It must have been so simple when he was a nipper. You buy a house with a mortgage, and you got to pay back a shedload of interest and a teensy bit of the capital. 25 long years later and this happens

as the dynamic balance between interest and capital repaid shifts in your favour. The downside, of course, is that you have to pay off the capital. You pay roughly twice as much1 for your house if you buy it with a mortgage than with cash, due to paying interest for 25 years. Which is why some bright spark dreamed up the interest-only mortage.

Although we now think of them as ways to enable the BTL brigade to shaft everyone younger than themselves, the IO mortgage was originally dreamed up to make houses more affordable by halving the mortgage payments. Easy peasy. What actually happened for a while was house prices went up2, because every time you make the existing price more affordable the price adjusts so it becomes only-just-about-affordable, because that’s where premium scarce goods reach equilibrium in a market economy. It’s only the punters that can’t afford the prices and fall out of the market that puts a brake on house prices, but UK governments have never acted on this because most voters want high house prices. Governments will change that when the increasing age people buy their first property means there are as many non homeowners as there are homeowners of voting age.

Enter stage left, an accountant, age 77, mithering about his IO mortgage being called in

who didn’t realise you had a pay off an interest-only mortgage in this lifetime, rather than the next. Len, this post is for you. There’s pathos in this story on so many levels, I mean, FFS, this dude worked as an accountant for a living. It’s fair enough for the interest-only mortgage to catch out young whippersnappers like Joe and Josephine in the hands of Mr big Bad Wolf, but grizzled greybeards of 77 who have only just wised up to the fact that they have aught to pay off the capital have no excuse. These guys had the temerity to complain to the Financial Ombudsman and then when they got the finger from the FOS because of the pickle they got themselves into through overspending in retirement, bleat to their local MP. The MP spins this as a tale of dreadful ageism by Santander. No, they’d just like to get their fricking money back before you die. I’ve done this story too many times before, WTF is it with the British and housing?

I know it’s impolite to mention the Grim reaper but it’s a fact that every 24 hours you live you get a day closer to death. I am nearly three decades closer to death than when I took out that mortgage, which is why I paid the bugger down, and that’s even without the benefit of a life of accounting to see the problem rushing up to meet me. The MP puts this spin on it

Lloyd called on Santander to either increase its age limit for mortgage borrowers or abolish it, and said: “Without such a move, Mr and Mrs Fitzgerald will lose their home. Is that really what the bank wants to see happen? I will also be raising this vital issue in parliament. I am sure there are tens of thousands of other families potentially facing the same, desperate situation in the coming years, which is unacceptable.”

No. It’s a situation that has been developing over decades, and they can’t say they weren’t warned. The Fitzgeralds chose to stick their heads firmly in the sand, and that’s why they are in the shit. It also shows the folly of another innovation in mortgage finance, the short-term fix. These guys remortgaged in 2007 for 8 years. It’s fair enough, when the 8 years are up, you need to ask again if you can stay in that house if you don’t have the money to redeem it.

You have the option to borrow from someone else I guess, but nearing 80 you just aren’t a good prospect, because you have zero human capital left. If you financial capital isn’t enough to keep you in your house, then you don’t get to stay in that house, and you can’t earn any more financial capital. You are stuffed. The moral of the story is pay your bloody mortgage off in your early retirement, or be prepared to move or rent.

This is not a sob story of somebody who was taken out by events beyond their control. This was wilful overspending on a big scale for decades. I could have had many fine holidays with the money I used to pay down my mortgage. The fact this guy plied his trade as an accountant takes the biscuit.

The Way We Were, B.M.T

Before Margaret Thatcher, who became prime minister in 1979. The youthful Ermine voted for her party – if you lived through Britain in the 1970s when it was run by the unions and Arthur Scargill you would understand the attraction. Never voted for her again, but she did do a lot of good, and a lot of bad.

In the good old days head honchos of the nation’s building societies gathered in smoke-filled rooms to have a chinwag with the government along the lines of “how much lending should we have in the market this year, dear boy?” 3

That worked fine for a long time and building societies had 80% of the home loan market at the time. It was stuffy, Dad had to put on a suit4 and go for an interview to be able to get a mortgage, and show some evidence of financial probity and proof of earnings, all things that we discovered were totally unnecessary to qualifying borrowers in the intervening years.

