On the last working day of 2017, the Ermine pulled up the FTSE100 index and was greeted with the following tribute to irrational exuberance.

What’s a fellow to do? Way back when, I wrote a post inspired by the reported comment by a City gent, to the effect of I don’t know WTF we are doing up here, with the implication that it’ll all end in tears. That was in 2013, with the index about a thousand points lower than now.

I’m still heavy on FTSE100 shares in my HYP, despite efforts to build around them with world index-trackers, which tend to be over half exposed to the US. I used to grouse about that, buying into an overpriced American market, but not so much now. Which brings me to the problem for a net investor, where the hell do you find value?

Ah yes, Bitcoin. It’s the latest craze, tulip bulbs got nothing on this, along with the stories of people making loadsamoney. Trouble is the price curve looks like an exponential ramp, which means if there is value there it’s largely captured by people who were into it over a year ago. Not going there – at least some of what you buy on the stock market is a productive asset, and it’s always nice to see that in an investment, though I will make an exception for gold due to its long history 😉

the fog of war and confounding factors

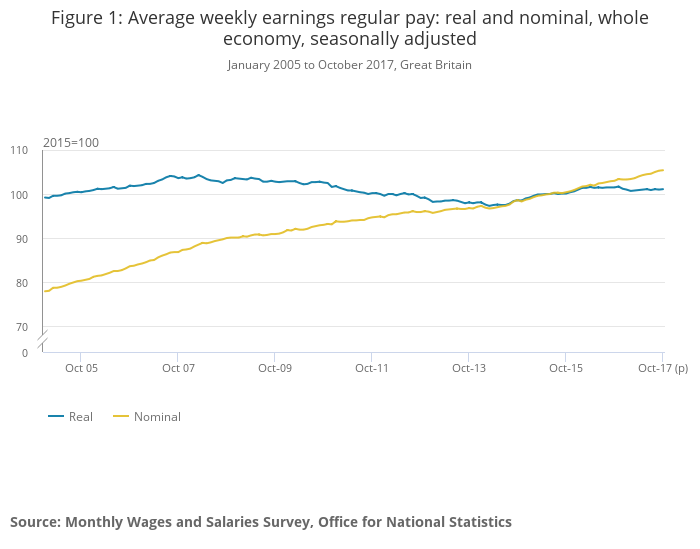

One confusing factor for Brits is that we voted last year to kick all those foreign sorts out and/or take back control at the cost of our economy, so the value of the pound is down a long way. Which has the effect of making everything else look higher than it really is, so say a fifth of this effect is due to the fact that the numbers on the vertical scale are 80% of what they used to be. In a country with a midget currency, everything looks like the work of kings. So some of this gain isn’t real, although it still makes life more expensive for savers buying their future income streams using the fruits of their toil earned in Great British Pounds, because wages haven’t gone up 20% to compensate. I guess Remoaners often work in the City so they may be getting some salary lift, which seems only fair for having their futures shat on. Most Brits aren’t so lucky as to get wage rises, but at least they got the result they wanted.

I’m surprised that the Brexit inflation hasn’t shown up more, I look at things like petrol and food and obviously I’m buying the wrong things. Maybe I need to buy Uber rides and 4k TVs to get my inflation rate down 😉

The BBC wryly observes

If ever we needed a reminder about the disconnect between our largest listed companies and Britain’s ‘real’ economy , we got it today. UK GDP growth is well below the G7 average and real wages continue to fall.

Despite that, Britain’s PLCs are doing very well thank you. That’s because most of them earn the vast majority of their profits overseas and the global economy is enjoying is best period of sustained growth in a decade.

it is the swansong of my investment career

Notwithstanding all that, it all seems a little bit frothy and overoptimistic. That’s a depressing sort of market to buy into, particularly with the possibility that investors may need to lower their their sights due to falling productivity. Buying into a lower future income stream at a high price is not a recipe for deep joy.

I have dropped back to regular index buying to replace my Charles Stanley Flexible ISA where I borrowed money from to fund a house purchase. Arguably the money I borrowed from the Bank of Ermine ISA involved selling stocks at high valuations so I am chilled about buying overvalued stocks with the same money, after all I’ve already had the Brexit Bung on it. I’ve also taken up some of Monevator’s idea of using currency hedged ETFs for a part of my world index funds because, well, perhaps Brexit might be a success and the pound rallies1.

I still have this year’s ISA contribution to make by March 2018. I’m a market timer this year, because I have to balance being slaughtered by Brexit inflation against being slaughtered by buying into a market at high valuations in the swansong of my investing career. Although 20k is a small part of my ISA, it’s not a trivial part of it. If I were saving 20k a year for the next 10 years I could take the pound cost averaging litany and ignore valuations.

