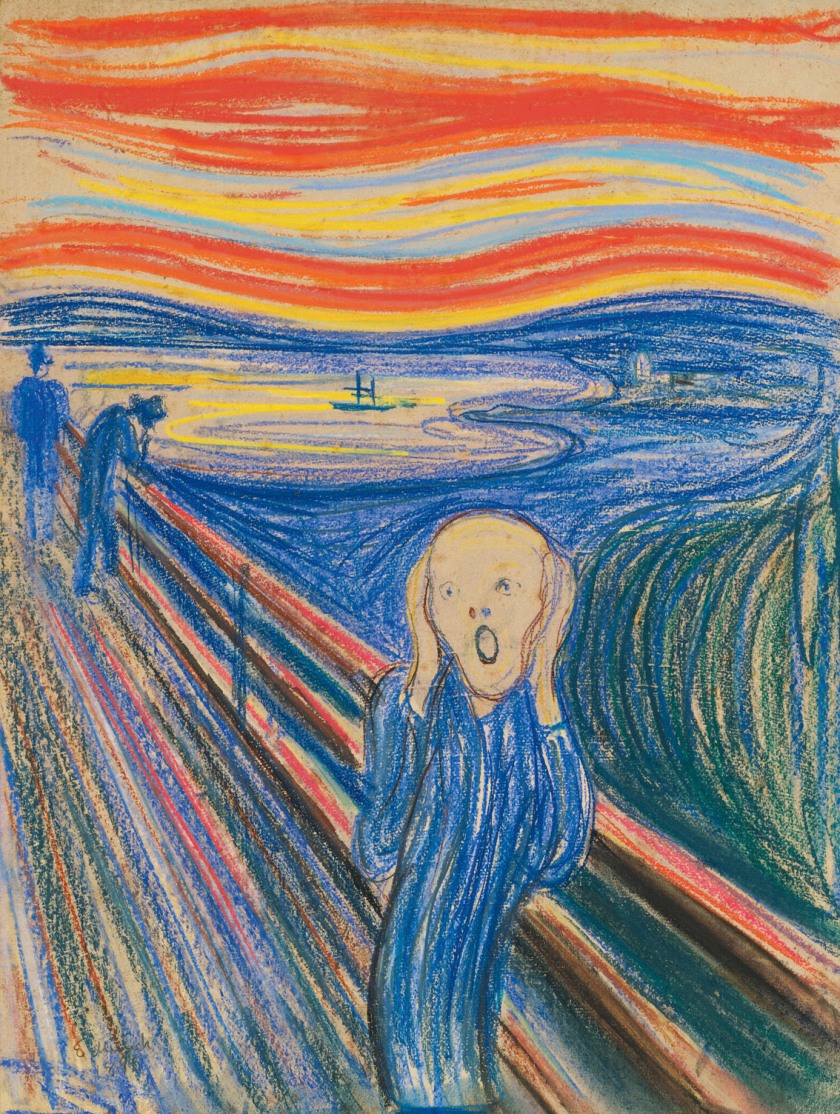

A Happy New Year to you – what are we looking forward to in 2019 then?

Oh. Not so much, really. Did you know there were four versions of this picture? I didn’t until now, so I have learned something new today before 10am. Can’t be all bad. There are great parallels between now and the beginning of the global financial crisis. There are some that say there are great parallels between now and the 1930s, but let’s fight that one later on, eh? What do we have in front of us?

It’s an ill wind blowing, young FIRE folk…

The problem with seeing many new bloggers starting on their journey to financial freedom in the last couple of years is the thought in the grizzled Ermine’s fur that you really want to start that journey with a stock market that hasn’t been pumped up by funny money. I wish y’all the best of British luck, but I know from bitter experience that taking a suckout a couple of years after starting one’s journey to fabulous riches financial independence via the stock market is tough as hell if you take a spanking a few years in. Here’s how I did it wrong, so you don’t have to 😉

I’ve seen this movie before

That was me, starting in 1997. No idea about highfalutin’ shit like diversification, so guess what I invested in? Heck, I was the proud owner of an early technology ETF, TMT. How did that go down for me? Badly, so badly that even the ETF provider was so embarrassed about the appalling performance that they pulled the ETF in 2003, making forced sellers of their punters into a market low.

Some time in 2001 the Ermine gave up on dotcom stocks, and bought into the indexing mantra. So I got myself a low cost Virgin FTSE all-share CAT1 approved index fund, which had charges of a piffling 1% p.a.

I got pissed off with all that guess when – 2003. I gave up about £7000 to the stock market. Compared to what I surrendered to the evil housing market it doesn’t amount to a hill of beans, and nowadays I look at that as excellent value training in what not to do with the stock market in the University of Life. That £7k (probably 14k in today’s money) was my entry ticket to seeing the wisdom of this in my hour of need, and getting to act on it, timidly in my ISA and full-on in my AVC (sort of like a SIPP). It was good value – you can spend a lot more that that on shysters trying to sell you courses and newsletters on how to be a great trader/investor/stock market hot handed king. I say pay your dues directly to the market if you have to. After all, the obvious question to ask of anybody selling you how to be a great investor, is if this is so damn good, why aren’t they borrowing the money from a bank if they have to and eating their own dog food?

Market routs are good for FIRE folk.