Then Thatcher rocked up, you can pretty much trace anything that is wrong with UK housing to Thatcher, later governments tinkered on the side but never put the fire out because people thought they were rich when their house was dearer than what they paid for it.

She decided that all this stuffiness Just Will Not Do, so let’s lift all these stuffy restrictions, and then later on bring banks in on the home loans act too. Lenders gonna lend like haters gonna hate, , and it’s an ineluctable law of economics that when you have more money chasing a limited resource, the nominal price of the resource goes up.

Which is how my Dad got to pay £500 for his London starter family home in 1960-something, and a young Ermine got to pay about 100 times that much at the same stage of life on a crappy two-up two down in a provincial town, in a fit of Torschlußpanik folly. The Bank of England inflation calculator tells me that Dad’s £500 whould have been worth £4600 when I perpetrated the most monumental PF mistake of my whole life, so 90% of the difference in price is the result of a buggered up housing market. It’s only buggered up for new entrants, everyone in the system has an interest in ever higher house prices. Once, in a drunken stupor I did suggest to the somewhat addled host that the reason they were whingeing that their kids couldn’t afford to buy a house was because they kept governments in fear of seeing prices fall.

I’m not going to go all David Willetts and Resolution Foundation on y’all. Another reason is that better communications have concentrated jobs shockingly since the days when every village had a butcher, baker and candlestick-maker. There was once a time in the mid 1960s when people thought that London was going to die out as the population fell, but now if you want a well-paid graduate job it seems you have to start in London.

Britain has always had trouble with housing, in the old system you could afford a mortgage but often struggled to get one because of credit controls. Now you can get a mortgage easy, but can’t afford it because all the money sloshing about has forced the price up.

- at a typical 25 year term and interest rates typical over the last 20-30 years, the long-term average interest rate in the UK is about 6% ↩

- Until it all went titsup and we called it the credit crunch, then the Global Financial Crisis as the roosters came in to roost ↩

- Joint Advisory Committee to agree savings and lending rates at regular meetings between lenders and government, according the Christine Whitehead, which I discovered in this Swedish report, presumably the Swedes are looking fondly at our history and wondering how to screw their own lending market up as well as Mrs Thatcher did. You need deep talent and an insight into how to leverage human greed to be able to shit on people two generations not yet born from beyond the grave, an ordinary MBA just will not cut it. ↩

- He was a fitter, so overalls was work attire, not a suit ↩

Thanks for this. As soon as I saw the articles in today’s papers I thought of you and hoped you’d write about it(!) The Daily Mail version was even better because it mentioned that they borrowed £40,000 extra in 2007 for “home improvements” and also managed to lose £11,000 on a failed will writing franchise along the way. I’m sure Mrs Ermine has already mentioned that just more clickbait, but you can’t help getting wound up that they want you to feel sorry for them because they’re old and banks are horrible and they can’t just get given a house they haven’t paid for.

LikeLike

I had forsworn the Daily Mail but their article on this is a little better on detail, thanks for the tip!

The financial muppetry is even worse. For starters, you don’t buy a house with a 90% mortgage in your fifties. TBH you should be buying cash, but if not you should be having a much higher level of equity. Otherwise you are too poor or you are buying too much house, given your depleted value of your future income stream in the shortened time you have on earth. To compound the error by blasting another borrowed third on improvements is foolhardy. OK so he was only an accountant after 50, but even so not understanding the servicing of the debt and the debt is nuts.

He did also have some genuine bad luck in being unable to work and the franchise farrago. But the heartstrings tugging copy wants to make me gag –

They never missed a mortgage payment, well apart from the most important one of them all – the redemption of the capital, FFS, it’s typically as much as all the other payments put togther. That retirement haven was built on sand and an accountant should have known better.

LikeLike

There was time when indebtness was seen in a poor light.

But for the past 20 years or so, at least, it’s been viewed that to be ‘maxed-out’ on credit cards and mortgage debt is just the way it is, and it’s perfectly ok.

How have we got into this state?

