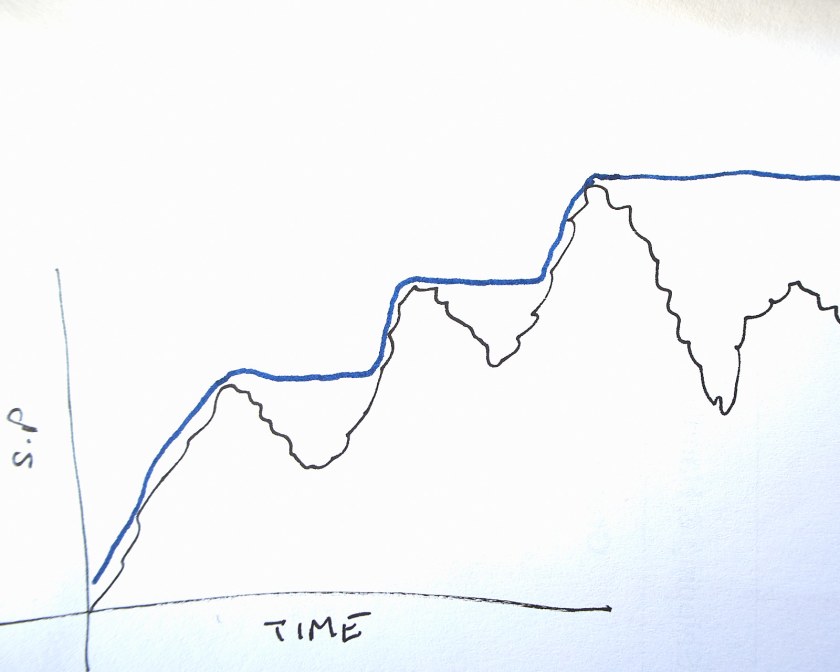

In my dotcom trading days I bought a program from a company called Updata, their manual had a delightful picture of a stock chart with the punter buying low and selling at the crest, buying back in the trough of a dip, hockey-sticking himself up into nirvana.

In the early days (’98 ish ISTR) I did something close to that, and thought I was clever. Any bastard can make money in a rising market and the dotcom frenzy was just that. I’d have made a lot more if I had saved the money on the program and simply bought and held, but you shouldn’t put an old head on young shoulders.

So much for that theory. Stock Market investing really isn’t like trading anything else in a market economy, particularly on the sell side of things.

Turns out there’s trouble in this Paradise, and that trouble is we don’t know how to sell (H/T Monevator). I discovered this for myself. After a period of absolute nuttiness in the dotcom boom and bust – see above, where trading was all, and dividends – what are they7 I gave up nursing a decent loss.

I returned to the fray in 2009 having read this and needing to get out of work, fast. But in those first few months there was still a tendency to trade, although Monevator had educated me to the concept of income, and Do Not Churn. But what cured me of trading was hard evidence. I used interactive investor at the time, and they had a feature where you could have multiple portfolios. So every time I sold, I added that stock to a portfolio called sold. Effectively that created a simulation of my alter ego, one who buys whatever I sell, at the a number of shares and sale price on the day of sale.

We buy on optimism and sell on fear

My alter ego and his purchases of my sold portfolio started to do better than I was. I suspect the reason is that I buy on optimism and sell on fear, and it turns out that’s a terrible way to make investment decisions. It is gratifying to learn that professionals have the same problem with selling, I thought it was just me.

Fortunately, there’s an easy way to fix that. Do Not Sell. Job done, sorted. At the same time I read a couple of interesting pieces pointing the same way but from a different angle. Warren Buffet said something about buying and holding as if the market will be closed for the next ten years. There’s another canard of this, which is imagine you have a 20 hole punch ticket of companies you can buy, once it’s full it’s full.8

Not selling is one of the fundamental premises behind a HYP and Robert Kirby’s 1983 paper on the Coffee Can Portfolio – if you Google The Coffee Can Portfolio you can probably get the whole PDF somewhere.

The Coffee Can Portfolio

Just buy. Kirby’s tale was of a husband simply following Kirby’s recommendations to the wife of what stocks to buy, but the husband simply put the share certificates in a coffee tin and left them. On his death the value of the portfolio had risen much more than the wife’s holdings – presumably because she was instructed to buy and sell9.

That simple move to not selling improved my batting average, I only had a few months of muppetry before I switched to buy only, running a HYP. As time went by I grew lazier and moved towards a VWRL approach, because the research needed to buy intelligently into a HYP was getting onerous when I couldn’t do it on one of those interminable telephone conference meetings at work 😉 But I still have most of the HYP10, which has had the temerity to aggrandise itself over the nearly ten years of ownership. It’s the magic of the coffee can. You don’t rebalance a HYP either. You just leave it, que sera sera. You can add to it, sure. But don’t rebalance it. A HYP is a specific instance of Kirby’s more general coffee can principle.