There’s an ill wind a blowin’ in this new year, and it’s blowing you guys some good. The overvalued stock market is finally beginning to surrender to gravity and reality. There be opportunities out there for young folk looking to achieve financial freedom, buy into the suckout when it comes. Could be as easy as buy regularly every month if we can get the FTSE100 down to 4500. You don’t have to catch the cusp of the turn, just the general suckout, hold on for ten years and look back. Things are looking up. young FIRE folk, go get em. This ain’t anywhere near a rout, yet, but here’s hoping for 2019 mayhem, eh?

while you’re at it, batten down the hatches

Obviously you have to be fortunate enough to keep a hold of your job, so watch your backs and keep those CVs up to date and your contacts close. There’s an argument that the last downturn busted the Ermine out of the jobs market though it also bent the stock market out of shape enough to help him bridge the gap. Companies go nutty in squeezes like this and they start setting you performance management objectives like “Boil the North Sea.” Basically so they can make you feel like shit and be more compliant, in downturns they don’t have to try and retain people.

I’d say now is the time to make sure your emergency fund is in good shape, to stop buying consumer shit and other lifestyle accoutrements you can’t afford. Thin out consumer debt in all its forms.

That’s a tough one to do at the same time as girding your loins to carpe diem on the stock market. I was dumbass enough and fearful enough to prioritize cash savings in my ISA in 2009, although I was at least bright enough to half split it with S&S ISA savings. Where I did win bigly2, however, was ramming my pension AVCs in a 100% stock market fund, I was a sub-50 whippersnapper at the time so by definition I was 5 years off from using that, and this sort of logic was compelling. When I see that post appear on Monevator again, I am going to sell gold and buy stocks 😉

OTOH I can’t be too hard on my getting on for ten year’s younger self. He was not to foreknow that I would be able to hold on to that job for another three years of massive savings, so prioritising cash savings first was perhaps not so daft. I did not have the classic six month’s salary in reserve, because I was doing something else that was tremendously dumb in hindsight.

Don’t pay down your mortgage. Have resources to do that instead

I accelerated paying down my mortgage, I wanted to bust its ass before I left work early. I wasn’t actually in that bad a position – I bought my first house in 1989, which meant I was on course to clear the mortgage 25 years later, which works out to 2014, so I had five years to run. I was slightly ahead, but I switched resources to paying that down. It was a flexible mortgage, it worked like an offset, but one where you can draw back the overpayment. I was daft enough to clear the bugger around 2010. FFS I even comprehended Monevator’s concept of using it as an investment tool, and wrote this tripe about paying it off.

I could have invested in 2008 and made a mint, and indeed could have had 11 years more use of this cash, currently at rock-bottom rates. But I don’t have his edge and ambition, and in the end I wanted my house to be truly mine.

Berk. In all fairness, I was frightened of getting canned, and fearful people do stupid things. Don’t get me wrong, I am all for canning debt where you can. Get an offset mortgage or a flexible one like mine, and ram the bugger down to the minimum amount if you can, while you are working.

In my case the minimum was £1000 when I asked them. Anyway, FFS don’t pay the damn thing off, and above all else, don’t pay it off before you are 55. Why 55 – that’s when you can draw from a SIPP, and one of the best ways of paying off your mortgage is with a little bit of help from HMRC 3, using your pension commencement lump sum. Consider paying into your pension what you would be paying down on your mortgage. Keep it in cash in your SIPP, if you must.

The second win from carrying the mortgage is that no blighter will lend money to someone without an income. Seriously, the retired ermine was a much better risk than the employed Ermine – I had several years erstwhile gross salary in the ISA, I had SIPP pension savings that would be available in a few years, and it all counted for aught. If you put income of 0 on any application to borrow money or even on a credit card application, they immediately think you are living under the railway arches, because no ordinary punter in Britain has capital assets, they all live paycheque to paycheque, and having more month than money is the only reason people borrow.

The only capital asset some punters have is a house, and a mortgage is a loan against that asset. Keep the facility of that loan, because it allows you to smooth your income, particularly early FIRE folk before 55. But do it in a cost effective way – run the minimum balance if you can. And do bear in mind you need other cash savings, because under times of economic stress, finance institutions can revoke the terms of a flexible mortgage.

So I’ve nailed my colours to the mast of serious incoming ahoy – after all, the best pundits predict about 200% of the real recessions that happened, because the bear case always sounds smarter. I may look like a serious tosspot this time next year when the FTSE100 is up at 9000, you can have a larf then!

- Charges, Access, Terms minimum standards, fees max 1% pa. This was meant to be good value, and it was, compared to the rogering punters got from the City of London back in the day before 2000. I guess RIT wouldn’t be that impressed by an OCF of 1% p.a on a FTSE all-share fund nowadays. The past is a different country. ↩

- What can I say, it’s the time of of the Donald and resistance to populist simplicity is futile, the will of the people™ must be respected, init? ↩

- Ayn Randian types would say that’s without hindrance from HMRC rather than with help from them, anyway, the point is you pay down some of your mortgage from pre-tax income. ↩

Good advice, and I’m awaiting the long-promised stock market rout. In retrospect perhaps it was a bit daft to start changing jobs with Who-The-Hell-Knows-What-It-Means-Brexit in the works, but it’s too late for regrets now.

Strangely, for some reason central bankers keep insisting that exonomic fundamentals remain strong.

I’m less worried about China now than I was 2 years ago. First, we’ll never know the real state of their economy because the lie about their numbers and have done for years. And second, they’re a much more centralised and controlled economy than what we have in the West, which means they have some levers to pull that we don’t.

