The UK PF scene has expanded a lot of late, and this is all to the good IMO – there are many ways along the path to freedom from The Man. Some are slow and steady, some have Sturm und Drang. Most writers are far more ambitious that I was. As yet there aren’t that many other reporters filing reports from across the FI event horizon, indeed there are more from the US side than from Blighty.

There are, at heart, two different sides to personal finance, as epitomised in the classic highwayman’s salutation and title of the seminal PF book Your Money or Your Life. You start out in an industrial consumer society as an adult with nothing, indeed, increasingly with less than nothing due to student debt1 but with a stupendous energy, ability to learn and ambition. You gradually exchange this capacity for financial income, and if you are part of the PF community, you try and accumulate some of this income as wealth.

The financial side – it’s all about the money

There is the finance side, this is all about SWRs, reducing fees, seeking opportunities, evaluating risk. I’ve drawn back a little bit from writing about that, because a) there have been a lot of new authors entering the market that fundamentally know more about these things, Monevator is still there and there’s not much that I can add, b) some of the changes Osborne has made have given me the opportunity to seriously derisk my pension savings by allowing me to buy out some of the actuarial reduction to my pension; my ISA will be paying for wants rather than needs, and c) personal finance is interesting but not fascinating for me now – it was fascinating while I was working for The Man and it was an enabling technology to shorten that period. The essential takeaway I have learned by experience is still the same as was taught me by my parents and that I largely followed –

Don’t spend more than you earn, son, and never borrow money for Wants, and only for those Needs that are non-wasting assets[ref]the common examples are a house and education[/ref]

I can count the number of times I used more than a month-long consumer credit on my fingers, which is uncommon in the modern world. Once when starting work to buy a hi-fi preamplifier on 9 month’s 0% credit, which although stupid didn’t cost me anything because it was paid on schedule (and is still in service over 30 years later), one bank loan to buy my first car which was also stupid but was paid back on time and never repeated, a 0% credit card loan to pump up the deposit on my first house, paid back on time, a mortgage for 20 years, one time with credit cards when first going out with DxGF where I failed Micawber and started to fall behind but corrective action was taken within two months, and more recently to avoid having to sell more than a capital gains tax allowance worth of shares.

The personal and the cycle of life

The young, of course, bless ’em, know they will never get old. So you start work, and life is good, you’re earning money, and of course you will always have the capabilities you’ve always had. Age shall not weary you, nor the years condemn – after all you have not seen the changes that time wreaks on the human spirit. Or indeed the quieter rewards of wisdom if knowledge is integrated over time.

It is as it should be, life is not a rehearsal, you pass through the stages but one time, and each of them has value. Unfortunately, to make a decent fist of financial independence/retiring early you need to have some feel of these stages, because the demands on your finances will never be the same as when you start work. As a rough obvious qualification, and making tremendous generalisations:

20-30:

huge changes in these years, between possibly university and getting the first job. People often pair up in these years, bringing a different set of rewards and challenges. Deep within the British psyche is the concept that you should be able to buy a house in this period, but I would venture this is unrealistic at the current time. I was 29 when I bought my first house in 1989, which is a time that has similarities to now, that was both unwise and also jobs are less stable now.

These are the years when you set the foundations of a professional career, because of this, taking time out (to have children or take a break) tend to have a serious adverse effect on your lifetime earning power. This is particularly bad in technical fields like IT – a year out of IT is pretty much ‘hello world’ time again

30-40:

Four-fifths of people will be wrangling children and work in these decades. Taking time out in the first half of this decade has some adverse effect on lifetime earning power. People start to slow down towards the second half of this decade – particularly those with children are run ragged, and their focus is not as single-minded as it once was. Mark Zuckerberg summed it up well

“Young people are just smarter,” he said with a straight face. “Why are most chess masters under 30?” he asked. “I don’t know,” he answered. “Young people just have simpler lives. We may not own a car. We may not have family.” In the absence of those distractions, he says, you can focus on big ideologies. He added, “I only own a mattress.” Later: “Simplicity in life allows you to focus on what’s important.”

He got slaughtered for it because it’s not politically correct, but I believe he has a lot of point in that the simplicity of young people’s lives is a great asset for work areas that deal with roiling change.

In the second half of this decade it’s often about domain knowledge, contacts and leadership. You better have some of these, because towards the end of this decade if you don’t, you start to become expensive and replaceable.

40-50:

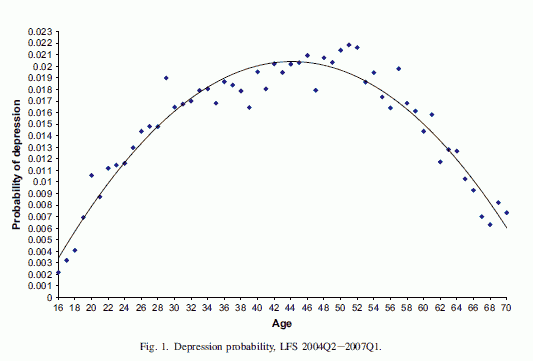

These are often the hardest years for many people, and they coincide with a statistical low-water mark of psychological well-being2 in people

I personally wouldn’t casually draw a U through this – the peak in the late 20s I think is real – a quarter life crisis, the disappointment is ‘is this all there is’ and to me there seems a clear deterioration from the 30s to the early 50s. I like the personalTao’s explanation

Quarter life crisis in a nutshell is all about how a person shifts into society. Midlife crisis is the reflection of Quarter life crisis. Midlife transformation is all about how a person shifts out of society to become their own person.

I’m going to barge off the scientific into the anecdotal. The part of The Firm I was in never had great mental health. It hired people who were already a bit unbalanced, in the early days before a big purging in the late 1990s they had a significant number of serious outliers and downright weird people – stupendously brilliant in some areas and almost dysfunctional in others. They got rid of most of these folk by 2000, as they decided to get out of R&D. But the background radiation of the selection was presumably still there. Every so often someone would top themselves, this always got hushed up but I knew someone on the site fire team who got to hear about incidents. The windows in one of the towers aren’t openable any more, but the paving slabs were still cracked last tie I saw them.

I saw some people go off with stress. I saw heart disease claim the lives of some colleagues, and towards the end of this age decade is when that starts catching up with you.

50:60

In the early part of my career, this age cohort was well represented. After all, the human lifespan is typically three-score years and ten, even 30 years ago, and in something soft like electronics and studio engineering it’s hardly like the Grim Reaper comes to call early. Indeed, in the late 1980s and early 1990s these guys formed the typical 25% of workplaces that elementary arithmetic would lead you to expect, given my decade grouping and a 40-year working life. Early retirement was not a thing then – I went and got truly hammered at my first BBC boss’s retirement bash – he was 65 ISTR although I’m pretty sure the BBC NRA was 60. At The Firm I saw a fair few old gits swan off into the sunset at 60.

