Regardless of your views on Brexit’s ultimate desirability or not, it’s likely to bring choppy waters to the UK in the near future. You’ve heard quite enough of Remainers saying that, but the view is shared by some Brexiters. Take a random look at LeaveHQ’s content After all, Britain is about to set up a new startup called UK PLC in the world, and we have good people like Liam Fox and Boris Johnson at the helm, what on earth could go wrong…? In my youth the British elite seemed to be able to screen for competence and eliminate buffoons like BoJo and fops like Fox, but clearly this process has broken down. There’s nothing wrong with saying that Brexit is a tough job with notable risks, let’s spit on our hands and get to work to maximise the utility and minimise the costs. But that’s not what’s being done. The ruling party is a house divided, and so it doesn’t know what Brexit means. Other than Brexit, and I think we all got that over a year ago.

After all, Britain is about to set up a new startup called UK PLC in the world, and we have good people like Liam Fox and Boris Johnson at the helm, what on earth could go wrong…? In my youth the British elite seemed to be able to screen for competence and eliminate buffoons like BoJo and fops like Fox, but clearly this process has broken down. There’s nothing wrong with saying that Brexit is a tough job with notable risks, let’s spit on our hands and get to work to maximise the utility and minimise the costs. But that’s not what’s being done. The ruling party is a house divided, and so it doesn’t know what Brexit means. Other than Brexit, and I think we all got that over a year ago.

What we do know is that Brexit will be a point of change, the nature and type of change is uncertain, but in the short term will not be increased trade, the date is reasonably set though subject to late-stage fudging. There will be threats and opportunities to be had. It’s worth considering these ahead of time. I’ve already done an investing for Brexit post, but the inflation of the stock market since then makes the stock market more dangerous.

The boy scouts bit

It’s reasonable to expect shit to go down on the transition. There are some obvious things to do – stockpile water, bogroll, tins, dry carbs and motor fuel (outside the house and in approved fuel cans, people!). The Ermine is fortunate enough not to consume medication, but if you need this then having some advance supply would be wise, and do all this before Christmas, because the history of the world shows that if you are going to panic, then panic early or not at all.

I would hope Brexit would be a transient supply chain disturbance issue, but let’s face it, the government seems to be ill-prepared for some of the obvious interruptions to local trade. If you want to get more into this then UK Preppers are your friend. I’m not sure I want to live in their world for more than a couple of weeks…

Personal Finance – threats and opportunities

One of the great things about Brexit is that it is a planned and a local shitstorm. You don’t normally get advance warning about financial challenges, and nor do you usually get a massive store of assets that are definitely not involved with the crisis. Brexit isn’t going to threaten the world economy. The Brexiter Peter North was offering us a ten-year recession.

Britain is about to become a much more expensive pace to live. It will cause a spike in crime. […] Basically it will wipe out the cosseted lower middle class and remind them that they are just as dispensable as the rest of us.

The Ermine has already dealt with some of the threats, before the vote, by shifting into global assets and gold. There are other aspects of derisking:

I owe nobody any money, other than the credit card which is paid off each month. This is a big win in times of trouble, and I am probably not exposed to the jobs market1

I have ramped down my allocation to equity markets over the last year, not to do with Brexit, but to do with overvaluation. Tragically that increases my exposure to Brexit induced devaluation.

I was going to draw my DB pension early, but I can’t think of anything I really want to invest in at the moment, so I run down cash, indirectly buying more annuity. Everyone else lucky enough to have a DB pension seems to be asking how much the CETV is. I wish I knew what asset class promising a good future income stream they were going to invest it in!2

I made several mistakes shortly after the vote, and several wins around it too, but overall I experienced a very significant numerical win from Brexit in my equity holdings. One of the problems now is that stocks are on very high valuations worldwide, buying equities anew is not so attractive. Monevator made a good move with the Brexit dividend, buying his flat with it, so he is less exposed to the overvalued stock market to the tune of one London flat3

the threats are more important to me than the gains

If Brexit is an economic success and I adopted a brace for impact position, then I look a bit stupid, but I get to live in a country that is doing well, though I’ve lost money on my ISA I have gained it in the future income stream of my pension. That’s a win as far as I am concerned, apart from the hurt to my pride in being wrong. I’ve had a lifetime of practice in being wrong, it’s no big deal. You Brexiters can have a jolly good laugh at my expense. I’m big enough to take the ribbing for my lack of faith in Bulldog Blighty.