Valuation matters in the Ermine’s experience

Rob Bennett has been snarling about the buy and hold mentality (Google What Is Valuation-Informed Indexing? – RB has a good case but tends to push it everywhere he can without holding back as one UK PF blogger found out, and I don’t need the fight on here) and I agree with him – from experience:

Housing

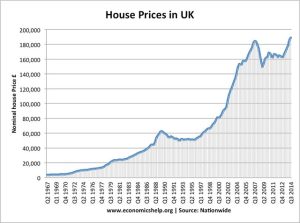

I bought a house in 1989

That house price chart is all you need to see how dumb that was2. Valuation matters, it probably took me 20 years to break even

Shares – 1

I started buying in the dotcom boom, and lost about £7k through committing every tyro mistake in the book

Start in 1998 when everybody is talking about tech stocks like they talk about Bitcoin now. Just say no.

Shares – 2

A desperate Ermine sits in the office after a bad interaction with the performance management system and a psycho manager who has just had a baby with his new second wife, so he is desperate for money and frightened because of the economy. He wants to squeeze everyone in the team to become the Next Big Thing despite being a talentless though ruthless shit. Ermine thinks I wanna get out of this place and reads this. That was the catalyst, I had been studying why I made such a pig’s ear of the dotcom bust. I realise that valuation matters, start buying in a hole, which is conveniently the stock market on its knees as an open goal right next to me 😉 Buy and hold works a treat then, because valuation matters… Now I had a massive amount of luck since then in other ways, which is why I am writing this as a retiree rather than a wage slave, but the principle is the same. Buy when it looks terrible, run towards fire.

So I’ve had two busts with valuation and one win. The win has beat out the busts3. So I am not that keen to toss my last £20k in shares right now when everything is up in the sky. Where I don’t have Rob Bennett’s chutzpah is I don’t aim to use valuation and sell at high valuations. I aim to buy at lows, and hold. I came to the conclusion a long time ago that I have no talent for choosing the right time to sell, but I am OK on choosing the time to buy. Now is not that time.

Hopefully we will have some sort of reprise of January 2016 when it all looked very different, I still have the VUKE I bought from then which appears to have crept up by a third4. But we haven’t really had a bearish stretch worth buying into for a while.

- Not convinced? Me neither, but I need to hedge that unlikely event to reduce my exposure, effectively trying to lock in some of the Brexit Boost. ↩

- I wish people would use a log scale on the y axis of price charts, the recent gyrations aren’t astronomically worse than the 1989 peak as a linear scale makes them out. ↩

- valuing it at roughly 60% of nominal value, which is probably where shares ought to be at fair value IMO. ↩

- I know, I know, it ain’t real, guys, although the Brexit boost probably is there for a while ;) ↩

Oh boy, I was just this morning thinking about lumping a large chunk of my cash reserves into the ISA fund. Now you’ve made me doubt myself, what’s a guy to do?

LikeLike

This is the opportunity to put the caveat in I really should have done at the top – you have the advantage of youth and hopefully a net contributing career of many years ahead of you. I don’t have that, so the risk profile is genuinely different. Having said that I don’t usually buy anything in the Santa rally. If it turns into a bust in January, though ,now that’s a different matter 😉

What we really need for the New Year is a jolly good stock market swoon, get shares on January sales!

LikeLike

‘What we really need for the New Year is a jolly good stock market swoon, get shares on January sales!’

Would Sir like an hors d’oeuvre from the trigger trolley? [ – https://medium.com/insurge-intelligence/brace-for-the-financial-crash-of-2018-b2f81f85686b ]

Perhaps madame L’ermine should stick with a smallholding even just as a hedge…….

LikeLike

We bought a secondhand greenhouse but it will take a little time to restore the soil using compost, it is very claylike rather than sandly loam. OTOH we aren’t water starved. Mrs Ermine tells me we have enough land to produce for ourselves, apparently this is the difference between intensive rather than extensive horticulture as at the farm. The scale looks unequal to me, but this is not my area of expertise…

> a housing-triggered banking crisis would be sparked in the context of the new era of expensive fossil fuels.

As per the Italian Job, you’re only supposed to blow the bloody doors off

LikeLike

When still a spring chicken & fine-feathered at veterinary college a small era ago, I met a woman who later started a business with [possibly angora?] goats nestled amidst the beauty of the Malvern hills. She’s doing very nicely now & it took surprisingly little land, I salute her creativity & courage because it was relatively unheard of in the UK back then…..

As per soil enrichment, I have a scientific colleague whose area of interest is in the regeneration of degraded land using primarily fungal means – the results are apparently stunning in producing sustainable yields a multiple of those using various petro-chemical inputs unthinkingly currently used.