Something changed in the last decade and a half. Now The Firm ran out a lot of their 50-somethings in the dying days of the dotcom boom. But I went to very few retirement celebrations in the last five years of working there, when some of the late 40’s people in 2000 would be coming up to 60. Some of that is due to other changes in the workplace – The Firm shattered the esprit de corps with some of the changes. But I saw a lot of people go off sick and there were a few funerals. Now I don’t know enough of longevity to know if this is the natural slope of the bathtub curve of reliability, but I do know that in the rest of the community I know I haven’t seen any 50-60 years olds get planted…

This age cohort is prime target for redundancy at the level of middle management. They’re often expensive, Zuckerberg’s thinking abounds. To be honest, if you are working for The Man, just don’t expect to for most of this time. As a test, look around your office and take the average age of the oldest 25%. It should be in the 50s. If it’s less, there’s a message in there for you that’s worth listening to.

60:65

You’re in extra time, bud. Though you’re probably feeling more chipper 🙂 By definition you aren’t interested in early retirement.

What’s with this U shaped curve?

Two things. One is practical and by observation – work and raising kids is no fun when both partners work, and even if you are part of the child-free 20%, work is no fun. As you progress higher up the greasy pole, you feel less secure, because the last few years in business have been challenging and wider changes are making your position more precarious. It isn’t entirely enough to explain it, and I’d venture that some of the explanation is to be had in these words

It seems to me that the basic facts of the psyche undergo a very marked alteration in the course of life, so much so that we could almost speak of a psychology of life’s morning and a psychology of its afternoon. As a rule, the life of a young person is characterized by a general expansion and a striving towards concrete ends; and his neurosis seems mainly to rest on his hesitation or shrinking back from this necessity. But the life of an older person is characterized by a contraction of forces, by the affirmation of what has been achieved, and by the curtailment of further growth. His neurosis comes mainly from his clinging to a youthful attitude which is now out of season….

Carl Jung, 1929, CW 16, ¶75

There is a change and a reorientation to be had across this time, and in a consumer society this is a particularly pathless land. The changeover of perspective is felt, and it is never comfortable

“The truth is that our finest moments are most likely to occur when we are feeling deeply uncomfortable, unhappy, or unfulfilled. For it is only in such moments, propelled by our discomfort, that we are likely to step out of our ruts and start searching for different ways or truer answers.”

M Scott Peck

In a materialist world-view, it’s hard to square these changes that seem universal enough to be part of being human, and all too often the discomfort is projected upon the outside world – the hoary new sportscar of the mid-life crisis, the trophy younger wife, the endless striving to avoid the uncomfortable truth that wherever you run to, still yourself you see in the mirror in the morning. To pinch some more of the wisdom of M Scott Peck in The Road Less Travelled

“Life is difficult. This is a great truth, one of the greatest truths. It is a great truth because once we truly see this truth, we transcend it. Once we truly know that life is difficult-once we truly understand and accept it-then life is no longer difficult. Because once it is accepted, the fact that life is difficult no longer matters.”

Many, many people fail the test of mid-life – because as they come to the signal-box where the switches will be thrown they project their past upon their future and fail to give the right instructions

“Thoroughly unprepared, we take the step into the afternoon of life. Worse still, we take this step with the false presupposition that our truths and our ideals will serve us as hitherto. But we cannot live the afternoon of life according to the program of life’s morning, for what was great in the morning will be little at evening and what in the morning was true, at evening will have become a lie.”

Carl Jung, Modern Man in search of a soul

You may disagree with some of Jung’s background, and some of the surrounding text is of its time, though I would say still translatable to the modern world.

Corroboration is to be had in the Harley Davidsons, sports cars and the existence of sugardaddie.com (tagline – where the classy, attractive and affluent meet). Thank you to the Daily Fail’s Helen for the tipoff!

Ok Ermine, WTF has all this psychology/metaphysical shite got to do with FI/RE?

tl:dr – Life is short, use it well. You will change if you grow well through the life-cycle, else ossify and atrophy. Don’t count on a 40 year working life in a stressful field.

Welcome young PF reader (if you’re an old git you’ll have gone meh way back). Think of the grizzled Ermine as the Ancient Mariner in Coleridge’s Rime of the Ancient Mariner, and you as the Wedding-Guest3 – because if you are still reading by now then the hidden menace of the tale holds reader in thrall

It was kicked off by Mr Z’s great post – Sprint, Walk or Jog and it reminded me of a long three-year journey I undertook, in adverse conditions, to try and get out. Believe me, I would have given a lot ot kick back from the sprint phase – The Firm was desperate for people to go part-time and offered decent terms. I considered it, but then lifted my eyes to the glittering prize, and kept going.

It was kicked off by Mr Z’s great post – Sprint, Walk or Jog and it reminded me of a long three-year journey I undertook, in adverse conditions, to try and get out. Believe me, I would have given a lot ot kick back from the sprint phase – The Firm was desperate for people to go part-time and offered decent terms. I considered it, but then lifted my eyes to the glittering prize, and kept going.

It’s hard to make the figures add up to retire early, and to be honest to do it at all compared to your fellow wage-slaves you need to sprint. Mr Z’s walkers will never get there – subtle trends in the economy are running away from the workforce, and if you do the same old same old then you will probably retire at 70+ if at all. Some of these forces are the same ones that make saving for a house run away from the average punter. FWIW to some extent I am absolutely guilty as charged by Mr Z

It’s whirlwind at the end, pulling together what ever resources are available and blaming everyone else for not letting you know that this day would come.

although in my favour I would say that I took corrective action with extreme prejudice when I did realise I had been asleep at the switch…

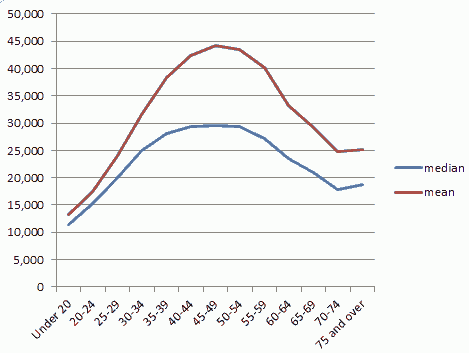

but I can return the favour. Beware of the siren song of sabbaticals – because if you plan to get to FI/RE working for a company the cost of taking time off is high and variable, and you are unlikely to get much beyond 50. Many people will think they see lots of 50+ people in the workplace, and it’s true. But there’s a dirty little secret about the whole FI/RE community that is rarely acknowledged – income matters. If you are talking about early retirement you are unlikely to be on the UK average household income of £27k p.a.

Note that this is taxpayers only – it doesn’t include those with an income below £11k p.a., the unemployed, welfare claimants, Ermines. Now think about the odds, you’re somewhere between the blue and the red lines, and I’d say you can’t necessarily count on a long, highly paid working life of 21 to 65. The signs of the 50-60 flameout are written all over that chart.

It isn’t predetermined – but the odds ain’t great.

Like anything else in life, you can shift the needle on the dial. Certainly working for The Man post 40 is a hazardous thing to rely on for FI/RE, but maybe you will run a business or become a contractor, as long as you can stay ahead of the game you can do well. But when setting direction in your 20s and early 30s you don’t know how well this is going to turn out. Right up until the month4 before I recognized the writing on the wall I was expecting to work to 60 and then retire. Why 60? That was NRA for The Firm when I joined. It would have been a terrible waste to have done that – to call in M Scott Peck again

“Until you value yourself, you won’t value your time. Until you value your time, you will not do anything with it.”