If Brexit leads to a 10 year recession, that’s at least a third of my life blighted by that from now on, and my globalised ISA becomes a larger proportion of my future assets/income stream. Just to add spice to the mix, the stock market is at very high valuations. I hold two years worth of cash expenses because that’s how long I have to reach the age to draw my pension without penalty.

I hold most of last year’s ISA contribution in cash in my ISA, and may do the same with this year, because there may be opportunities in Brexit to buy UK assets cheaply in the turmoil. This is hard to execute because you never catch the low-water mark, so you buy stuff, then see it plunge 20% and have to be prepared to take the chance of buying similar assets and holding the trash you already have. While all the time you have this horrible screaming noise in your ears from the media telling you all is lost. What I need is for Monevator to do this again, at a suitable point, to stiffen the spine in April 2019. Let’s look on the bright side, it’ll be a new ISA year…

I already hold a lot of gold in ETF form. Rather foolishly I hold it in my ISA. In general you should hold gold outside an ISA, since it pays no dividend. Should the price appreciate to approach the capital gains limit, then sell the ETF and buy another gold etf. I hold SGLP, I could sell that and buy say PHGP at the same time, crystallise the capital gain but stay exposed to the same asset class. As long as there’s not a flash hike in the gold price in the 10 minutes between transactions I am OK. However, given it is in the ISA, the gold gives me some more working capital, if I have the balls to sell it and buy pounded-down UK stock indices.

Repositioning myself for Brexit

Cash and gold represent about 12% and 9% of my ISA. A lot of the shares part is sky-high, and fortunately a lot was bought before this time two years ago. The cash, however, is bad news, it’s GBP.

What can I do with it to get it out of the country?

- Buy foreign currency

- Spreadbet foreign currency

- buy global government bonds

- buy gold

- buy world equities

- buy world equities hedged to GBP

5 and 6 aren’t attractive, because I feel equities are overvalued now. I already hold a lot of VWRL and IGWD anyway. 4 isn’t that attractive either, because I hold a lot of gold ETFs from the first round of this Brexit aggravation in 2016.

1 and 2 are difficult for me because I want to do this in my ISA, the cash is already in the ISA. I could take it out and try and put it back in, unfortunately the Brexit date 29th March 2019 is very awkwardly close to the turn of the tax year (5th April), it’s possible that the financial system will seize up. It did after the original Brexit vote so it is likely to do so again4. They’re a possibility for next year’s ISA contribution, I guess.

For this year’s ISA, one obvious thing to do is to buy bonds. They are supposed to be the yin of the equity yang. Not so much corporate bonds, which seem to vary with equities these days. I’m already jumpy that the stock market is overvalued, so it’s government bonds I want. I know absolutely nothing about bonds, never been interested because my defined benefit pension has always been more fixed income than I would ever need for a notional 60:40 equities:bonds balanced portfolio for someone of my age and risk tolerance. There was an interesting thread on Monevator about bonds, but I am not sure I understand it well enough. The pointers seems to be to use currency hedged bond funds, which make great sense except for a guy who is explicitly looking for safety against the pound going down the toilet, I don’t want to hedge to the GBP. I read youngFIGuy’s piece on how he invests but it’s for the long term, and I am trynig to forestall a particular short term adversity. Here’s Lars Kroijer on Monevator taling about government bonds. He says:

If your base currency has government bonds of the highest credit quality (£, $, €) then those should be your choice as the minimal risk asset.

Err, no, Lars. With all due respect, not £. The last UK government took the piss having the referendum to alleviate a cat-fight in the Tory party. Not only did that shit on my future to feed tossers like Jacob Rees-Mogg, but the entire prosecution of the process of leaving the EU has been dominated by internecine fighting and precious little effective progress. I’d rather live in the UK than say Uganda, but I don’t view the £ as having the highest stability at all. So the last thing I want is UK government bonds for this particular job. That’s a no to YoungFiGuy’s VGOV, although that is fine for his purposes. Given that premise that UK government bonds may be risk-free in one way, but track the fail I am trying to hedge, Lars carries on

If your base currency does not offer minimal risk alternatives, you have the choice of lower-rated domestic bonds where you take a credit risk, or higher-rated foreign ones where you take a currency risk. Keep in mind that any domestic default would probably happen at the same time as other problems in your portfolio, and your domestic currency would probably devalue. That would render foreign currency denominated bonds worth more in local currency terms.