At first glance so is a VWRL passive portfolio, but with VWRL the rebalancing is concealed in the ETF. Vanguard do it on your behalf. I can’t tell if that is a better or worse way to do things – my HYP was bought in the first part of my investing career so it performed better because I’ve had it for longer and it was bought at better valuations than my VWRL purchases.

Timing matters – Events, dear boy, events…

as Macmillan may or may not have answered a question as to what would blow a government off course, but the same applies to you and me.

Most people have to buy their portfolios from earnings, a steady trickle into the market over thirty years. For all I know that may well be a great way to do things. The trouble is that life throws curveballs. I’ve never had a thirty-year steady trickle into the market, and I had a boring working life by modern standards working 23 years for one company. I have never been made redundant or fired, other than taking VR at the end of my working life. Events fall into:

external events

I am mindful of another Buffetism

“Four or five times during their lifetimes, [investors will] see incredible opportunities probably in equity markets . . . [they] have to have the mental fortitude to jump in when most are jumping out.”

2009 was such an event, and it coincided with me wanting to retire early. The events are connected; the GFC made The Firm want to cut costs so it hired some bunch of American management consultants to draft a vile and vindictive performance management system designed to drive people out, and hire knuckledragging mouth-breathers to put fear into the middle management so they executed the plan. But this time a Buffettesque incredible opportunity was offered me on the stock market, and I played a weak hand well. Without those pieces of linked good and bad fortune my view of shares and FI/RE might be very different – I have only been in this game for ten years, and that isn’t enough to say if passive investing works for the long run. Starting at a time of those incredible opportunities, however, gives you a big leg up.

Sadly, incredible opportunities aren’t something you can invoke, though I suspect you’ll get a good if not incredible one of the in the next five to ten years. You just have to be ready. It was easier for me in that I wasn’t nursing losses to trigger the old loss aversion problem, and there were certain people going around saying what the hell are you waiting for, punks? Git your ass into this market, like, NOW.

Some of the writers in the current UK scene are more talented stockpickers than I am, have worked in finance, and usually start from higher earning base. I am in this race because I had a decent job, and I was next to one of Buffett’s incredible opportunities, and swung for it. The foundations were good, too. A company pension and being fortunate enough to be born at a time when the economy had more use for technical/scientific skills but I wasn’t set against the capabilities of the entire world through globalisation. There’s a lot more luck than judgement in that. Events, dear boy, as the man said.

The micro matters as much as the macro

The arc of your working life carries dramas particular to you – working opportunities but also the financial vicissitudes of kids, redundancy, divorce, disease, untimely death of those close to you. Any of these can push you off the 30-year steady passive investing track. How much that affects the outcome11 will depend on valuations when you need to reduce your savings rate or draw down – if the market is up in the sky then not so much, but if you took a break in 2009 you’ll have missed out on a lot of future income streams bought at rock bottom. Tragically it’s more likely that you lose your job in the times of economic stress that tend to hammer the stock market – truly this stuff is stacked against the common man who has to fund their investing as they go rather than from Daddy’s trust fund or ancestral wealth. Investing into that sort of market when you have just lost your job is for those with cojones hard as solid diamond only, plus there’s the vexed question of where do you get your money from if you aren’t earning it?

Some of these micro lifestyle things you can bring forward or stave off for a few years – when to live with someone, when to try an buy a house and when to have children are things you have some control of, though chance and the year you were born have more effect than we’d like to think. When you catch the market and what phase it is in isn’t hugely under your control – the market cycles are of the order of a decade, perhaps slower in the housing market. Ten years is a long time to put your life on hold waiting for the market cycle to be right.

Micro events can change your savings rate – for instance I sold some index funds from the ISA when the market was high to bridge a house purchase. Selling is not so bad if it’s the positive thinking brain that says valuations are high and I have a chance to do something else with this money, move, and get a detached house so I don’t get to hear the neighbour’s telly volume gradually increasing as he gets more and more mutton jeff, poor devil, I don’t think he realised. And if we want to play Figaro at full tilt at 1am that’s also cool. That’s a good reason to sell out a bit. Not everything in the world is about getting the best return on investment.

What isn’t a good reason to sell is the monkey brain yelling “valuations are high, MARKET CRASH is round the corner OMG it’s all going down the tubes, SELL NOW”. The monkey brain is entirely correct, the crash is round the corner, but you can give up a lot of income trying to nail that corner to an exact couple of years. I am pretty dead certain sure the world economy will go titsup in some fashion in the next five years, but I’m not smart enough to know how to invest for that before it happens.