I hadn’t got my head round the fact that I really should have been asking myself what do I want to be doing with my time – I was guilty of using the program of life’s morning into its afternoon, without even a celebratory drink when the sun passed the yardarm!

You’d be unwise to assume a 30-40 year working life in a highly paid/stressful job. Your late forties onwards is when the cracks are likely to start showing up. And the blighters don’t take no for an answer. One of the computations I did was if I bailed early, how many years of working minimum wage at Tesco were going to be needed. Let’s just say that the answers was enough to get sufficient intestinal fortitude to keep going, discard the blandishments of going part time or taking a year out and getting on with it.

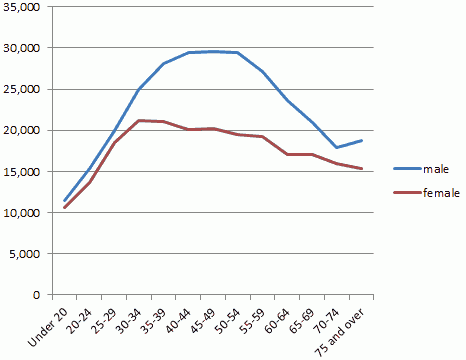

The life-cycle favours doing your sabbaticals either before you start on the treadmill, in which case they are called gap years or postgraduate degrees, or taking them at the end of your working life – as I am doing now. If you want circumstantial evidence of the magnitude of that hit, then look at this chart

and ask yourself when in the age grouping do women typically start having children – and remember this is taxpayers only so a SAHM presumably does not feature. Having children may be a very rewarding activity, but it’s not remunerative work, and it has consequences for earnings. Everything worthwhile has a cost; and if a sabbatical is worthwhile than of course it also has a cost. That cost does not appear to be trivial. Although I’m not comparing like with like, since a sabbatical is a one-off setback, it still not zero and it’s more than the pay you forego.

and ask yourself when in the age grouping do women typically start having children – and remember this is taxpayers only so a SAHM presumably does not feature. Having children may be a very rewarding activity, but it’s not remunerative work, and it has consequences for earnings. Everything worthwhile has a cost; and if a sabbatical is worthwhile than of course it also has a cost. That cost does not appear to be trivial. Although I’m not comparing like with like, since a sabbatical is a one-off setback, it still not zero and it’s more than the pay you forego.

If you want FI/RE, the odds favour keeping your nose to the grindstone. Extraordinary results demand extraordinary effort to achieve. There’s a damn good reason why most people don’t retire early, and of the rest, many just retire early (50+) like me, rather than extremely early (40+). If you want to make easy money, do something hard.

- there’s a strong case to view this as a graduate tax, due to its peculiar nature and to try and not normalise debt ↩

- Is well-being U-shaped over the life cycle? Blanchflower and Oswald, Social Science & Medicine 66 (2008) ↩

- I failed Eng Lit so here is a secondary interpretation of the meaning ↩

- Hindsight shows that the evidence was scribbled all over the place in the preceding couple of years, but that’s hindsight for you ↩

I always found the idea, and company acceptance of sabbaticals very odd.

From the company viewpoint; if they are able to survive (and likely temporarily replace) the person going on a sabbatical.. why do they bother keeping the position open for them on return? It’s similar to maternity leave although without the legal obligations. Perhaps I’m just too harsh.. but if I wanted to go on a year’s break re-living my student days and trekking across the world, I certainly wouldn’t expect my old job to still be waiting for me with open arms.

For those who take sabbaticals, I question why. The financial hit is huge, and at a time when you’re likely to be around peak earnings. Plus many seem to use it as an ‘escape from work’, begging the question of why they don’t aim for ER instead or even begin a near career.

As I mentioned on Mr Z; I purposely delayed taking my gap year until after university because I knew I couldn’t stomach returning to classrooms and exams had I taken it between 6th form and university. Im thinking similarly on taking a sabbatical; would I really want to go back to working the 9-5 after taking a year out? Unlikely. Better instead to delay the gratification and leave the rat run for good a few years later.

On the subject of the majority working until their company defined retirement age – I wonder how many do it simply because they don’t know of any alternative. Any time I mention retiring early to people there are always a handful to respond that “you’re not allowed to retire until 55/60/69”. To them they know of no other options beside either a company or state pension and so all of their spending/saving and retirement timescales are based on this sleepwalk.

LikeLike

None of my employers would allow sabbaticals. If you wanted a year off, you had to resign and it was very unlikely they would give you a job when you returned and came knocking on their door.

I knew of someone who worked for a charity and if you worked there for 10 years, you could have a 1 year sabbatical – they had a lot of long-serving employees and it was seen as a benefit.

LikeLike

I dunno taking time off makes a lot of sense if your industry is hugely cyclical, e.g. tourism, finance or real estate spring to mind easily

The idea of a stable job with a stable employer is dying off fast so the same goes for stable working patterns

Of course if you are going to have to fund longish periods not earning you need to be earning that much more when you are working…

…you also need to be sure you can get a job when you come back of course

Also, Ermine, your idea of the average working life is very last century. Official retirement ages have been abolished and the state pension age for someone in their 20-30s now is 68 and will rise to 70 in the next ten years probably

How working to 70 matches to employers who like to put their workers on the bonfire in their 50s is something I have yet to actually work out

LikeLike

” the average working life is very last century”

I think it’s carved into our psyche like death and taxes. Some fashionable people might be making headlines for changing their working life to this and that. It makes headlines because it’s so remote from the norm. e.g. in my office, people couldn’t tell me when they can claim their private pension.

Here, there is one person over 55 and he’s the boss. There are empty chairs where the careers of older members of staff died. Their ghosts still haunt the corridors to the chorus of “please, just another 10 more years” as they tried to hit the mythical 65 and a carriage clock

For myself, starting @ 39 years old with nothing but a life-long sabbatical, I’ll do whatever it takes to get out as soon as possible. My time is the most precious thing in the world.

LikeLike

Great post ermine.

I’m at the stage in my career where seemingly all the women my age are leaving/pausing for motherhood (I received an email to this effect as I was reading). While parenthood holds no appeal for me, I have been tempted by a time out (or half-time break) from the work force. Your charts have convinced me this is not the way forward, thank you. You have given me one less thing to think about which makes me smarter!

Income matters – agreed, and I think it goes even deeper than this. Have you seen studies on the cognitive load of poverty? If you are struggling (regardless of the absolute wealth), people tend to make worst financial decisions than if they are not struggling.

Cheers,,

Emma

LikeLike

In my industry, notice periods/gardening leave policies can extend to six and twelve months. It is possible to interview for a new position, negotiate a start date in the future with the new firm, a reduced notice period with the old firm, and have an unpaid break in the middle. This is what I was toying with doing.

LikeLike

If you have an extended notice period than a gap within that can occur but you need to be in a quite senior or responsible position to get that opportunity.

LikeLike

Another good article ….. deep & thoughtful, while laced with gentle humour.