LikeLike

Mortgage burning parties were once a thing – they might have helped normalise the concept you are meant to pay off the mortgage 😉

When I left The Firm in my early fifties, I recall most of my peer group still had mortgages. OTOH it’s not necessarily a good idea to pay down a mortgage before you can draw a pension, because the pension commencement tax-free lump sum is a way of paying down the capital from gross earnings, but you have to have a plan, which is shockingly absent here.

LikeLike

In my experience, some accountants might be good with numbers in their day job but not much with personal finances. It’s obviously something of a personal difficulty for this couple and I sympathise on a human level but unfortunately reflective of the wider system which relies on kicking the can down the road.

LikeLiked by 1 person

A mortgage is one of the simpler personal finance propositions, though. My Dad managed to get it and pay his off by 45, and he was a fitter. I’d agree it is a tragedy, but a self-inflicted one here. The Franklins have played a relatively good hand badly by getting hung up on home ownership and starting too late, renting fits their profile much better. There’s no mention of children in the articles which is sometimes why elderly people hang on to a house, and if that conern does not apply then owning a house into their dotage sterilises a load of capital that could go on fun earlier and eventually care. As it is, they planned to rent their money from the bank, and that puts them at the mercy of the bank.

Elderly people eking out an existence in a house beyond their capacity to maintain it tend to let it get very run down. I wouldn’t risk my capital on them as a bank. If they owned it mortgage-free then they can let the house slide until the roof falls in on them, but since they want to live in a house without ever paying for the capital, they don’t get to make that decision.

LikeLiked by 1 person

Interest only mortgages are only a good idea when interest rates are low – when your mortgage interest is less than rent. Otherwise it’s the worst of the two worlds – you’re overpaying for the privilege of getting to live in your digs and you’re responsible for the repairs. Utter nonsense.

As for the BTL, I think at least part of the appeal is that people can understand how it works, and it appears safer because the house is physically THERE. I’ve heard it said a few times that people are afraid to invest in the market because they don’t understand it. Whereas with a house they understand where the rent comes from, and as you said, the capital value is effectively underwritten by the government, at least for now.

LikeLike

Even as a capital investment housing is not that thrilling relative to equities. I think a lot of the love hosuing gets is because many people have had a great experience from investing on leverage in a rising market. Although the ride would be a bit rougher, if you could buy a portfolio of shares/equities on an 80% margin and were only allowed to trade them once every seven years (the typical UK housing dwell time) and have no CGT people would be raving about shares the way they do about property.

LikeLike

P.S. Gators gonna gate.

LikeLiked by 1 person

I find it hard to have sympathy for people how have made their bed for the last 20 years and now are complaining about lying in it.

Interest only mortgages have their place and can be used effectively as part of a well throughout and structured plan. It’s obvious these people didn’t have a plan apart from hope someone would take sympathy on them when the time came. When they couldn’t find it at the bank, or the financial ombudsman they ran to their MP. This all despite being told of the rules and warned of the consequences from several sources.

LikeLiked by 1 person

I’m so glad you gave this both barrels of an Ermine-rant! I saw this the other day and was so annoyed I had to close the computer and sit down for a while.

One thing to bear in mind, Mr Fitzgerald is being called an “accountant”. That means nothing. Anybody can call themselves an accountant (same for lawyer, builder etc.) If you call yourself an accountant that very likely means you are not a Chartered Accountant or a Chartered Certified Accountant (otherwise you’d say). If you need the services of an accountant you should use a Chartered Accountant or Chartered Certified Accountant (for disclosure I’m a Chartered Accountant, ACA). That’s because we are regulated, have to pass a number of exams, maintain a high level of professional competence and adhere to a code of ethics.

LikeLike

I didn’t know that about the term accountant – thanks!

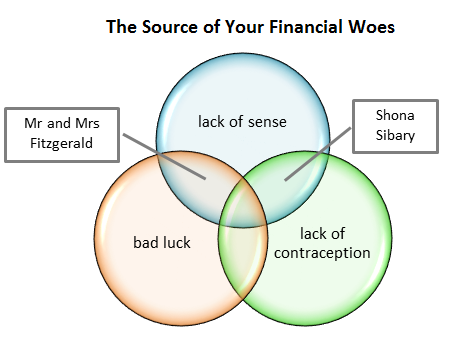

The rant had to happen. Not quite as bad as Shona Sibary and her four sproglets of doom but still top muppetry.