I don’t want to spam you links you may not need, but shout if you would like to be pointed towards university studies – the upshot was that we can actually easily feed the world right now, cheaper, easier & sustainably if we could get past the gate-keeping of the immensely powerful Big Agriculture lobby.

LikeLike

I would absolutely agree, and Mrs Ermine wouldn’t dream of using big Ag chemical evilry. Hot composting and microscopy are our tools. Fortunately the ground she is using has been under pavig slabs rather than under industrial agricultutre. We had theresults of industrial ag on the farm, there weren’t any flippin’ earthworms on the farm in the first year, and if that doesn’t say wrong way, I don’t know what does FFS.

Whereas only the day after we lifted the slabs the blackbirds were out after the worms. But we need organic matter to improve drainage. Seems fertile enough looking at what’s in the greenhouse, but the tendendy to mud and water puddling is bad. But we have a slope, and also are sufficiently high up which was one of the specifications for the house search, as Somerset is no stranger to flooding

LikeLike

Dear Mr Ermine,

Sorry to add to your worries, but what I _actually_ said is that I think that our back garden could supply all our _vegetable_ needs (year round), if and _only_ if you abandon your prejudice against kale, spring greens etc etc…. and you accept that lawn is a luxury that we can forget about.

Love, Mrs Ermine.

LikeLike

Lawn is okay, but the aim of becoming finacially independent is to be well-off enough not to have to eat kale. Spring greens maybe, but kale and swiss chard fall into the same category as swede IMO

LikeLike

Cale & potato mash is a standard Dutch stable food for the winter season, normally served with smoked sausage.

It is surprisingly good, much better that the individual components would let you expect. Make sure the cale has been frozen over at least once before harvesting.

Google for “boerenkool stamppot”

Jos , who really ought to know better that to partake in domestic disputes !

LikeLike

Oh, don’t – I try and eat low-carb and that does sound marvellous. I had a penchant for Kartoffelcloesen in an earlier life 😉

LikeLiked by 1 person

could you console yourself with the fact that the FTSE100 is yielding about 4%?

LikeLike

That makes me feel better about the big slug of FTSE100 shares in my HYP which ain’t going nowhere, but not so much on dropping the cash at the mo. Inflation isn’t so scary that I can’t wait. There are some that say Innovative Finance ISA is the way to get an infaltion-beating return on cash, but that’s basically UK consumer debt, which frightens me only slightly less than bitcoin 😉

LikeLiked by 2 people

hmmm, what about getting everything that you can think of that needs doing to the new house/garden/land done now? Buy a real hedge as an inflation hedge? Plus you reap the benefits every day going forward. Then you’ve got less left to invest so can feel less bad about market timing issues? Do you need a new car or anything like that? Buy it today?

I’d agree you don’t want to go balls deep in P2P, maybe 5% absolute tops?

I wouldn’t follow in FFB40s footsteps…

“One of my friends said that if he could, he would transfer all of his money over to a Peer to Peer company called ‘Saving Stream’, who have since changed their name to ‘Lendy‘*.”

I believe he is “easily” chasing yield there? That post and the associated comments were really flaky..

LikeLike

“what about getting everything that you can think of that needs doing to the new house/garden/land done now? Buy a real hedge as an inflation hedge?”

Good thinking! I have been thinking renewable energy systems (solar thermal, biomass?) planting willow, doing extra insulation work…

I’m really interested in John Michael Greer’s book “Green Wizardry” on how to “Collapse Now and avoid the rush” – his phrase 🙂 In short how to live comfortably on fewer resources. We’ll all have to at some point (is the idea) so why not be prepared?

LikeLiked by 1 person

Plant your willow a long way from your house. Their roots search out moisture; if they go looking for it under the house you’ll start to notice cracking.

P.S. Gardening on clay can be pretty hellish. We’ve used compost, leaf mould, peat, sand, straw, dung … and still it can be a sod to turn the heaviest soil over except in brief periods in Autumn and Spring. A tip: buy mushroom compost – it will often give you a nice free crop of mushrooms. A second tip: if you plan to stay in that house for the rest of your days consider building raised beds and filling them with light soil.

P.P.S. Would kale work well in the delicious Polish dish Bigos? And as for swede, it’s delicious with haggis. Sainsbury’s has just restarted stocking Macsweens’s: get to it.

LikeLike

> I wouldn’t follow in FFB40s footsteps

Holy shit, that reminds me of me and my colleagues way back in 1998. Scrabbles back through the old backup archives of getting on for two decades to find the delightfully hubristic introduction to the messageboard I set up on a server in the lab so colleagues could share ideas about investing in tech stocks.