The monkey brain did get the better of me buying gold ahead of 2016’s disastrous referendum. Although it’s usually sales that are the problem, any purchase of gold is also monkey-brain driven. Gold is inherently a fear purchase. Warren Buffett would not approve, because it’s also a deadbeat – gold is the ultimate shirker. It doesn’t do any work for you, if it were a stock you’d kick its butt all the way to the Moon.

I need to derisk over the next year or so as non-ISA reserves run low before drawing my pension. Some types of fear are OK – if you need the money in the next year or so you can’t invest like a twenty-something with 40 years of working life ahead of him. So I hold too much cash and too much gold compared to where I want to be long term because of a foreseeable cashflow squeeze. Events, dear boy…

A coffee can portfolio has no cost of carry

One of the tragedies of the retail distribution review is that my ISA platforms used to be subsidised from the punters who bought funds. Stockpickers and ETF-heads had no cost of carry. Trying to find a platform that doesn’t charge a fixed fee or a percentage of assets under management is the key to making do not sell type passivity work. I use iWeb now who have no cost of carry for shares in an ISA.

I do not expect to pay charges simply to hold a line of stock. The coffee can doesn’t charge for the certificates it holds either, but it’s not prepared to fill in the government paperwork to make it an ISA tax shelter. I don’t mind paying buy and sell charges – in the days of Kirby’s paper from the 1980s the costs of buying and selling stocks was stupendous, which rewarded inactivity even more.

My future more passive self will return to the Coffee Can principle

At the moment because I have no income I need to use the ISA to help with cash flow. Once I start to draw my main pension then I can return to using it as a contribute only stash to defend against long term hazards. I will move the gold outside the ISA, running the emergency fund/float as a mix of gold and cash/NS&I ILSCs. The ISA can return to holding just equities. I’ve seen the coffee can principle work in the HYP, and I will probably consolidate the index funds into VWRL and a Dev World ex-UK L&G ETF (ex-UK to acknowledge the HYP is largely UK big fish). That will give me diversification across two ETF providers.

Conclusion – I have no stockpicking edge, but luck and timing matter if you want to get there quickly.

My high yield portfolio makes a decent income, in that respect it serves me well, but it is perfectly possible that a VWRL holding selling off units would do better. I came to the regretful conclusion I have no persistent stockpicking edge in normal or highly valued markets, and my retired self isn’t prepared to put the effort in to get one. Results didn’t support the theory that I was getting better at choosing stocks12. I have no background in finance so that is to be expected. That I have no stockpicking edge is not to say I don’t believe anybody else has13. The Escape Artist and FireVLondon probably have as a result of their experience, and Monevator has from natural cunning and intense study – I have never gone wrong with stocks informed by reading between the lines of Monevator in his more active days, which will hopefully return after the next crash 😉

I can’t get away from the feeling timing matters. That might be because in my short history timing did matter – I have good years following stock market routs, and I am buggered as to what to do over years like the last two. Timing matters more to people whose time horizon is short – mine was I want to leave work early and three years at most. That’s short, and you need to be standing next to an incredible opportunity to have any hope in hell of doing that. RIT’s ebook is titled From Zero to Financial Independence in less than Ten Years, which is absolutely right. But he did start about ten years ago, in 2008/9, same as me. One of those Buffett incredible opportunities that rock up four or five times in a lifetime. The incredible opportunity is not enough , you have to grab the sucker and drive down your costs and save hard and have a decent job to start with and hold it for long enough.

Market timing is anathema to the passive investing crew, but though one doesn’t dare mention the name Rob Bennett in polite company, I think he has a point. Valuations matter. I don’t do market timing as in trying to sell out before a crash, but I do it as in paying a lot more attention into buying into lows, and more lately, into withdrawing if I can sell at high valuations to do other stuff in life. Markets are tidal, and so is life. If you can make these tides work with each other, so much the better.

The reason it’s hard to sell out before a crash is because of the general problem with selling. Crashes are dead easy to predict, there’s always one coming, and the impending doom scares the monkey-brain pretty much all of the time. The trouble is discriminating between the crashes that do happen and the four or five false alarms that don’t. Act on predictions and you will be whipsawed in and out of the market or sit in cash for ages. If you have something better to do with the cash, great. If not, you are losing money, because cash dies quietly into the night, leaking purchasing power to inflation. Inflation is the government’s tax on the well-off but timid, cash is a decent medium of exchange but a terrible store of value.

