Another one in the complainypants section, but this one’s a more subtle object lesson in how not to lead a middle-class life. Perhaps the Ermine’s heart is softening as he gets older, or there’s a little bit of the there but for the grace of God since I screwed up with the toxic UK housing market too, though I don’t have 4 children 😉

Let’s hear it for the Daily Mail’s Shona Sibary, who sold her house and considers herself now in the rent trap.

Now I was able to see her fundamental problem, just from looking at the picture. In Britain today, a middle class family with both parents working will find it hard to raise four children. We normally associate big families with the undeserving poor because of the headlines, but thankfully they are not the only section of society that has large families, otherwise we would long ago have succumbed to the premise of the movie Idiocracy. The unsung other sector of society that often has larger than normal families seem to be those with a bob or two. Like David and Samantha Cameron, who ain’t short of a bean, or even IDS and Nick Clegg. Other wealthy families include Victoria & David Beckham (4) and Boris Johnson (4)

I first noticed this with older colleagues at work. The Firm was a prestigious operation in the 1970s and 1980s, and pay was probably upper middle class (in the eighth or ninth decile of the IFS income scales). There is a surprising prevalence of three-child families there, which I had found particularly surprising when I joined nearly a quarter of a century ago.

It’s not surprising that nowadays it is the poor and the wealthy that can go beyond the one and two-child norm. The former get us all to pay for it, and the latter are presumably rich enough to pay for it themselves. Anyway, ’nuff about families. How did Shona screw up?

Shona’s financial red cards

By failing to watch her back. Shona had a couple of big red cards, I suspect that family was living way beyond its means for a long time.

Red flag #1 – they were remortgaging, not building equity in their home.

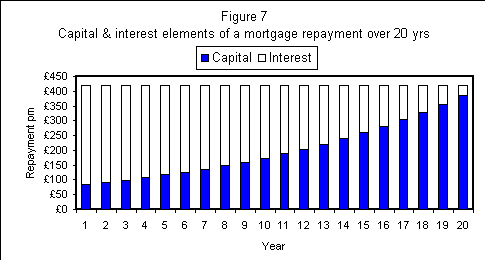

Look at how an old-skool repayment mortgage builds up equity in the house, by repaying some of the capital.

I pinched this from the excellent Mortgages Exposed website, which unfortunately uses infernal frames so I can’t link to the source itself, it’s under Capital Repayment in part 1. Now there are other ways of doing it. My original endowment mortgage was interest only, so in parallel with the mortgage there was an investment that should have been slowly rising to match the original loan. Either way, you should be building up equity, even if it takes the form of a separate asset.

Now the modern way to look at a mortgage is to take out an interest only loan, sit on your butt and whistle a dancing tune while the value of your house goes up. Voila, free money, you get equity without having to lift a finger. The catch is, of course, that the value of the house has to go up 🙂

Shona asserts that

After two decades of slogging to buy a house, maintain it and give our children security for the future

You see that by 1996 I had at least reduced the total, by about a fifth in real terms (this graph is inflation adjusted to a nominal salary of 10k in 1984). That underestimates my repayment as it doesn’t show the value of my endowment.

So what did you do Shona? You remortgaged. Taking that equity out, and spending it. Doing that once is a bad sign – nothing wrong with remortgaging per se, but spending the proceeds is bad. Doing it another two times is more than careless, it’s positively greedy.It’s a big red sign in your finances that says “Wrong Way, Do Not Enter, Turn Back NOW”.

Your house is a place to live, it is not an ATM. Over the 25 year span of a mortgage, you will probably see at least two housing booms and busts. I bought in a boom, ate a 10-year bust, and discharged my mortgage in the next boom, that has now turned to a bust (my mortgage would have finished in February 2014 had I not discharged it early)

It is the foreknowledge of that next bust that should make you say “I will not take the money I gain from remortgaging and use it for anything other than buying an investment which will go towards buying this house”. For most people that investment is reducing the total amount of the next mortgage, which is tantamount to saying “never withdraw equity from your house, unless you are trading down”. There are some people who can do better than that. They are few and far between. Otherwise that bust is just round the corner, waiting to bite you.

Red Flag # 2 – your house is not your biggest cost!

This is awesome. If you really are middle class, and buying your house, then that house is nearly always your biggest cost. If it isn’t, you are either not middle class, you are rich/wealthy. Or you are in deep, deep, trouble. Nowadays it’s pretty marginal for the ‘middle class’ to be able to afford the typical ‘middle class’ three or four bed detached family home in the ‘burbs. If your house isn’t your biggest cost and you’re not rich, you’re skint.