LikeLike

It differs somewhat from Mrs Sibary’s tale of woe. A picture’s worth a thousand words, so here – I’ve done a ‘splainer .

LikeLiked by 2 people

hehe – some things should be clearer 🙂

LikeLike

@hosimpson

You’re probably right about the physical ature of investing in property.

Another explanation is one I think given by Buffet: namely that nobody stands at your front gate yelling bid prices for your house between 8am-4.30pm every day – so you don’t see or hear price drops so well. Long term that’s a huge neutraliser of behavioural biases.

LikeLike

Read the article, and got to say that, like you, I didn’t have much sympathy for them. What were they expecting to happen after re-mortgaging at such an advanced age?

One of the quotes in the article was along the lines of why can’t Santander allow re-mortgages up to age 85 as some other lenders do, but I don’t see what difference this would make in general terms – we’d only end up with 85 year olds in a similar pickle.

LikeLike

The other trouble with that is often older people tend to let repairs slide, to the value of the capital asset drops for the lender. That’s not so bad if the mortage is 25 years old, but if it’s less than 10 years old the risk is that house price appreciation hasn’t beaten the depreciation in the house value due to the remedial work needed.

LikeLike

It states in the Guardian article that when the couple took out the interest-only mortgage they agreed to sell the house to pay off the capital in 2015. I don’t therefore understand why they then borrowed a further £40,000 for improvements to turn their house into a “retirement haven”. They had already reached agreement with the bank that it wasn’t going to be a “retirement haven” because they were going to sell. Did they think that bit was just going to go away? … Am I missing something? … Mind you I’m not clear on how Santander/Abbey managed to overlook that part of it when they agreed to the loan extension either,or why the bank agreed to the loan extension for any reason at all, given the couple’s age and the fact that they had already had difficulties with repayment.

I notice that most of the commenters in the Guardian have no sympathy with the couple at all – and Graun commenters are normally pretty right-on over property issues, so that tells you something.

LikeLike

I read a similar case on the FOS website a year or two back but in that case the FOS sided with the customer against the lender and instructed the lender not to bother the customer again! http://www.financial-ombudsman.org.uk/publications/ombudsman-news/126/126-mortgages.html There was some wrinkle to it but it was essentially the same. I thought at the time that it might be a sound strategy to get an interest only mortgage but treat it as a 25 year long rental agreement, where you return the property at the end.

Interestingly, a lot of the comments in the Daily Mail article take the same tack – “they didn’t pay back any of the capital so what do they expect? !” It is infuriating though that one of the reasons why house prices are as high as they are now is that they were bid up by people who could never afford them in the first place.

LikeLike

the IO mortgage does seem to have been a weapon of wealth destruction – incuding people caught on the sidelines by these guys overbidding.

It’s people that claim they didn’t know the capital was to be repaid that get me – when I had an IO mortgage I also had an endowment that was explicity set up to discharge the capital, they wouldn’t let you get out the door without having some plan to repay the capital. Somewhere along the line, this was dropped.

LikeLike

We converted our conventional mortgage into an interest-only flexible mortgage. It was wonderful: if flush we could pay a bit of capital off, if on short commons borrow it back again. We had agreed to pay it all off finally with my retirement lump sum and did so. It turned out that the “pension freedoms” let me take a bigger lump sum than I had expected. We invested the surplus in deferring our state pensions, a deal that was absurdly, extravagantly disadvantageous to the taxpayer. I call all this the huge-dollop-of-luck strategy.

LikeLike

This couple effectively rented the property from the bank and are now complaining that they do not have an automatic right to continue renting it. This isn’t a council house and the bank are not their charity, they do not owe them a house to rent. And what if they did allow a remortgage to continue the interest only ride? The couple would be a decade older and in the exact same position.

I don’t agree with some comments on the news sites that these people are idiots or ignorant. I think they knew exactly what they were doing and were hoping to continue renting this house at far below market rent rates whilst enjoying the capital payments saved before eventually passing away at which point the house liability becomes the bank’s problem.

If I were to be more cynical I’d suggest they’re even going so far as to purposely avoid accumulating wealth in property so that should they need care in the near future it will be entirely at the local council’s burden..