There’s nothing wrong with steady passive investing, but thirty or forty years is a long time to wait for your ship to come in. If you want to get there quicker, you need to do something else or have luck. Doing something else, if it’s other than luck, is extremely high risk. Some people may have a stockpicking edge – Monevator, FvL, TEA, UKVI, MP. They can get away with doing something. Most of the rest of us can’t do something consistently right, though I’d make an honourable mention for those who can work with the tides of the market and life – but then you are at the mercy of market valuations, you can’t do something to change that.

Everybody chasing FI/RE needs to have been earning above average, which is the dirty little secret of the FIRE community. It’s for perhaps the upper two deciles14 of the income scale.That makes it a minority pursuit, and it’s only a subset of that minority that will begin the journey. Of those that start now, only some will make it to the finish line in twenty or thirty years time. Valuations are such that now is a tough time to start, IMO. I’m not so surprised that Monevator is finding himself a big fish in a dwindling pool, and I don’t think it’s because he’s eating the small fry. Valuation matters, and there’s just not the drama or the returns to be had now that there were ten years ago. That will change. There are many straws in the wind of trouble for Britain, and they are picking up. There be opportunities in that sort of aggravation, for the stout of heart. One presumes Jacob Rees-Mogg and Somerset Capital Management are licking their chops 😉

We believe that long-term, active management is a better way to reduce risk than simply following the index.

Somerset Capital Management’s website

Obviously you tell your investors to git the hell out the UK but presumably there’s a slush fund at SCM to pick up on any, ahem, opportunities that may arise in the next few months. It’s an ill wind that blows nobody any good.

One of the straws in the wind for me is the announcement of a 100% mortgage for first-time buyers. Dependent on BOMAD putting 10% of the loan in a Lloyds savings account, setting the value at risk for three years. That says hard times lie ahead to me. When was the last time 100% loans looked like a good idea? Ten years ago, was it?

- As an example of how things have changed, the Ermine has been unemployed for six months, at the very start of my career just after I left university in the early 1980s. I went for the interview, where they asked me am I looking for work – yes of course I was, but the economy was on its knees. Right, fill in these forms, and basically let us know when you find a job. I claimed means-tested unemployment benefit for six months on the basis of that. The current vile and vindictive sanctions systems where you have to justify your existence and be hectored each week as to why you have failed to find a job, and fill in job applications for 35 hours a week would have shattered my already fragile self-image. As it was the Ermine found work early in the next year, did well, paid shitloads of tax and NI and never troubled the unemployment benefit system again ↩

- an honourable mention for supporting role should be the smartphone, which has made us rude bastards to those who share our space IRL. Tim Harford described it as the mutually reinforcing nature of the distraction ecosystem — and how I’d failed to see it clearly when inside it ↩

- A friend at work gave me a floppy disk with an early copy of NCSA Mosaic late in 1993 ISTR, and the potential caught my imagination, I wrote a music website using a text editor which was hosted on a Stanford computer (webspace was somewhat challenging in those dial-up days). Mosaic was pretty much the first easily adopted browser though TCPIP on Windows 3 was flakey as hell. Some fifteen years later a punk named Mark Zuckerberg pretty much destroyed the open Web to the extent that some benighted souls believe Facebook is the Internet ↩

- As a large information processing system connected with life perhaps this is a special case of the new information theory of life. ↩

- in my defence although tilting at the British shibboleth of you can’t go wrong with housing is fun from a contrarian point of view, there is a genuine point. Leveraged hits that you take early in your working life are much more damaging IMO. You tend to run into the housing market early in your working life, because everybody needs to live somewhere. A large proportion of the UK working population never get hurt by the stock market because they haven’t got enough money to invest, or if they do they regard the stock market as a casino and whack the money into cash savings. Eating an opportunity cost is a whole different ballgame to paying down negative equity in the first half of your working life. ↩

- this is proof positive that valuation matters. You will normally struggle dreadfully to find companies valued such that their future income streams will write off the capital investment in 10 years. But in exceptional circumstances of almost universal market despair that can happen, because valuations are depressed. ↩

- dotcom companies very rarely paid dividends, because 99% of them were terrible companies, and pretty much 100% of them didn’t make any money in those heady pre-millennial days. ↩

- Warren Buffett’s 20 hole punch card notion is all very well if you are running a successful insurance company in the early days so you can wait out your turn invested in alternative productive assets, not so easy for the rest of us who have to commit money to the market as we earn it, where do we invest productively if the market looks overvalued? Perhaps there’s a suggestion in the way MP bought his house while the market is about to go titsup which is one good alternative asset, but even if you use an offset mortgage to allocate capital when the market is too high you can permanently lose your ISA or SIPP tax-sheltering for years. Note MP does not claim to have foreseen the GFC, he merely found valuations such that he felt ready to redeploy the proceeds in something else he wanted to do. There is still a hefty element of luck there to my eyes. ↩