“Welcome to the messagboard. The aim is to help make you rich. Very rich”

What a jumped up little pipsqueak I was. Mind you, it did make one fellow very rich. Before it didn’t. He was up £100k (that was a lot of money for engineer employees 20 years ago). Shame that he sold the shares and what he bought with the proceeds went titsup/down the tubes the next year. Then HMRC asked him to pay his capital gains tax, for which he needed to extend his mortgage. At least that doesn’t happen on P2P, eh.

These extroverts have got balls of hardened steel. They will either take over the whole world or get slaughtered in a bloodbath. Saving Stream -> Lendy contains a message, similar to waking up and finding yousrelf next to a horse’s head. Mind you, I confess a sneaking admiration for a dude who became FI by 34 and can afford to live mortgage-free in Cambridge. I could just about afford a two-up-two-down in some unsalubrious part of the city, so you go boy 😉

I think given the choice I’d rather go with Bitcoin than P2P secured on UK property. A loan is only secured on an asset if the asset is worth more than the loan, and the sort of leverage means if the asset falls that only holds true for a short while. Then there’s the lingo

Didn’t we hear that about CDOs and MBS back in 2008. Then on the very same page we flip the coin and

Yup. Google translate that from bullshit to English and it says “We can lend money to people who can’t afford to pay”

It’s a hard rain a-gonna fall in 2018….

LikeLike

> Do you need a new car

I’m with the MMM cult on that

Nobody needs a new car 😉 Even with both hands I would struggle to sign the cheque on a new car 😉

I am planning to indulge in a bit of consumerism, but I still like to pay myself first, old habits die hard 😉

LikeLike

“I am planning to indulge in a bit of consumerism, but I still like to pay myself first, old habits die hard 😉”

I wouldn’t classify stuff like renewable energy systems, insulation, gardening works as consumerism, to my mind its almost the opposite?

I am monumentally anti-consumer/anti-consumption – comes as naturally as breathing.. helps with the old FIRE process. I don’t let on in the real world that I own any assets, so people assume I’m poor. I’m also originally a Northerner so its easy just to play out the stereotype and let people assume that’s why I’m frugal/tight 😉

LikeLike

> consumerism

Interesting that you naturally didn’t have this, I fear that I had to fight that down, although wanting to RE helped the process no end. I wouldn’t actually say I am frugal, but some simple wins like running ad-blocking and not having a TV saves me from an awful lot of marketing in a passive way.

I was going to start on getting a fellow in Bath to fix my old record deck from 1989. I’m hoping everyone will be feeling skint in January so he’ll have the time. Then some CD shelving so I’m definitiely along the consumerism axis at the mo 😉 Although at the same time I will dust off the old Raspberry Pi and upgrade the compost monitoring system. None of this is going to bend that 20k though, it’s part of the entertainment budget. I would struggle to go spend that much on other stuff at the mo. We need to see the cycle of a year to know what the ask is of renewables. So far it seems a lot milder than Suffolk, but I don’t want to fall into Trumpian levels and conflate weather with climate. It rains more, which is much better for gardening , but we need a lot of compost because the previous lot were more keep on BBQ parties than gardening and paved eveything they could.

I probably want to take the same approach to consumerism this year as in 2016. But I’m not taking it from that 20k – I still want to invest that, just not now. It is part of my defence strategy against the long term erosion of my pension by inflation, and also in the long run I expect to pay for future healthcare in a way I hadn’t anticipated in the past due to the erosion of the NHS.

LikeLike

I too have alot of reservations about P2P and particularly Lendy. Back when they were still Saving Stream I had a successful ICO complaint against them regarding certain DPA breaches involving myself & a group of others. They further assured me that my data had been removed following the complaint and yet that was later proven to not be the case.

I’m not sure I could every trust a company with my money if they have such a disregard for my data..

LikeLiked by 1 person

New to you, i should have clarified, not new to the world..

The general point being when interest rates are low and inflation higher its time for infrastructure spending.

LikeLike

PS sounds like Mrs Ermine is ahead of the curve on this already? Some great projects there to get your teeth into?

LikeLike

Just been dredging up some old work we did on thermal composting. We have the advantage of a more enclosed site not on top of a ridgeline so it doesn’t blow a hoolie chilling the heap. But we have a serious need to add organic matter to the clay. The joy of mains power and access to the LAN makes monitoring the temperature easier, we had one compost heap go over 70C on the farm. Too much of a good thing can be bad…

LikeLike

If you stuck a pipe through that you’d have free hot water?