So then it’s just the US and Europe. The US will be fine for another couple of years, and Europe is unlikely to get worse than it is now. This bullshit that Apple are spouting about global slowdown… is bullshit. The real problem is that they have reached the ceiling of their pricing, even people in rich countries can’t afford their stuff anymore, and their competition have figured out how to make stuff that’s almost the same and much cheaper. But of course “adverse trading enfironment” sounds better on the quarterly satement than “we’re getting buggered by our competition” 😉

LikeLike

central bankers and their economic strong fundamentals, hmm, I’m with Mandy Rice-Davies on that. I’m also kinda tickled by the fondness for planned economies, though I know what you mean 😉

Apple are piss-taking bastards and the sooner they go the way of Nokia the better IMO. I’ve had that view ever since I tried first came across a Mac in the 1980s with the prissy shutdown by dragging all my shit into the trashcan icon and the poncey little bomb icon when it all goes titsup, cos it’s obviously more important to draw a bomb than to actually waste CPU cycles trying to save my sorry ass. And seriously, £1000 for a mobile phone? WTAF? No wonder there are scrotes on mopeds trying to relive the punters of their expensive clobber while they surrender their situational awareness to facetweeting their last meal. You absolutely couldn’t make that up.

LikeLiked by 1 person

I’ve been waiting for a rout but can’t say I feel totally comfortable with it, despite the fact that it’s far better for it to happen now, rther than a couple of years before/after I pull the FIRE trigger. Keep calm and carry on investing is what I’ll be doing anyway.

LikeLiked by 1 person

Happy New Year Ermine, thank you for another timely and insightful post. Interested to know why you are so hard on yourself “I was dumbass enough and fearful enough to prioritize cash savings in my ISA in 2009”, with the benefit of hindsight we’d all make perfect decisions. I imagine at the time having seen equities take a hiding in recent years, it was natural to fear that further falls were likely. I face the exact opposite at the mo, so much talk of equities being close to a major adjustment but money that I want to put to work. Having just started, do I hold in cash for now within ISA and AVC pending a potential fall and take a short term inflation loss or invest now and try not to look at it for 20 years….. any thoughts would be appreciated.

LikeLike

If you’re at a loss then the strategy my younger self took isn’t a bad one. Half split it – bet on both sides. That way your older self only gets to kick half your current self’s ass 😉 There are practical advantages you have with ISAs these days that I didn’t have then – get a flexible ISA, keep your cash in an offset mortgage account, pay from that into flexible ISA in March, next month end April draw it pack out and reduce your mortgage interest if you don’t feel there are investment opportunities ahoy. You can put it back into the ISA and make use to TY 19/20’s £20k allowance if you do want to invest. Rinse and repeat with some of the cash the next year if I turn out to be wrong and the stock market doesn’t take a tumble. Still mulling over whether I should do that with the 20k I took out of my Charles Stanley ISA, thankfully before the falls, or whether I should take the line that the 20k allowance is good enough for a non-earning Ermine. The ISA allowance used to be a lot smaller, in real terms.

LikeLike

Typical of my timing to chuck 12k into mortgage overpayments just yesterday, i think it’s too late to stop that bank transfer

Foxymoney recently wrote a good article which demonstrates why a falling stock market can be good for those (us?) young’ns – https://www.foxymonkey.com/stock-market-crash-good/

Very interesting results from the thought experiment and a far greater difference in eventual returns than I would have guessed.

LikeLiked by 1 person

It’s pretty clear why a falling market is good for young’uns, as Monevator said, stocks are on sale. Foxymonkey’s last example is funny but that’s the sort of person who shouldn’t go anywhere near the stock market. The other two, well, I fear that Alice is the canonical example of why market timing works if you get it right. Buying into a suckout at the start is a good way to get that right, because the future expected value of those stocks and their income stream is higher.

As dearieme says, some of these calls depend on where you are in your lifecycle when the opportunity presents itself, and you parents had more control over than than you did. So I end up bitching all the time about UK housing, because I presented myself to a market at an all time high. And I end up cheering the stock market, because I presented myself to it at the peak of my earning capacity in 2009.

For the sake of clarity – I’m absolutely behind you in that mortgage repayment – if your mortgage is flexible. Where I went wrong is ringing up Birmingham Midshires where I was carrying about £1000 residual and paying ~£150 a year for the privilege of up to about £50k HELOC, and saying no, I don’t need that, I want to redeem this account and have the deeds to the house. Paying it right down to the bone is always a good thing, it was paying it off when I was standing next to a stock market on its knees and Monevator hollering from the rooftops why aren’t y’all buying, you lily-livered punks* that was the serious bed judgment call, of an, ahem, lily-livered punk fearful of being flattened out of my job in the next few months. Had that happened, that mortage could have saved my ass – make a withdrawal up to the amount I would have paid off, giving me £50k in the bank. The pay the mortgage repayments steadily at @500 p.cm from the bank, giving me thinking and breathing time. As it was that didn’t happen, but it wasn’t my talented money manamegement that saved the day, just sheer luck.

* To save Monevator giving me the formal bollocking, of course, he said no such thing, his disclaimer makes that clear

But hell, I’m going to do the Galileo ‘and yet it moves’. Buy, you lily livered punks, or forever eschew the stock market because you have ‘nads of Swiss cheese is what he meant. IMO of course 😉

LikeLike

You offer sage advice on the paying down the mortgage front. When fear and pride combine, it makes for some doubly daft financial decisions, that is for sure!

Mixed feelings about a stock market stink. The global market had appeared like it needed some air let out of the tyres for a while now (by historic measures). However a post-Brexit reversion to hunter-gatherer lifestyles that some doomsayers predict may mean it doesn’t bounce here like it probably would elsewhere. Interesting times!

Personally I’ll continue steadily drip feeding into the global markets (while stocking up on canned goods and shotgun shells). I’ll also redraw against some of that mortgage flexibility to capitalise on a major market wobble.

LikeLiked by 1 person

> However a post-Brexit reversion to hunter-gatherer lifestyles that some doomsayers predict may mean it doesn’t bounce here like it probably would elsewhere.