I think if anyone is going to go for a sabbatical, they should think very, very carefully what they are trying to achieve with it & ask if they can handle the consequences before doing it.

You don’t know how you will feel at the end, you may well be a changed person, having been off the corporate treadmill for enough time to break the trance & see your world from a different perspective. It might make you unhappy to go back, where you weren’t before, or you may think ”I just wont go back” & do something else instead.

One good reason to take the break would be to have a shot at a dream, like experimenting with seeing if your hobby/interest could be stepped up to a job in itself to free you from working for the machine….. maybe you could give yourself a strictly defined period to see if the project sinks or can swim.

For sure you would have to have a good financial parachute in place first, in case things went unexpectedly wrong ….. the ‘held job offer’ evaporates for example. For this reason alone, it would be a luxury for most people.

LikeLike

I took a ‘sabbatical’ when I was 27 to do an MSc, but that was to fix my first degree which wasn’t good enough to get into research, and I got a decent ROI for the foregone pay. But I suspect that’s not what Mr Z was hankering after, looking a the gentle Autumn sunshine out of his office window 😉

> For sure you would have to have a good financial parachute in place first, in case things went unexpectedly wrong

That’s the trouble, really. You almost need to have FI before the risk can be addressed, in which case you don’t need it.

Going part-time is a different way of doing that. Before I started saving for the final runout, I bought an extra 5 days annual holiday, because paying 40% tax made it look a better deal, and, well, there were some glimmerings of valuing my time!

LikeLike

Yes, this is exactly why women who have children take an enormous hit on their lifetime wealth accumulation. Its a good job really that we don’t usually sit and calculate it in that way 😉 Myself and spouse both reduced hours when we had children – personally I can’t see how you can both carry on full time without, as you put it, being run ragged…easily our most expensive lifestyle decision to date. But that’s when it becomes not all about total return (to hark back to another of your recent posts)

Every time I read your posts ermine I get a step closer to making the leap out of work. Nearly 50 and definitely in the low point – getting much less tolerant of other people being able to waste my time. Still its hard to jump without the helping hand of a push, I find.

LikeLike

> calculate it in that way

You can’t take it with you 🙂

I was surprised on researching this article and indeed from many of the recent comments on the performance art one that there is such a groundswell of ennui in the late 40s, while being mindful of sample bias. I thought it was just me. I suspect this is part of the effect of individuation – you get less tolerant of your time being wasted as you begin to value yourself more through turning knowledge into wisdom, perhaps.

LikeLike

@ERG > the majority working until their company defined retirement age

I was going to be one of them 😉 In all fairness, one fellow had warmed me up the the power of AVCs and the implied 66% ROI you get on them as a 40% taxpayer (amortized over the years to retirement, plus any investment gain natch). I had started this because it looked too good to pass up and I didn’t need all my pay to have a good time – knowing this worked in practice helped me amp it up greatly when I needed to. It reduced the leap of faith. I accept Neverland’s charge of having an C20 view of the career arc thoguh!

@Neverland much of the new UK PF scene I estimate is still written by people working for a company. The warning that this is not a long-term solution stands IMO, and doubly so if FI/RE is predicated on carrying on working for a company.. I don’t know either how the off at 45/50 retire at 70 will be resolved. We’re looking at a 25 year gap – some will find roles as ‘consultants’, some as self-employed, many of them will be finished at fifty

@Emma PwF – ah – the Vimes Boots observation – articulated so well by this lady

Interesting that the notice periods in some industries are so long, looks like sabbaticals are possible then. Some companies (including The Firm) offered then over the aftermath of the crash, but you’d have to ask yourself, in the midst of a recession, well, do you feel lucky 😉

LikeLike

Ermine,

Thanks again for another thoughtful, well written article.

I’ve pulled the trigger after some silliness at work.

I’m a Physics teacher at a private school and the management felt it was easier to sort out me (they pay me) than the conflicted young gentleman whom I was having trouble with. His mum pays the school and she believed everything her son told her. (Guess what – kids tell fibs). Very sad but the management were rather stuffed as out of a department of 7 Physics teachers 3 have gone/are going on maternity leave this year!

This ties into your article as reading between the lines talking to my lovely pregnant colleagues, they have been finding life so stressful that a year’s maternity leave and going part time seems a better choice for them. I’m staying for 12 months to help out the department in their hour of need (& save a bit more) but the balance of power has shifted. Having the option of FI and the fact that they need me means they have rapidly backed off and let me be. FI is a real stress busting life saver.

Telling my colleagues I’m going when I’m 52 in Nov 2016 was an eye opener. Most people are shocked. Perhaps I should have kept quiet about it but that is not really my thing – keeping such a big secret. I really think that people do not think that there are any alternatives to retiring at NRA.

I’ll be able to pay myself the equivalent of the median wage but I can cope with less. Happiness is a lack of want.

I’ll hopefully decompress.

I’m planning on cycling around every country in Europe in 2017 as part of the process.

Matt

LikeLike

Oh dear – the UK loses a scarce resource – and congratulations on your success! Give yourself time to decompress – of those I’ve seen it is months, not weeks.

> FI is a real stress busting life saver.

Indeed – one of the few joys I had at the halfway mark though my exit was finally confronting a tosspot line manager who was just assuming I would do all the crappy performance management hoops. I looked this sucker in the eye in a 1 to 1 and told him “I don’t need this job in the way you do”. It wasn’t strictly true, but I was well on the way. And it seriously spoiled his day, because a limiting belief of his was shown not to be universal 😉

LikeLike

@Ermine

Yes, for an introvert (I think we’re not as good at the bravado/toughing it out when negotiating, etc), it can be quite enlightening when you actually get to see the cards the other guy’s holding for a change. When that solid wall of “oh, we can’t do that – it’s not company policy”, etc finally breaks* as someone tells them “actually, that part of the project’s not done yet – he knows that bit inside out, erm, we need him back”. I guess you felt a bit like that over the Olympics 2012 project perhaps ?

As an IT contractor, there were one or two occasions where, working a considerable distance from home and having to stay away the whole week, I got to the end of a contract and ended up with a classic Mexican stand-off over a renewal. I’d like to add that whilst I witnessed plenty of other contractors over the years who’d think nothing of taking the position “I couldn’t care less about the job mate – pay me X or I walk”, I personally avoided such an adversarial approach. You can negotiate hard and still be pleasant about it (perhaps wildly paraphrasing something Churchill once said :-)).

I once got a phone call (about an hour after I’d already left on the last day of my old expired contract and was still travelling home+) to say they’d agree to my terms after all, which I hadn’t considered all that onerous to start with. All the way through that final week it had been a case of “oh, sorry, we can’t agree to that but we hope you’ll renew anyway”.

Talking about a contract renewal when you have sod-all mortgage left to pay off, don’t live up to anything like your income and the work location’s the other end of the country is very different to being mortgaged to the eyeballs, never managing to save anything and desperate to keep the job that’s five minutes from home (and don’t want to look it).