LikeLiked by 1 person

You can do that, but getting enough compost for hot water is a massive job, and if you chill this stuff it takes longer to make the compost. Much easier is the gonzo version of stringing PET 2l bottles with the bottom cut out around a black hose and circulating the water slowly – not necessarily a winter project, but the leccy co charges the same in winter as summer,so the power bill is fungible 😉

LikeLike

Hmm, sorry this reply’s six months “behind the times” but I wondered if you (and possibly more likely Mrs Ermine) had seen a three part TV series Alan Titchmarsh did, back in 2015, entitled “Britain’s Best Back Gardens” ?

The reason I mention it here is that one place (somewhere in Wiltshire I believe, so not that far away) was owned by a lovely couple who, amongst the many and varied things they’d done to it, had got composting down to a fine art – so much so that they demonstrated on camera cooking a joint of beef in a cassarole dish right in the midst of the heap – it was apparently hot enough to do that to perfection 🙂 Fan-bloody-tastic, I’m impressed !

BTW, nice to see you’re keeping up the article writing. From my sense that the gap between “overall cost” and “customer experience” (yuk!) of almost anything to do with consumerism these days is widening ever further, it’s nice to feel I’m not alone on that score.

Regards

Mike

Ah, just found it here: https://www.youtube.com/watch?v=y-vAa_p8BX4

With a little background, the bit of interest starts about 38:30 in (never mind these bloody smart TVs – could do with “Smellivision” really, maybe not – can’t afford it …) – anyway, enjoy 🙂

LikeLiked by 1 person

@Mike nice one, though 70C is about as high as you ever want to go. The same reason why getting his brisket up to 70, pasteurising out any bugs is the other side of why you don’t want to get over that in the heap – you don’t want to pasteurise it. I remember one heap we had at the farm, we had a remote temperature monitoring rig on that. We had to go out early in the morning one day to turn it because the heap had reached 70C, which is around the point where you shut down the aerobic bacteria which is what you want for compost.

Bioactive compost is a marvellous thing, totally different to the sterile stuff you get at garden centres. We did one heap here with a mix of wood chippings scrounged from local tree surgeons ,hedge clippings and a smidgen of chicken shit, and used it for potting tomatoes outside this year. These plants are far more vigorous and thriving than the toms in the greenhouse, which are into the clayey soil which was covered for years with paving slabs. We need to get some of that compost in there to get some life back into the soil!

LikeLike

[ Side issue: having to click on Reply button found under your “Just been dredging up…” comment. The old system, i.e. back in good ‘ol Suff’k (sorry, can’t do the accent :-)) used to allow you to click Reply to the exact comment you wanted. Not sure how this new one works in that regard, but hey, it works after a fashion. ]

Anyway, bioactive vs stuff from garden centre: oh, not a bit surprised ! I’m not quite old enough to remember Geoff Hamilton in his heyday (dreadfully sad to lose him so early), but I imagine this subject would’ve been right up his street, as part of “the full life cycle” and recycling/reusing/making do, etc. He was doubtless well ahead of his time in that regard.

Being a hoarder of books, I’ve still got one of his around here somewhere. Haven’t read it for many years, but I seem to remember it being VERY different from the average “how to add colour to the shrubbery”, or equally likely “how to design and plant up the bloody mess on a new estate after the builders are done with it” style (can’t get the opening credits to “Blott on the Landscape” out of my head, especially the bit where everything mushrooms out into what looks like a glorified Punch & Judy box…, sorry). It was very much “let’s start with the garden’s engine room – the compost heap, THEN we have something we can work with”, something like that 🙂 Nice easy style of TV presentation from what little I remember, anyway.

As regards compost temperatures, I can quite imagine there’s a difficult balance to be struck given that above a certain temperature it’s too hot for some natural processes to continue, yet it needs to be high enough to cook food and kill what’s not supposed to be still alive in there. Given they’re sort of related, I imagine there’s potentially a fairly narrow operating temperature range.

What sort of (network of ?) probe/sensor did you use for measuring temperatures ? I found the following quite useful for implementing a small network of temperature sensors for measuring various HW & CH pipework at interesting points (definitely another story :-)):

https://www.amazon.co.uk/DALLAS-DS18B20-Thermometer-Temperature-Sensor/dp/B00HCB8D8Q/ref=pd_vtph_tr_t_2?_encoding=UTF8

They’re fine for my pipework purposes but for sticking into a compost heap, well, it’s a touch more “hostile environment” really, isn’t it ? 😉

Mike

LikeLiked by 1 person

The old system reply only went so many levels deep too, I guess otherwise you end up all on the RHS and the poor devils reading this on their mobile phones get only one letter per line…

Use the same DS18B20 sensor, but the Chinese version

https://www.ebay.co.uk/itm/1PC-DS1820-Stainless-Steel-Waterproof-Temperature-Sensor-Probe-18B20-for-Arduino-/222547940077

Epoxy the suckers in the end of a stainless steel tube about 70cm long, and I use RF boards similar to Jeelabs to concentrate the data back to a Raspberry Pi. The farm rig used SMS to send it back, but now I’m on site the RF link is good enough.