- Because this is the I am assuming that they controlled for obvious confounding variables, like if the wife drew an income from the portfolio as well as buying and selling stock then the husband’s outperformance is to be expected. it’s been a few years since I read the paper. ↩

- I have made very few exceptions to the HYP Do Not Sell doctrine. I bought Tesco basically because Warren Buffett did, and sold it because he did, nursing a loss because WB is better at this game than I am though that particular call wasn’t his most glorious moment. To my shame I sold out of ASL in 2016 and rebought at a worse price when I realised the error of my ways. Muppetry never really leaves one’s psyche, though the fight gets easier with time as long as you add the cock-ups to the collection of skulls in your ’50 ways to cock up on the markets’ cupboard to remind you that this too shall pass. ↩

- this is called sequence of returns risk, probably because we aren’t allowed to mention market timing or valuation these days. ↩

- statistical analysis is the devil’s own job in things to do with shares because it is not possible to hold confounding variables constant. For instance the drop in my unitised return towards the passive average could simply be a function of valuations drifting up over the years. It was much easier to shoot the lights out in 2009-2012 than 2012 to now, simply because market valuations were lower. But I can’t separate the variables properly, the signal is lost in the noise of everything else that changes. I did better than most people in the first part because I ran towards fire. But as Buffett said, opportunities like that are rare, four or five times in a lifetime. ↩

- these examples aren’t meant to be an exhaustive list, they are just those that spring to mind right now. ↩

- Interestingly, the IFS place the boundary of this at roughly the UK average household income for a couple without children. I find something counterintuitive about the median household income being the starting point of the ninth decile of couples without children (and about the seventh of those with) ↩

I used to read alot of the advice type finance blogs in the beginning, but once you’ve read a few then you’ve read them all. There’s really only so many different ways of saying to save money and invest in low cost trackers. The worst blogs are the ones which just keep repeating that same advice over and over.

What’s interesting to read now is people personal experiences of implementing that advice while keeping their lives appearing somewhat interesting. Yourself and TheFireStarter do a good job of it, whereas others like myself eventually realise much of our life is far too dull and so reduce or stop the blog updates entirely.

People want to read about others getting out of a debt emergency and then retiring in wealth.. they don’t much care for the decades of normality in between.

LikeLiked by 4 people

> The worst blogs are the ones which just keep repeating that same advice over and over.

That’s the case for all types of blogs I think. I used to read a blog about improving personal and professional habits until I realised that the guy had only about 5 unique ideas and just used to regurgitate and rehash them into different blog posts ad infinitum.

Mind you he did carve out an ( apparently ) lucrative career of lectures and books on the back of it which is something which the Ermine has yet to exploit 🙂

LikeLiked by 1 person

Ah, but I have the advantage that Joe Heller had in Kurt Vonnegut’s poem 😉 A man is rich in the number of things he can let alone, and a career of lectures and books is just that sort of thing for me.

LikeLiked by 1 person

Agreed, the initial excitement of watching debt go down and net worth increase can wear off quite quickly. Once you master the basics of clearing your debt, living within your means and investing excess funds for the future you are pretty much set for life. It’s sticking to that mind set that can turn people off. Making your own lunch each day, batch cooking, getting the cheapest deal on insurance / gas and then switching each year can be tiresome too but I know why I do it. My personal goals have always been clear the mortgages ( I have 2 houses ), and have enough saved / invested for a comfortable early retirement ( my spreadsheet indicates I’ve now done this ). The goals changed a bit when my son ( now 4 came along) and I’m now putting in a couple of extra years to put enough by to buy a house for him or cover his university fees. I also used to work with a chap called Jason Buckley (https://ourtour.co.uk/home/), He and his wife retired at 43 an have been travelling in their motor home on and off ever since – that wouldn’t have been possible without inspiration from some of the FI bloggers out there. When I finally stop working I don’t think I’ll be doing any blogging. Tales of a middle aged man spending his days walking his son to and from school, flying kites, riding bikes etc aren’t as interesting as the celebrity nonsense.

LikeLike

“The FTSE100 is back to two years ago, not 10”

Er, actually the FTSE 100 is back to levels of c.20 years ago and is yielding well over 4%.

I think (but as you know we cannot *know*) that the UK market is cheap. 🙂

Thanks as ever for the link love!

LikeLiked by 1 person

You do know how to rub it in about those dotcom days 😉 I would say those times of irrational exuberance are the yin to the yang of Buffett’s incredible opportunities. Four or five times in an investor’s lifetime there will be a collective madness of crowds that will devastate anybody who buys into it.