Let’s take a look at what Shona spent the money on.

In our defence, we weren’t spending the money on expensive designer clothes, luxurious holidays or flash cars.

So glad to hear it. So what exactly was it that you overspent on then?

Much of it was going on school fees and upkeep of the house.

If you’re withdrawing equity from your house to keep the damn thing standing then you have got too much house for your income. However, that’s not really your problem. It’s the school fees. According to the ISC the average termly fee at a day school is £3655, about 11 grand p.a. A cursory look at your family photo puts three of those kids in school, ie £33k p.a. Assuming for sibling rivalry you aim to do that for all of them, you are looking at paying 4 * 11000 * (18-11) = £308,000 if you just pay school fees for secondary school 11 to 18 and £572,000 if you pay from 5 to 18.

That’s more than your house was worth at the peak. The house is not your biggest problem. It’s a combination of having too many children and looking down on the sort of education that dragged up scumbags like me. So for all the mawkish whingeing about losing your home, Shona, you have failed to clock the real problem with your finances. ‘Tis the fruit of your loins and the style in which you’d like to keep them. With their own rooms, if you please, nothing else will do for Shona’s little ones 😉 Since humans come in two genders and it is apparently not acceptable for brothers and sisters to share a room these days you actually only need three bedrooms if the family is boracic lint, fixed that for ya.

Get real, Shona. You were on a middle class income but living a life not commensurate with your means. It’s hard enough for the middle class these days to buy one house in 25 years. To aim to do that and spend even more than that on the nice things in life on that middle class income is taking the piss. It cannae be done, and you’ve just found that out the hard way. To my eyes you’ve cut the wrong thing, but I respect it’s your call.

Shona shows me I need a financial Distant Early Warning Line

I learned something from Shona. Her family fell foul of slow changes that gradually overwhelmed them. Many things get imperceptibly worse day by day, as global imbalances right themselves but they’re resisted by the structures we have already built. The creeping rise of Digital Taylorism making the professional and technical job a stressful and unrewarding experience is an insidious change, little by little. I didn’t realise that until it became too much and my defences were overwelmed, hence the crash course over the last three years in becoming finacially independent as a counterattack.

In the 1950s the US instigated a distant early warning line to scan the northern skies at the 69th parallel north of the Arctic Circle. It was standing sentinel for the signs of incoming Russian nuclear bombers, and was located in the harsh North to give enough early warning to mount a counter-attack.

I need something analogous to stand watch for slow insidious creeping costs and sound the early warning. I plan to instigate an annual review of financial commitments as a percentage of resources. If I see a non-negotiable cost starting to rise proportionally I will consider that the alarm is sounding and it is time to attend to it. It is always easier to launch a counter-attack before it is upon you overwhelming your defences, and this annual review of commitments will be my distant early warning line against stealthy creeping costs.

Shona’s family could have used something like that. Okay, the alarm would probably have sounded as soon as it was set up, but certainly on the second child’s school fees. It would have been an easier call to make at that stage – do we want a big house, or do we believe in the value of public school education* makes it worth getting the girls to share a room?

While I am working I’ve generally lived sufficiently below my means that I didn’t need that sort of thing. Though I aim to have over 50% income in hand once I stop working, I’ve still got several decades, decades in which I believe living standards in the West will decline in a big way. Though I may be resistant to wages being eroded, I won’t be immune from inflation and its evil twin, rising prices and taxation. A financial DEWline will help me marshal resources ahead of time, and shift them to minimise taxation. Particularly with significant holdings in shares, it’s good to have as much advance warning if changes are needed, to average out the horrendous temporal volatility.

*NB for non UK readers, bizarrely schools that you pay fees for, those that Americans rationally call private schools are called ‘public schools’ in the UK, because we’re strange like that.

You couldn’t make it up could you:

“By the beginning of 2008 we had remortgaged three times, taking out a staggering £500,000 loan on a house that wasn’t worth much more. Our interest-only mortgage payments had soared to nearly £3,000 a month.”

On a house that cost £419,000. They couldn’t afford their lifestyle… enough said. They need to do what everyone else does and live within their means and then they’ll be able to afford a house. Sure it might not be as nice as that house, but that house is a pretty nice house.

“Not having a hefty deposit had never stopped us before.”

Oh dear… if your in your 40s and you can’t raise a 20% deposit its too expensive think smaller, much smaller. With the amount they’ve spent in school fees and trying to buy too expensive a house (i.e. higher mortgage payments), they could have bought something smaller, quickly paid the mortgage off, built up some savings and bought their dream house that they just had to sell (and actually owned a significant part of it with most of the mortgage payments going towards equity rather than debt).