I used Elaine Ingham’s SFI guidelines for thermal compost, went to her presentation at the Oxford Real Farming conference a while ago. There’s some stuff on Youtube. 70C really is as hot as you want to let a compost heap get. Ingham goes through the temperature profile you want to get, in that link, basically you want to kill off human pathogens but keep the heap aerobic. If you’re capable of using the DS18B20, get a Pi and rrdtool onto the job, run two probes into your heap, turn as required.

I’m not a gardener personally, but you only need eyes in your head to see the difference bioactive compost makes for our toms. I did a project using NVDI IR photography against non IR imagery to check activity on the farm. But you didn’t need the tech to see where the residue of the compost we used to make compost tea had been slung out. You needed to get in the polytunnel and look at the difference in height and difference in deep green colour of the bean plants 😉

Bioactive compost is the dog’s ‘nads. Other areas of interest are Albert Howard’s Indore method, although you need manpower at ridiculous levels for a First World Country, plus cow shit if poss. And Farmers of Forty Centuries is a great read, and can be hacked through t’internet although the concept of night soil is at variance with the Roman doctrine that civilisation is measured by the distance man puts between himself and his excrement…

LikeLike

The sensor, RF and computing stuff’s easy enough. I’ve not played with RF bits and pieces as you can happily recycle old ethernet wiring for a 1-wire network inside a building, but it’s something to add to my “when I’m at a loose end” list, or it’s a dreary monday morning.

Wow, thanks for the links in your (as usual) well considered reply – there’s a fair bit there to rummage through. Actually, the composting stuff’s probably more appropriate to my parents’ place down the road as they’ve a fair size garden that became somewhat neglected by the previous owners in their last few years there. I’ve seen an overhead photo of the plot from about twenty years ago and evidently it was bursting at the seams produce-wise.

When my parents’ moved in we found the old greenhouse was so knackered it was only being held in place by the huge vine fighting to get out ! It looked like something that might interest Professor Quatermass 😉

Anyway, thanks for the links.

Mike

LikeLiked by 1 person

Depends on your layout and power availability. My experience on the farm was that wiring of any sort was painful, and the RF modules are cheap. You can use the HopeRF RFM12B, I bet on the wrong horse and used Cicesco SRFs but the company went bust. Bought a load of bits in their closing down sale, so I probably have enough RF parts to see me out 😉 Stick them together with a PIC that only wakes up every 15min and you have a low power outstation that can run off 4 AAs and solar in the summer. But if you have the power, run a raspberry Pi than can run an instance of onewire on each GPIO pin if you like. Dunno how the Pi version would like summer lightning though…

I can vouch for Ingham’s techniques, did some of the microscope work earlier on. You need to do thermal composting on a big enough scale, at least 1m round by 1m high if you are using the mesh technique, otherwise the heap easily chills, good to keep it out of the wind for the same reason. If you go larger then you can keep the heap going regardless of wind. I kept notes on mine incuding the failures, a struggle to get things going (and enough material) much before April or much beyond October if you’re on the small scale end of things. This is the temperature profile of one of my successful heaps, it didn’t exactly match Ingham’s temp spec three times, but it worked well enough (the green trace was reallocated to monitoring ambient partway through)

LikeLike

“Mind you, I confess a sneaking admiration for a dude who became FI by 34 and can afford to live mortgage-free in Cambridge. ”

Yes, it is impressive – especially as it sounds from the backstory like it hasn’t always come naturally

But FI isn’t a one way gate, fortunes can be made, and fortunes can be lost? I’m sure he’ll be fine though – he’s very enterprising..

I do find the business model of paying someone to write low quality books really quickly then flogging them on Amazon quite upsetting though. I really like books, it seems almost sacrilegious to me?

LikeLike

Rhino; These are primarily kindle books which sell for 99p-£2.99. They are almost always very niche and focus on a specific item or area. Think something like “How to grown a watermelon plant” etc. The information doesn’t need to be particularly long or amazingly indepth, it just needs to fulfill the requirements of that small group of purchasers at the time.

Also a majority of the page views are from those on the Kindle unlimited subscription. They pay a monthly charge for unlimited access to Kindle books and so are far more likely to be getting these kind of niche books often for a short read and then ditching onto the next.