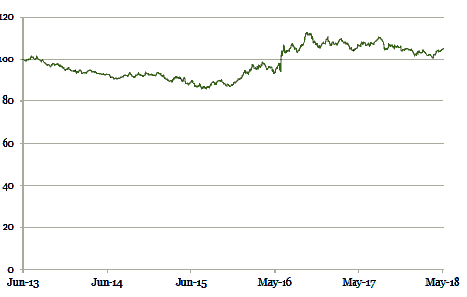

Exactly. in his next paragraph, it’s basically short-term foreign bonds i want. But looking at, say this US bond, I see shocking volatility. And given it’s only a year, I am chuffed to discover currency ETFs – a class of thing I didn’t even know existed. Let’s take a look at SGBB

The ETFS Bearish GBP vs G10 Currency Basket (SGBB) is designed to provide investors with a short exposure to the British Pound relative to a basket of G10 currencies by tracking the Diversified GBP Short Basket Index (GBP) (TR) (the “Index”).

Thank you for waiting, it looks like the company may be a derivative and if that is the case we won’t be able to offer it. We will need to do some further checks for the company which can take up to 2 working days.

Blimey. Well that’s pissed on that idea then. I didn’t think ETFS securities was such a bunch of dodgy geezers, but it seems they are viewed with suspicion5. Hargreaves Lansdown do this one but disturbingly they say the ongoing charge is 1.24%. I suppose I could do it in my SIPP with them. I pay £24 on the turn, couldn’t work out if I get to pay the 0.5% Stamp duty on this.

Surely the market has priced Brexit in

and will do a great big meh on the day? I’m not sure the market has priced the stupendous incompetence that could be displayed, the danger of a no deal Brexit seems to be mounting. Some of the trend to no deal comes from the bad faith of the likes of Rees-Mogg and the shadowy European Research Group, the quality of whose thought is to be seen here. These are cakeists6, and I’m not personally convinced that Britain has such a compelling offer. Leo Varadkar has a point when he said

“We are two years telling people that it can’t be cherry-picking, it can’t be cake and eat it, so it [the white paper] needs to understand we are a union of 27 member states, 500 million people.

We have laws and rules and principles and they can’t be changed for any one country, even a country like Britain. Any relationship in the future between the EU and UK isn’t going to be one of absolute equals.”

The ERG hasn’t got that yet, to wit:

Which is why we are writing to reassure you of our continued, strong backing for the clear vision of an internationally-engaged, free-trading, global Britain which you laid out at Lancaster House.

That’s the internationally-engaged Britain that has just told the 450 million strong nearest trading partners to f*ck right off. I’m not convinced a no deal Brexit is priced in by the market at all. I’m prepared to lose money if we do better than that and there’s a stonking rise in the £.

Obviously it may all be a grand game of chicken, but I’d say that the EU can do without the UK better than t’other way round, and it’s pretty obvious that there will be less UK trade with the EU when we are outside the EU than before. That’s fine, may be a price well worth paying to cut ourselves adrift from these moribund losers as some would see it. We don’t have to be members of the EU to trade with it, other countries seem to manage. But there does have to be some sort of agreement. At the moment it’s we want to have our cake and eat it, or we’ll walk away. Looks like walk away it is, then. That’s not in the price at all, IMO.

- probably is because at the moment my deferred DB pension is easily enough to live on, so my ISA holdings and residual SIPP give some buffer. But it is possible to imagine inflation and taxes rising so I struggle, in which case I am stuffed. I am not going to do engineering again after five years out of the field, I am not entrepreneurial by nature and I am too old. ↩

- OK, I know the answer. The asset class is BTL residential property, FTW! ↩

- He’s of course now exposed to a differently overvalued asset class, London property, but given it’s his first purchase and he wants to live in London, the utility value is high, and if it’s the Brexit dividend then it’s free money anyway… ↩

- that could mean that for all this fine talk I will be unable to take advantage of any Brexit opportunities, squeezed out by all the shares selling going on in the market jamming retail websites. ↩

- iWeb has since rung me up to confirm, this is considered a derivative and therefore not available to retail investors on their platform. It is news to be that not all listed shares are considered tradable. Need to sit down and think about this, because perhaps this red flag is there for a reason and ETFS really are dodgy geezers. ↩

- they want to have their cake and eat it ↩

I am sure Canadians would be happy if the UK brought back the Commonwealth. Talking trade with even your dodgiest politicians would be a walk in the park compared with our major trading partner who is led by someone totally unhinged.