I’m too old to want to run on ammo and beans, if there be zombies roaming the streets I am stuffed and they’ll eat my brains. I am not so sure that it will be as hellacious as all that.

LikeLike

Already loads of zombies walking the streets… but their attention is glued to social media on their smartphone screens, so your brains are probably safe!

LikeLiked by 1 person

You should be fine so long as you stick to the rules and avoid public loos.

LikeLike

OK, OK I admit it. We went to extraordinary effort to pay off our mortgage in the 80s – but interest rates were north of 15% at the time. At least we got the dam’ thing out of the way with time left to save.

Real estate has such emotional baggage attached to it that one can never be rational about it. Ignore it as part of your financial planning, don’t let it screw you, collect your imputed rent and move on.

LikeLike

Ah, I remember those 15% interest rates – the year after I bought that first house. Faced with that sort of usury paying the sucker off PDQ ir pretty much the only way to go, so well done for effective action in the face of adversity!

LikeLike

I agree; a flexible mortgage is a desirable item.

Another thing to bear in mind is that the returns you will get are quite likely to depend on your birthday. Meaning your date of birth. For example anyone born in the late forties might have become interested in investing, and first had some spare cash, in the middle eighties. So he starts buying shares and, especially if he had had the gumption to ignore the little contretemps in ’87, he could have ridden the bull market right up to its daft bubble peak at around the end of ’99. Then he sells shares and buys gilts – which were very decent value then. Bingo; he’ll have made enough that he may never again risk most of his capital in the stock markets. Some, perhaps, but not most. There would have been little harm if he’d sold a year early. The thing not to do was to hang on for two or three years too long.

The point is that people born in some other year might never in their investing lifetime get as good an opportunity. The opportunity was just luck. Seizing it wasn’t luck, or at least not all luck. At the very least you’d have needed to have developed a healthy scepticism about the buy-and-hold religion, the market-timers-will-rot-in-hell religion, the all-equities-all-the-time religion.

Retirement is so expensive that anyone without a good DB pension is going to have to take stock market risk. But risk is risky, so he’s also got to be prepared to use market timing, especially as he gets closer to his hoped-for retirement date.

LikeLiked by 1 person

Agreed – lifecycle timing is why I moan endlessly about the housing market on here, whereas everybody else thinks UK res property = money tree. I showed up in the housing market at a really bad time, although I compounded it with some epic bad muppetry of my own.

The 2006 changes and the Osborne changes making drawdown possible means that many people aren’t aware of the need ot change their risk profile as they get close to retirement. I shifted more to cash an gold, partly because I was pissed off with the high market valuations, partly because of Brexit fears, and partly because I need some of the cash ahead of drawing my DB pension. I was lucky to start in 2009, and I was lucky to derisk in 2018 for those technical reasons specific to me. A highly valued stock market made that derisking less painful, though.

LikeLike

As noted the bear story is always more compelling and those telling it are more likely to be wrong than not.

Fortunately, people planning for a future financial independence don’t have to worry about their own (or someone else’s) ability to read the tea leaves. Why? Because their actions should be broadly the same regardless; try and push the savings rate, reduce outgoings, diversify, keep debt down etc. etc.

I like the arguments about whether it’s better to put savings in the mortgage or the SIPP. It’s worth considering that if you (a) are saving and (b) considering what’s best for those savings you’re ahead of most of your peers. It’s an argument about what colour icing to have on top of the cake.

LikeLike

I broadly agree with you that the first parts of getting to FI aren’t dependent on the tea leaves. If you spend more than you earn, buy McMansions, remortgage the term and take out a HELOC each time you go up the housing ladder then you are hosed, sure.

But once you’ve got past the necessary elements into the second-order stuff, you’re gonna have to take some judgement calls. I hadn’t saved enough to take eight years off by the time I had retired. I was boosted by the stock market, and most of the boost was timing. True, the timing wasn’t entirely my call, it was the GFC that accelerated my job going bad, and the GFC hammered the stock market that gave me the boost to get away with that chance.

LikeLike

Hi there, first time poster. I’ve really enjoyed reading your blog from start to finish over the Christmas period. I would have liked to have done this real time, but it was fun remembering events you referred to that happened over the last few years.

I’m similar to you in a lot of ways. I am in my early forties and am starting to be very disillusioned with the cold corporate world. I want out. Unfortunately I largely missed the bull run of the last few years because I was overpaying my low rate mortgage! I’m a bit cautious like that. I found MMM just over a year ago and have since had the courage to start to invest.

There is so much to learn and so much uncertainty to worry about too. I’m doing what I can but with company pension access age creeping up towards 60 it’s not going to be easy to get out in my forties. I’ll just keep going.

Thanks again for the insight in here.

LikeLiked by 1 person

Welcome on board – glad the cautionary tale was enjoyable 😉

Re the mortgage. There’s now’t wrong with overpaying a mortgage, but get the bugger on flexible terms if you can. Offset if good, flexible is good. Just make sure you don’t bank with the the same company as the offset/flex mortgage company or affiliated company. Because: setting off.

Secondly, not investing is only an opportunity cost – what is worse and you must must must not do is invest above your risk tolerance, because people like that sell into bear markets. See above, 2003. As it was, I was only investing from earnings and at a relatively low level, so the training was a good investment in the long run. It appears very few people learn form that sort of cock-up, however.

> company? pension access age creeping up

That’s why you save in your ISA for your running costs pre 55 or whatever pension access age applies to you, and pensions for post 55. You aim to run that ISA flat just before the pension access age. However, creative use of your mortgage to carry a higher pre pension age debt (offset by pension savings) lets you defer some of that pre pension ISA spending needs, because pension savings are usually more tax-efficient, particularly for higher rate taxpayers.