LikeLike

@ERG – you’ve chosen a bad example to sell the concept – there are some *beautiful* gardening books out there that are a joy to read written by people who are both genius and lifelong devotees. Why waste your time on an e-book that’s been cobbled together in an afternoon? I don’t think I can be persuaded on this one? Its just a tawdry way of making a quick buck.

LikeLike

I suspect those with a true passion for gardening won’t be spending 99p on a kindle book and expecting much from it. A totally different market. My example is the person who has received a ‘grow your own watermelon plant’ pack in the work Secret Santa.

LikeLike

There is clearly a market for it, it seems that FFB40 is making a small fortune?

But just because something is lucrative, doesn’t mean you should do it.

I mean you could become a recruitment agent, put cheese on to trays in a factory*, do matched betting, rob a bank, work in finance?

All of which will earn you a crust – but at the expense of being spiritually moribund. I’d argue only do these things if you absolutely have to in order to get where you need to go. Otherwise you’re wasting valuable days?

* I’ve done this one 😉

LikeLike

As I’m not spiritual, nor yet FI and find at least one of those activities to be particularly lucrative I’ll thank you for your endorsement of my continuation 😉

LikeLike

Spiritual in the sense of relating to or affecting the human spirit or soul as opposed to material or physical things.

Not spiritual in the sense of relating to religion or religious belief.

Are you telling me you don’t have a soul?

LikeLike

I’d find it impossible to say I had a soul when I don’t believe in such things.

LikeLike

In which case I’d chance your arm and try and flog it to the devil – he’ll think that you’ve got one..

not sure what the going rate is?

LikeLike

I’ve since read that they inherited the Cambridge house mortgage free which explains that side. And of course not feeding the Mortgage beast from early adulthood makes FI much easier. That’s not to detract from an impressive achievement notwithstanding, after all enough Lottery winners could become mortgage free bu end up boracic lint ten years down the line.

Yeah, I’m not sure about sweatshopping crappy ebooks either. As a Kindle user it really buggers up the signal to noise ratio. I wish they had a screener “only show me books that have a dead-tree version” and hide the rest.

LikeLike

“I wish they had a screener “only show me books that have a dead-tree version” and hide the rest.”

Pointless I’m afraid. Createspace (Also owned by Amazon) will let an author upload their kindle ebook and have it available in paper format printed on demand, all fulfilled and shipped directly from Amazon.

LikeLike

I’m with @rhino and ermine on this one. It’s always mattered to me how I make money, even in times when I had less option about whether to do so.

LikeLike

@RK – I struggled for a bit to articulate why matched betting wasn’t something you should do with your time, I just had a gut feeling about it. Then liberate life pointed out it was its zero sum nature that was the problem. Its not good for the psyche to engage too much in zero-sum games. Non zero sum games, or win-win strategies are much healthier and create real value.

LikeLike

Matched betting is in essence manual labour, only without the good feeling that you get from doing manual labour – none of that heavy-limbed contentment of sitting on the steps of your freshly pressure-washed patio, with a glass of chilled white, surveying your newly trimmed hedge. There’s no skill required with matched betting, aside from being able to quickly punch numbers into websites and press the “confirm” button. Its reward is slight mental fatigue and enough earnings to pay someone else to pressure wash your patio and trim your hedge. Not my cuppa.

I agree with you about the gardening books.

LikeLike

It gets depressing after a time – when I tried it, it was good fun at first because making money out of people who usually make money out of others feels good.

But after a while the nagging voice in my head goes something like I have another 30 years on this earth if I’ve very lucky, so how many of those eleven thousand days do I want to spend peering a a computer screen doing as @hosimpson says, manual makework? I was too fussy to sell my time to The Firm any more, matched betting was not progress.

I did enough shit-shovelling jobs when I was younger, butyou get a lot more discriminating when you are FI. Before then the choice is MB or working for The Man, after FI the choice is MB or doing something far more interesting instead from reading a book upwards. Life is too short for matched betting under those circumstances.

LikeLike

In a way I’m glad that yourself and @hosimpson do refer to it as a form of labour. All too often I see the adverts for the various MBing services who paint it as a get rich quick scheme with no work. Granted some of the initial signup offers take minutes to complete but beyond that things get alot leaner and require alot more of a time investment to give any reasonable returns.

I disagree with @hosimpon that there is no skill involved. Perhaps for the initial signup offers it is just a case of putting numbers into the calculator with no decision making involved but that quickly changes when you begin taking on the more complex methods; sharbing, greyhound races with no time to use calculators, extra places etc.

For me the big draw is it being tax free. Working overtime at a 40% tax rate, plus NI & student loan means my hourly rate on the normal job would be far below what I can make on a Saturday during the ITV horses.