LikeLiked by 1 person

I don’t think there will be no deal.

The EU has a deal worked out and the UK will just accept it because any plan beats no plan.

And the UK government has no plan that will be acceptable to itself or the EU.

The UK government will fold and meekly accept whatever the EU puts forward with a few cosmetic adjustments.

That is what happened with Greece.

That is what happened to the UK with the interim agreement made in December.

Indeed its what usually happens when one party has all the negotiating strength.

Its probably just to sign a meaningless piece of paper in March signing up to everything for another 2/3 years and then go into the EEA because thats where they put all the nations that can’t manage on their own.

LikeLike

I want to be a fly on the wall of the ERG in that case 😉 That Jacob’e eyes are gonna bulge with rage…

LikeLike

They might well bulge but he is smart enough to know that if they mess this up the Conservatives will be out of government for a generation.

I’m sure the Brexiters didn’t have a socialist paradise in mind when they sent us down this road.

LikeLike

“Basically it will wipe out the cosseted lower middle class and remind them that they are just as dispensable as the rest of us.”

That’s what I’m afraid of. Because: then the f*ers will go and elect Corbyn + his Marxist sidekick, and THAT is a greater threat IMHO than Brexit.

Have you read McDonnell’s interview in the FT a few months ago? Christ. I still shudder when I remember it. The man is both unhinged and stupid, and the only reason he doesn’t come across as such is that he has obviously memorised a few passages from Capital and broadly knows the context in which each of those can be quoted. So people think that he’s an ideologue rather than a lunatic. People are wrong.

LikeLike

I dug that out, though I confess that while it did seem unhinged in places it was also curiously content-free IMO. They seemed to get a significant amount of the information from Ken Livingstone, having failed to get a straight answer from the man himself. I guess he was in what he’d regard as enemy territory.

LikeLike

I really don’t know, no act of incompetence or cruelty seems to dent the level of support in the polls for the current incumbents, undoubtably helped by the lack of a decent opposition; so unpalatable as that might be for half the population, it must be that the other half like what they are seeing. I have a Greek friend who was horrified that Syrizia could get into power, calling them cartoon communists who would destroy what was left of the economy, alikening it to letting your dog take over the steering wheel while on the motorway. But within months, they’d been throttled into obeying by the boa constriction action of the global neoliberal order and now they fetch sticks for their creditors when not playing dead. So why would labour over here be any different? Even if they have a better starting hand, I can’t see them playing it well, like Putin for example.

LikeLike

Thanks for this thoughtful post, Ermine. There’ll be quite a few of us mulling these issues over at the moment.

I also made good calls immediately pre-referendum and was almost completely out of sterling / UK assets by the time the 15% devaluation hit, but now have a lot of cash sitting in my HL account and face the dilemma you describe: over-priced equities vs potential drop in the £.

One thing I did pre-referendum was to open a CHF a/c with HSBC and transfer in a decent amount using HiFX – overall cost around 1%, one way. Similarly I shifted larger amounts to the AUS$ (I spend about half my life in Oz and have bank accounts there). Maybe I’ll repeat the process. Still, all said and done, Brexit is a bit of a horror show for UK investors.

LikeLike

That’s a good alternative way – actually holding the cash. Makes me miss my old TD Direct ISA, where one could actually hold different currency accounts and move it betwween them, although I never used the facility. And the mix of CHF and AUS$ gives diversification – nice one!

LikeLike

I am slowly learning not to second guess what may or may not happen with the markets. For me, investing is mostly about having a solid plan and then seeing it through. Whatever happens with Brexit, the global markets will continue. I believe things will turn out better than many fear but even if it is a complete shambles, life goes on, the markets wobble from time to time but Amazon, Unilever, Netflix, Samsung and the many thousands of companies will continue to trade and make profits.

Take it easy…keep the faith…

LikeLike

I certainly wasn’t thinking of divesting what I have already. One train of thought set off by your sage comment is that if I feel the £ is trashed by the event itself is to emphasise buying IGWD (sort of like VWRL hedged to GBP) in the hope fo the £ recovering from the suckout. Yes, stocks are overvalued but if the £ is bent more out of shape then I could hope for some cancellation of the overvaluation, but still buying something of long-term value with fewer transaction costs and costs of carry.