It’s really liberating to think to yourself “ok, I’ve told them what I’m looking for to extend for another six months – I’m completely neutral. If they go for it, fine. If not, I’m equally fine taking some time off and finding something else. I don’t actually NEED this.” This, of course was a long time ago, when such work was relatively easy to come by and paid well. I haven’t bothered to see what things are like these days: a) it’s consigned to the “happy days” archive I remember fondly and have no need to go in search of again, and b) I have this constant “it’ll be dreadful – I’d rather not know” view, much like it’s a bad idea to revisit a house you used to live in 20-30 years ago – it’s NEVER as good NOW as you remember it somehow.

Thanks for writing another great article and, in doing so, “allowing” me to reminisce about a period of my working past I actually enjoyed … before it all turned to stuff for the compost heap and I felt it was time to move on.

* do you remember the bit at the end of “Force 10 from Navarone”, when Miller’s sitting patiently waiting whilst nature takes her course with the dam ?

Give it time, it’ll work … 🙂

+ don’t worry, it was a hands-free device and long ago, well before the current law on driving and mobile phones came into being in any case

LikeLike

Very interesting post ermine.

The effect of having kids on (mostly) women’s earning power has been highlighted by the recent finding that women in their 20’s are actually earning more than men of the same age. Things change drastically from then on in as your graph shows.. Personally I was lucky, had kids very young and then managed to do my MSc part-time along side a part-time job when the kids were established in school. This got back me back onto the bottom of the professional ladder in my mid-30’s (Not easy in IT :-)) with time to do a little climbing before I decided I’d got far enough and then went part-time again last year.

As it’s unlikely that the wage gap between women and men will be closed any time soon and that very early retirement is not possible for any but very determined people on high(ish) salaries, it’s essential that the rest of us try to find a job we basically enjoy (which I have mine until recently), and the right work/life balance. Even those who are aiming to leave work at a very young age still spend a lot of time there, the notion that they feel they are “buckling” down and “getting through” it seems wrong to me. I have gained a great deal of satisfaction from my working life, there is interesting, challenging and rewarding work out there (though it may not carry the highest pay). But, as red kite says, surely it’s the “total return” that counts?

LikeLike

@Ermine

“much of the new UK PF scene I estimate is still written by people working for a company” *chortle*

You can go a lot further than that…most of the new UK personal finance scene is written by people working in the SE of England working in IT and finance jobs….which are precisely the careers where most people are finished at 50

LikeLike

@Neverland

+1 …

I spent a good deal of my IT contracting career living (well, if you can call friday night to very early hours of monday morning only, “living”) in the Midlands/North, and working in the South East. I was single during that time, largely enjoyed the work and, strangely, living out of a suitcase four nights a week, but that was then. I certainly couldn’t go back to doing that now, and not just because those working environments have changed beyond recognition. Like other participants around here, I got very pissed off with the “he who shouts loudest” extroverts dictating the “way forward” in meetings. At least as a contractor I could detach myself from the internal politics of it all to some degree.

I got out around the time of the early 2000s recession. The writing was clearly on the wall even as far back as that – there had already been a shift towards farming out software design and coding to whoever quoted the lowest possible price (with very mixed results but hey, experience is too damned expensive*, right ?)

I think I’ve unwittingly always been on the FI/RE track probably as a result of “informal financial education” similar to Ermine’s: my parents never bought anything (except somewhere to live, of course) unless they had the cash to do so.

* “If you think it’s expensive to hire a professional to do the job, wait until you hire an amateur”

— Red Adair

That quote’s prompting me to go back and comment on Ermine’s articles about the endless “price is everything” cheapening of things these days: my year old 3Kw kettle’s just broken it’s plastic lid (without any provocation from me), whereas the 2.2Kw metal one (which pre-dates the Falklands War !) is still going fine and still on it’s original element. Progress. Huh. Sorry, way off topic 🙂

LikeLike

I totally agree with your comments, Mike. They made me smile as it is the stage I am at now – the “shouter” decision makers and office politics have really p* me off in the past few years. I have sampled redundancy twice now and all before reaching my 50s.

I am in IT but have had a permanent job up until now. I worked in the Midlands for various FTSE100 companies that paid well. I too have been unknowingly following a FI/RE track due to parents telling me to save and not to get into debt.

The redundancies focused my mind and made me want to get to a place where I didn’t have to worry.

I have just quit a job as the management there was a mess, I was getting stress headaches and possibly burnout (probably accumulated from the past 3 years) and I am pretty much FI. I am treating it as a sabbatical/break at the moment with the current intention to find some work which gives me the “reward” element that isn’t financial. If I cannot find that, I can at least feel confident I can survive without a job until i reach my NRA.

LikeLike

Good stuff – another belter; Introspective, philosophical insights abound.

There is definitiely room to transcend the whole FIRE thing, but you probably have think/read about it first to get to the other side. Really its just an expression of thinking carefully about how you spend your time, whether you have lived, are living or have the capability to live the Socratean ‘good-life’. That way of thinking can leave all the detail of FIRE behind I think when you really start getting to the roots of it.

I’m pretty sure the ancient greeks pontificating on the painted porch weren’t overly worried with when they might retire or the absence of Excel in their lives..

LikeLike

@Cerridwen – it is the total return that counts when all is said and done, but the trouble is that people need to start taking decisions and allocating resources (life energy) and capital – from life energy and time that they sell. They have to do this against a shifting economic background, in the fog of inexperience and uncertainty.

You and I, for instance, have an easier time on the pensions front – I have an insane madcap risk tolerance partly because of that, but even I figured I’d bottle the chance of a higher upside for a known DB amount. Imagine being 21 again and having to balance these factors!

So the issue is how does one optimise the TR, or find the wisdom to manage the risks, resources and the known and unknown unknowns? Some of it is, of course, part fo the mystery of that gratuitous, show called Life which has many more threads than finance?

> there is interesting, challenging and rewarding work out there

I would venture that the middle ground of this is getting scarcer – when I look my pre-2000 career this was much more prevalent than the post-2000 career (with the possible exception of the very last 2 years). It’s less true IMO than it used to be, and to get into it you need to be more exceptional than in the past.

@Neverland – you’re a hard man 😉

LikeLike

@Ermine

This feels like it’s parallelling (sp? 🙂 the hollowing out of the middle ground in various products you wrote about not too long ago (re: cameras if I recall correctly). It’s either second mortgage territory and loaded with a mountain of “features” no-one needs, or it’s ultra-cheap junk that belongs in a christmas cracker.

I feel I’ve identified a kindred spirit here – I’m the sort who’ll find the bits on the net and repair a twenty year old washing machine rather than junk it … because I consider it better than the new stuff.

LikeLike

Interesting, and I’d argue the mechanism is the same. Better communications has dramatically improved price discovery, but not quality discovery, which is harder now if we buy online. The same applies to suppliers buying services – price is easy to compare. Same mechanism as this great rant on RIT

LikeLike

Yes, I’d agree with that – I probably do what a lot of others do in that case: stuff that’s difficult to assess the quality of, or varies despite a size being quoted (think clothing) I go and physically look at, stuff that is uniform “they’re all the same if you can identify a part number” (think computer bits and car parts to some extent) I order online.