If you are lucky enough to have a company pension, then although they can shift the normal retirement age (NRA), accrual to date is grandfathered to the original retirement date.

LikeLike

Thanks for the reply. I paid off my mortgage in full a couple of years back before early retirement was a thing I even knew was achievable. As a result I was in a situation where the vast majority of my net worth was tied up in my home and my age restricted company pension. So I was effectively starting from scratch with ISA’s. Obviously not a great position for an early retiree wannabe! Thankfully I avoided lifestyle inflation at this point and in my favour I have an 80%+ savings rate having spent around £10,000 last year. I’m also considering moving in the future (from south east) to take some cash out of my home and into investments to live on.

Thanks for the warnings on risk. I’m fully bought into the global passive investing approach so I’m confident I won’t sell and am in for the long haul. It is a tricky balancing act knowing how to split the pension/ISA ratio. I’m around 50:50 here.

I thought my pension age was 58, but thanks I’ll take a look into that. That would impact my pension/ISA split. It’s all very exciting, but daunting as well.

LikeLiked by 1 person

If your company pension has a specific age restriction > the date you can take a DC pension (currently 55) then you could front run a SIPP into the ground ahead of it. I am doing exactly that in front of my DB pension.

You could always take out a mortgage on the new house, while you are still employed, to free up some pre-access-to-pensions capital. Or even on your current one 😉 I spotted this mortgage is a flexible loan gotcha too late, so it wasn’t an option for me.

LikeLike

Sorry it is a DC pension that I have. Yes I would have to think about a mortgage. I do like being debt free. The simplicity and psychological aspect of this has been extremely positive for me although I understand the downside of the approach now looking back. I’m mainly concentrating on savings rate and understanding future expenses as my focus at the moment. Looking forward to learning more.

LikeLike

“buy into the suckout when it comes. Could be as easy as buy regularly every month if we can get the FTSE100 down to 4500”

That’s just bearp*rn (which isn’t a phrase to google). Shame on you.

If you want clickbait I would suggest sticking to acerbic reviews of the readers case studies in the personal finance sections of the Daily Telegraph or Sunday Times

LikeLiked by 1 person

Aw c’mon. Hyperbole, yes. Though I like the turn of phrase, I’ll get me coat and get onto zero hedge.

LikeLiked by 1 person

“Hyperbole, yes” Or not, as the case may be. People may end up longing for the FTSE to bubble up to 4500. There’s just no knowing.

LikeLike

Hey Ermine – I think I might be your target audience in some ways, but then not in others. My mortgage is only 1.5% why on earth would I pay it off? However I didn’t have the money to invest in the previous recessions, so this is my first time seeing my portfolio going down………and I want to see if I can stick to the plan. Like everyone, I think I can do it, but in reality? Only time will tell!

LikeLike

I’s guess you have a little way to go age-wise to get to the danger point where I screwed up. People with an FI mentality don’t like debt, and as you get older, you will have more accumulated equity and in many cases your earning power will have risen. There’s a strong temptation to overpay the mortgage, and in my case, as my career was going down the pan, to pay it off, to be secure from the wolf at the door. I was late 40s on paying it off, so six years away from accessing pension savings.

The best way of paying off a mortgage in times of low interest rates is using money that has gone through your pension, which by definition precludes paying it off pre 55. You are quite right with

> My mortgage is only 1.5% why on earth would I pay it off?

but look at what my fearful younger self did. I was paying less than £10 a month for a loan facility that would have carried me to the time when I can draw a pension, and would have let me invest at a time when stock markets were at low valuations. And I went pfft – I don’t need this. D’oh

Things may be different when you get to this point – low interest rates may be a thing of the past, after all, I paid a 15% rate at one point. Ray was perfectly rational in making a massive effort to can his in the late 1980s, in a way I wasn’t making an effort to pay mine off in 2008-9.

LikeLike

I’m currently holding a fully offset interest only mortgage ( at 2%) with about 15 years to run. This means I have just over 100k of “available cheap money” for investment opportunities. With the benefit of hindsight I should have previously drawn on this cheap loan for investing but I liked the security of effectively having cleared the mortgage. I won’t be settling the mortgage account as it continues to offer cheap money. I’m presently on a personal savings rate of about 80% but continuing to work ( for a couple of years ). All excess wages are being paid into my pension and ISA.

LikeLike

I might add that in addition to paying 15.25% on my mortgage, I was going through a period of employment instability – so it made sense to discharge the mortgage as soon as possible. It’s another world today when it comes to mortgage interest rates.

LikeLike

I overpaid my mortgage to get it down to 60% ltv then fixed it for ten years at 2. 59% in 2016. I’ll pay a bit more than a shorter fix but for me it was worth it to now be able to plow all my money into investments. I contribute high amount to a pension so have this pretty well covered so now need to up my non pension assets. Aiming to retire early 50s with about 600k in a pension and 300k in isas plus a paid off house

LikeLike

A totally useless tip: you could probably have got a FTSE All-Share Tracker for 0.5% in 2001. ISTR that two other managers were offering trackers at that price soon after Virgin’s 1% tracker came out.

I’m not convinced that stock markets are about to go much lower. But the important thing is to have a plan that covers what you’ll do in all market conditions. And then to stick to it. (Also, it needs to not be completely daft! :))

Your example of putting half your savings into cash, half into stock markets, is a clear plan, and better than many plans. For people still earning, it’s going to be about where to direct savings; for those of us not earning any more, it’s about what to do with the capital we already have.

The simplest plan is to hold a fixed percentage of capital in stock markets (rebalancing to get back to the target percentage). But going beyond that, it can make sense to take some more chips off the table when markets have been booming. It’s dependent on life situation; how much do we need more gains on investments, versus how much would losses from here hinder our life plans?