> UK market

I confess I haven’t been able to help myself every so often. I almost know there will be richer pickings as this clusterf*ck marches on, but every so often an Ermine paw sticks out and buys into a bit of it, it seems one of the few bits of value around, albeit hazed with massive hazard. I know I shouldn’t, this one has to get a lot worse before it gets better, but…

LikeLike

Sorry for being a yelling rationalist 😉 and I hear what you’re saying about selling being difficult, but it’s very easy to get suckered into the ‘yield-on-the-prices-I-paid ‘ trap – I’ve done it myself – especially if the shares have tanked recently but your holding is still worth much more than the initial book cost from many years ago. Simply seeing black type instead of red gives you a nice warm feeling (understandably), as does receiving double-digit percentage returns every year on your original investment sum.

However, if it’s income today in actual cash terms that you’re chasing (and why wouldn’t it be ?) then unless those companies you bought years ago are still up amongst the high-yielders based on today’s valuations, you’d likely be better off cashing in your existing HYP chips and starting afresh, or else buying a higher yielding tracker or investment trust.

LikeLike

I don’t dispute the logic in theory. But every investor needs a map for the territory, else they will swing in the wind and churn like bastards. The principle behind a HYP is never sell. In the original Kirby paper there were enough companies that went to the wall. The tin would have been richer if it had sold those, if it knew what they were in advance. But the noise level in the price is too high – the tin might have sold the ones that saved its backside too.

In a world of perfect knowledge and prescience you’re right. But every decision you take is riddled with hazard, and for most of us sell decisions have even more hazard. For me, Do Not Sell shifted me from doing worse that the index to better in the early days. It’s still a fight at times – I failed in a couple of places in 2016. With predictable results. The #1 rule of investing is “Know Thyself”. That article that I am in good company lifted the spirits. Every investor’s biggest enemy isn’t the market. It’s the face that looks back in the mirror.

LikeLike

Hi Ermine, thank you for the ‘shoutout’ as ever.

There ain’t much to this FI/RE. In many ways, it’s an intellectually shallow subject. What is more, it is far too easy to overcomplicate it. After a certain critical mass, the more one reads about it, arguably the worse off you are.

Coming from the school of: “only say something if it’s worth saying” – that lends itself to cutting one’s emissions.

That sentiment feels more common here in the UK than with our cousins over in the US.

As to stockpicking, I believe people can do it. But it takes a level of discipline and hard work well beyond my interest levels. To be successful I’d say it’s most important that you enjoy investing in and of itself. A good test being, would you do it, even if you had no money to invest.

LikeLike

> A good test being, would you do it, even if you had no money to invest.

That’s interesting, and back in 2009 to 2012 I would have said I had that passion. Now, not so much. Part of the trouble is that the stockpicking aspect became tougher, and beyond my limited ability. Back in 2009-2012 all you needed after screening for a HYP was to ask is 1) do I expect this company to be still standing in 5 years time and b) can I see the dividend coming from a reasonably sustainable base.

Whereas now the best I can do is try and by ETFs at less outrageous prices than normal. Nothing feels terribly good about that, and the whole passive investing mantra bores me senseless. And I haven’t necessarily got 30 years for purchases at high valuations to come good over a couple of cycles, I do it because it’s probably less bad than letting spare capacity fester in cash.

LikeLike

I think certain blogs will continue if they are unique in some way that has inbuilt novelty, so being more philosophical, yours for example contemplates contemporary events, which by definition always appear over the horizon & are refreshingly unpredictable. That means that mostly, your posts will be spontaneous on randomly generated, real, topical material. Monevator comes across as more educational and so will always have relevance in the interpretation of new material, like the latest budget, financial event or change in regulations – that impacts on investing and money matters. TEA has interesting case studies and psychological explanations of human behaviours, helping investors know themselves their world and others within it, so as to improve their performance & so chances in life …..these angles need not repeat the same baseline beat then, because enough novelty is ingrained in the style.

LikeLike

I would assume almost all bloggers started post-2008 and have had the benefit of a ten-year bull market. I wonder how many will continue to blog as their “journey” is interrupted by reality. It seems most are young and perhaps overly optimistic. I’ve been reading your blog for a few years now and it is one of my favourites as you touch on more subjects than just finance and explore other issues around society, retirement and life. I reached FI almost by accident and first stumbled across your blog as I was looking what to do after work. Reading your posts helped clarify a few things and the financial mechanics or FI was perhaps the least important. I’m hoping you continue to blog as you have now been joined by RIT and iretiredyoung and together are the most relevent to my own circumstances.