It comes down to whether I have established enough confidence that what I’m seeing on the screen really is what it claims to be and doesn’t require me to go put a mit on it to check.

Just read Jim F’s comments (thanks for the link). Oh Jesus, in between chuckling at his observations, I found myself stone cold soberly agreeing with them too.

I’m reminded of something my father said years ago about a guy he used to work with (back in the early 1960s at a guess). He was of the opinion that advertising was a bad thing because it tried to convince you you were a failure if you didn’t drive an E-Type Jag and fly BOAC everywhere.

I’m afraid I rate compost heaps rather higher than a lot of stuff that’s advertised these days. Very often I simply “don’t see” adverts – to me they’re just meaningless noise which buggers up the continuity of whatever I’m watching (on TV that is). And, of course, like a chocolate teapot, a compost heap is (eventually) useful, one might be tempted to say in coming years/decades, somewhat fundamental to our continued existence. Is a smart phone really that important ? …

LikeLike

Your dad’s pal was spot-on. In Ad-Block Plus I trust 😉

Our compost making operation is our main hope to improve productivity after 50 years of industrial farming on the site so the soil is nuked. But we can get wood chip free and clover and green stuff. It’s getting the mix right and the micro-organisms right than is hard – the last lot of mainstream research dates back to the 1920s with T Howard and the Indore research station in Imperial India although the microbiological science has been advanced by Ingham et al in the last few decades. Why did composting research stop – because in the 1950s we all started using chemical fertilisers. Which works as long as you keep applying them, but the soil fertility cycle has been wrecked as Ingham described.

Ingham’s method is to track the temperature at half-daily samples. call me lazy, but if I can get a RF network to measure it every 15 mins 24/7 and plot on t’intertubes while I’m in bed at night that’s a good advance in my book 😉 Particularly as people on site already have the smartphones so I don’t have to distribute displays. So some modern tech is useful. Jim F’s rant about how the teens insecurity is used by the admen made me titter. In the same way as the crabby old git behind basic car audio electronics made me laugh, he’s clearly heard it all from young pups who are suckered into spending money on specmanship and is trying to get some reality into these guys.

LikeLike

I enjoyed your thoughtful and well written post.

I suppose like most wage slaves I did not give a lot of thought to a FI/RE plan. As it was I got out a couple of years early when it finally dawned on me that it was possible.

I had the advantage of a life mate who worked professionally and has a better DB plan than I have. Without her…oblivion. One child only.

Most of my colleagues willingly got out at 60 although normal retirement age in Canada is 65. The Boss would have liked to stay on, but HR made sure he was out at 60 as well. He probably got a good package.

I had no sabbaticals in 35 years aside from a 3 month stretch when my health failed in my mid 40s.

Peck and Jung are right on in my view.

As far as part time work goes I was offered it by The Boss when I handed in my retirement notice – but if full time work did not meet my needs how could part time work do so? PT work is essentially full time effort with half time pay.

No, as I told my wife – work till you’re sick of it then never go back. As a French teacher she could have worked part time till she’s 95, let alone 65.

LikeLike

> work till you’re sick of it then never go back

I’m a cold-turkey kinda guy too. Though I do feel for some of the young ‘uns at the coalface and their desire for a break. For the vast majority of my working life I had the privilege of doing something reasonably interesting that paid decently, so I didn’t need sabbaticals.

I hadn’t spotted the parallels between Peck and Jung’s description, although the Tao guys thesis that the quarter-century and mid-life cries are the moving in and out of society has merit too.

LikeLike

Well those young ‘uns might be doing just fine. My niece graduated from Teacher’s College in May, spent the summer working on a cruise ship to/from Alaska and now will spend a year in Florida at Walt Disney World. I know she’s working but c’mon…

LikeLike

Thanks, Ermine, another brilliant and highly relevant piece 🙂

I’m one year post retirement now, and I’m amazed at how much I’ve changed/am changing. Hubby is retiring in 6 months time, and we discuss this change and have decided to not make any major plans, just hang loose, take opportunities, try things out.

The slow losing of the “corporate face” that I needed to survive the gamesmanship of the workplace has felt peculiar – but relaxing, sometimes too relaxing!

And there is acceptance of the loss of work – but loss happens throughout life – cute kids grow up, parents die, careers end………

There is a difference between what I thought retirement would be like, and how much I would get done (boy, was I driven!!) and what has happened. The future will probably be different again. Interestingly, we’re loosing any inclinations for expensive activities, we just want to have some simple fun. There’s lots to do out there……

LikeLike

> decided to not make any major plans, just hang loose, take opportunities, try things out.

Way to go IMO. After all, if retirement changes you, it’ll change him too, and certainly any major life changes are worth doing as the new you/him rather than the tired wage slave.

> Interestingly, we’re loosing any inclinations for expensive activities, we just want to have some simple fun.

Simple fun often takes time – it works so much better without work IMO!

LikeLike

as an aside, is peck worth reading? i’m sure jung is but slightly intimidated to start down that road which i’m sure is very much less travelled.. peck might be an easier starter for 10..

LikeLike

M Scott Peck’s The Road Less Travelled is a reasonably easy read IMO and any library probably has a copy. Carl Jung’s Memories Dream Reflections is a reasonable guide ot his thinking, in the form of a biography.

In Scott Peck’s work you see some of the themes that help FI – eg

Where many people may have difficulty is with the second part of Peck’s book where there are parallels with the charge often laid on Jung that he is mystical – there’s a strong thread of materialist rationalism running through the PF community, and some of the material may sit ill with such a worldview. They don’t give me a problem, but I wouldn’t describe myself as a materialist rationalist. I will gravitate to maps that correspond closest with my territory. It’s different from other people’s territories – individuation is something people do by themselves IMO.

OTOH it never does an enquiring mind any harm to read something that doesn’t totally correspond to their existing world-view. Give MSP a go!

LikeLike

Just ordered it from my library – It’s years since I read this, the time before the job took over my life! It will be interesting to reflect on it.

LikeLike

Thanks for the link to “The Rime of the Ancient Mariner”

I too failed English Lit O level, ‘cos I was concentrating on science etc. 😉 but now I can enjoy it to my heart’s content!

LikeLike

@ermine > Before I started saving for the final runout, I bought an extra 5 days annual holiday, because paying 40% tax made it look a better deal, and, well, there were some glimmerings of valuing my time!

I’d recommend that. My employer allowed up to 10 days to be purchased through salary sacrifice. I availed myself of that for a couple of years before finally leaving which did make a difference at a time when I was seriously juggling work/life commitments. Time can be our most precious commodity when working, but second comes managing stress effectively. It might seem counter-intuitive to forego some salary but the upside can be great on both these fronts.

LikeLike

I went the other way, and canned the extra holiday (once I’d discovered I could use AVCs) in the runout. But then I never expected to last the three years the calculations told me I needed. I needed the fastest rate of accumulation and took the chance if I fell before the finish line, so be it. However, this is going to be an individual call depending on the situation and what’s at issue, there’s much to be said for buying time out!