LikeLike

It appears very skillful to me. Needs good numerical skills and attention to detail. Plus zero sum games with a skillful opposition will always require skill? Classic Red Queen stuff? Other giveaway that it requires skill is the huge differential between how much individuals are able to make per hour?

LikeLike

Certainly if you go in and lump £200 on an Argentinean 2nd division team playing a friendly then you’re gonna get spotted pretty quickly… exactly how I happened to lose my Bet365 account in the early days!

LikeLike

No numerical skills are required – matched betting websites provide calculators and other tools, and the algebra behind them doesn’t require a science degree.

As for the classic Red Queen stuff, it’s quite the opposite, in fact. The premise of matched betting is that there has to be an offer available – be it an easy get-your-money-back-if-you-lose, or enhanced odds, or extra places – something given away as a sweetener for free, which nonetheless has a monetary value that can be separated from the bundle and exploited. The idea is to carve the sweetener off from the main bet and make “free” money on it while breaking even on the main part of the bet.

Of course there’s also plain arbitrage, where you exploit market inefficiencies – price differences between bookies and exchanges. We used to have people who did exact same thing in the financial markets in the 80s, and now algorythms do it. The way I see it, if it can be automated so as to eliminate human fingers from the process, then it’s manual labour.

Private Sub Dig_Field()

Dim Shovel As Tool.55.Degress.To.Ground

Get

SoilCondition _Conditiontable

End Get

Set Thrust = Value.SoilCondition

… etc, etc…

End Sub

😉

LikeLike

@hoS – wow! – you must be smashing it on the income? All those pension contribs and still all that income tax? Possibly the mortgage overpayment fail is a good thing? Is inflation running higher than your interest rate?

I would agree though that freedom fund looks a bit small alongside property and pension? You must be about 40 so a way off being able to access those pension funds? Are the ISAs inc. in the freedom fund or are they categorised somewhere else?

LikeLike

TBH, in the spirit of market timing, I was going to focus some more on the mortgage this year. Raise a glass to freedom and all that. The interest rate is less than CPI, but my personal inflation rate is not CPI, and as is often the case in complex and uncertain situations, ignoring it may not be as dumb a call as it may appear. Of all investment decisions, if it turns out to be a mistake, having a lower mortgage, even if there’s a high opportunity cost, I’d probably regret that the least.

I agree about the freedom fund. The thing is, my limiting factor is the availability of cash to invest 😉 It could delay my retirement, since I’ll need something to live on before I’m 58. Still, I have to balance the possibility of having to buy private health insurance at old age (if NHS has to downsize), I’d hate to have to die of being poor, and I have no DB pension to look forward to. So…

LikeLike

Interesting – it would seem me and TI are looking to do the exact opposite?

I definitely get it about regretting the least though..

Do you attempt to calculate a personal inflation rate? I tried for a bit and concluded it was impossible.

I’d argue you aren’t limited by cash to invest, its just a case of whether you’re willing to divert from the pension, bearing in mind the (probably unattractive) tax implications of that?

Ah balls – is it 58 for us GenX’s? I was hoping it might still be 55..

LikeLike

do you have a portfolio breakdown anywhere?

I’ve also been market timing as I thought things would fall apart sooner, hard knowing what to do before the new tax year begins.

LikeLike

I am about half in a combination of VWRL and a Legal and General Dev World exUK fund, and the other half an old HYP largely of FTSE100 big fish which I haven’t added to for ages

LikeLike

one thought on the market timing – if you’ve got a mechanical rebalancing strategy and have been using it a good while, could you console yourself with how that approach has effectively mitigated market timing issues?

We can see that both ermine and SHMD have foregone returns through market timing worries? This being outside the remit of foregoing returns based on their individual risk tolerances?

Individual risk tolerance should be independent of what the markets are doing?

LikeLike

Au contraire, I’ve done well out of market timing. Though I claim no Buffetesque individual talent! I was desperate enough to get want to get out of the rat race in 2009, so I started then. That’s market timing in spades. I have filled my ISA (and bought shares with that) every single year since, bar this year. Although I did draw out from last year to finance bridging the house purchase, but that is going back in monthly until it runs out.

Also note that my and SHMD’s risk profile will be different from you whippersnappers. I have an investment horizon of about 30 years absolute tops, and no extended future of regular contributions ahead of me, I am probably in my penultimate year of contributing signficantly to my ISA. That makes the risk profile very different – the risk profile of someone going into drawdown is maximally exposed to the market at the point of retiring. Mine is not so bad because I will use this ISA to defend the long-term erosion of my DB pension from inflation and wage rises, and also health costs, I am fortunate enough at the moment not to have those.

LikeLike

Well that’s good news. Must have got the wrong end of the stick on the market timing issue.

LikeLike