If I had twenty years of investing career ahead of me I would probably be more of the keep calm and ignore it all, because the integration time would be longer. But I am in my last couple of years of contributions at all, so I don’t have this sort of averaging out ahead, though I have of course benefited from it looking back!

LikeLike

Is there a bit of cognitive dissonance here?

i.e.

a) I haven’t got time to be passive so I’m forced to be active

b) therefore I’m implicitly assuming active is going to have a better outcome

c) so therefore even if I had time I should still be active due to b)

d) but if you had the time you’d be passive, so you don’t really believe b) and if that doesn’t hold neither does a)

It seems sensible at first glance but on further consideration it doesn’t mesh together logically?

possibly DIY investor is right? All you can really do is dial back risk if you’re worried about stuff?

LikeLiked by 2 people

@Rhino

I’m not absolutely sure it’s quite that bad, but I am open to the idea it is that dissonant –

a) Although I started active with a HYP I am probably mostly passive by now. And on the HYP I am passively active, as outlined by Kirby in 1984 – my aim is do not sell. It isn’t cast iron, but I have the vast majority of what I bought in that. The remaining part of my portfolio is a mix of Vwrl and a L&G Dev Wrld ExUK- because: Lars Kroijer and more lately a mix of that and IGWD because: I am the typical guy Monevator was talking about, who did numerically well out of Brexit devaluation, but hasn’t got much investing contribution time ahead of me. The exUK index not because of Brexit, but to balance out the HYP.

I have left this alone, and I still steadily invest in IGWD at a low level

b) I came to the conclusion have no sector edge, but I have at least one pretty good win on timing. So no, I am not passive in that respect. It’s a fair cop, and c) also follows

I don’t see d) as illogical – if I have 30 years of pound cost averaging then I’d accept the premise of the fellow who posted on Monevator that this is all mental onanism. As it is, my remaining contributing amount is about 40k, after which I shall leave this ISA alone and live off my pension, it will defend the long-term hazards of inflation and let me pay private health on the odd one-off intervention should that lie in my future. So I am trying to work out if I can make that count for more – I didn’t ask for this shitstorm or vote for it.

LikeLike

The £/$ will fluctuate just as the FTSE and global stock market moves up and down. A couple of months back the £ was at $1.42…today $1.31…Goldman Sachs are now bullish on sterling. The £ may continue to fall further who knows but I suggest it is tricky trying to second guess where all of these moving parts are heading over the next 3, 6, 12, 24 months so OK another 2 yrs of money to allocate but then it could do well for then next 20 yrs or more.

This recent article on TEBI may be of relevance?

https://www.evidenceinvestor.co.uk/carl-richards-stop-focusing-wrong-things/

LikeLike

It’s probably easier for someone with a positive view of Brexit, whereas I can see largelly negatives. I’m prepared to lose out on this last cash injection for being wrong – I will gain in so many other ways if it’s a success or neutral. It’s a shame equities are at such high valuations at the moment, else the keep calm and invest in equities would be an easier win 😉

LikeLike

I’m think you’re doing Lars Kroijer a disservice in the article. His premise is that government bonds are the best ‘risk free’ asset for people who don’t know what markets are going to do (which is most people).

You’ve got a couple of years spends in cash, DB pensions waiting in the wings, full state pension entitlement, a paid for house , reasonable outgoings and other investments. You were preparing for brexit before it even had a name.

However, Kroijer is clear – if you think markets have incorrectly priced a potential event his advice is to fill your boots!

LikeLike

I have most of my assets in Pounds but live abroad so Brexit and attendant devaluations are a nightmare. Should I stay in Sterling and hope things get better eventually or panic and move money abroad? I suspect the horse has already bolted and there are no good options.

LikeLike

Are they actually in £ or denominated in £? I could see that’s a tough call to make if they are in £ as cash-like assets. Even though I think Brexit is a ghastly mess, I suspect it will go down but recover, so a £ income stream may come good – one could hedge say half a year’s worth of that to soften the inital blow/ride over it. After all, the problems of the Euro have not been fixed yet, if that goes down I can see there may be some circumstances where Remainers could end up being grateful to Brexiters for getting the right answer, possibly for the wrong reasons.