LikeLike

God help you if there’s a period of life entitled The Dogfood Years! (from Boyd’s Any Human Heart)

LikeLike

Not familiar with Boyd, though this seems to echo the same sentiment. It’s always possible, sic transit gloria etc…

LikeLike

Another thought provoking article, thanks Ermine.

From my experience the U curve is changing. For me as a female , it is following the same profile as the female salary line.Hit your late 40s and you hit the ‘eject’ zone with “the firm”.

About 4 years before I was ejected,”the firm” changed its pension rules and there was a mass exodus of employees in their 50s as they jumped before the minimum retirement age rules on the pension changed to 65. So there were not may people in the office over 55 when I was hit by the ‘eject’ button.

I am glad I didnt have kids, otherwise I would be in a real mess! At least I have had a good salary and a DB pension. I have been able to save towards FI/RE.

The redundancy focused my mind and set me on the track to reach FI and not have to worry of I encountered the ‘eject’ button again. Which I did 18 months later at my next job.

I frantically searched for a new job – I found one, only to find it ‘hell’. My mindset has changed, I hate the office politics, I detest the performance tracked and micro-managed office which has killed off any autonomy and personal reward in doing a good job (delivery to time is all that counts at the lowest cost).

I hit the stress/burnout wall (it had been building since my first ‘ejection’) and I have quit. I may not be completely FI/RE and my funds equate to a salary just below the UK average wage but I can at least feel more relaxed now and recover before any real health concerns start to kick in.

I intent looking for some rewarding work – whatever that is – but I do think that those in their 20s/30s following a FI path will find it harder unless they have high salaries and can achieve a 50%+ SWR.

LikeLike

> I detest the performance tracked and micro-managed office which has killed off any autonomy and personal reward in doing a good job

hehe – BTDT in 2010. It’s odd that unlike nearly any other early retiree I’m a total refusenik on the idea of working again. Done that too – I just don’t have the taste for it, the politics, the micromanagement, the bureaucracy. Nah. I’ve never been bored 😉

> I do think that those in their 20s/30s following a FI path will find it harder unless they have high salaries and can achieve a 50%+ SWR.

I think at a gut level they get that, and track the bejesus out of their savings rate, research exactly what it is.

LikeLike

After having a marathon session of watching “The Fall and Rise of Reginald Perrin”, the voice of C.J. is resounding a chorus in my head:

“We’re not one of those dreadful companies that believe a man is washed up just because he is turning 46. Goodbye, Reggie.”

LikeLike

Sorry, can’t do the rather appropriate raspberry from the chair, so …

“Well Reggie, are you with us ?”

“I certainly am not. I’ve never heard such absolute and utter rubbish. It is all rubbish. It is absolute and utter rubbish. Not only that Jimmy, it is neo-rubbish and crypto-rubbish… Rubbish… Rubbish ! Rubbish !! Jimmy ! Thank you very much indeed !”

The rest as they say is, well, er, classic comedy. At least it is for those of us who now see much of what’s going on out there in the real world as an absolute and utter (careful :-)) joke, often in extremely poor taste :-|.

This was almost 40 years ago too. Mother of God, I’m getting old. It gets worse – my father loves that series too.

LikeLike

@EarlyRetirementGuy + Ermine,

A long time lurker, first time poster here. I just had to chip in as I’ve just started a sabbatical in my early 30’s so have some direct perspective.

I picked up the FIRE bug around 3 years ago, although I’d always been a (less focused) saver before then. I would estimate that as a couple we now have around 75% of the net wealth we need to FIRE.

You may well ask the reason we didn’t just hang on for a few more years to finish the job and opted for this route instead. For me, after a great deal of introspection and useful reading on blogs such as this one, I realised that becoming FI would only have succeeded in giving me no choice but to own up to the fact that I’ve never found what I was interested in doing. Having reached that FI goal, all I would have had is further solid evidence to the effect that what I really needed was a change of direction a long time ago.

So, what we’re doing now is taking the chance to firstly unhook our minds from the corporate matrix and have some fun, and secondly see if we can work something else out to generate income in a less crushingly meaningless way (without going into detail, just about all of the standard corporate stereotypes apply to my job).

After all, we would only need to replace 25% of that target net wealth in income generation to make it work, it has to be worth a shot,

If all else fails, it’ll be back to the grindstone and time to focus again on really nailing that quarterly self-appraisal performance report. Now there’s some motivation for me…shudder!

Although there are probably many other valid reasons to take a sabbatical, I hope this illustrates one. Three quarters of the way there, I realised that FI wasn’t my ultimate goal and that if I got there without a clue as to what to do next, I’d probably become (slightly more) unhinged 🙂

LikeLike

@OnSabbatical Interesting – I’d been thinking of a sabbatical as more like a break and then returning to the same job – a bit like maternity leave or indeed the original form – an academic who has tenure but takes a break, originally to travel and see how other workers in the same field do things to get new ideas.

A career break to zoom out and get the big picture sounds great – particularly if you have accumulated most of the wealth you need – all the best for a decent respite and (re)finding your work mojo!

LikeLike

@OnSabbatical – yes it can certainly work just fine for some if your skills & experiences are sought after. Friends of mine took a full year out to travel the world & to do so both quit there jobs…. on return they were both hired straight back to their old firms. That said, they were both perfectly happy to seek other employment if this hadn’t been the case.

I’ve actually taken an alternative sabbatical myself – working in a slightly more junior role in the same company, but only working 3 days a week. Critically I look after a few specific things that are legal compliance pieces so my position even though part time is very secure. I’m pursuing hobbies & community interests whilst looking after my young kids on the other days. No regrets about this in any way…. Mrs LCIL & I are financially secure so the choice as to whether i go back to work full time at any point isn’t really one we are asking ourselves at the moment. November will be 5 years 🙂

About a decade ago i did take a 2 month sabbatical from a job – went hiking & rafting around Nepal. This trip fitted just about into the quiet cycle of the industry i worked in & my colleagues covered my work. I had done the same for one of the guys the previous year whilst he went out to Mexico. Good times.

LikeLike

Thanks for the mention of sugardaddie

LikeLike

🙂

LikeLike

My approach is to work 4 days a week. Rather than retire early, I plan to enjoy more of my time throughout. It also gives great flexibility – e.g. I just bunked off to go promming with no faff at all, making up the time by working a bit of another day.

My move from academia to industry was a complex one and involved an (extremely stressful & draining) year-long sabbatical to finish off my research.

When I eventually retire, I’ll probably get this “post-retirement clock” to track my time:

LikeLike

> involved an (extremely stressful & draining) year-long sabbatical to finish off my research.

That doesn’t sound like the canonical definition of a sabbatical, which probably should be a bit more fun!

Working 4 days a week is a step towards the original JMK Economic Possibilities for our Grandchildren which is probably the most human-friendly way of doing it – people get to see their kids growing up and enjoy the Proms.

However, the employee needs to be a bit exceptional to get away with that – companies don’t seem to like managing two part-time workers relative to one full-time worker, and the bias to full-time working means the cost of essentials like housing rises to match the means of full-time workers who crowd other working patterns out 😦

LikeLike

We’ve just come across your site via Monevator, which we came across via Can I Retire Yet. We’ve enjoyed reading the UK perspective–we being US hopeful FI/REs–partly because we lived in the UK, both Manchester and Cambridge.