LikeLike

Another excellent article, certainly much better then most MSM’s

The Link to Mortgages Exposed was good lots of useful info, i shall be shifting thru it for sometime.

LikeLike

Where do they find these people? The problem with being a financial blogger and having the smart readers we’re lucky enough to have is it makes you ever more removed from the real world of Shona et al.

LikeLike

@Rob, You’re right that they would have been better staging their house purchases, I missed that aspect, so it is possible they could have done it by not overcommitting at the start!

@Lupulco, I was fascinated by the mortgages exposed website. I don’t have and don’t plan to have another mortgage, but I could have done with some of that knowledge earlier.

@Monevator, I do at times wonder if there shouldn’t be a financial basics test people have to pass before being let loose on anything more than a basic bank account 😉 Shona doesn’t come across as fundamentaly dim-witted but the family has been on the wrong track from the off.

LikeLike

Its easy to be rational about someone elses life but for the upper side of middle class these are brutal times with generation X ers significantly harder up than their baby-boomer parents. The desire they have to maintain the same lifestyle they were brought up with is almost certainly overpowering as can be seen in your example. There will be a lot of folk out there who *cannot* compromise on (a) house and (b) private schools – its just too beastly to contemplate. NB I’d like to make it clear I suffer from neither complaint but have plenty of universty aqquaintances that do

LikeLike

@Ben take your point that the reversal of fortunes is a bit tough to take. However, they’re gonna take the lifestyle hit, either now (no private school) or later (no home). Sometimes it’s easier to take the bullet earlier…

LikeLike

@ermine – you’re right of course – i’ll admit to taking a perverse pleasure in watching them drown

LikeLike

On another note, there are 4 Boris Johnson offspring!

LikeLike

“If you really are middle class, and buying your house, then that house is nearly always your biggest cost. If it isn’t, you are either not middle class, you are rich/wealthy. Or you are in deep, deep, trouble.”

Well, no. For the middle class, our biggest cost is now building the defined-contribution pension fund. It’s easy for the minority with employer-underwritten defined-benefit pensions to forget that, since they rarely bother to estimate the capital equivalent of their expected pension benefits (why should they? It’s an effort that brings no rewards).

My current rule-of-thumb is that middle-class folks, who want the mythical “comfortable retirement”, should be accumulating £2 of pension fund for each £1 of housing they own. However, many folks seem to have paid so much for housing that they’re unable to accumulate a pension pot of the same size as their home’s worth.

These guys need to realize that one can’t afford to live in a £450k house if one’s pension income is around the national minimum wage. The council tax alone would be crippling, let alone the necessary maintenance.

Only those with defined-benefit pensions can afford to spend all their salary surplus on housing.

LikeLiked by 1 person

@Jonathan I agree, although ideally you have 40 years of a working life to build up that pension, versus 25 years for a mortgage. At Shona Sibary’s time of life I’d expect housing to be the highest monthly cost, simply because of the difference in integration time of the house v pension and the fact that one doesn’t borrow the capital for a pension at the outset and pay interest on it.

However, I’ve lived your principle – unlike most Britons if I were to count my house as part of my networth it’s nowhere near half. This is because it’s a relatively crappy house compared to the houses my ex-colleagues typically ‘owned’. Not buying too much house seems to be one of the unsung wins in improving one’s personal finances in the UK, despite the hard sell of ‘buy as much house as you can afford, it only goes up’ that has been the mantra for so long.

LikeLike

Open In New Window allows you to see what to link to in frmes ..

e.g. http://www.mortgagesexposed.com/Book_Contents/capital%20repayment%20loans.htm

LikeLike

In case you missed the conclusion of this particular tale ermine, I thought I’d share the latest update from our good friend Mrs Sibary on the ROI that she has realised from her financial decisions…

http://www.dailymail.co.uk/femail/article-3453786/I-just-want-weep-Shona-flogged-home-jewellery-pay-daughter-s-100-000-education-defiant-teen-s-dropped-school-bar-job-Magaluf.html

LikeLike

I kinda feel sorry for the girl. She’s been brought up by the vlaues that money is a proxy for good qualities in a human being, so it isn’t that surprising she sees the instant win of being a jelly-shot girl. You get it all – instant hit with the guys, chance to let your hair down and break out a bit and of course what looks to her like lots of money.

Her mother then confirms the lack of values by regaling the poor young woman with

> For every penny was a complete and utter waste.

Nice. I know writing sensationalist stories pays the rent, and presumably the school fees for t’others, but kids probably still need to believe in unconditional love at 17, at least from their parents 😉

LikeLike