LikeLike

A mixture of both in Sterling and denominated but the big asset is my former home which I now rent out. It is not (yet) the end of the world as I don’t need to draw down these assets and I may end up retiring in the UK anyway.

LikeLike

Are fluctuations in the GBP all that big a deal if you stay in the UK and do the majority of your purchasing there? The value of your currency must be determined somewhat by other factors than Brexit.

The Canadian dollar is arguably a petrocurrency now and it is profoundly influenced by US monetary and political policy. We have seen fluctuations of 40% in its value relative to the US dollar over ten years. This kills us if we take a US holiday or buy anything denominated in US dollars, but we muddle through. Conventional wisdom for investing here is to stick with Canadian fixed income by and large for our “safer” assets and to have about 20% of our portfolio in US denominated securities.

Right now we are going into a pretty bad time of it given the US government’s attitude toward Canada but at least we are trying to maintain free trade.

LikeLike

The fall in the pound translated into higher inflation although this is now starting to fall out of the stats- the UK imports an awful lot of food and fuel because it’s a small and densely populated country. You’re probably more insulated from fuel prices due to local Canadian production, and you have more agricultural output because you have a lot more land. This apart, most of my future income is GBP denominated in my deferred DB pension, so diversification would probably push me more in the direction fo foreign assets in investments than would normally be the case.

LikeLike

Hah, you’ve got closest to my rationale for throwing in the towel on the flat. My working title for my unwritten post I’ve been kicking around is: “Buying an expensive London flat when everything is expensive.” I really need to finish that post and sit back for the kicking. 😉

Have you consider US TIPS? UBS has a currency hedged ETF, although I know you say you *want* currency risk. (Are you sure? A £ rally on a weak-ass self-defeating mediocre for everyone deal could rip overseas holdings down 20% easily. Personally I’m diversifying widely.) TIPS aren’t great obviously, but on a comparative basis potentially… e.g. Peter Spiller at CGT thinks they’re one of the only attractive opportunities.

LikeLiked by 1 person

There’s much to be said for diversification in your overvalued assets! May it serve you well, and the associated big cheap mortgage 😉

LikeLike

I’m missing something. How does a “mediocre for everyone deal” cause “a £ rally?”

LikeLike

Presumably because the default assumption that is currently priced in is worse, or simply because markets hate the uncertainty, so why risk exposure to the £ at all?

LikeLike

I’d expect people to sell the £ and £ exposed assets in the event of unwelcome news – usually only some of this reflects the lowered future income stream, most of the suckout tends to be people selling on momentum. In that case buying these give you a win when the suckout corrects. Similarly, having my assets in something other than £ safeguards those from the fall i nthe £ relative to everything else.

Other commenters are making the case that this will probably be undetectable in the noise aftear a few years, and also that markets are reactive systems, not single stimulus responses, and there si something to commend that too 😉

LikeLike

@Dave — My hunch (and obviously it’s only that) is that a mediocre deal Brexit will reduce UK GDP by (guesstimate) 0.15%-0.25% forever / over useful time horizons. (Say two to three decades).

GDP will be lower, state tax receipts lower, public services further crimped, more misery in the North etc. A total waste of time for everyone except Max Sovereignty voters, which is fair enough, I don’t dismiss their concerns out of hand.

However in this scenario, the UK soldiers on in its mildly wounded state and government bonds and so forth rally. The £ would look fairly bombproof over the long-term, and I’d expect it to rise.

The big risk is a no deal crash-out disaster, in which case I think we’ll go into a deep recession. (Don’t be misled by the fact we didn’t after the Vote result — nothing really changed for months and it’s only changing now at the margin (projects being postponed, jobs moving and so forth).

This could be disastrous for the UK as we rely on foreign capital to balance our books. Consider too that politics would probably take an even more extreme lurch towards populism on both left and right. (Corbyn nationalisation. Brexiteers crying “we were betrayed and stabbed in the back by the elites” or whatever).

The Bank of England could conceivably have to raise interest rates to halt a run on the pound. The whole thing *could* (who knows) be a train wreck.

That’s what I believe the extremes of the £ devaluation was trying to price in (especially when it was down at $1.20). So a mediocre deal takes away this big tail risk.

We’ll see!

LikeLike

Looking forward to that post, TI. Jeez – what do we pay you for 😉 Chop chop!