LikeLike

It seems I can’t edit the post above. Just to clarify when I wrote about you being joined by RIT and iretiredyoung I was referring to you all blogging now post FIRE.

LikeLike

Thanks – glad some of the non financial stuff was of interest. I always wonder abotu those bits because they tend to be very specific to me. Iretriedyoung’s fat and lean FIRE was intriguing – thanks for the pointer to that site!

LikeLike

“I wonder how many will continue to blog as their “journey” is interrupted by reality” – This is something I have worried about in the past but seeing as my monthly updates are the most painful and boring for me to write when things are going well, maybe it will actually spice them up a bit and get me more interested in what is going on with the markets….?! I think ermine has hit on that exact point in this post hasn’t he.

I definitely agree that some of the newer blogs around are far to over optimistic in their approach to FI (as was I 5+ years ago) but now I’m content that I am in for at least another 10 years of grind no matter what the markets do, which should allow me to ride any downward trend back up the other side again.

@ermine – I do my best to ignore twitter as much as I can. So much noise, not much signal, as you often say!

LikeLike

Hi Ermine – I do agree there are not many purely financial blogs left out there – and even The Investor regales us with tales of his house purchase and love life occasionally.

I would put forward the idea that just money is kinda dry. And the advice doesn’t change much, so there is not much scope for a long term blog. But as soon as you add the human perspective in, and human’s inherently flawed and biases decisions, that is where the interest starts in my humble opinion. Additionally, I love hearing from bloggers with many different lived experiences and hence perspectives. I don’t want to just hear the one white middle-class middle-aged dudes opinion. (No offence intended on anyone who meets this criterion, but they are just our common scapegoat/overrepresented in all positions of power and influence).

I used to consider myself on the science side of the art vs science divide. But nowadays, I think I am more on the art side……there is something deeper and difficult to describe that connects with people more. And that is what blogs bring to me more of a connection that pure finance. And hence more longevity.

LikeLiked by 1 person

I like your article but if I squint I can see how an algorithm could have put it together by cutting and pasting bits from other blog posts you’ve written over the past decade.

Comedians stops being funny and start being pitiable (e.g. John Cleese), football managers stop winning and start whining (e.g. Jose Mourihino) …. and bloggers just stop having anything new to say I’m afraid.

The most comments you get are when you deconstruct an ego expressed as a financial objective from the personal finance pages of The Daily Telegraph and the most comments Monevator gets is when The Investor writes an article about how terribly unfair for him Brexit is. The people want bread and circuses.

LikeLike

I’m been deprived of grist for that mill because of their firewall, though I suppose I could deploy a battery of email addresses and Private Browsing. Although the advice in this advertorial for Laura who wants to retire at 65 makes me facepalm. Don’t pay off your mortgage before it runs out at 67 for God’s sake woman – save the wedge in a SIPP and then use that to pay your mortgage after 65 FFS, aaargh, and it is the deputy personal finance editor in charge of the podcast making such a tyro mistake. And no, MMM is not yer typical Torygraph reader either, though his achievement is amazing. But he earned a shitload of money in his software engineer days (43k$ to 100k$ post tax across 10 years), this is not a slightly different change to spending replicable by people on the average wage over here, although it is still a very impressive achievement…

LikeLike

I “circumvent” the paywall by having my own web domain with a catch all email address that forwards to my main gmail address. The domain was free for a year. Once the free year is up I’ll just let it lapse and then acquire another free domain. I use it if an interesting article appears in the Telegraph. A free domain is also handy for getting free beer and coffee from a couple of well know high street chains. Easy enough to do

LikeLike

Many thanks for the suckerpunch to my site traffic Ermine. I’ll put on my best suit and tie for the next post.

I have to agree with MsZiYou, YFG etc and say I think the passive investment towards financial independence game is pretty dry chat. TI has cornered the market on educational articles through Monevator, and there’s none of the ongoing churn interest of UKVIs material for most of us. Beyond that there has to be human interest to get me into the topic; your own rants, where weenie and TFS are earning and saving etc.

Personally I just rant/write/moan about whatever the hell interests my cynical mind at the time. I worry about my own face validity and content given that I’m still in the pay-down debt/ build emergency fund stage. At least with content I actually know about and can reference there’s some substance, and if it doesn’t get read it’s something I can read back in five years time, shake my head and think “what an anus I was”.

LikeLike

I agree with you that much of what passes for success in retirement planning is luck. In my case it was year of birth, ability to do math and science stuff and above all marrying someone who combined a good job, a killer DB pension and a willingness to stay out of debt and save.