You note early in your post that the UK PF scene has expanded of late, and I’m curious about that movement. Why might the UK PF scene be expanding at this juncture in culture/history? Would you (and your readers) say that the US PF scene was more robust–and/or started earlier? If so, what might account for the difference?

Thanks for your insights!

LikeLike

And we’d also be curious about the extent to which the explosion of the IT industry (with frugal-minded engineer-philosophers) is responsible for the FI/RE popularity in recent decades. There seems to be a high percentage of engineers amongst the FI/RE crowd…

LikeLike

@Julie & Will the US scene is a lot more developed – much of my early learning (2009 onwards) was from US perspectives – in particular ERE which assisted me with the why, although Monevator helped me with the how.

Americans are simply more open and honest to do with things about money, culturally.

> and I’m curious about that movement.

Many recent-ish (well, more recent than when I started) entrants work(ed) in finance, as examples

http://firevlondon.com/

http://www.thefinancezombie.com/

http://theescapeartist.me/

http://www.underthemoneytree.com/

and money saving challenge did a taxonomy of UK PF sites three years ago, the direction of travel has definitely been away from the frugality towards the earn more/invest well

> the explosion of the IT industry (with frugal-minded engineer-philosophers) is responsible for the FI/RE popularity in recent decades. There seems to be a high percentage of engineers amongst the FI/RE crowd…

There’s a case to be made that introverts have an easier time retiring early, both in seeing why and also dealing with the non-financial aspects of being retired early. OTOH it could also be due to changes in these kinds of workplaces simply becoming a lot less fun places to work; this was primarily my reason for getting out. I was not particularly in IT though.

LikeLike

@Julie/Will

Investing booms require asset price booms. The UK’s asset price boom has been in house prices not stock prices

Therefore our TV is wall-to-wall property investing shows not wall to wall technology start-ups and stock market shows

LikeLike

Thanks to both @ermine and @Neverland for your perspectives. These are all valid and interesting points (cultural differences in talking about money, introverted and frugal nature of many engineers, and the focus on US stock market vs UK housing boom).

In the US, while there are also numerous financial investment blogs, perhaps the most popular are ones that deal with lifestyles (like ERE already mentioned, and the wildly popular http://www.mrmoneymustache.com/, for instance). Or, at least, those are the ones that we tend to read…

LikeLike

Interesting thoughts about the FI communities on each side of the Atlantic. I think there are a few key differences. one is the ‘dirty little secret’ issue – ie income. Basically in the UK very high incomes are almost exclusively associated with finance and associated City based jobs. Engineers in particular are far less well paid than in the States (I don’t know about tech related jobs but definitely other types of engineering are pretty modestly paid in the UK). So, I think there are more people in the US on good wages. Second issue may be pensions – I think in the UK we have only recently grasped the issue of living off a pension pot, as opposed to having either a DB pension or buying an annuity. Mind you, from my readings of the Bogleheads forums I have been pretty shocked at how generous the US social security and some occupational pensions can be – here we are always led to believe that the US is the land where everyone has to make their own provision for retirement…

But I guess the cultural issues about talking about money are also very pertinent. We do have a thriving ‘frugal living’ blogosphere in the UK, like the US, but mainly people who have low incomes and need to get the most out of them. The idea of living frugally when you have a million in the bank, not so common here….

LikeLike

I worked with a guy who had spent 10 years working in the US as an IT engineer. He earned silly money and had a big house which he sold for a huge profit and moved back to the UK. He has invested the money into two properties, one he lives in with his family the other is rented out.

He works as he is a bit of a workaholic and isn’t on an FI/RE path.

Plenty of bloggers seem to work in finance as they are the best paid – although under the new ‘will a robot take your job’ analysis the first area that will be targeted is finance. So they need to earn their money while they can as it appears that their employment days are numbered.

LikeLike

> So they need to earn their money while they can as it appears that their employment days are numbered.

It’s not just the robots, the stress means their working lives in that industry tend to be short. As Mr Z observed when he looked round his office for greybeards 😉

LikeLike

@Jule&will

For frugal living UK style I would suggest

http://forums.moneysavingexpert.com/forumdisplay.php?s=cf29533923d912b72ba33380aca95198&f=33

Home of threads like:

“charity shop [thrift store] bargain of the week”

“am I too young for the womens institute?”

“raspberries in less likely liqueurs”

LikeLike

I think you meant http://forums.moneysavingexpert.com/forumdisplay.php?f=33

I confess I hadn’t ventured into that niche of MSE before but the raspberries and liqueurs were enough fo a search key! 😉

LikeLike

The thread ‘is frugal the new normal’ is also quite interesting..

LikeLike

Excellent post Ermine 🙂 Glad to have inspired it 😀

But terrified having looked about my office at the tail end of last week, and it’s exactly like you described…not too many wise looking people about and lots of keen’uns burning through their supplies of midnight oil.

Head down, keep on bludgeoning the savings rate and do my best to ignore performance management as it slowly kills my will to perform.

LikeLike

If @Neverland’s threads are representative, then @Red kite is probably correct that there is a difference between frugality blogs UK-style vs. US.

Yes, it does seem that many of the most popular US finance blogs which also preach frugality tend to be written by once highly-paid IT engineers who were savvy enough to have saved up most of their income and retired between ages of 30 and 50 with a million or so.

This conversation has been enlightening. Thanks all!

LikeLike

I don’t know many people in the UK with the ability to stash £1m away from their jobs in a short period of years – other than financial types or business owners who sell up.

One of my old bosses who sold his company for over £50m. He has started up another business as he cannot stop working and has a big tech consumer habit to maintain 🙂

Another colleague, whose husband sold his business and she then retired! He invested the money to provide a base income then used the rest to travel and do ‘pet projects’ such as property renovations for fun.

LikeLike

I’m late to the party as always but just wanted to thank you for this perspective.

I definitely reached the conclusion that my high-paying, high-stress job will not suit for very long -even barring redundancy. A layoff would be a blessing. This is not the life I want to live or what I want to do with my precious time.

I’d suppose also that quitting ‘the work’ might make me slightly less extroverted as I wouldn’t be constantly bristling at the ‘performances’ of my colleagues.

If only I had read/understood this perspective in college… There were a good seven years wasted on the standard lifestyle that could have been reapplied to much earlier retirement.

LikeLike

@sparkleb33

£1m is actually 50% more than $1m

$1m is actually not that much money

LikeLike

Thanks, @Neverland, for clarifying. Yes, I was talking about US dollars–equivalent to only half of UK pounds. It’s also important to remember that items like food, clothing, and housing can be considerably cheaper in the US, thus allowing you to save a considerable percentage of your pay. When we came back to the US in 2007 after living in the UK for a year, we were astonished by how low our grocery bill was!

If anyone is interested in the sort of US personal finance blog that talks about frugality leading to millions (again, US$), here’s a timely post from Go Curry Cracker!

http://www.gocurrycracker.com/how-we-saved-multi-millions/#more-4910

LikeLike