LikeLike

> you could probably have got a FTSE All-Share Tracker for 0.5% in 2001

That’s as maybe, but let’s tell it as it is. The main source of my losses around the turn of the Millennium was being an absolute muppet on timing. Richard Branson running off with an extra 0.5% of my dwindling capital times three years is way down in the noise floor.

LikeLike

Anyone saving for retirement ought to think about how he plans to organise his finances in retirement. My favourite blogger on the subject is Dirk Cotton: here’s a recent post I liked.

http://www.theretirementcafe.com/2018/12/my-year-end-review-and-planning-regime.html

LikeLiked by 1 person

I like his once a year review style. Though seriously, he still has most of his hair. He’s too young to be retired 10 years plus 😉

LikeLike

Well I went similarly old school and went for a 1 year FU fund, then paying off my mortage (twice) before investing anything except any matched pension. However my job was risky as f*** and I was out on my ear for a few months every recession, so je ne regrette rien.

IMO if your job’s risky you probably don’t want to carry so much risk in your savings allocation unless you have ice in your veins. Which I found I most definitely don’t.

LikeLiked by 1 person

Heh heh, two laughs for me in this piece. Your story of a neophyte loose in the world of investing making all the classic mistakes, I suspect almost everyone climbs the same learning curve. I also bought into a tech ISA in about 2000 at the height of the dotcom boom, Aberdeen Tech, when I eventually got rid of it a few years later it was worth around a quarter of the 7k I’d paid for it. The one memory that sticks in my mind is Mark Dampier from HL (through whom I’d bought the ISA) advising in one of their newsletters that since the fund had dropped by 50% it was now a great time to buy back in… Dear old Mark. I already had doubts about his financial nous even then, these days I’d rather saw my arm off with a rusty hacksaw than take his ‘advice’.

The second laugh was your comments on the financial pariah status automatically assigned to anyone who is capital rich and income poor. I needed a credit card a few months ago, and was successively bounced by three banks both here and in Australia for having too low an income. In vain did I point to my net worth, they were not interested. On reflection it signals to me how tightly the banks and broader system fits its walls around people. The great majority of people fall into the ‘average punter’ category so never bump into these walls, and don’t realise how closely they are penned in.

LikeLike

Yep, all my credit cards were taken out while I was still employed, and I have religiously paid at least the minimum on the suckers (where I am stoozing) via DD. The Ermine credit score is great in terms of being a deadbeat borrower and I have a pure white snout going back years. But I was given the bum’s rush by the bank and a card provider and a mortgage broker said forget it mate. I only got the Starling card because it’s not a credit card, so poverty-stricken scum like me sans income could qualify.

As for those average punters? On average the poor devils owe £15k on unsecured debt so presumably excluding mortgages per household. I don’t think I have ever borrowed more than £15k on unsecured debt, and definitely not for services or Things – I may have edged that figure borrowing over the tax year to preserve a flexible ISA allowance, but that borrowing was against the cash in the ISA. But no, it is assumed every man jack needs to borrow because their income is less than their outgoings, rather than for the old cash in silos problem. An Ermine is probably not even good for a mobile phone contract.

Mind you, there’s ice in my mustelid heart for the punters that ran up their credit card balance by £252 to pay for Christmas.

Tell you frickin’ kids that Christmas is cancelled if you must, but don’t go in hock for an entirely elective spend. Just say no to Christmas if you can’t afford it. Previous generations did that and survived, FFS.

> I suspect almost everyone climbs the same learning curve

It’s what you do with the experience that matters 😉 Too many people come away from the experience ‘you can lose money on shares’ inferring the general from the particular, that ‘you will lose money on shares’. So they go along to lose money to inflation instead.

LikeLike

I made a few of the same mistakes as you. I contemplated using as much of my interest only offset mortgage to invest after the market crash of 2008. However, I swore I’d never risk my home for anything and having a fully paid off property enables me to sleep well at night. Also not investing more in my pension AVC’s when I was younger ( and paying higher rate tax ) was a big mistake. However, I’ve hopefully learned from my mistakes. I’m now making maximum pension contributions ( using salary sacrifice ) to bring me to just around the annual tax threshold. I’m lucky that I also have a frozen DB scheme too. I’ll continue working for another few years and hopefully be on track to vastly reduce my hours or quit in 4 years ( at 50)

LikeLike

Sal sac to the tax threshold is neat. Unlike me when I was doing that, you have that offset mortgage to make it a little bit more bearable too. Nicely played, sir 😉

LikeLike

I should have done it a few years ago but we all live and learn. I think the pension team in my former and new employer are getting tired of my many questions but I think I’ve got all my calculations right now.

LikeLike

If this were MSE, Mr Andrews, someone would point out that your pension is not frozen but deferred. Even worse, they’d be right.

LikeLike

Indeed, I’m most concerned that when I can actually get my hands on the pension the provider my have gone bust and chucked me into the PPF for a vastly reduced experience. Thus, I’m continuing to get my annual CETV and evaluating if I should transfer it into a SIPP. The risk worries me though

LikeLike

You bloody UK’ers and your ISAs and SIPPs (we don’t have that, unfortunately!). I’m jealous 😉

What I do have however, is a flexible mortgage. I’m glad to read your insights on NOT paying off your mortgage. I currently pay 0.5% (3-year fixed, flex mortgage) and owe about 75% in my house. I plan to pay off my mortgage til I owe about 50%, but then I actually plan to stop paying it off altogether. At least for a while, and invest the savings instead. If all goes well, I’ll be FI in 12 years time, before I hit 50. By then I can move to a smaller/cheaper house, and hopefully owe below 25%. I don’t see the point in owing 0% on your house, really. That equity can earn a much better interest elsewhere. Not many of my peers understand this though, so I sometime feel like a nutter when I float my plans to my friends/family. Being like everyone else has never really been my life goal anyway 😛

Cheers!