LikeLiked by 1 person

> think they knew exactly what they were doing and were hoping to continue renting this house at far below market rent rates

That’s the effective result of what they were doing, but heck, it’s a hell of a gamble to take on the aggravation deliberately. I’m decades behind them but I already start to favour sometimes paying more to have less aggravation in life.

As for care (I’m making the assumption there aren’t children, because children make normally rational people do some absolutely barking mad things to try and give their adult sprogs an inheritance) they may as well pay until the welfare budget kicks it. LA care homes aren’t necessarily the most salubrious, and they can’t take it with them…

I’d have thought their risk of needing care, or just one of them needing it is the worst part of this plan. Only one in five people need a care home but these guys are edging towards the danger age for that.

LikeLike

I must be a softie but having seen the photo of the couple I feel some sympathy for them. I wonder if they took a gamble on longevity risk and lost. I just took a similar gamble and cashed in a DB pension to fund an earlier retirement. I had to get (ie pay for) mandatory IFA advice to get my hands on it but I was confident I knew what I was doing (because i’m a chartered certified accountant) and my spreadsheets tell me I’ll be fine.. But they are all built on the premise that men past the age of 80 just need enough income to keep them in biscuits and teabags. The Fitzgeralds look pretty sprightly for 77 year olds. What if that happens to me?

Well obviously I hope I am as blessed as they are. And I’ve dealt with my mortgage so ready to tackle shedloads of rich teas (denture friendly, especially when dunked) in my dotage

LikeLiked by 1 person

This seems to be yet another example (which seems to generally work) of people choosing to sign agreements with large companies with a reputation to protect, and then when the large company in question has the temerity to try and hold them to the agreement they cry to the papers, MP’s, Government etc in the hope that the large company will cave in to protect their reputation. Alternatively the government will change the law to stop the “unfair” treatment of customers.

Why can’t people man up and take responsibility for the choices they make.

LikeLike

“Why can’t people man up and take responsibility for the choices they make.” You’ve just answered that yourself.

LikeLike

@cathy

The reason why the guardian comments about this couple are so negative is that guardian readers are young and therefore rent

Generation rent are all too aware of the fact that if you miss a rental payment or three they will be evicted

LikeLike

Neverland – I worked there for several years and know the readership. As a matter of fact, though, most of the Graun readers I’ve come across personally online or otherwise are older (and tend towards the well off, though not all). The younger ones I’ve encountered are generally most disinclined to sympathise with big bad banks.

LikeLiked by 1 person

It’s morbidly amusing to see the mindless masses bleating when they lose at financial roulette, having shown little or no interest in learning the rules before betting all their worldly possessions. As the local elections just showed again, they also make no connection between cause and effect, repeatedly voting for the status quo before complaining that nothing changed. We’re probably only seeing the tip of the iceberg on this issue, given the interest-only era is just starting to mature; how many mortgage-holders today remember high interest rates or endowment mortgages?

LikeLike

The house price graph would clearly show that prices rose quicker from 1970 to 1988 ( up 10 times?) Than the next thirty years ( x 3 or 4) if you had used a log graph.

Interest rates were also a tad more. 15% at one time.

LikeLike

There’s a certain amount of selectivity in choosing 1988, because it was a high-water mark, so amplifies the first part and the suckout reduces the second part. Although it’s more generally true that high inflation eroded the capital part of my Dad’s repayment mortgage quicker over his term than it did for me, the current relatively low inflation is going to make it tougher for people who bought since the 2000s to reapy their mortgages because this erosion of the real value of the capital repayment is slowed. OTOH paying a 15% mortgage was never any fun, although my longer run average rate was about 7%.

LikeLike

I worked with a guy years ago who earned a high salary and took on an IO mortgage for a new build 4 bed house on a new estate. We heard all about it at work for weeks because it was a very nice and expensive house.

He liked the finer things. He ran a very expensive company car and spent money like water. Our paths diverged but i happened across him years later. Still plenty of bling, but now 3 kids at private school at that stage. I cheekily asked about the house and whether hed stuck to the “plan” of chucking his bonuses into the mortgage.

He cheerily confirmed he hadn’t. When i timidly asked what he would do when the bank came calling, he just said “sell it”. Quite where he is meant to live at that stage in his late 50s isnt clear. The guy in question is very intelligent by conventional measures, well qualified and would spend months assessing which new company car to acquire.