LikeLike

@ermine, just before the referendum, I nearly moved all my (deliberately increased) cash to US$ a few days before, because I thought brexit would win at least narrowly. What stopped me then, was that I thought that my procrastination had made me way too late and so it was pointless. Needless to say I was soon kicking myself as I’d have made at least 15% overnight for nothing, easily a year’s income for effectively a low-risk gamble. I have a Revolut card and can slide cash between currencies on it for almost no cost, so given that that experience was a shock in that it wasn’t ‘priced in’, I’m seriously considering giving it a go next march.

In the process of selling a flat currently, all the agents I’m dealing with are telling me that they expect a panic next march to similarly dip prices, even though the date is known. They don’t know how bad and for how long, just that it’s a date to keep in mind and use to your advantage. Regardless of politics, in that there may be no need to panic, but human nature being what it is, they’re expecting it and positioning themselves to fleece the stampeding crowd. So I’m trying very hard not to be in said crowd playing ”Where’s Wally?”

LikeLiked by 1 person

I think the trick with situations like that is the good old half split – hedge half your cash 😉 It’s why I’ve bought half IGWD and half the L&G unhedged dev world xUK, so part of me can curse the other half for its lack of forward vision.

If you’re Nigel Farage you can do better 😉

LikeLike

What you want, my son, is Jimmy O’Gobblins. Gold sovs buried in the garden. No VAT, no CGT, and – obviously – no income tax. God’s FX. Even Martians will accept them.

Back them up with plenty of cheap, low carat, second-hand gold jewellery – a tip I learnt from an Argie who had lots of experience of using informal currencies during inflationary episodes.

You needn’t worry about taking money out of ISAs now that couples can bung in £40k per annum.

And commodities: I’m thinking of buying grains – I wonder how you do that. Any suggestions? Foreign residential property – I had my eye on JRIC and then it evaporated. What else is there?

LikeLiked by 1 person

Yeah, I agree that it’s going to be very volatile, and I selfishly want to get the brexit crash over before I FIRE in 2-3 years. I’m moving away from UK based investments gradually – at 18% FTSE now, aiming to get down to 14%. Also have ~2% GILTS and ~2% Corp Bonds. I’m not selling, but just diverting all new money into foreign options.

The more I think about it, we’re only ~6-8% of the global economy; so if the UK goes down, the rest of the world will be fine. Or only frictionally impacted as they arrange new trading partners/routes.

LikeLike

“I already hold a lot of gold in ETF form. Rather foolishly I hold it in my ISA. In general you should hold gold inside an ISA, since it pays no dividend. ”

Did you mean you should hold non-dividend assets outside the ISA?

LikeLiked by 1 person

Yep, I’m of that general opinion, particularly in the case of non-dividend-paying assets that have mulitple ETFs representing them. You’re exposed to both capital gains and (potentially) income tax on dividend paying assets, both of which you get rid of in an ISA. With gold ETFs you are only really exposed to capital gains, and if that gets close to being an issue, use up your CGT allowance to sell out £10k worth of gains and buy a different gold ETF with the proceeds, to reset the CGT counter. Usually you have to wait 30 days to rebuy the same share for that to work for CGT, but PHGP is not the same as SGLP form a capital gains point of view, though it’s an investment into the same underlying asset.

LikeLike

Damn, typo caught – thanks. Yes, I meant outside an ISA, rather than inside an ISA for gold, which is what I wrote originally. D’oh!

LikeLike

This could possibly be the first time Ive read a well researched, well thought out piece, seeing both sides of the story and still remain unable to make my mind up what side of the fence to sit on. I guess thats why the good Lord gave me a crack in my arse so I could sit on that fence in relative comfort.

Im off to read it again!

LikeLike

I share your concerns about sterling. The newly anti-business Tory party, with its incredible incompetence on Brexit, definitely makes sterling a high-risk currency. Leading Brexiters like Odey have already made fortunes shorting sterling and are presumably hoping for another big leg down in March. One hedge you definitely can buy with iWeb – I know that because I hold it there myself – is IBGE. iShares 0-1 year euro gov bond. A little bit of Italian credit risk, but basically it’s a low-duration, high-quality way of holding euro in an ISA. No-deal Brexit would easily send the pound to parity with the euro, in which case this would do nicely. If not, it’s still a useful and fairly low-risk piece of currency diversification. Personally I’ve also stocked up on UK equities which earn most of their cash overseas. Some of them are still reasonably valued.