LikeLike

> I’m jealous

Don’t be – there are downsides of the red in tooth and claw Anglo capitalism too. Much of my ISA is now allocated to defend my older self against the Brexit nuts privatizing/destroying the NHS into some US style hellhole just as I may get to the age to need it, whereas Denmark is reasonably safe from US style healthcare.

Certainly for young people, and particularly in the tough years ~25 to 45 where outgoings may include children, I’d say it’s barmy to pay off more than you absolutely have to into a mortgage at current interest rates. Obviously have a plan to pay it down, but preferably investing in something that appreciates faster. We used to have ISA mortgages where you’d save into an ISA and run the mortgage interest-only, but I don’t hear so much about them. Interest-only is lethal in the hands of the British homebuying public, they nonchalantly spend the money they should be setting towards the capital and then act all hurt 25 years later when the lender asks them for the capital at the end of term.

The obvious proviso – interest rates are currently at historic lows. Things could change 15-20 years hence. I paid an average of ~6% p.a. over 20 years

Paying it off entirely makes more sense as you reach typical retirement ages, where your human capital has drifted to zero, servicing a mortgage means you need a higher retirement income. I pay neither rent nor mortgage, though of course the usual issues of a house have some cost. But for early retirees, if you can save towards discharging a low-interest mortgage with tax-privileged (or employer-matched, which seems to be a thing in Denmark) it’ll make the job easier by the value of the employer match/tax bung. But heck, I missed this and/or emotion/fear trumped reason at the time

LikeLike

“the Brexit nuts privatizing/destroying the NHS into some US style hellhole”: yeah, yeah, the bogeyman will get you.

“Privatising the NHS” has been an election Project Fear for at least a generation, and has always turned out to be utter bollocks. I have never met a soul – not one, ever – who wanted to impose the American sickcare shambles on Britain. You might reasonably guess at reform in the direction of France, or Canada, or Australia, or Singapore – but there’s not a cat’s chance in hell of a US non-system being imposed here. Personally I think rational reform is probably impossible unless a political giant comes along who can carry the electorate with him. The NHS will just limp along in line with the remarkable description in the Guardian of its international standing – words to the effect of its doing well on many metrics except saving lives.

LikeLike

I’ve found the Guardian’s remark: “The only serious black mark against the NHS was its poor record on keeping people alive.” I think my paraphrase wasn’t too bad.

LikeLike

I think you really ought to cite the original article rather than a sensational extract.

Life is terminal, and I am sure that the very best of US healthcare is better than the NHS. I’m just not rich enough to be able to afford it. And even that best of US healthcare isn’t going to keep you alive forever any more than the NHS. I’d rather go reasonably quickly when the game is up.

But the creeping privatisation means that I anticipate having to pay to have some elective things sooner, the classic hip replacements and cateract surgery should that lie in my future for example. These make a difference to quality of life, though aren’t life-threatening. I am fortunate enough to have managed to avoid doctors for a long time since childhood.

LikeLike

“creeping privatisation”: you say that, but what is it? If you mean the patient having to pay for things, that started under the very Labour government that set up the NHS. There were cabinet resignations over the issue.

If you mean having to pay for private dentistry, that was wished on me by Mr Blair’s Labour government. If you mean “pay for your own hip, buster”, then I suppose history suggests that some future Labour government might do it. But it seems pretty bloody unlikely to me.

And why do you bang on about the US? I repeat, I’ve never met anyone – sane or mad – who wanted the US system here. It’s just a bogeyman, a hallucination.

LikeLike

The US healthcare system is the bogeyman because it is the canonical example of a free-market healthcare system, and this seems like the direction of travel, the US is the endstation on that line. Presumably they didn’t set out to make something that causes such distress, it’s just what you get when the free market chomps down on people’s desperation and difficult to qualify risks. See education for a similar cautionary tale unfolding.

I am better off than average but not in the 1% which is probably where you can be safe from the excesses of the free market grinding you into the dust. I wouldn’t mind a European style insurance model, but Brexit isn’t about becoming more European any time real soon, and the Brexit headbangers seem to have a fondness for US market values that I just don’t share.

I don’t give a toss about which colour of government makes adverse changes, I am not big enough, rich enough or powerful enough to change what will happen. Demographics will increase the load on the NHS, so the load will be shed somehow, increased waiting times is tried and tested. There’s a bathtub shaped health issues curve in humans and statistically I am more likely to run into the problems as the years go by. I want options, and a degradation of the NHS is a foreseeable hazard. If it doesn’t happen or I don’t need it, that’s not such a terrible thing to happen to me.

LikeLike

An aside on cataract surgery based on the Canadian health insurance system. The plan covers the basics but I paid extra for a more precise corneal assessment, and a pair of aspherical lenses which give better contrast for night driving. Worth the extra. I did not go for the Cadillac lenses that would have eliminated astigmatism and (maybe) allowed me to get away without glasses. At my age, I need glasses for reading so I may as well wear them full time.

LikeLike

” This ain’t anywhere near a rout, yet, but here’s hoping for 2019 mayhem, eh?” Sing it! Would be good for us buying, although the fallout from a big crash is a bit more real with job losses and the rest. But us FIRE folk are dogged if nothing else.

Not to many of us have been tested by a crash, let’s hope we aren’t all woof and no chomp eh. Can’t wait to panic sell and invest heavily in cricket farms or whatever the latest trend is.