Funny world.

LikeLike

The one thing that works in his favour, though it doesn’t sound like this is a case of forward thinking, is that a house that can accomodate 3 kids is probably too big for a retired couple. So the extra equity in the house price boom across the 20-25 years between the first child being born and the last one coming of age may leave him enough to downsize and have a decent stake in the smaller house from the gains on the larger.

LikeLike

In Canada the gubmints do lots of diddling with the housing markets, but I’ve never encountered the interest only mortgage. We do have Home Equity Lines of Credit (which nobody repays – not even the interest) and Reverse Mortgages (great if you hate your kids.) Those seem like useful enough Weapons of Financial Destruction to me.

LikeLiked by 1 person

I suspect the HELOC is how people over the pond transform a repayment mortgage into a largely interest only one as aspirations rise 😉 Conversely the reverse mortgage looks more reasonable to me as a way of effectively turning the house equity into an annuity, I’ve never understood why adult children deserve a free house roundabout when they are 60. Howver, it’s tied to the particular house, which does make people a hostage to fortune. Only 1 in 5 people need to go into a care home, but it’s hard to know which one in 5…

LikeLike

I suppose if you are house rich and cash poor an RM may be the way out of your problem. Call me old-fashioned, but I believe in saving some money during one’s working years so that doesn’t happen.

My brother-in-law’s parents recently took out a reverse mortgage. They live in urban Toronto so their home is worth megabucks. They are in their 80s – at least he is – and he’s in frail health, so I wonder if this arrangement will last all that long.

They have a middle-aged single daughter living with them and she invested a fair sum to make a separate apartment in the basement for herself. I can’t see this ending all that well for her.

LikeLike

@ermine

You make an interesting point. I remember what the mortgage was in the early noughties and Zoopla tells me the place has increased in value by 280k. Providing there hasn’t been any remortgaging, you are right that there should be enough left to buy a decent pad for retirement. Provided the market does not plummet of course.

LikeLike

> Providing there hasn’t been any remortgaging

I think therein lies the rub. Shona Sibary and her four sproglets of doom show how it goes all titsup if you do remortgaging/HELOCs along the way. Personally I’ve never understood the logic of remortgaging to do house improvements, you save up for that sort of thing because they are an elective expense IMO 😉

LikeLike

My gut reaction response is similar to many others on the board. A couple of thoughts:

– I’d be surprised if someone wasn’t prepared to put up the money for the property (I’d say equity release, but I gather you need to own the house to do that) – okay, the couple may have to forego all equity in the house, but I’m sure it wouldn’t be too difficult to draw up a binding agreement that effectively ensured them residency for the rest of their natural life.

– Inter-generational mortgages – I think something along these lines have already been trialed in Jersey and Japan? Obviously not applicable in this case, but I wonder whether this could be the new trick to fuelling further property increases – “don’t worry if you can’t pay off the capital, leave that to your children, grand-children, [ad nauseam]”.

LikeLike

Oh, God – where to begin with this couple? I fear they have subscribed to the Mr Micawber school of financial management: “something will turn up”. But they knew they were switching to interest-only, and that the loan would need to be repaid when the term ran out (by the way, don’t you love how the journalists talk about the mortgage “maturing”, as though it were some sort of investment).

Obviously, things would have been better (and equity release/lifetime loan perhaps more viable) if they hadn’t decided to borrow £40,000 more. This is a small house, and I can’t see new PVC windows and an extra loo costing anything like that much, so maybe the further advance rolled up other pre-existing debt too.

In fact, Len and Val could easily continue to enjoy the coastal lifestyle with complete security – tidy 2-bedroomed flats near the sea front in Scarborough appear to be readily available for £70,000 or less, leaving them plenty to play around with. Ok, perhaps not as desirable as their existing location, but a respectable town with a vibrant retirement community and low cost of living. With no mortgage, they could live very comfortably there.

I doubt they’d do that, though. Assuming nobody rides to their rescue, in 6 months’ time a luckless District Judge will have to make a decision in the possession proceedings. Judges are famously reluctant to give a mortgagee possession where the borrowers are elderly and (not unreasonably) will try everything possible to achieve some other outcome.