LikeLike

Nice tip on a way to hedge, thank you. I also have tweaked my investments to ensure the UK holdings earn in forex and the advantage we have this time is that we do know it worked when the markets last devalued the £ overnight. Please people, keep those hedging tips coming, this is Cakeism I will join in to save my future.

LikeLike

Interesting – I also found IGLO (G7 gov bonds) and the £ variant SGLOnot available on iWeb, and IGLO not available online. And yes, I should look at some of my UK holdings that earn overseas to see if a top up is in order as another way – a good alternative!

LikeLike

Have you tried using the Morningstar ETF screener?

From that, SAAA (AAA & AA Gov bonds 0.2%), SAGG (Global Aggregate 0.1% – I assume an unhedged version of AGBP which would be my go-to hedged ETF) & SGLO (G7 nations 0.2%) might fit the bill?

Weirdly, iShares pretend these don’t exist if you use their site as an ‘individual investor’ but you may still be able to get them from your broker.

http://tools.morningstar.co.uk/uk/etfscreener/results.aspx?LanguageId=en-GB&Universe=ETEXG%24XLON&Category=EUCA000759&BaseCurrencyId=GBP&CurrencyId=GBP&URLKey=t92wz0sj7c

Of course, if you think Brexit is localised to messing up the UK then perhaps EM debt might be ok? I’m aware that the ETFs tend not to track the indexes brilliantly as they have to pay tax, but there’s VEMT (Vanguard 0.25%) & SEMB (iShares 0.45%) for dollar-denominated debt and SEML (iShares 0.5%) & EMDL (SPDR 0.55%) for local currency debt. (I checked these are available on IG a while ago.)

Personally, if there was a least-bad Brexit (BINO), I would expect a big surge in UKPLC – companies have been stockpiling cash for 2 years now and if they started spending it, we would get something of a boom. Of course, with politicians, you have to be careful that they might be lying when they say “we’ve agreed this”…

I’m pleased with my Blackrock Smaller Companies (BRSC) investment I made in the misery of the referendum result – it’s up about 100% in 2 years. (Though some of that is due to the recent irritating narrowing of the discount due to it appearing in the random lists of some tipsters.)

LikeLiked by 1 person

I picked up SGLO but iWeb just won’t let me buy it, it would fit the bill well. unhedged G7 short term government debt – pretty good. iWeb seems to have quite a restricted selection agailable – even IGLO can’t be traded online with them.

BRSC is a nice alternative to Aberforth (ASL) which I hold for smaller company stuff

LikeLike

I’m with rhino here, I think trying to position for Brexit is a bit of a fools errand. I’ve seen many comments recently to the effect that private investors are reducing UK exposure. But, UK valuations are already lower than elsewhere, it’s not like Brexit is a big secret. Moving out of the UK is hardly contrarian. It could even be argued that by doing so one is falling into the old behavioural trap of selling low and buying high….

If it’s just safety you’re after, then yes, probably hedged global govnt bonds of short duration is as good as it gets.

LikeLike

I’m not changing what’s held in my portfolio, I have the fond hope that I might be able to preserve the value of the cash I hold should Brexit devalue the £. I would like to buy some UK stuff in such a shitstorm, ideally converting some of my sheltered cash into more £

If it doesn’t devalue the £, or is a roaring success, then I look stupid but win big in the future income stream of my pension not being devalued. I can live with that 😉 Hence the focus on the downside.

LikeLike

I think you may have misread the GB12:GOV Bloomberg page showing “shocking” volatility. It shows the rate for a 1 year US treasury bill in %, not the price of it ( the data is mislabelled ). So one year ago you would receive 1.2% of interest over the year if you invested in a one year US gov bond. And if you reinvest it now you can get 2.3% of interest for the coming year.

LikeLike

When did the name change from ‘Suffolk’ to ‘Somerset’? I’ve only just noticed it!

LikeLike

I moved about this time last year but I moved the domain to outsource the IT security side to people with more time, inclination and expertise than me

LikeLike

Buy international equities. There is no alternative.

LikeLike

Canadians would be pleased to retain the Commonwealth. Can you imagine what it’s like with that guy next door to us!

LikeLike

Why not just buy US Treasuries? I’m actually planning on taking the opposite strategy: buying GBP shares and assets particularly after Brexit (and even more so in case of a no-deal scenario).

LikeLike