I never have been a good stock picker or market timer. We relied on steady savings. Right now I have a financial adviser company owned by the greaterfool.ca guy. They provide diversification, balance, smart ETF selection, financial planning and estate planning – all for a reasonable fee. I feel I can trust them to do the right thing by me.

I can get on with playing with the grandchildren and let somebody else worry about the dismal science.

LikeLike

You have been a great help to me over the years, Ermine, because we are similar in age. It helps with focus and reflection. For example I remember commenting years ago on HYP building that I just couldn’t get my head around it and would stick with something boring (like LS60). Also your pieces on taking a pension and understanding tax. Also, we have lived through the same crazy events over time, something the young will get to happen to themselves in the future no doubt.

I particularly enjoy the philosophy. What is this money and life for anyway?

I used to read Jung in the 1990s. Then I started a well paid new career and reflections went out the window. It’s good to remember what he said, but I’ve found that now, 25 years later, my local library stocks none of his books! Times change and we change; apparently the ability to handle change is a sign of good mental health.

Many thanks and please keep writing when you can.

LikeLiked by 1 person

As a person with roughly half their adult life straddling each side of the millenium, I’m like a split personality on the digital divide, still drawn to writing to be able to think, but comfortable enough with smartphones & the practical uses of IT gizmos …..so that discussion (Vaknin guy’s) U-tube video clip was really thought-provoking. The whole social media phenomenon was always disconcerting to me but I found it hard to define why & that underlying psychological analysis helps articulate it now. It had felt similar to when the faceless, ruthless corporates pretend to be your friend to sell you their wares under the guise of convenience or whatever, but you end up shafting yourself in the end without realising until its too late. Like loving the cheapness & efficiency of Amazon, BnB or Uber, then realising as businesses and the knock-on effects of supply chain collapse destroy the local community, your job & so eventually your future, you realise it was too good to be true after all.

It’s insidious harm, so the conditioning to not care pretty much about anything, but mainly the erosion of basic societal norms of decent human behaviour, means we sleepwalk into being a more callous culture. So austerity for example ‘others’ the vulnerable & people no longer feel bad about those receiving benefits being humiliated or subjected to pain. After that its only another step to not batting an eyelid when councils routinely install anti-homeless features in doorways & on park benches, [subtly reducing them legally to vermin] like with the anti-pigeon spikes. Then quietly deporting those of the Windrush generation for example who can’t afford their rights over missing documentation – but as the song said, ”if you tolerate this, then your children will be next”. People are indifferent now as the vulnerable are picked off, thinking it’ll never be them, but amazing things become possible when almost the whole population stands by & just watches.

That’s what Vaknin mean by an entire nation drifting into a psychotic phase – I remember being aghast during the Yugoslav breakup war, that we were seeing concentration camps again in Europe – when people were still alive from the last lesson. I can’t understand how quick people are to take peace, prosperity & general humanity for granted.

LikeLike

> roughly half their adult life straddling each side of the millenium

OMG I’ve realised that coud be me too 😉 as in leaving university 20 years pre-millennium and it’s now more or less 20 years after…

Vaknin’s video was very thought-provoking. Somewhere in the back of my mind I can’t help the suspicion that it might be a grumpy old man rant, but OTOH he has called out a deeply pathological nature to some of what goes on, and the evil genius Zuckerberg seems to be a firm believer in the ends justify the means doctrine – he and his company that he retains majority control of despite his minority capital stake is a serial offender and shows no contrition. I don’t thing Nick ‘I’m Sorry‘ Clegg can whitewash that turd.

LikeLike

> When you catch the market and what phase it is in isn’t hugely under your control – the market cycles are of the order of a decade, perhaps slower in the housing market. Ten years is a long time to put your life on hold waiting for the market cycle to be right.

This doesn’t get said aloud often enough IMO, perhaps because many of the current bloggers and commentators have been on the winning side of it and the natural inclination to believe we are wise not lucky.

We shouldn’t try to time the markets.. but timing matters and humans don’t live long enough to pick the timing on the scale of decades. If only we could dollar cost average into housing instead of buying all at once. I suppose in a roundabout way that’s what renting is, and countries where renting for life (with regulation, protections, etc) is normal and encouraged had it right all along.

LikeLike

Don’t worry – we won’t be kicking the UK blogs out of FIREhub after Brexit! The “.eu” bit is misleading I admit, but we’re a Europe-wide site and we try to be as inclusive as possible (we even have an Israeli blog on our blogroll).

LikeLiked by 2 people

@Mrs W – “we even have an Israeli blog on our blogroll”

Well, Israel does take part in the Eurovision Song contest too…. 🙂

LikeLike

Haha, that was our logic too 😛

LikeLiked by 1 person