My best guess? The judge will ask whether Len and Val could manage to pay, say, £50 more a month. If they say they can, then the judge will conclude that they are beginning to address the debt and will suggest that proceedings should be adjourned for something like a year to see how things go. And so it will play out, with successive judges kicking it into the long grass and nobody really any further forward.

At some point, Santander will decide the hassle, bad publicity and wasted legal costs are not worth it and will quietly give them another 10 years. If Len and/or Val is still alive in 10 years’ time, they will get to re-live the whole ruddy mess again…

Jane

LikeLike

> In fact, Len and Val could easily continue to enjoy the coastal lifestyle with complete security – tidy 2-bedroomed flats near the sea front in Scarborough appear to be readily available for £70,000 or less, leaving them plenty to play around with. Ok, perhaps not as desirable as their existing location, but a respectable town with a vibrant retirement community and low cost of living. With no mortgage, they could live very comfortably there.

This is the mad thing. Are they so hard-done-by? They aren’t attached to the house – reckless remodeling aside – they’re attached to the location. Well tough bikkies. As someone who’s been driven out of two major cities so far in life, I can assure them no-one is guaranteed the right to live indefinitely in the region of their choice, regardless of tenure or social connections.

They’ve paid an absolute pittance for their housing (vs a trad mortgage or renting) for decades – with all the economic opportunities that allows – and can now realise a large capital gain and live mortgage free for the rest of their lives elsewhere.

We should all be so lucky.

LikeLike

I’ve decided to only skim read the Daily Mail article and even that has annoyed me. I have to agree with many of the comments. They can’t even claim ignorance. It’s pure stupidity and hoping the inevitable problem will just somehow sort itself out. The sad thing is that they are not alone and I have personally met people with similar attitudes who will no doubt find themselves in the same position years down the line.

I know it’s not the same thing, but in a similar vein, it really annoys me when I hear of stories about how someone has had to raise X amount of money through crowdfunding to cover medical bills abroad because they made the deliberate decision to not buy insurance before travelling. What happened to taking ownership and having a little bit of personal responsibility?! Some will say I’m being a litte too harsh here, but sometimes the truth is not a nice thing to hear.

LikeLiked by 1 person

This morning’s Tel announced that a couple of BSs are now about to offer Interest Only mortgages to the over-65s; the Bath and the Vernon. Shazam!

LikeLike

“BTL brigade to shaft everyone younger than themselves”?

While I worked hard, went without and invested in BTL, (almost) everyone else lived at home and spent money like water. The property market is NOT there to provide cheap quality housing to everyone who needs or wants it, just as the Stock market is not there to provide risk free growth and income to anybody who wants a life of plenty.

I have zero sympathy for Mr & Mrs failed accountant, just as I have zero sympathy for tenants who don’t pay their rent (that’s not completely true – during an eviction hearing the Judge complimented us on being very sympathetic to our unfortunate defaulter), and I have zero sympathy for people whinging about BTL landlords driving house prices up.

Firstly, house prices are subject to the same laws of supply and demand that have worked ever since money was invented. Unless BTL landlords are creating or destroying homes, there are still the same number of families chasing the same number of homes, so there is zero effect on supply and zero effect on demand, and therefore BTL landlords have zero effect on prices. You may as well complain about the existence of credit, ie Building Societies granting mortgages in the first place, undermining the very principle that people have to pay for whatever they want to buy.

Secondly, our various Governments have abdicated responsibility for housing and left it to people like you and me. What have YOU done to help house the poor? Anyone who bemoans parasitic landlords making huge profits from tenants is free to spend money they haven’t got on a home they don’t need for a family they don’t know, comply with licensing requirements, health & safety requirements, management standards and tax obligations. And to do all the above for minimal cost. This is the UK Govt plan to avoid you, the taxpayer from paying for it yourselves. Come on Ermine, show me how it’s done, but don’t criticize me for doing something instead of doing nothing.

Lastly, it’s these same young spendthrift whingers complaining they can’t afford a decent first home (a nice three bed semi near a great school, near their work and also excellent transport links) but they lease two cars, have a full Sky subscription, new phones every year, eat out every other night and take at least one foreign holiday each year to take their minds off how poor they are.