LikeLike

“The US healthcare system is the bogeyman because it is the canonical example of a free-market healthcare system”: what an absurd argument. It bears no resemblance to a free-market system. It is dominated by government-sponsored monopolies, restraints on trade, failures to apply anti-trust and consumer-protection laws, tax exemptions, abuses of trade union power, and general corrupt cronyism.

One of its worst features – tying medical insurance to employment – emerged during and after WWII as a way of avoiding pay controls imposed by the federal government. There’s not much free-market about that.

LikeLike

I think prioritising investment over paying off the mortgage is too clever by half. It looks good with the benefit of hindsight after a long bull run. Imagine most people who are trapped in the grind of paying off a big mortgage with a mediocre income. If the investments go wrong they will be cursing themselves for the extra years of stressful drudgery they have condemned themselves too by gambling. Humans feel disproportionate pain for losses made vs the elation for gains made.

LikeLike

Although I’ve probably pushed the investment case in the comments, and you have a fair point, it’s only the extreme early retirees or Monevators of this world that applies to. I did screw up in the second case where a mortgage helps. The mortgage is valuable liquidity in those tough years pre-55 where you can’t get hold of your pension savings. In the post I said

and I lived this cock-up. I took a massive income suckout from going from a professional wage to now’t but cash savings (because I was also too fearful to draw from the ISA) across four years from retiring until I could get hold of pension savings. As it happened those pension savings were invested and they did take a lift, but they did no good to me in that intercession. Had I not paid off the mortgage I could have drawn down from the mortgage through those years. No investment necessary, for a few years you can live with holding the savings into a SIPP in cash. It’s over gaps of > 5 years that you tend to take a hit from inflation at current rates.

LikeLike

Pretty insightful as always ermine. Can’t wait for the panic selling, red-sky doom, and inevitable crash. Though time in the market is more important than market timing eh? 🙂

The mortgage one is not so black and white for me. I’m fortunate enough to be clear at 35, and the extra income, safety, not having to worry about a roof over my head etc., I find valuable. If not fiscally valuable, mentally valuable. By the numbers you are obviously right, but life isn’t just about numbers.

The danger is only clearing the mortgage and not utilizing tax friendly options like pensions. I salary sacrifice into my pension heavily, for the immediate 40% win. Heavy into pension & clearing off the mortgage has felt like the right thing. Time will tell. Either way I’ve now got an extra grand and a bit a month to invest, and £30K saved mortgage interest over the next ~20 years, by clearing early. And if the job blows up in Brexit red-skies, somewhere that’s mine not the banks.

-MM

LikeLiked by 1 person

The case I’m making is to bring the mortgage to a minimum, but retaining the facility. Particularly across the retire earlier than 55 to getting to 55 suckout. A mortgage ramped up but secured against a sum held in a pension is a different thing from a ramped up mortgage to have too many kids/holidays/whatever a la Shona Sibary.

But if you earn enough to be able to max the £40k pension AA and pay down your mortgage then for sure, zero risk beats minimised risk.

BTW you might want to change

on this page – I think you mean £40,000 🙂

LikeLike

Thanks for the heads up on the typo ermine, you have been at it longer than I so have a keener eye! Appreciated and fixed!

I think your view about retaining the facility is a good one, and one I haven’t really considered if I am honest.

For the now, the mortgage is gone. It’s something I can always take out again if I need to unlock some equity.

LikeLike

That typo was also on your invite to the subscription, so I figured you’d prefer to nail the sucker. Interesting observation, that one about so many people slipping underwater!

> It’s something I can always take out again if I need to unlock some equity.

I believe you are still working, so this may well be true. But absolutely do not make that assumption as an early retiree, it’s why I bang on about this. Pretty much all a mortgage lender seems to qualify whether to lend to you is your income. If you cross the RE event horizon, your income is impossible for them to qualify and you become a liar loan. What is the income on an equity holding? Where’s the payslip?

I moved as a RE a year or so ago, and since it was sort of a move across country I did not want to buy and sell on the same day. fair enough I thought, I own the old place outright, sans mortgage. Went to a mortgage broker and they pretty much said no way, bud. But I have enough capital to float both places, I am a better risk than Joe and Josephine Public, after all at least I am worth the money and I have a pension coming at 60-ish.

Nope, Computer sez no. We can’t do that, Sir.

If I hadn’t cleared that mortgage as my fearful about to retire early self, I’d have rolled it back up again to the original track, stumped up the difference and job done. As it was I had to float both houses and pay over the odds SDLT as if I were a vile Buy To Letter rapaciously stamping down putative first time buyers, though I got to claim it back a few months later because I wasn’t in fact oppressing FTBers.

You’re an absolute pariah as far as lenders are concerned if you have no income even if you have capital locked up somewhere, or indeed you are living off a capital lump sum. This is not a problem for you at the moment. But take your mortgage out while you can still show an income if you envisage needing to borrow money against cashflow issues particularly before you can spring your pension. You’re not getting one afterwards 😉

LikeLike

I am indeed still in hell-work. Though this does mean it’s still a possibility to remortgage if we need. But you are spot on as always ermine – the tending to 0% chance of getting a remortgage after RE is true.

I am hoping to make some positive use of the extra cash in hand without seeing £14K net go out the door on a mortgage over the coming few years before considering RE anyway.

Pariah, you are completely right – I have family who not RE, but unable to get a mortgage because of similar income proof. They are working but as directors of a small firm with sporadic income and it totally spooks the brokers and mortgage providers. RE with no income proof will be as you say, Computer sez no.

LikeLike

> typo

Oops, it’s still there on the popup box that invites to the mainchimp thing on your site. Could be a cache thing, but I see the correction on About. Thought you might want to know as you probably don’t get to see that popup box as owner 😉

LikeLike