I’ve done quite well out of BTL, and helped many households find accommodation who otherwise wouldn’t have, but I think it would have been better for the country and you, the UK taxpayer if HM Govt had done it instead of me. So if you don’t like the current housing situation, then vote in a Government that will build more houses. If you think BTL landlords are making easy money at the expense of the general public, go and ask for an interest only mortgage and invest….

LikeLike

I was surprised I didn’t get more bite for this, though a tip of the hat for a good one 😉

The taxpayer does pay for it, through housing benefit and [indirectly] tax credits. We can absolutely agree on:

particularly as I am old enough to remeber a time when that was the case – half the kids in my grammar school lived in council houses.

As a wider point, I am probably a little bit more dirigiste than most PF bloggers by temperament, as such I am not so sure that the market should set everything. As a result there is disagreement about how we run these things, in the same way as about half of us wanted Brexit and about half not. We have to choose one way, the way we have chosen to do housing isn’t one I like. Every nation has its fiscal pecaddiloes. As Michael Lewis wrote in Vanity Fair

In the UK what we wanted to do when the lights went out was property, and a significant number of people wanted to become onesey-twosey landlords because they had bought after the 1980s bust that pasted me, and therefore come to the conclusion that res property=money tree.

BTL mortgages only started to get rolling in the mid 1990s, so by definition they were after that bust. Why we used to sponsor BTLers to shaft putative owner occupiers by sponsoring the BTLers’ leverage from tax beats the bejesus out of me. Nobody is going to give me a tax break on the interest if I foolishly borrow to put money in the stock market but at least that theoretically would benefit business. Why this was the case to help BTLers outbid people who wanted to just buy a house to live in it escapes me, though thankfully it has been stopped.

I’ve had the surreal conversation more than once with a family where the fifty-plus parents talk about how well they are doing out of their one or two BTL properties, and later on in the same conversation they grizzle that their so-called adult children are still living with them because they can’t buy a house. In my day if you lived with your parents you weren’t an adult, the connection between the BTL doing well and the inability of their kids to set up an independent household seems to be invisible to the perps.

Not all BTL landlords are rapacious, not all people early in their working lives want to buy a house and the poor will always be with us. Other European countries and even the US seem to be able to arrange the balance of power between renting and owning so that the experience is less horrible for renters, the desperation of Brits for owner-occupation is partly because the rental experience is so bloody awful. It’s the reason I stupidly bought a house at an all-time high and took twenty years to break even. It’s because landlords were awful, they’d steal every deposit, some of the buggers would try and kill me with dodgy electrics and skanky gas appliances, and I had to move at other people’s whim.

At the moment because Britain is an ageing society the haves are the BTLers. As I said, I presume that as the proportion of renters to owner occupiers and BTLers shifts, we may see some of the policy shifts you said I should vote for. I don’t have a dog in this race, I own outright and I am child-free. The injustice does offend me, but I figure it will correct in time – the dropping of mortgage interest relief for BTLers and the SDLT surcharge show that the playing field is tilting away from BTL. I don’t see that as a bad thing.

LikeLike

BTL is the very definition of rent-seeking behaviour. It doesn’t create wealth for society as a whole it just enables some people to grab a bigger piece of the pie. We need to make the pie bigger by investing in things which create wealth – not in activities which exacerbate inequality.

LikeLike

> Lastly, it’s these same young spendthrift whingers complaining they can’t afford a decent first home … but they lease two cars, have a full Sky subscription, new phones every year, eat out every other night and take at least one foreign holiday each year to take their minds off how poor they are.

I have friends in their 20s who have no car, no Sky, cheap phones, cook all their own food, never fly, have financial help from parents, well paid jobs, and follow all the excellent saving advice of ermine, and yet will not be able to afford a home for another decade or more with current prices. But they aren’t whingers so perhaps they’re not who you’re yelling at to get off your lawn.

LikeLiked by 1 person

I was just re-reading this – it’s amazing that based on a few anecdotes of the grey hairs in my office, guys that have been at the same company for 30 years still have mortgages that they have not paid off.

Our annual “pensions advisor” was in the office today so people were talking about property and pensions – a few are looking at cashing in their pensions to pay their mortgages.

One guy with a £107k mortgage has lived in the same house for over 30 years inherited the property in his twenties. You couldn’t make it up – and of course an IO mortgage with no payment plan in place. Obviously a case of mis-selling!

LikeLike